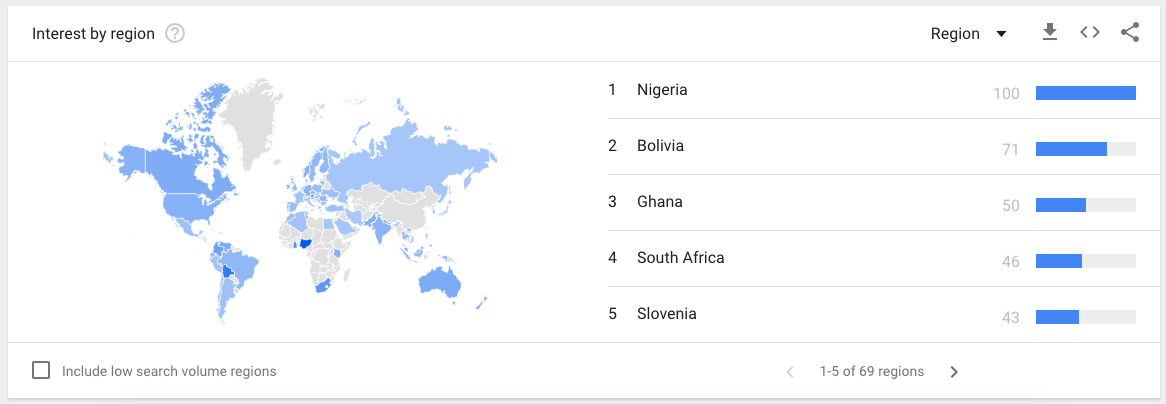

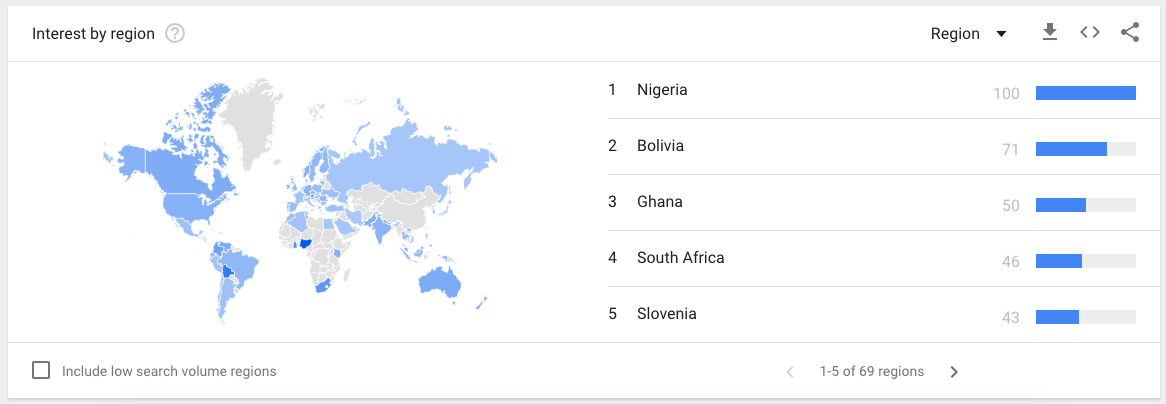

Without a doubt, the rise of bitcoin and its underlying technology blockchain represent a historical technological disruption. While the technology has already found success in economically developed countries, bitcoin is just starting to gain momentum here in Africa. Over the past 2-3 years, we’ve seen growing interest in bitcoin and the technology behind its increase in African countries such as Kenya, South Africa, Ghana, and in Nigeria.

In this article you will be introduced to the state of bitcoin in Nigeria, the people’s perception of this new technology and how it is being used.

Nigeria’s Bitcoin Ecosystem

The bitcoin ecosystem in Nigeria has been experiencing tremendous growth over the past two years. This is evidenced by the growing number of bitcoin related queries on Google Trends charts as well as increasing bitcoin trading volumes in the West African nation.

Nigeria is already witnessing the birth of new startups, initiatives, local meet-ups and social groups with the aim of educating interested parties about the fundamentals of bitcoin and blockchain technology as well as promoting its benefits. Some of this startups and initiatives include CDIN, PEX Bank, Cryptogene, Cryptomart, NGExchanger, and Nairaex. Additionally, top bitcoin companies such as Luno and ICE3X are already exploring the Nigeria market.

Cryptographic Development Initiative Nigeria (CDIN)

The Cryptographic Development Initiative in Nigeria (CDIN) is one of the blockchain focused groups that has successfully positioned itself as a pacesetter in this new industry.

The CDIN is a non-governmental organisation and platform that encourages the learning and practice of cryptography amongst relevant stakeholders from both the public and private sectors. It is subdivided into three groups: Crypto Nigeria, Blockchain Nigeria, and Nigeria Blockchain Alliance (NBA).

The CDIN has been able to deliver on some of its promises from educating the masses on the cryptocurrency. Through its Crypto-Nigeria arm, local meet ups have been arranged in order to tackle criminal activities by collaborating with government agencies and relevant bodies in fighting against crypto-related crimes, such as HYIP and Ponzi schemes that use bitcoin and other cryptocurrencies for payment.

Recently, the CDIN announced that the Nigeria government is willing to offer its support to the initiative. The organisation has announced a partnership with the National Electronic Fraud Forum (NEFF) for the Blockchain Nigeria 2017 conference. NEFF’s chairman, who’s also the director of banking and payment system of the Central Bank of Nigeria, Dipo Fatokun said:

“Please be informed that NEFF is willing to collaborate with CDIN and will assist with technical advice and/or speakers at the […] 2017 conference on Blockchain. Also note that as the collaboration progresses, Neff will also, count on your support.”

The Central Bank of Nigeria’s Stance on Bitcoin

The Central Bank of Nigeria seems to understand the potential that comes from bitcoin and blockchain technology. However, the CBN is concerned about the financial losses that traditional banks will incur as well the growth of bitcoin-related crimes, such as ransomware and pyramid schemes if the technology becomes widely accepted.

Factors slowing down the adoption of digital currency

The CBN issued a circular to banks, similar to a statement released by the Nigeria Securities and Exchange Commission to the public, on January 12, 2017. Both regulatory bodies warned against the usage of digital currencies like bitcoin as it is not a legal tender in the country and any bank or business that would deal or invest in such would do so at their own risk.

Furthermore, in a March 2017 meeting focused on digital currencies organised by the Chartered Institute of Bankers in Nigeria, the CBN through its Deputy Director for Banking and Payment Musa Itopa Jimoh reiterated the central bank’s view of cryptocurrencies like bitcoin.

“The Central bank cannot control or regulate blockchain. Just the same way no one is going to control or regulate the Internet. We don’t own it.”

Mr. Itopa Jimoh further clarifies the CBN’s previous warning that he believed was misunderstood by the public.

“A lot of people misinterpreted it that we wanted to stop bitcoin. We can’t stop bitcoin. Bitcoin is not an invention of 2015 or 2012; it’s not even an invention of 2010. So, how can the Central Bank of Nigeria, not central bank of the world, stop the running and implementation of bitcoin?”

In spite the warnings from the government, the growing interest in bitcoin has refused to slow down. A key reason behind it is the persistent depreciation of the country’s local currency, the naira. Many people are beginning to see bitcoin as a good alternative to hedge their wealth against currency losses.

The remittance market is another major area driving the usage of digital currency. As a cost-effective and borderless payment network, bitcoin and other digital currencies are offering a long-term solution to Nigeria’s large remittance markets’ challenges.

Nigeria’s Bitcoin Startups

Nigeria is also the home to several bitcoin startups with the largest being the country’s leading bitcoin exchange NairaEx.

Nigeria is also the home to several bitcoin startups with the largest being the country’s leading bitcoin exchange NairaEx.

NairaEx offers a quick and easy way of for Nigerians to purchase the digital currency using credit cards, debit cards, or bank deposits using local currency. There is also BTC.ng, which is a NairaEx run bitcoin publication that aims to close the big gap by educating newbies in Nigeria on everything happening in the bitcoin ecosystem.

Cryptogene is another Nigerian startup, which launched in late 2016 to focus on educating African on the benefits of bitcoin and blockchain technology.

Cryptomart and NGExchanger are two further startups in Nigeria’s bitcoin community while leading African bitcoin exchanges Luno and ICE3X are also exploring the Nigerian market. ICE3X, for example, enables Nigerians to buy bitcoin, litecoin, and ether with the naira.

How Nigerians Are Using Bitcoin

A recent study conducted by leading bitcoin wallet provider Luno reveals a great deal of faith in the future of the digital currency in Nigeria.

57 percent of the respondents believe bitcoin to be the future of money. When asked to state their main reason for buying bitcoin, 28.8 percent used it for investing while 20.3 percent used it for remittance purposes while others used it for trading and speculation purposes. Interestingly, a majority of Nigerians, 45.3 percent, would rather own bitcoin than gold. This is a large number in comparison to the 10.3 percent figure for gold ownership.

News1 year ago

News1 year ago

News1 year ago

News1 year ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

Sponsored Posts2 years ago

Sponsored Posts2 years ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

Nigeria is also the home to several bitcoin startups with the largest being the country’s leading bitcoin exchange

Nigeria is also the home to several bitcoin startups with the largest being the country’s leading bitcoin exchange

Buroka exchange makes use of Two-Factor Authentication (2FA). 2FA provides an extra layer of protection for users. With the 2FA in place, an extra piece of information is needed before login into the platform or making any withdrawals.

Buroka exchange makes use of Two-Factor Authentication (2FA). 2FA provides an extra layer of protection for users. With the 2FA in place, an extra piece of information is needed before login into the platform or making any withdrawals.