The acquisition enables Amber Group to conduct relevant regulated activities under the auspices of Type 1, 2, 4, 5, and 9 licenses from the Hong Kong...

EmpireChain platform is a breakthrough development in the cryptocurrency and blockchain space. The new platform allows users to exchange currency and form a reliable trading community...

Co-hosted by the Conflux Network and ChainIDE, the Conflux Labs x ChainIDE: Hydra Developer Bootcamp is launching its opening ceremony starts on April 2nd at 1...

SINGAPORE, 21 March 2022 — Amber Group, a leading global digital asset platform, is proud to announce the appointment of Ehsan Haque as its General Counsel...

Zurich (CH), 17 February 2022 – CLST Markets, an institutional-only lending and borrowing venue for stablecoins and crypto assets, has successfully facilitated an uncollateralized multi-million USDC...

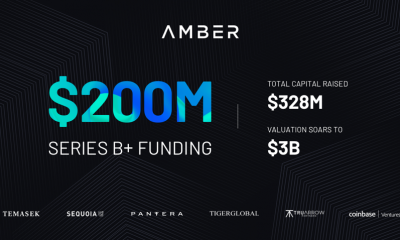

SINGAPORE, 22 February 2022 — Amber Group, a leading global digital asset platform, announced a $200 million Series B+ round led by investment company Temasek, with...

The most anticipated Africa Cup of Nations 2022 is happening right now in Cameroon until February 6, 2022. The top teams of Africa will compete with...