Bitcoin

The State of Bitcoin Regulation in Africa

Published

6 years agoon

The legal status of bitcoin varies from one country to another and is mostly undefined or under review in most parts of the world. While some African central banks have explicitly banned or restricted its use, others have allowed it or have simply not issued any statement or regulations covering digital currencies.

In this guide, you will find a list of financial regulators in Africa that have made statements or issued regulations for the use of bitcoin and other decentralised cryptocurrencies within its borders.

Kenya

Kenyan Central Bank is not a Fan of Bitcoin

However, the CBK’s stance seemed to have little impact on Kenyans appetite for bitcoin with the country being ranked third in Africa when it came to trading volumes at local exchanges such as Localbitcoins. Also, things seem to be looking up with a number of public and private entities now experimenting with blockchain technology.

In addition, some financial regulators seem to differ with CBK’s stance, such as the country’s financial market regulator, the Capital Markets Authority (CMA). The CMA announced plans in April 2017 to organise forums for fintech and cryptocurrency players to discuss the state of regulations and challenges it poses to their activities. It is also worth noting the Kenyan government and World Bank announced their intention to partner in using blockchain technology to sell government bonds earlier this year.

South Africa

South African Reserve Bank is Open to Digital Currencies

Having said that, in August 2016, the SARB softened its stance on digital currencies with the Reserve Bank Governor, Lesetja Kganyago hinting the bank was open to cryptocurrencies. In July 2017, the SARB indicated plans to test regulations related to bitcoin and other digital currencies and selected Bankymoon, a blockchain solutions provider for its first sandbox trial run.

The Reserve Bank had already announced its intention to undertake its own research about blockchain technology’s feasibility in South Africa. However, according to an ITWeb report, the deputy governor of the SARB, Francis Groepe indicated at an August 2017 conference in Johannesburg,

“For the central bank to issue virtual currencies or cryptocurrencies in an open system will be too risky for us. This is something we really need to think about.”

Nigeria

The Central Bank of Nigeria is Open to Digital Currencies

Having said that, the CBN has shifted its position and is now researching blockchain technology and its possible applications in various industries. The regulator has also allocated personnel and resources to work on a whitepaper on digital currencies and its underlying technologies.

Many people in Nigeria view bitcoin as the alternative to hedge their wealth against currency losses, brought about by the constant depreciation of the local currency, the naira.

Speaking at a recent cryptocurrency conference in Lagos, CBN deputy director, Musa Jimoh said,

“[The CBN] cannot stop the tide of waves generated by the blockchain technology and its derivatives. Currently, we have taken measures to create four departments in the institution that are looking forward to harmonising the white paper on cryptocurrency.”

Uganda

The Bank of Uganda warns against Cryptocurrencies

The bank also warned against the use of digital currencies indicating there was lack of consumer protections or a regulatory framework to govern their use. As of the time of writing this article, the central bank’s position remains unchanged despite a growing bitcoin presence in the country.

Namibia

The Bank of Namibia bans Bitcoin for Commercial Purposes

In September 2017, the bank proceeded to officially ban the use of bitcoin or other cryptocurrencies in the country. The directive was contained in a nine-page position paper which cited risks such as money laundering, legal, credit and operational risks as threats to Namibian users. However, recognising the potential of blockchain technology and its possible application in various sectors, the Namibian Central bank acknowledged the need for further research stating, “the current position of the Bank may be amended and/or supplemented, should a need arise.”

Cameroon

Cameroon Still Undecided on Bitcoin

The government has previously tested a cryptocurrency called Trest in 2015, which shows the country could be open to cryptocurrency solutions given its largely underbanked population.

Egypt

The Central Bank of Egypt Rejects Bitcoin Use

Mauritius

State Bank of Mauritius is Receptive to Cryptocurrencies

Already, the country’s second-largest bank, State Bank of Mauritius (SBM) has partnered with Secured Automated Lending Technology (SALT) to allow its clients to use bitcoin or ether as a guarantee for loans. However, this was not always the case with recognition of cryptocurrencies in the country. Previously, in December 2013 the Bank of Mauritius warned the public about risks associated with the use of bitcoin. It appears the Bank reversed its position in light of the island nations ambitions to cement its position as a breeding ground for blockchain solutions.

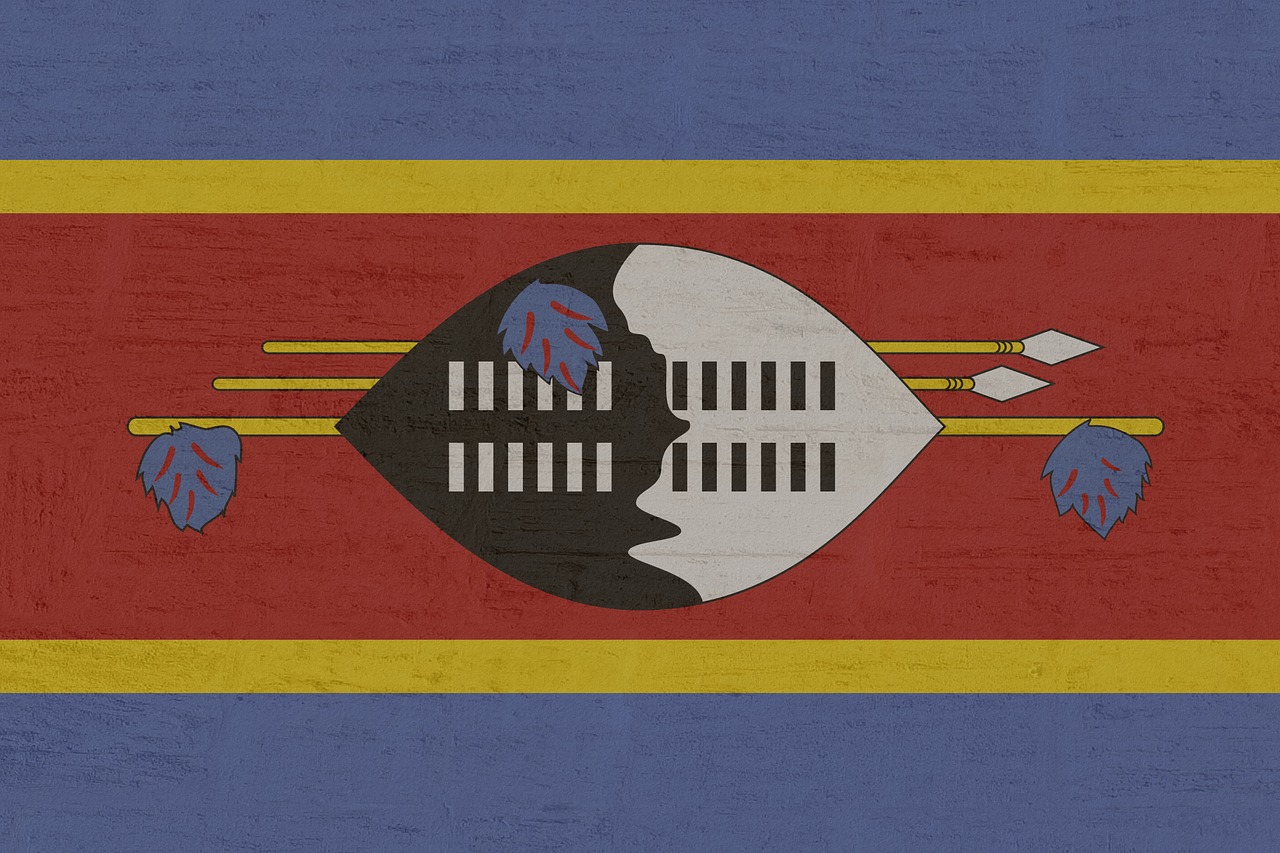

Swaziland

Swaziland Central Bank is Studying Cryptocurrencies

“It may not be wise to dismiss virtual currencies, and as the CBS we are learning, and we want to accept and support innovation. If this is innovation, we do not want to stifle it. We want to learn more about it.”

Currently, cryptocurrencies like bitcoin remain unregulated in the country and Sithole cautioned traders on local exchanges to be careful as the Central Bank seeks opinions of experts on the issue.

Algeria

Algeria Plans to Ban Bitcoin and Other Cryptocurrencies

Article 113 of the Finance Bill states,

“The purchase, sale, use and holding of the so-called virtual currency is prohibited. The virtual currency is the one used by Internet users through the web. It is characterized by the absence of physical support such as coins, banknotes, payments by check or bank cards. […] Any violation of this provision is punished in accordance with the laws and regulations in force.”

The document also recognises that cryptocurrencies such as bitcoin have no central authority, and presently escape any regulations or control by the state. This means bitcoin users in Algeria can still go about their activities until tighter restrictions are put in place.

Zimbabwe

Reserve Bank of Zimbabwe Remains skeptical about Bitcoin

The Reserve Bank of Zimbabwe (RBZ) has not officially permitted the use of bitcoin. In July 2016, the RBZ’s Director of National Payments, Josephat Mutepfa, warned Zimbabweans about the risks associated with bitcoin while speaking at a conference. He asserted that while they were a number of bitcoin initiatives in the country offering specific services, the central bank was yet to devise regulations for use of cryptocurrencies.

Recently, Reserve Bank of Zimbabwe director and registrar of banking institutions, Norman Mataruka, stated that the use of bitcoin is illegal in Zimbabwe. However, no actual regulations have been issued by the RBZ and no laws have been passed covering digital currencies in Zimbabwe.

Morocco

Regulators in Morocco Declare Bitcoin to be Illegal

The two regulators point to the risks involved in using digital currencies for transactions as their reason for the directive. They further state,

“As a hidden payment system that is not backed by a financial institution, the use of virtual currencies entails significant risks for their users.”

This comes at a time when the demand for bitcoin in Morocco has been growing steadily for the past one and half years evident from trading volumes on the bitcoin exchange, Localbitcoins. But while the ban is a blow to bitcoin adoption in the country, it will be hard to control the cryptocurrency given its pseudo-anonymous and censorship-resistant nature.

Rest of Africa

Bitcoin regulation in the rest of Africa is essentially uncharted territory as regulators are still coming to terms with how best they can assimilate decentralised digital currencies into their economic structures without potentially destabilising their economies.

Ultimately, the challenge will be to come up with a regulatory framework that protects consumers against harmful activities and promotes cryptocurrency-based innovation. For now, bitcoin is largely unregulated and, therefore, de facto legal to use in the majority of African countries.

You may like

-

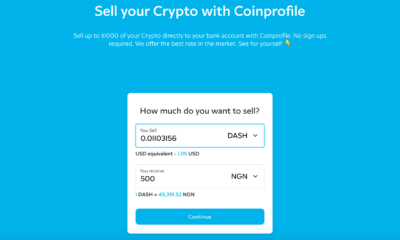

Coinprofile Listing Enhances Living on Dash in Nigeria

-

Chinese Blockchain Startup Conflux to Establish Base in Africa

-

10 Reasons Why Africa Will Set the Pace for Bitcoin Adoption

-

Africa Blockchain Alliance Announces Call for Applications for Second Cohort of Africa Blockchain Developer Program

-

How Blockchain Turns the Game in African Financial Life

-

3 Reasons Why Africa Is Set For A Cryptocurrency Explosion

Statistics, examples, and ways to legally use cryptocurrency

October 1, 2013, was a turbulent day for San Francisco Public Library. A dozen FBI agents pretending to be usual visitors surrounded a man sitting at one of the tables, took his laptop and put a pair of handcuffs on his hands. That man was Ross Ulbricht, founder of Silk Road – the largest darknet marketplace for drug dealers, killers, and other criminals. The seizure of Ulbricht was supposed to tackle the illegal online trade, but, as the news site DeepDotWeb wrote, the bust was “the best advertising the darknet markets could have hoped for”. The reputation of cryptocurrency also suffers from associations with terrorists, who sometimes use it for their needs. How big is the real scale of the problem? And how many legal ways to use crypto exist? ChangeNOW has dived into the topic – and suggests you an overview of the current state of the problem.

Highlights:

- The drugs trade volume using cryptocurrency is relatively large

- Crypto was a significant reason why a part of drug sales migrated to the web, though stays yet not viable and anonymous enough for dealers (same as for terrorists)

- As efficient use of blockchain technology requires good infrastructure, crypto remains not suitable enough for many terrorist groups

- However, some terrorists are trying to adjust to anonymity threats and hold fundraising in crypto

- Legal ways to use cryptocurrency include dozens and vary from IT services to car rentals

Crypto & Drugs & Rock’n’Roll

The total volume of the online drug market using cryptocurrency is around $1 billion. It is located in the darknet, which provides an attractive, profitable, and mostly secure environment for drug dealers. Cryptocurrency, in turn, allows making payments that are hard to be tracked by authorities. This is how blockchain technology has helped to bring a big part of drug sales online from the streets. And it’s not only about drugs themselves – many legal opioid drugs are illegally sold here, too.

However, cryptocurrency is not always as secure and anonymous as it is thought to be. The information about any transaction ever made stays forever in the blockchain, which makes the system way more transparent than cash payments. This is a significant limitation for using crypto in illegal purposes.

According to the University of Technology Sydney, about 46% of criminal activity of each year is connected to Bitcoin. As for the drug sale itself, trade volumes in crypto keep rising, but the percent of Bitcoin drug transactions out of all transactions goes down. This means Bitcoin is more frequently used for legitimate purposes.

What cryptocurrency is used for drug sales most often? Surprisingly, privacy coins such as Monero are used only for 4% of transactions. Due to its pioneer position, Bitcoin is used in 76% of all deals despite all its anonymity risks.

The main problem for drug dealers using crypto is to turn their income into cash. This move remains complicated and insecure. Most cryptocurrency exchanges have instruments to define whether a transaction is coming from a suspicious source like the darknet. The rise of Monero use in the online drug market will hinder such tracking. However, for the reasons listed above, crypto is unlikely to completely replace regular cash in drug sales in the foreseeable future.

Cryptoterrorism

The views on how much cryptocurrency is used and will be used by terrorists vary widely. While some claim that terrorists have no infrastructure to use it and the methods are not secure enough, others argue that they are learning fast and adjust to crypto rapidly. Let’s see what both sides say.

Not actively using, unclear future

Lack of appropriate infrastructure, inability to use crypto. Most terrorist groups settle in the Middle East region, especially on its remote and war-torn territories. The vast majority of roads and technological infrastructure have been destroyed. In such circumstances, cash remains the most common and convenient way to pay and fundraise. Imagine a gun seller in a Syrian village – does it look like he has a tool to accept Monero?

Anonymity threats. Given the relative transparency of blockchain mentioned above, crypto might remain too unsafe for terrorists. Miners can see any potential terrorist money exchange while checking transactions, and it’s not too hard to see who sends them money. It can change with the rising use rate of privacy coins, but the ability to spend such money remains questionable.

Increased attention to crypto by the authorities. As the number of transactions keeps rising, more regulatory bodies’ attention gets focused on cryptocurrency, which apparently makes terrorists nervous and cautious.

Problems of specific currencies. While top cryptocurrencies like Bitcoin receive much regulatory attention, others remain marginal and unreliable because of a lack of support. Conflicts and uncertainty lower the trust to such cryptocurrencies – yes, even terrorists’ trust.

Using actively now, increasingly in the future

Terrorists seem to be rapidly learning to escape from tracking in blockchain. Several years ago it was easy to find any address or transaction made for a terrorists’ fundraiser. Today they use well organized and finely designed websites, where detailed video tutorials show how to donate money anonymously. Unique Bitcoin addresses and other crypto tricks are used to preserve security. Analysts from intelligence services claim there’s only going to be more such cases. And, of course, privacy coins are a “great opportunity” for terrorists too.

Shift to cryptocurrency is a reaction to economic sanctions. ISIS has lost most of its territory and resources, Hamas has been sanctioned by the West. Having been cut off from all main financial institutes, terrorist groups had to find other pathways for their financial activities – and cryptocurrency appeared to be the best substitute.

There might be difficulties and inconveniences, and the number of terrorists using crypto is yet unknown – but as we can see, digital money in terrorism is reality. Same as in drugs. And this is what cryptocurrency is notorious for, lacking trust among millions of people. The reputation of some of the exchange services only adds to this mistrust – ChangeNOW has carried out a special investigation on how such platforms may cheat their clients. But can you buy anything besides heroin and firearms with your crypto? What about pizza or a concert ticket?

Only Antarctica left

Cryptwerk, a platform monitoring actual use cases of different cryptocurrencies, says there are about 3500 ways to spend Bitcoin and more than 800 for Monero today. They range from music services to car rentals, from buying clothes to hotel booking services, and from sports bets to virtual tours.

Organizations accepting cryptocurrency are located on all continents besides Antarctica (what could be a better place for crypto than a continent without governments and countries though?). Mostly, in the USA and Central Europe. Bitcoin as the largest cryptocurrency is relatively widespread in India and Southeast Asia.

As this is a whole another topic, ChangeNOW will issue a post dedicated to use cases of cryptocurrencies. As it will be more detailed, who knows – maybe you’ll find a pizza right by that you could pay for from your crypto wallet!

This article was contributed by Jeremy from ChangeNow.

Bitcoin

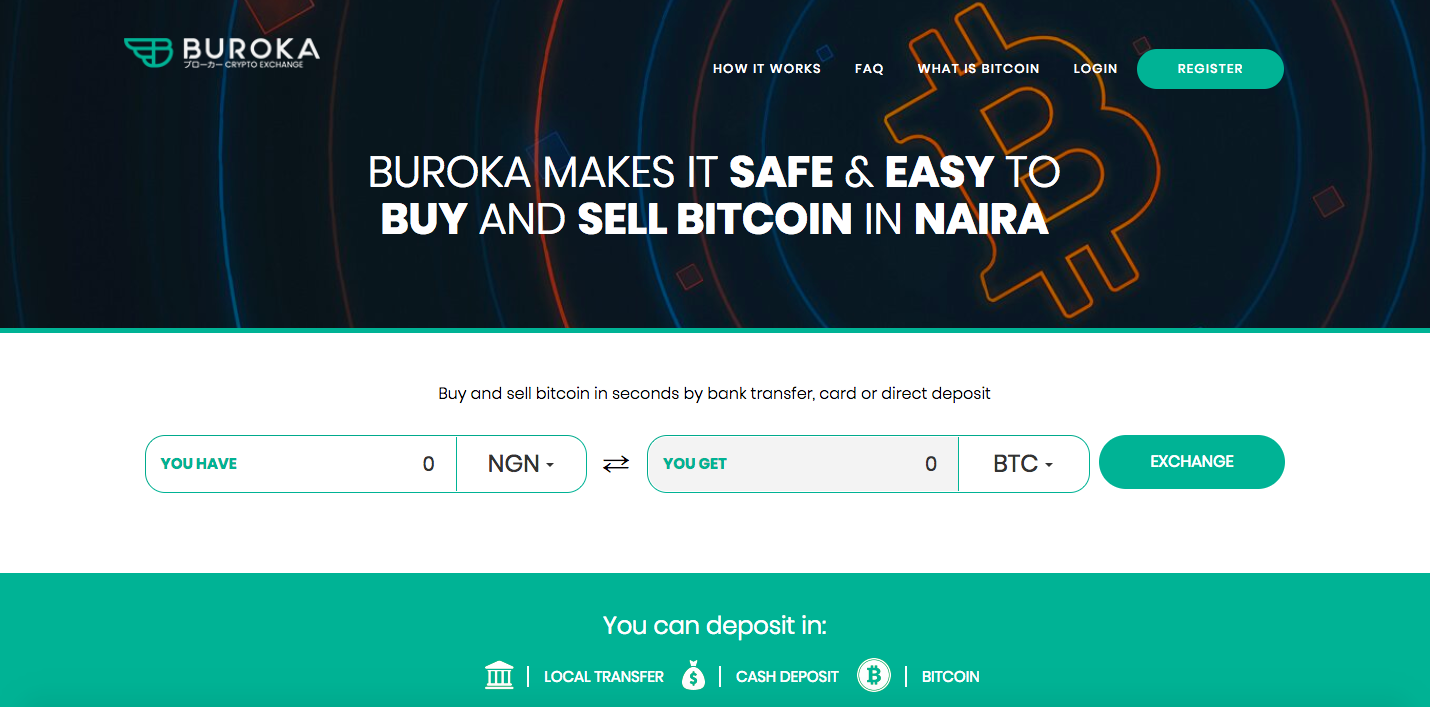

Buroka Review: How to Buy Bitcoin on Nigeria’s Newest Bitcoin Exchange

Published

3 years agoon

February 27, 2020

Buroka is a new breed of cryptocurrency exchange for Africa! Currently operating in Nigeria, Buroka was designed to fulfill the needs of modern Africans. Buroka allows customers to buy and sell Bitcoin with Naira via Local Transfers and cash deposits at the bank. In this Buroka review, you will learn more about the exchange and how you can use it to buy bitcoin in Nigeria.

How to Buy Bitcoin on Buroka

Step 1: Account Creation

To create an account, visit Buroka.com and hit the “Register” button. This will lead you to a page where you will be asked to fill in your personal information, including your name, email address, and password. Like any other serious exchange, Boruka will ask you for your ID, Proof of Address, and to take a selfie with your ID to eliminate fraud.

Step 2: Fund Your Account

Funding your account on the platform is straightforward. You can deposit either via bank transfer or at any bank branch. Make sure to use a unique reference code given to you by Buroka deposit system.

Step 3: Buying and Selling BTC

Once your deposit has been credited to your account you can immediately buy your Bitcoin. The buying and selling tab is located on the top right corner of the dashboard. There you can input the amount of bitcoin you want to buy. Once you do that, you then click on the “BUY BTC” button.

Step 4: Storing Your BTC

After buying BTC, Buroka provides users with the option of either storing bitcoin on the platform in a BitGo wallet or any other wallet of their choice.

Currently, Buroka only supports bitcoin (BTC). However, the exchange plans to include other cryptocurrencies going forward.

Security

In addition, Buroka’s platform is also protected using the latest security technology, including web-socket and API protocols that allow for a fast and secure order processing. Buroka also makes use of a well-updated SSL certificate, which makes it easy to detect a phishing attempt.

To further ensure that clients’ funds are secure, Buroka operates segregated accounts. These accounts are held with trusted banks so that clients can enjoy an extra layer of security provided by the banking system.

Conclusion

Buroka is a relatively new Bitcoin exchange with a well-designed, user-friendly interface. The Bitcoin trading platform provides several deposit options, which is attractive for Nigerian Bitcoin traders, as well as competitive market rates for both buyers and sellers.

If you are looking to buy or sell bitcoin in Nigeria, you can give Buroka a try.

Bitcoin is not as anonymous as people think. Bitcoin transactions are viewable on the network’s public blockchain, which also means that transactions can be linked to real-world identities. As a result, bitcoin is not (yet) fungible and does not protect individuals’ financial sovereignty as much as it should. Fortunately, there is something called a bitcoin mixer that enables bitcoin users to increase their financial privacy.

In this guide, you will learn what bitcoin mixers are and why you should consider using them.

How Anonymous Are Regular Bitcoin Transactions?

Regular bitcoin transactions are not anonymous. Bitcoin addresses are pseudonymous. They do not reveal your identity as a user but can be linked to your identity.

For instance, most exchanges require you to verify your identity with legal identification (ID) documents. In a situation where you withdraw funds from an exchange into your wallet, your identity can be linked to that wallet, and all your linked transactions could be tracked.

Blockchain analysis companies can use information from your linkable transactions to track how many bitcoins you own, what you spend your coins on, and who you transact with. If you are conscious about your privacy, you might need a bitcoin mixer.

What is a Bitcoin Mixer?

A bitcoin mixer allows you to mix your coins with other users. This obscures the ties between your personal identity and bitcoin transactions.

The end goal of a bitcoin mixing service is to create a misleading trail of transactions that makes it difficult to track your transactions. This is achieved by breaking down your bitcoin into smaller parts and then mixing them with coins from other transactions.

Most bitcoin mixers are non-custodial, run on the Tor network, and do not keep records of users after a couple of hours.

Why Do People Use Bitcoin Mixers?

The primary reason for using a bitcoin mixer is to increase transactional privacy. You may not want “the whole world” to be able to see what you are doing with your bitcoin. Through the use of a mixing service, you can achieve that despite Bitcoin’s public blockchain.

Moreover, there are a number of other reasons why you should consider using a bitcoin mixer. They include:

Your Transactions Reveal Personal Finance Information

Every time you send bitcoin to or receive bitcoin from an individual, the other party gains some information about your bitcoin holdings.

For example, if you have ten bitcoin in your wallet and you send two to another person. The individual who received the bitcoin now has access to your bitcoin address, which allows them to check your balance on the blockchain.

In some cases, by analyzing your inputs and outputs, they can predict other addresses you own, giving them more information about your finances and transactions you have done in the past. Mixers can prevent this. The mixer breaks the connection between addresses in your wallet by creating transactions that make it difficult for blockchain analysts to track.

Based on the example above, if you use a coin mixing service to send out the coins, the receiver can still check the blockchain to verify the transaction but will be unable to track your old transactions and find your bitcoin address.

Blockchain Analysis Companies Are Watching

Over the years, blockchain analysis companies have been established to track transactions and monitor the Bitcoin blockchain. These groups have resources to probe deeper into transactions, with some going as far as connecting IP addresses to bitcoin transactions.

Further, cryptocurrency exchange verification is required by regulators to keep an eye on how individuals use their bitcoin. This means that exchanges can still trace your transactions after you have purchased bitcoin.

Bitcoin mixers allow you to detach connections between your initial receiving address and other transactions you make. This can prevent companies from gathering data about you, which it would otherwise share with (or sell to) third parties.

To Prevent Censorship

Money has become a tool used to fund political groups and operations. In authoritarian regimes, where the financial system is highly monitored by the ruling government, critics or opposition groups may opt for bitcoin.

To ensure complete privacy while using bitcoin, such groups will require bitcoin mixing platforms. Without increased transaction privacy, these groups risk losing support in situations where the state begins to target individuals funding them by tracking their transactions on the blockchain.

This allows bitcoin to be used as a tool for freedom of speech and expression.

If you want to mix your coins to protect your financial sovereignty as a bitcoin user, check out Bitcoin Mixer.

How Mobile Apps are Changing Sports Betting

Weekly Roundup: Africa’s Cassava Network Partners with UniPass to Expand Crypto Adoption in Africa & More

Weekly Roundup: Kenyan Senate in Discussion with CBK to Legalise Bitcoin & More

Weekly Roundup: South Africa Introduces New Cryptocurrency Standards to Advertising Code & More

ND Labs Launches Crypto Exchange Software Development

Weekly Roundup: African Web3 Mobile Games Publisher Carry 1st Secures $27M in Funding & More

Weekly Roundup: Morocco’s Central Bank Announces Completion of Draft Cryptocurrency Regulatory Framework & More

Weekly Roundup: Nigeria Looking to Legalise Cryptocurrency Usage, CAR’s Sango Coin Postponed & More

Weekly Roundup: South African Crypto Exchange VALR Launches in Zambia & More

Weekly Roundup: Kenya’s Capital Markets Bill 2022 Seeks to Tax Crypto Transactions & More

Popular Posts

-

Features2 years ago

What Happened to “Bitconnect Guy” Carlos Matos?

-

Press Releases3 years ago

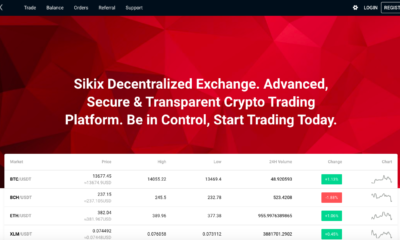

Sikix Exchange Launches with MoonPay as a Payments Partner

-

Sponsored Posts3 years ago

How to Make Profit Selling Bitcoin in South Africa During 2020

-

Sponsored Posts3 years ago

UMI Blockchain Ecosystem: Instant Transfers, Smart Contracts, and Profitable Staking

-

Guides3 years ago

How to Trade Cryptocurrency on Sikix.io

-

Features3 years ago

RESIST! How Activists Can Use Bitcoin

-

News3 years ago

Weekly Roundup: Bitcoin Hits New All-Time High, Expert Predicts Africa is the Future of DeFi

-

News3 years ago

Weekly Roundup: Binance Uganda to Close Up Shop, Gifts Cards “Moon” on Paxful