eToro Review: Pros and Cons of Trading Cryptocurrencies on eToro

Image by Marco Verch – Flickr – Attribution 2.0 Generic (CC BY 2.0) https://www.flickr.com/photos/149561324@N03/

eToro is a leading online social trading platform that enables the trading of stocks, forex, and cryptocurrencies. The UK-based company started out as a general trading platform but would eventually include cryptocurrency and other trading instruments to keep abreast of the shifting markets and consumer demands.

Brief History of eToro

eToro was founded in January 2007 as the brainchild of three entrepreneurs who aimed to make trading accessible for anyone, anywhere in the world. In addition, they espoused a libertarian philosophy for consumers when it came to trading, by reducing their dependency on banks and other financial intermediaries. The first iteration of the eToro online platform included a friendly UI and graphic representations for various financial instruments, to make it easy for traders.

eToro continued in the same vein and introduced the innovative CopyTrader feature that would enable users to mirror other successful traders and in 2013, eToro included stocks to its other assets allowing traders to go beyond currencies and commodities and trade in the stock market. In addition, the platform enabled bitcoin trading through CFDs.

In 2016, eToro had added Copy Portfolios, which were managed portfolios that bundle various top traders and assets within a market strategy.

In 2017, eToro fully integrated cryptocurrency trading to the platform by adding support for digital currencies such as ether (ETH), litecoin (LTC) and ripple (XRP).

Registration and Verification

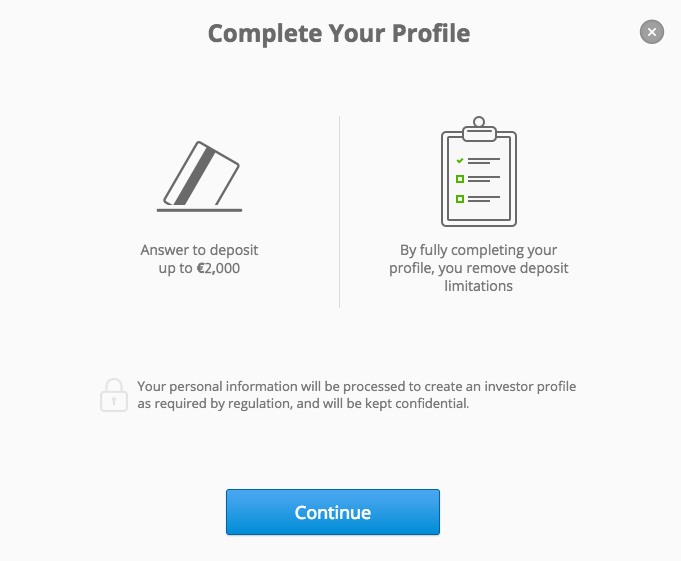

To register for eToro you will have to submit the following details: name, a username, email address, phone number, and country code. Once that is done you can proceed to create the account and log in. You will receive a confirmation email, which will require you to verify your identity in order to make your first deposit. Upon signing in you will view a pop-up window which will welcome you to eToro but also direct you to complete your profile. This is very important as it will allow the site to tailor make the experience to your needs.

To register for eToro you will have to submit the following details: name, a username, email address, phone number, and country code. Once that is done you can proceed to create the account and log in. You will receive a confirmation email, which will require you to verify your identity in order to make your first deposit. Upon signing in you will view a pop-up window which will welcome you to eToro but also direct you to complete your profile. This is very important as it will allow the site to tailor make the experience to your needs.

After you click on the “Complete Your Profile” tab on the left-hand dashboard, it will generate a pop-up KYC (Know Your Customer) window. Click on the “Continue” icon at the bottom of the window and proceed to the next pop up wizard. Fill in the details required as they appear from your I.D. or passport. Once you have completed a section move to the next using the arrows at the bottom of the wizard.

You will note many of the questions will encompass your knowledge of financial instruments and trading objectives so as to give you a more personalised experience that suits your needs. You will also be required to upload certain documents such as your ID/Passport.

How to Trade Crypto on eToro

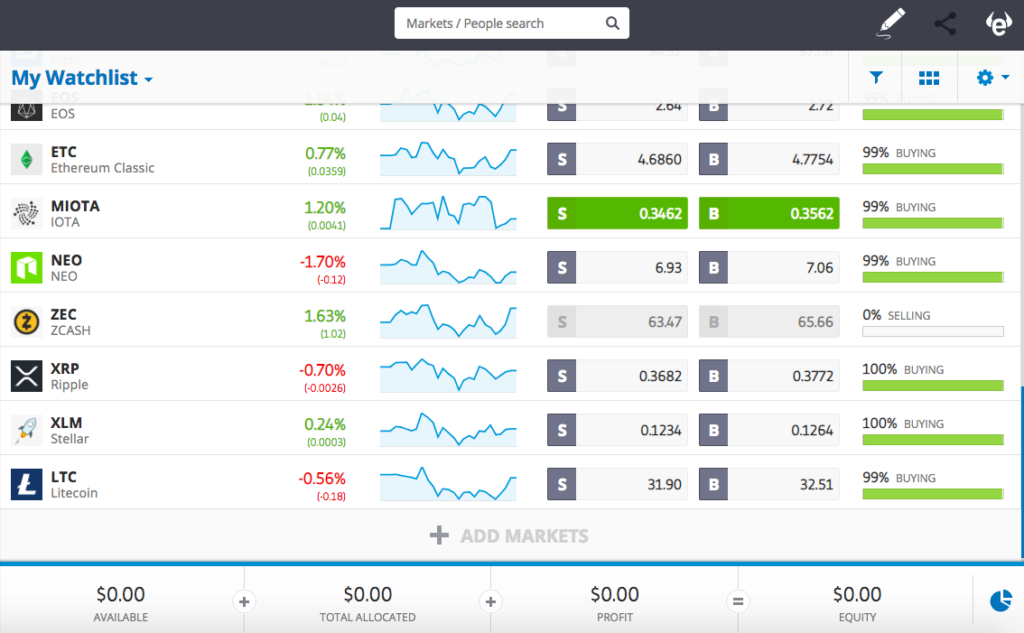

Trading in digital currencies on eToro is easy due to its simplified user interface where all key segments are placed on the left side of the screen. You will see a watchlist which will include a list of the main markets being traded on the platform. Each market row will have a number of specialized tools to assist you in your trades. For example, bitcoin will be listed alongside the bid and ask prices, the line graph of the assets price movements as well as the market sentiment (percentage of purchase and selling interests). If you are not content with the assets listed you can add new markets by scrolling down the page and clicking on the “ADD MARKETS” tab.

To have an easier experience when trading in cryptocurrencies it would be advisable for you to filter the watchlist results. Opposite the ‘My Watchlist’ drop-down option is a funnel-shaped icon which will provide you with a list of all the asset types available on the platform. The icon is set to list all the assets together as a default but once you click on crypto, your watchlist will only list digital currencies. You can add new cryptocurrency options by clicking on the “ADD MARKETS” tab then selecting from among the supported coins.

Furthermore, you can choose cryptocurrency trading pairs or select crypto-fiat trading pairs. To buy and sell all you have to do is click on the ticker of the cryptocurrency in question. For example, click on the BTC ticker and the platform will direct you to the BTC page. On this page, you can access the latest bitcoin-related news and statistics or study the market activity on charts.

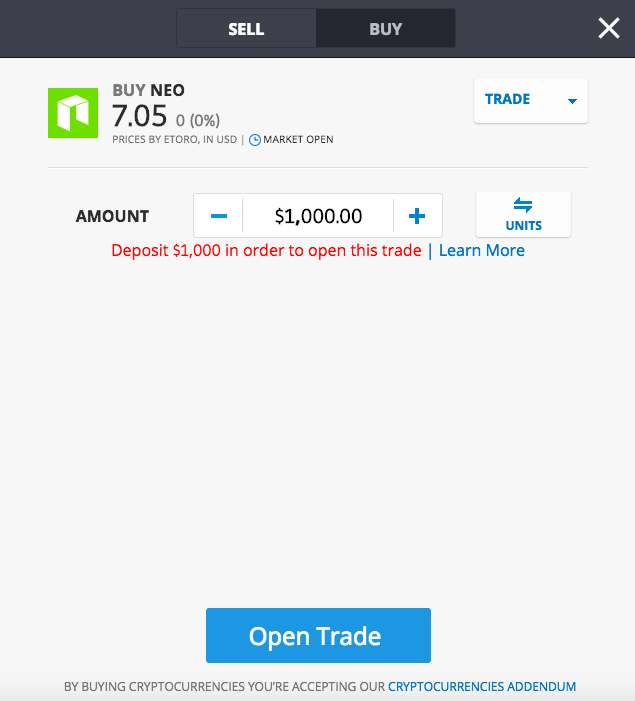

To execute a trade you will click on the TRADE tab at the top right corner of the page. The tab will generate a window that requires you to input the details of your trade. On the window, you will have to specify whether your transaction is a ‘Trade’ or an ‘Order’. With BTC you can settle on the position then place a BUY position. Once you set the order the platform will execute the trade on the set position. The same will apply for an open short or SELL order. Remember, if you choose to open short or SELL positions for digital currencies on the platform, this falls under a CFD position.

To execute a trade you will click on the TRADE tab at the top right corner of the page. The tab will generate a window that requires you to input the details of your trade. On the window, you will have to specify whether your transaction is a ‘Trade’ or an ‘Order’. With BTC you can settle on the position then place a BUY position. Once you set the order the platform will execute the trade on the set position. The same will apply for an open short or SELL order. Remember, if you choose to open short or SELL positions for digital currencies on the platform, this falls under a CFD position.

If you are looking to withdraw funds from your account then the procedure is simple. Click on the Withdraw tab at the bottom left of the dashboard. Money can be withdrawn up to the value of the balance of your account less the amount of margin used. You can withdraw funds using the same payment channel used for your deposit. Typically, withdrawals take up to one business day to be processed and subsequently sent to their recipients.

Cryptocurrency Trading Options and CFDs

The number of cryptocurrencies listed on eToro is relatively limited compared to other platforms. This can be attributed to its nature as a CFD trading platform as opposed to a “real” cryptocurrency exchange. Having said that, you can still own or short the most popular digital currencies in the market. You can also trade in cryptocurrencies such as Dash (DASH), Ethereum Classic (ETC), Stellar (XLM), NEO (NEO), Cardano (ADA) and EOS (EOS), among several others.

You will notice CFDs play an important role when it comes to cryptocurrency trading on eToro. A CFD or contract for difference is a type of derivative trading where investors can speculate on whether an asset will rise or fall using leverage. CFD activity cuts across markets such as forex, shares, indices, treasuries, commodities, and cryptocurrencies.

In regards to cryptocurrency, the important thing to remember when trading CFDs is that you will not be buying or selling the underlying asset. Instead, you will buy or sell a number of units for that instrument, in this case, the digital currency, based on your prediction of whether the price will rise or fall. Therefore, if the price moves in your favour you get multiples of the existing CFD units you purchased or sold. However, should the price move against your position you lose the points.

eToro advises users to be cautious when trading CFDs since its possible for your losses to exceed the deposit. Cryptocurrencies and CFD trading have always been interlinked on eToro. Remember, bitcoin trading was first enabled in 2013 via CFDs. The same trend continues to date with many of the cryptocurrency trades being CFDs instead of dealing with the actual asset. However, since September 2017, those who invested in the BUY position for any digital currency also own the underlying asset.

Copy Portfolios

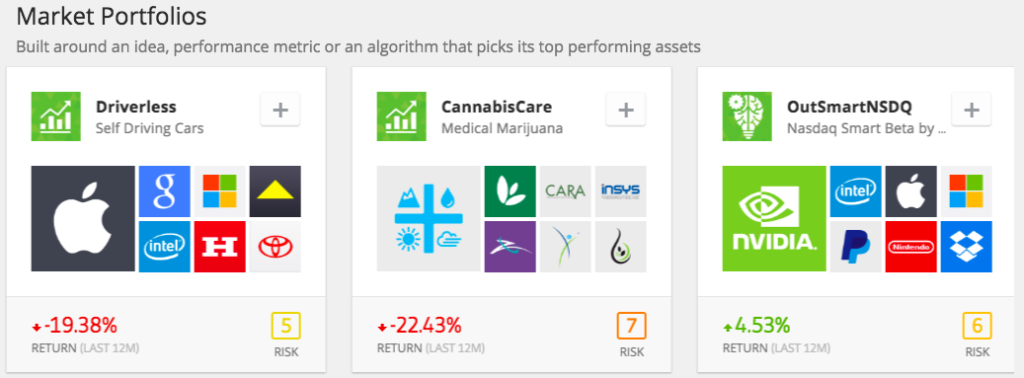

Another tool you can take advantage of on eToro is a Copy Portfolios. This feature allows for both fiat and cryptocurrency trading. Copy Portfolios are a managed portfolio account system where traders can invest their money and have a top trader make all the financial decisions. To access this all you need to do is click on the ‘Invest in Copy Portfolios’ tab at the bottom of the dashboard and find a Copy Portfolio that meets their investment strategy and goals, and click to join the desired portfolio.

There are three options when it comes to Copy Portfolios: Market Portfolios, Top Trader Portfolios, and Partner Portfolios.

Market Portfolios is where assets like stocks, commodities, ETFs or cryptocurrencies are bundled together under a predetermined trading strategy. Top Trader Portfolios are comprised of eToro’s best performing and sustainable traders. Finally, we have Partner Portfolios, which are formed by eToro’s partners who undertake thorough market scrutiny for the creation of investment engines under a chosen trading strategy.

Copy Trading

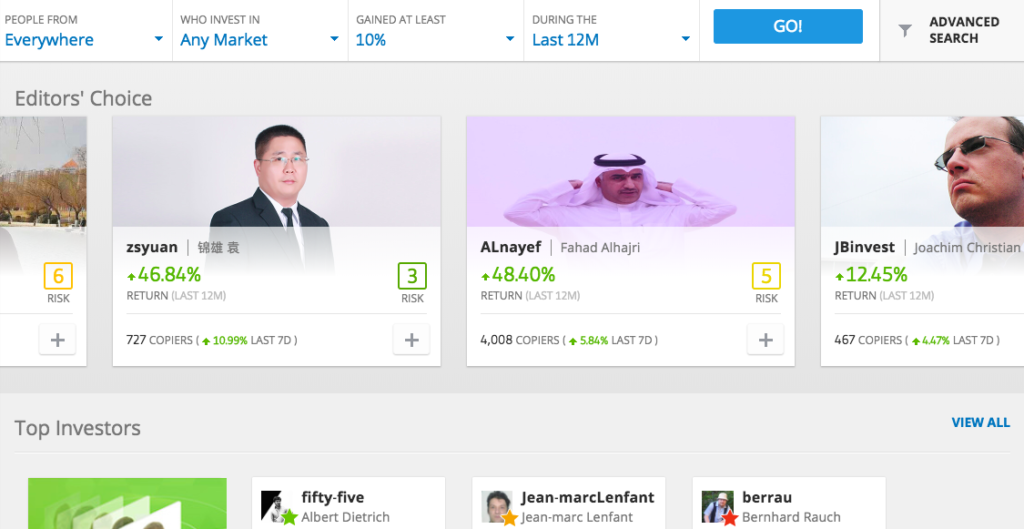

Copy trading enables traders to copy the trading activity of the best traders on eToro. This feature can be used for both fiat and cryptocurrency investments and is the feature that eToro has become famous for as a copy trading (or social trading) platform.

By copying the activity of another top investor you can enter into the cryptocurrency market without having to do a lot of research.

You can become a top trader yourself by ensuring you have a low-risk score and consistently generate a profit. This way other traders can learn from your wisdom and you get rewarded for your effort. To copy a trader who has cryptocurrency in his/her portfolio click on the ‘Copy People’ tab on the dashboard and select a trader after having analysed their portfolio and are comfortable with their results and investment strategy.

Minimum Trade Size and Fees

The minimum balances for manual positions are based on the instrument. For cryptocurrencies, the total minimum balance is $200 whereas for stocks and ETFs it is $500. For commodities, the minimum balance is $2,500 while for indices and Forex the amount is $5,000. For you to participate in copy trading, the minimum balance needed is only $200. To invest in Copy Portfolios you will need to part with a minimum of $5,000. As part of the exposure related policy, a cryptocurrency trade with a leverage of x1 requires a minimum of $200 to be invested. Nonetheless, if you invest $100 then you must have a minimum leverage of x2.

In regards to fees, eToro does not charge any fees if you open a position, instead, the fee is generated based on the spread. The platform has a record of minimum spreads for each cryptocurrency and those rates can vary based on market conditions and liquidity. You can view a comprehensive break down of the daily break spreads on the market hour & fees page on the site. The minimum withdrawal balance is $50 and the standard withdrawal fee is $25.

Cryptocurrency trading is available 24/7 and there are no charges for overnight or weekend trades. However, if you hold leveraged bitcoin or ether positions, or for shorting digital currencies you will attract some fees, the nature of which is not guaranteed. The platform will charge a monthly inactivity fee for accounts that have been dormant for up to twelve months.

Security

eToro has put in place stringent security measures to ensure your financial information and funds are protected. The platform is fully regulated and follows the FCA and CySEC guidelines. In addition, all the traditional funds are placed in Tier 1 European banks for security.

The reality about digital currencies is its largely an unregulated area, which means they are a very few legal options for redress in case of complaints. eToro understands this and has an accessible support team to listen to customer complaints and resolve them.

Mobile Version and Customer Service

eToro also has a mobile version for smartphone users. If you have an iOS device then you can download the eToro-Social Trading app on Apple Store. Alternatively, if you own an Android device you can download the eToro Cryptocurrency Trading app on Google Play. Both apps are designed to give you a social experience when it comes to cryptocurrency trading.

Moreover, you can contact any of the eToro offices in the UK, Europe, and Australia using the contact addresses listed on the contact page. For more trading related inquiries you can click on the ‘Customer Service Center’ section on the HELP & EDUCATION segment at the bottom of the site landing page.

Pros

- Wide range of markets

- Variety of trading options

- Easy to navigate user interface

- Trustworthy and secure

- Innovative trading features eg. Copy Portfolios, Copy Traders

- Data privacy

- Demo accounts

- Customer support

Cons

- Relatively high fees

- No cryptocurrency deposits

- Limited cryptocurrency options

The Verdict

While eToro is primarily a social trading platform for traditional assets it is still very useful for cryptocurrency traders. The platform scores highly by having a well-designed user interface that makes crypto trading easier than ever. While the limited cryptocurrency options may be disappointing for some digital currency investors, the platform makes up for it in way of trading options for those who prefer trading in popular coins and token using different trading strategies.

eToro is great for beginners who are just getting started with investing in crypto as well as more advanced traders who want to go both long and short the market.

Magic Eden Has Quietly Become the Best Ethereum NFT Marketplace

Samara Asset Group Launches Bitcoin CPI (BTCCPI)

Introducing Noones – Africa’s P2P Super App

Why Crypto’s Leading the Way in Africa’s Evolving Finance Landscape

The Rise of Bitcoin in the Online Gaming World

Unlock the Thrills of NHL Crypto Betting and Live Streaming

Understanding the Impact of Cryptocurrency Volatility on NBA Betting Markets

The Future of Crypto College Football Betting: Trends and Predictions

How Mobile Apps are Changing Sports Betting