On the 25th of August, I had the pleasure to interview BitHub Africa‘s founder John Karanja in his office in Nairobi. During our conversation, we discussed the potential and the challenges of bitcoin adoption in Kenya and Africa.

BitcoinAfrica.io: How do you see the current situation for bitcoin in Kenya and Africa in general?

John Karanja: I think bitcoin is still in the early stages, even beyond Africa. In Kenya, we see bitcoin adoption is mainly with speculators and traders who are buying and selling bitcoin to make money. Volumes have been growing over time. I think it’s about 10 million shillings weekly, which is around $100,000 traded every week on the peer-to-peer platform LocalBitcoins.com.

BitcoinAfrica.io: Is LocalBitcoins the main exchange used in Kenya?

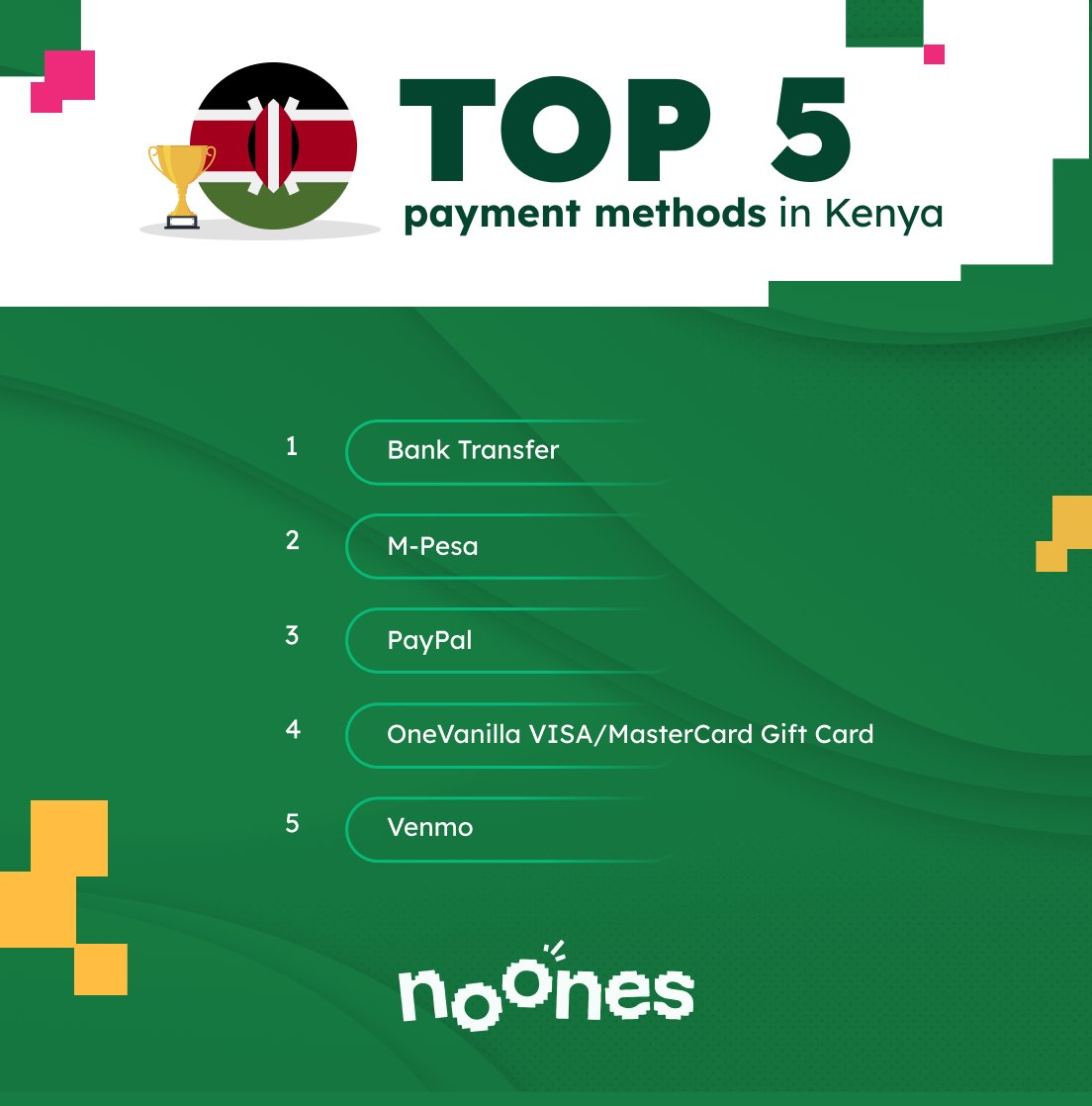

John Karanja: Yes, it is. Bitcoin in Kenya is still are a very early stage. There are start-ups that have come and gone because it appears that bitcoin is not ready to scale amongst the average person here. Hence, it’s not going to compete with the mobile money system M-Pesa, for example, at least in the short term.

I think what we’re seeing is now more focus shifting to blockchain technology, being used in other use cases like identification systems, data storage or smart energy. We’re applying ourselves in these different areas to see which are the most viable and we will then launch our projects after doing so. In fact, we’ve produced a report on blockchain opportunities in Africa that goes into depth on that subject. The report, titled The African Blockchain Opportunity, was officially launched at the AITEC Summit in Nairobi on the 31st of August. The reason we produced the report is to provide the information about the potential opportunities that the blockchain technology is creating in Africa for entrepreneurs.

That’s where we are at the moment. We’ll probably launch our first project in early 2017 using the blockchain. So far, our work has primarily been focused on research and development here at BitHub.

BitcoinAfrica.io: To touch on the point you made about the move away from bitcoin to the blockchain. Do you think that, while the initial bitcoin in Africa story was remittance and supporting the underbanked population, there is a move away from that to a focus on the blockchain for commercial users as it very much is in the Western world now?

John Karanja: I’d say they’d go in parallel because bitcoin has a lot of inherent advantages over any other secondary blockchain platform, in that it’s the most secure, it has the largest user base, it has a lot of liquidity and there’s money going in. But in terms of the user experience, it’s not quite mature yet. However, there are a lot of people working on improving that. So I think that will eventually be resolved but the technology is so disruptive that it can be applied to so many areas, some of which are fairly simple like storage of data, for many small enterprises getting cloud systems or complying with KYC. For these types of systems, the cost is often quite prohibitive. So what the blockchain can do is streamline that and open access to everyone. Identifying a customer, then also supplying him the products and enabling payment. So the blockchain can cover that whole process from start to finish. I see both bitcoin and the blockchain moving together.

John Karanja: I’d say they’d go in parallel because bitcoin has a lot of inherent advantages over any other secondary blockchain platform, in that it’s the most secure, it has the largest user base, it has a lot of liquidity and there’s money going in. But in terms of the user experience, it’s not quite mature yet. However, there are a lot of people working on improving that. So I think that will eventually be resolved but the technology is so disruptive that it can be applied to so many areas, some of which are fairly simple like storage of data, for many small enterprises getting cloud systems or complying with KYC. For these types of systems, the cost is often quite prohibitive. So what the blockchain can do is streamline that and open access to everyone. Identifying a customer, then also supplying him the products and enabling payment. So the blockchain can cover that whole process from start to finish. I see both bitcoin and the blockchain moving together.

BitcoinAfrica.io: Do you think bitcoin remittances will still be a growth market in Africa? One thing that you have now is there are so many low-cost remittances services, such as World Remit, TransferWise and CurrencyFair. Do you think that because of them, bitcoin for remittances is not going to be such a big growth market anymore as the cost of exchanging bitcoin back into local African currency can be quite high at times when using peer-to-peer exchanges as Citigroup pointed out in a recent research piece?

John Karanja: Bitcoin is not the clear winner yet when it comes to remittances. However, it is very much a possibility that it will be integrated into the background. For example, WorldRemit could end up using it for settlements, rather than pushing customers to use bitcoin. And we shouldn’t forget that there is still huge risk associated with bitcoin as its infrastructure is still relatively underdeveloped.

At the end of the day, it’s a protocol, it’s not an application. I don’t think anyone can say for sure bitcoin is dying or Bitcoin will succeed. But there’s also the possibility that we’ll see better technology rising very quickly and learning from what Bitcoin has been able to achieve.

BitcoinAfrica.io: Aside from Kenya, Nigeria, Ghana and South Africa, which country do you think will be the next African country to witness a reasonable rate of bitcoin adoption and the growth of a local bitcoin ecosystem?

John Karanja: I think those are the main countries. Possibly we could also see Rwanda because Rwanda has a very aggressive education platform that is aiming to leverage technology. I think that’s one country that’s usually left out, but it’s mostly those countries that have already advanced in terms of the internet and social media adoption. You can just look at Facebook statistics and see the countries where Facebook is heavily adopted. Those will be the likely next adopters of Bitcoin.

BitcoinAfrica.io: I read about how the telecoms giant Safaricom banned Bitcoin on their mobile money platform MPESA. Do you think that the “Safaricoms” in the other African countries will also try to hinder Bitcoin innovation to prevent their mobile payments systems from disruption?

John Karanja: That’s a good question. I’d say right now, ironically, more Bitcoin is traded using M-Pesa than ever before because of LocalBitcoins. They wouldn’t really be able to stomp it out but what they’d be able to do is restrict other centralized entities from using bitcoin as a platform to scale because obviously, they would be potential competition to them.

There may be room for telecoms innovating using bitcoin, but that would be very risky because bitcoin and other cryptocurrencies seem to work best in a peer-to-peer format because the risk is distributed as much as possible. If I’m sending you Bitcoin you send me M-Pesa, it’s just me and you. The counterparty risk is between me and you. It’s not in a centralized place that can get hacked. My guess would be that peer-to-peer platforms are where Bitcoin would dominate.

I don’t know if you saw the President signed the law that caps the interest rates at 14%?

BitcoinAfrica.io: Yes. I read that.

John Karanja: That’s the kind of situation that can now allow for bitcoin to triumph because the banks will not be too interested in micro-lending and may wish to partner with fintech solution providers to provide liquidity in that market segment. Therefore, people will now move more towards peer-to-peer or social lending platforms. I think in a peer-to-peer world bitcoin could dominate. The question is how simple can the peer-to-peer applications become? Because the peer-to-peer ecosystem is not really developed enough to be a safe and secure way to transact in digital currencies.

BitcoinAfrica.io: What are your thoughts on Ethereum and what do you think about ether from an investment point of view?

John Karanja: We did a study on it. It’s in the report. I believe Ethereum will have much more challenges than Bitcoin because they’ve used a high-level computer programming language called Solidity that essentially allows you to program ‘what if’ statement. But now, as they’ve realized from the Dao attack, by doing so that they opened so many vulnerabilities for attacks. For them to plug that, as a developer, I see that being more difficult than using a low-level platform like bitcoin where the rules are fixed. There are few rules and they are fixed. On the bitcoin platform, there’s no variation on what can happen. We know what can happen on that platform.

Ethereum, I would call ambitious but the advantage they have is they are secure. They have a good amount of miners behind the network. They’ve managed to attract enough interest in terms of safeguarding and keeping the platform that if they figure out their niche, it could advance blockchain technology even further.

BitcoinAfrica.io: My last question is about The African Blockchain Opportunity report that you have published. You mentioned it briefly earlier. Could you elaborate on it, please?

John Karanja: Essentially the whole idea behind the report is to provide a manual that anyone can pick up, whether it’s a developer, a bitcoin enthusiast or an entrepreneur and read up on areas of interest. It covers the technical aspects of bitcoin and the blockchain technology within an African context.

There are also a couple of chapters on fintech and we also have linked several developer resources. A developer can go and look at the source code and then try to either contribute or fork it and develop it as an application. We’re now going to be using that for our training curriculum. Then hopefully the idea is to have a second edition maybe in one or two years from now with updates.

BitcoinAfrica.io: Thank you for taking the time to conduct this interview.

BitcoinAfrica.io: Thank you for taking the time to conduct this interview.

If you want to find out more about BitHub Africa visit their website and if you would like to purchase the report The African Blockchain Opportunity click here or on the banner on the right. If you would like to reach out to John directly, you can find him on Twitter at @BitHubAfrica.

Features3 years ago

Features3 years ago

Bitcoin2 years ago

Bitcoin2 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features8 months ago

Features8 months ago

Bitcoin10 months ago

Bitcoin10 months ago