Statistics, examples, and ways to legally use cryptocurrency

October 1, 2013, was a turbulent day for San Francisco Public Library. A dozen FBI agents pretending to be usual visitors surrounded a man sitting at one of the tables, took his laptop and put a pair of handcuffs on his hands. That man was Ross Ulbricht, founder of Silk Road – the largest darknet marketplace for drug dealers, killers, and other criminals. The seizure of Ulbricht was supposed to tackle the illegal online trade, but, as the news site DeepDotWeb wrote, the bust was “the best advertising the darknet markets could have hoped for”. The reputation of cryptocurrency also suffers from associations with terrorists, who sometimes use it for their needs. How big is the real scale of the problem? And how many legal ways to use crypto exist? ChangeNOW has dived into the topic – and suggests you an overview of the current state of the problem.

Highlights:

- The drugs trade volume using cryptocurrency is relatively large

- Crypto was a significant reason why a part of drug sales migrated to the web, though stays yet not viable and anonymous enough for dealers (same as for terrorists)

- As efficient use of blockchain technology requires good infrastructure, crypto remains not suitable enough for many terrorist groups

- However, some terrorists are trying to adjust to anonymity threats and hold fundraising in crypto

- Legal ways to use cryptocurrency include dozens and vary from IT services to car rentals

Crypto & Drugs & Rock’n’Roll

The total volume of the online drug market using cryptocurrency is around $1 billion. It is located in the darknet, which provides an attractive, profitable, and mostly secure environment for drug dealers. Cryptocurrency, in turn, allows making payments that are hard to be tracked by authorities. This is how blockchain technology has helped to bring a big part of drug sales online from the streets. And it’s not only about drugs themselves – many legal opioid drugs are illegally sold here, too.

However, cryptocurrency is not always as secure and anonymous as it is thought to be. The information about any transaction ever made stays forever in the blockchain, which makes the system way more transparent than cash payments. This is a significant limitation for using crypto in illegal purposes.

According to the University of Technology Sydney, about 46% of criminal activity of each year is connected to Bitcoin. As for the drug sale itself, trade volumes in crypto keep rising, but the percent of Bitcoin drug transactions out of all transactions goes down. This means Bitcoin is more frequently used for legitimate purposes.

What cryptocurrency is used for drug sales most often? Surprisingly, privacy coins such as Monero are used only for 4% of transactions. Due to its pioneer position, Bitcoin is used in 76% of all deals despite all its anonymity risks.

The main problem for drug dealers using crypto is to turn their income into cash. This move remains complicated and insecure. Most cryptocurrency exchanges have instruments to define whether a transaction is coming from a suspicious source like the darknet. The rise of Monero use in the online drug market will hinder such tracking. However, for the reasons listed above, crypto is unlikely to completely replace regular cash in drug sales in the foreseeable future.

Cryptoterrorism

The views on how much cryptocurrency is used and will be used by terrorists vary widely. While some claim that terrorists have no infrastructure to use it and the methods are not secure enough, others argue that they are learning fast and adjust to crypto rapidly. Let’s see what both sides say.

Not actively using, unclear future

Lack of appropriate infrastructure, inability to use crypto. Most terrorist groups settle in the Middle East region, especially on its remote and war-torn territories. The vast majority of roads and technological infrastructure have been destroyed. In such circumstances, cash remains the most common and convenient way to pay and fundraise. Imagine a gun seller in a Syrian village – does it look like he has a tool to accept Monero?

Anonymity threats. Given the relative transparency of blockchain mentioned above, crypto might remain too unsafe for terrorists. Miners can see any potential terrorist money exchange while checking transactions, and it’s not too hard to see who sends them money. It can change with the rising use rate of privacy coins, but the ability to spend such money remains questionable.

Increased attention to crypto by the authorities. As the number of transactions keeps rising, more regulatory bodies’ attention gets focused on cryptocurrency, which apparently makes terrorists nervous and cautious.

Problems of specific currencies. While top cryptocurrencies like Bitcoin receive much regulatory attention, others remain marginal and unreliable because of a lack of support. Conflicts and uncertainty lower the trust to such cryptocurrencies – yes, even terrorists’ trust.

Using actively now, increasingly in the future

Terrorists seem to be rapidly learning to escape from tracking in blockchain. Several years ago it was easy to find any address or transaction made for a terrorists’ fundraiser. Today they use well organized and finely designed websites, where detailed video tutorials show how to donate money anonymously. Unique Bitcoin addresses and other crypto tricks are used to preserve security. Analysts from intelligence services claim there’s only going to be more such cases. And, of course, privacy coins are a “great opportunity” for terrorists too.

Shift to cryptocurrency is a reaction to economic sanctions. ISIS has lost most of its territory and resources, Hamas has been sanctioned by the West. Having been cut off from all main financial institutes, terrorist groups had to find other pathways for their financial activities – and cryptocurrency appeared to be the best substitute.

There might be difficulties and inconveniences, and the number of terrorists using crypto is yet unknown – but as we can see, digital money in terrorism is reality. Same as in drugs. And this is what cryptocurrency is notorious for, lacking trust among millions of people. The reputation of some of the exchange services only adds to this mistrust – ChangeNOW has carried out a special investigation on how such platforms may cheat their clients. But can you buy anything besides heroin and firearms with your crypto? What about pizza or a concert ticket?

Only Antarctica left

Cryptwerk, a platform monitoring actual use cases of different cryptocurrencies, says there are about 3500 ways to spend Bitcoin and more than 800 for Monero today. They range from music services to car rentals, from buying clothes to hotel booking services, and from sports bets to virtual tours.

Organizations accepting cryptocurrency are located on all continents besides Antarctica (what could be a better place for crypto than a continent without governments and countries though?). Mostly, in the USA and Central Europe. Bitcoin as the largest cryptocurrency is relatively widespread in India and Southeast Asia.

As this is a whole another topic, ChangeNOW will issue a post dedicated to use cases of cryptocurrencies. As it will be more detailed, who knows – maybe you’ll find a pizza right by that you could pay for from your crypto wallet!

This article was contributed by Jeremy from ChangeNow.

News1 year ago

News1 year ago

News1 year ago

News1 year ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

Sponsored Posts2 years ago

Sponsored Posts2 years ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

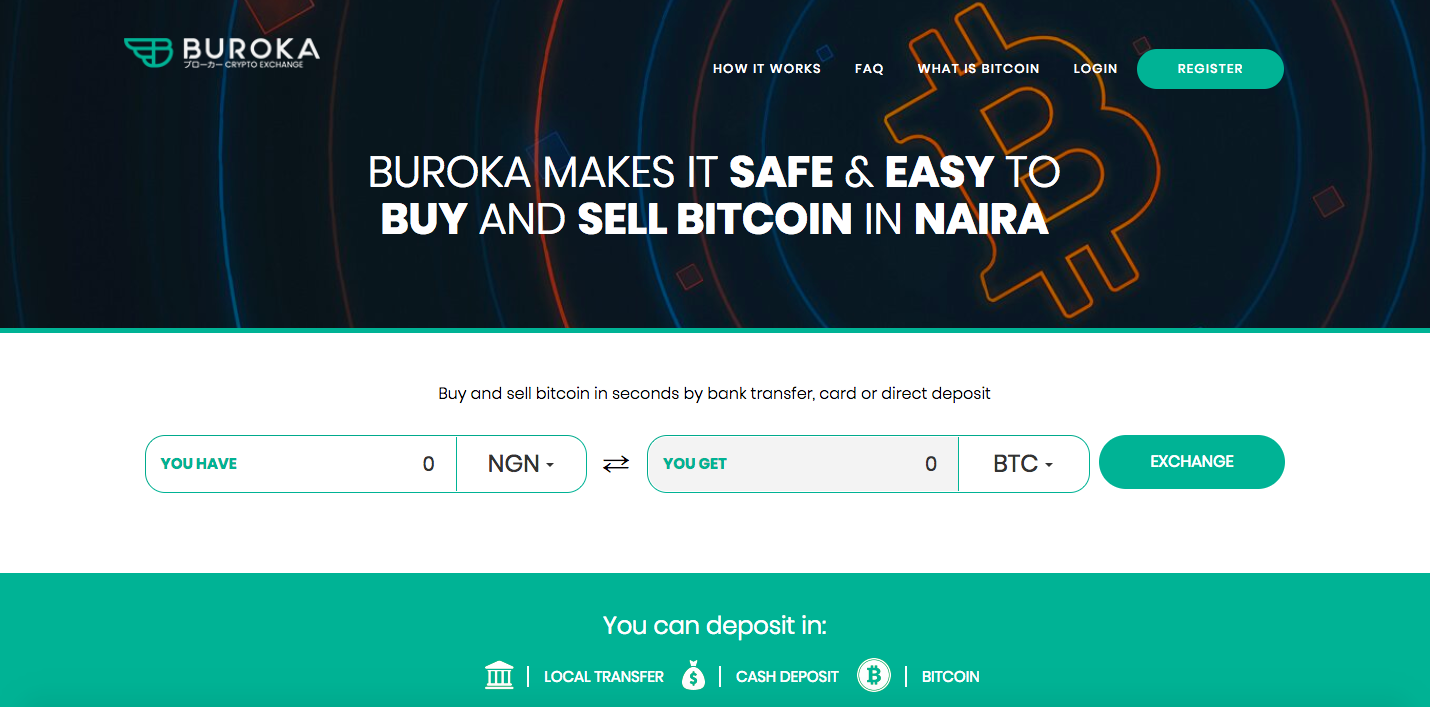

Buroka exchange makes use of Two-Factor Authentication (2FA). 2FA provides an extra layer of protection for users. With the 2FA in place, an extra piece of information is needed before login into the platform or making any withdrawals.

Buroka exchange makes use of Two-Factor Authentication (2FA). 2FA provides an extra layer of protection for users. With the 2FA in place, an extra piece of information is needed before login into the platform or making any withdrawals.