What is Crypto Arbitrage Trading?

The opportunities to make money with crypto are plenty, especially if you have trading experience. One of those opportunities is crypto arbitrage trading.

In this guide, you will learn what crypto arbitrage is and how it works.

What is Crypto Arbitrage Trading?

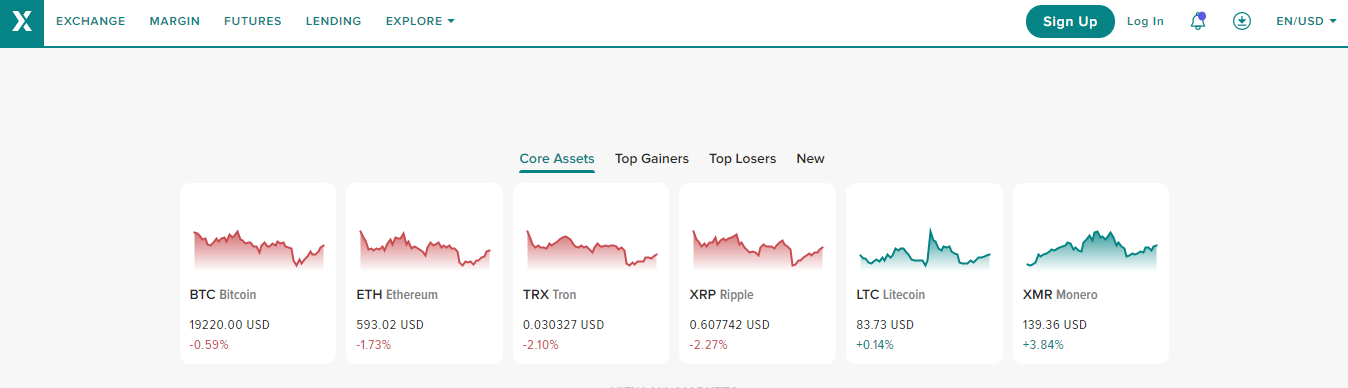

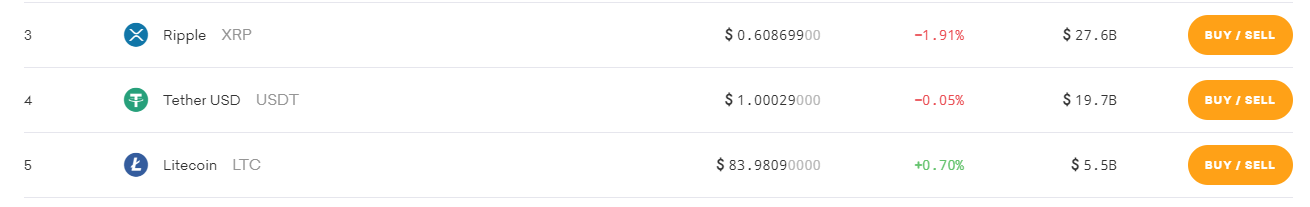

Crypto arbitrage is the practice of exploiting price differences between exchanges. For instance, the images below show the different litecoin prices between Poloniex and Kraken.

Arbitrage trading is not a new technique. It has been around in traditional markets where traders use it to buy and sell one stock on different markets. The goal of arbitrage trading is to make money from the price difference between separate exchanges.

However, this process is not as easy as it sounds. Traders have to buy and sell as fast as possible before the price changes.

A quick increase in trading volumes results in price differences, thereby creating an opportunity for arbitrage trading. Moreover, arbitrage opportunities can also arise from exchange inefficiencies.

How do Exchanges Set Prices?

The pricing process takes place on order books. An order book contains the buy and sell orders of various cryptocurrencies at different prices. Exchanges use the most recent trades to set crypto prices.

For example, a trader can place a buy order of $500 for one ETH. If another trader places a sell order of $500 for one ETH, the exchange will fulfill the trade and set the price of one ether at $500. If another ether sale takes place at $505, the price will move up as a result.

Alternatively, if a trader sells two ETH coins at the same price of $505, the exchange will still record this price. Therefore, the crypto amount does not matter because the exchange will always use the price of the most recent trade.

However, smaller exchanges with fewer trade volumes will base their prices on larger exchanges. This process might not happen instantly, creating a chance to perform arbitrage trading.

Note that since large exchanges have high trading volumes, their prices are likely to be favourable. On the contrary, small exchanges that depend on large exchanges are likely to have higher prices.

Types of Crypto Arbitrage

There are two main types of crypto arbitrage namely:

- Arbitrage between two exchanges

- Triangular arbitrage, which takes place within one exchange

Arbitrage Between Two Exchanges

Arbitrage between two exchanges occurs when you purchase a cryptocurrency from one exchange then sell it on another exchange where the price is higher. The risk with this type of arbitrage is high because price differences between exchanges last only a few seconds. On the other, transferring the crypto from one exchange to another will take minutes.

Therefore, by the time you move the crypto to the other exchange to sell, you might find that the price has dropped. That means that you might have to wait until it rises again in order to sell for a profit.

Furthermore, moving crypto from one exchange to another will incur withdrawal, deposit, and network fees. Traders can solve the transaction fees issue by holding the crypto on two exchanges. Next, they can buy and sell a cryptocurrency simultaneously on the two exchanges.

For instance, a trader might have $19,000 worth of tether on Binance and one bitcoin on Kriptomat. When the price of one bitcoin is $19,100 on Kriptomat but only $19,000 on Binance, they will buy bitcoin using tether on Binance. Next, they will sell the bitcoin on Kriptomat.

The trader will neither obtain nor lose bitcoin. However, they will make $100 because of the spread between Kriptomat and Binance.

Triangular Arbitrage

Triangular arbitrage takes place within one exchange. In this method, the trader will use three cryptocurrencies and trade the difference between them.

To illustrate, a trader might see an opportunity between litecoin, ether, and dash. If the exchange undervalues one of these cryptocurrencies, an arbitrage opportunity might arise.

Therefore, the trader could sell litecoin for ether, then use the ether to buy dash. Next, the trader will purchase back bitcoin with dash. If the strategy was a good move, the trader will end up with more bitcoin than they previously had.

Other Arbitrage Types

The other types of arbitrage are cross-border and statistical. Cross-border arbitrage takes place between two exchanges located in different countries, while statistical arbitrage entails mathematical modelling and the analysis of price patterns and price differences between separate assets.

Factors to Consider for Crypto Arbitrage

The difference in trading volumes on exchanges is one of the factors that determine an arbitrage opportunity.

Consequently, you should keep an eye on these volumes when trading between exchanges. For instance, you could buy from a smaller exchange and sell on a bigger exchange if it makes sense. You can also do the opposite. High volumes lead to low prices and vice versa. Therefore, pay attention to these two factors.

Location is also significant when it comes to arbitrage trading. An exchange in a different country might have low trade volumes at certain hours. Since you are in a different time zone, you could search for an opportunity to make money.

Another factor you can consider is the transaction confirmation time for cryptocurrencies, which is about 15 to 20 minutes. If the price drops within this time, you could make little to no money.

That means that arbitrage trading could sometimes take days to execute as you wait for a window to open. If you buy a cryptocurrency but cannot sell it for profits, then you have made a single-side trade.

Furthermore, you will need accounts on several exchanges to perform this type of trading. That is not enough, however, because you will need to watch the price and trade volumes before making a move.

Risks of Crypto Arbitrage

Crypto arbitrage is risky as is the case with all other trading methods. Traders that carry out arbitrage trading run the risk of slippage.

Slippage takes place when a trader creates an order to purchase crypto but discovers that it is larger than the most inexpensive offer on the order book. As a result, the order will ‘slip’ because it will cost more than the trader expected to pay.

Crypto price movements also work against arbitrage traders. Since the spread between two exchanges could disappear in a second, traders have to work fast.

With spreads being small most times for top cryptocurrencies, transaction fees could reduce or eliminate any potential earnings. Also, such tight margins could mean that a trader will have to make several trades to make a decent profit.

Furthermore, creating several accounts across various platforms puts your privacy and security at risk. Because most exchanges require your personal details, you will be sharing this information across several exchanges. Therefore, if one of these exchanges has a poor security system, hackers can access your information. Additionally, they could access your wallet holdings as well.

Crypto arbitrage is legal since you are only taking advantage of price gaps between one exchange and another. Nevertheless, it will take up a lot of your time analysing prices and making as many trades as possible to make a profit. That is why people use trading bots to increase efficiency and save on time. However, as more and more traders use bots, the competition increases.

To learn more about Bitcoin, download the Bitcoin Beginner’s Handbook for free.

Magic Eden Has Quietly Become the Best Ethereum NFT Marketplace

Samara Asset Group Launches Bitcoin CPI (BTCCPI)

Introducing Noones – Africa’s P2P Super App

Why Crypto’s Leading the Way in Africa’s Evolving Finance Landscape

The Rise of Bitcoin in the Online Gaming World

Unlock the Thrills of NHL Crypto Betting and Live Streaming

Understanding the Impact of Cryptocurrency Volatility on NBA Betting Markets

The Future of Crypto College Football Betting: Trends and Predictions

How Mobile Apps are Changing Sports Betting