Islam is not only the world’s second-largest religion but also the fastest growing religion globally. Today, there are more than 1.6 billion Muslims in the world. Islam is also one of the religions where financial systems have clear guidelines based on religious principles. With the soaring adoption of bitcoin in markets such as the Middle East, which is a predominantly Muslim region, the question on whether bitcoin is acceptable in the Islamic religion has given rise to the debate on whether bitcoin is halal or not.

Currency in Islam

Islam is one of the few religions where Muslims believe that religion is a complete code for life. This means that the followers look up and live their lives according to the Sharia law.

According to Teaching Tolerance, Sharia – which is an Arabic word – means “the way” or the path to water”. The Sharia law is based on the Quran – Islam’s holy book – as well as the life of Prophet Mohammed. It encompasses laws on how Muslims can practice Islam ensuring that people are treated justly, that financial systems are fair, and has laws on marriage, inheritance, punishment, and divorce.

Sharia law, therefore, has various rules regarding what a currency is. In trying to understand whether bitcoin should be considered halal by Muslims, it is important to first understand how currency is viewed in the Islam religion. For a currency to be acceptable in Islam, it must have intrinsic value – this is the value or worth that something has – and should be difficult to get. Additionally, according to Muslim scholars, currency or money, is defined as a means of use in the purchase of an object of sale. For instance, gold and silver in Islam are considered as halal as they were used historically as legal tender in the form of gold Dinar and silver Dirham.

Islam also requires that a currency should not be linked to any debt. That is because the religion believes money should be used as a means of exchange and not as a product. To this extent, bitcoin can be viewed as a currency as it is used as a means to pay for goods in different countries with various people earning their salaries in the form of bitcoin.

The Islamic banking principles also forbid the acceptance of interest of any kind. While charging interest benefits the lender, it does not do the same for the borrower and is thus not halal. Currencies should not be affected by inflation and should have a stable market price. Furthermore, a currency according to the Sharia law should have proof of existence and be tangible.

Islamic View on Bitcoin

While bitcoin’s existence can be proven, the digital currency is not tangible like other currencies such as the dollar or Euro. However, there are certain similarities between bitcoin with gold and silver. They are all mined, the supply and demand dictate its value, they can both be used as currencies on their own and are also scarce.

While bitcoin’s existence can be proven, the digital currency is not tangible like other currencies such as the dollar or Euro. However, there are certain similarities between bitcoin with gold and silver. They are all mined, the supply and demand dictate its value, they can both be used as currencies on their own and are also scarce.

Still, for a currency to be considered halal in Islam, it needs to be acceptable by a considerable number of people in any given community or demography which is not the case (yet) for decentralised digital currencies. In Islam, the fuqaha (body of scholars), define people living in a community as government. With this view, cryptocurrencies differ in their qualifications for the stature as most governments in different countries are not accepting bitcoin as a legal tender. A good example is in countries such as Kenya, Uganda, Zimbabwe, and other African nations, where investing in cryptocurrencies has been warned against but citizens still invest in them.

Most people view bitcoin as a form of money. When people think of spending bitcoin, investing or trading in it, they are usually doing so to make money. This was evident in the last year when the digital currency went mainstream and the prices soared to an all-time high of $20,000 before dropping to a low of $6,000 earlier this year. To this extent, the volatile nature of bitcoin also has some level of speculation. In this sense, bitcoin has some elements of gharar (risk) and Qimar (speculation) which contradicts the Sharia law.

As mentioned, the Sharia law also teaches about the fairness of financial systems. Most Islamic scholars and jurists agree on the fact that bitcoin is blockchain-based which prevents any level of exploitation or unfairness. To this extent, digital currency is permissible in Islamic. However, the same scholars believe that bitcoin can be manipulated in closed circles as there have been allegations of multiple market manipulations and bitcoin exchanges faking the trading volume in the past year. In this aspect, some scholars view bitcoin as haram.

Fintech Based on Sharia Law

When it comes to banking and finance, Muslims unlike other religions, have interesting needs since the Sharia law has guidelines on financial systems. As such, acceptance of any interest is considered illegal in the Islamic religion as well as investing in the alcohol, tobacco, pornography, pork, and sex industries. An increased interest in Islamic Banking has led to the first-ever discussion on Islamic banking by the executive board of the International Monetary Fund. This growing demand has led to the use of blockchain technology by various entrepreneurs to meet the needs of Islamic banking.

One such company is Blossom Finance, an Indonesian fintech startup that was established to provide microfinance services to small businesses and Muslim entrepreneurs. The Fintech startup collects capital from different investors globally using the cost-saving bitcoin transactions and provides the funds to microfinance units for different investments. After a 12-month period, the company issues the profit made back to the investors. Blossom Finance clearly demonstrates how blockchain transactions and bitcoin obey the Sharia law. How so? It is because the company does not get or distribute interest and it ensures that the microfinance institutions getting funded do not invest in haram businesses. The business model is also built on Mudharaba (risk-sharing) which is permissible according to the Sharia law.

One such company is Blossom Finance, an Indonesian fintech startup that was established to provide microfinance services to small businesses and Muslim entrepreneurs. The Fintech startup collects capital from different investors globally using the cost-saving bitcoin transactions and provides the funds to microfinance units for different investments. After a 12-month period, the company issues the profit made back to the investors. Blossom Finance clearly demonstrates how blockchain transactions and bitcoin obey the Sharia law. How so? It is because the company does not get or distribute interest and it ensures that the microfinance institutions getting funded do not invest in haram businesses. The business model is also built on Mudharaba (risk-sharing) which is permissible according to the Sharia law.

Moreover, with bitcoin, the transactions are transparent and are recorded on the blockchain, which is open to anyone for scrutiny. In this regard, Matthew J. Martin, Founder and CEO of Blossom Finance said, “Bitcoin guarantees that the money invested into small Islamic businesses is not done on margin, and that its existence as a real asset is publicly verifiable using the blockchain. Bitcoin ensures ownership of underlying assets with 100% mathematical certainty.”

And Blossom Finance is not the only fintech company to offer solutions in Islamic countries. Goldmoney Inc, a company based in Toronto, implemented the halal gold standard and got certified as Sharia-compliant for its gold-based financial product. This puts the company on the list of Islamic finance institutions that are utilising the blockchain for Islamic finance transactions.

In order to gain access to millions of Muslim clients in Malaysia, HelloGold introduced an online platform that is both blockchain-based and Sharia-compliant to enable customers to make direct transactions while incurring low costs for gold trading.

Is Bitcoin Halal or Haram?

This is one question where Muslim scholars have differing opinions. While some scholars view it as halal, some see it as haram. The latter make their argument based on the fact that its price volatility makes it a speculative currency, hence not compliant with Sharia law. Also, in Islam, a currency has to be tangible which is not the case with bitcoin or any other digital currency for that matter. On this point, another group of scholars argues that although money is tangible, its paper is worth close to nothing and is prone to damage, theft, illegal duplication, and loss. This is not the case with bitcoin.

In that regard, they see bitcoin as having proper value compared to money. Moreover, fiat currency is debt-based as most of the money in circulation is on loan which earns interest. Unlike fiat currency, bitcoin is asset-based making it abide by the Islamic finance principles. To this extent, most scholars believe that cryptocurrencies such as bitcoin are actually more halal than fiat currency.

The above argument shows the differing takes that scholars have concerning the halal nature of bitcoin. With these differing views from Muslim scholars, it is hard to decide whether bitcoin is indeed halal or haram. And while there are differing views, some Muslim scholars have only warned their Muslim counterparts to be wary of the digital currency due to its price volatility but have not declared it as impermissible according to Islam. Although there is still an ongoing debate on this, Muslims who want to invest in bitcoin or any other digital currency for that matter should look at the risks involved and tread carefully before making any investments. As digital currencies continue to soar in demand, it remains to be seen on whether Muslim scholars will eventually reach a consensus on the halal nature of bitcoin.

News1 year ago

News1 year ago

News1 year ago

News1 year ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

Sponsored Posts2 years ago

Sponsored Posts2 years ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

While bitcoin’s existence can be proven, the digital currency is not tangible like other currencies such as the dollar or Euro. However, there are certain similarities between bitcoin with gold and silver. They are all mined, the supply and demand dictate its value, they can both be used as currencies on their own and are also scarce.

While bitcoin’s existence can be proven, the digital currency is not tangible like other currencies such as the dollar or Euro. However, there are certain similarities between bitcoin with gold and silver. They are all mined, the supply and demand dictate its value, they can both be used as currencies on their own and are also scarce. One such company is

One such company is

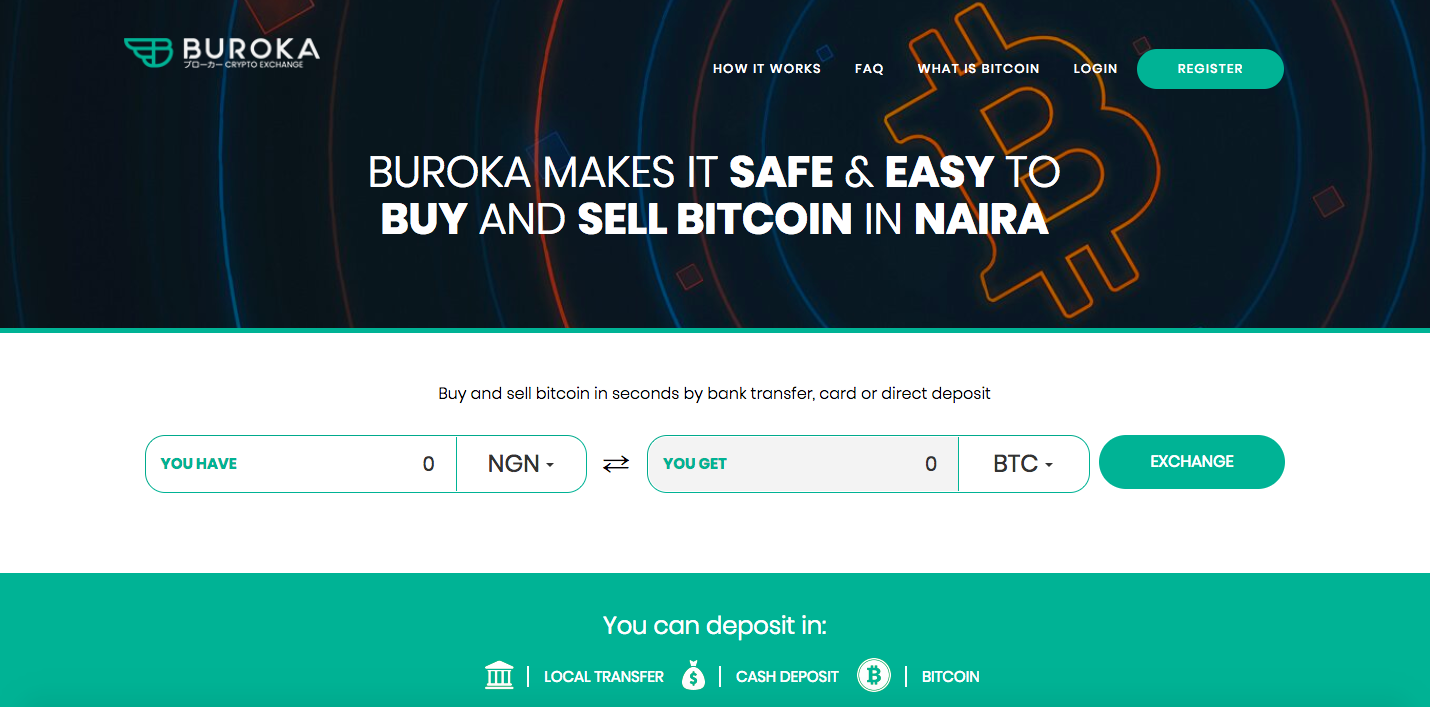

Buroka exchange makes use of Two-Factor Authentication (2FA). 2FA provides an extra layer of protection for users. With the 2FA in place, an extra piece of information is needed before login into the platform or making any withdrawals.

Buroka exchange makes use of Two-Factor Authentication (2FA). 2FA provides an extra layer of protection for users. With the 2FA in place, an extra piece of information is needed before login into the platform or making any withdrawals.