SAN FRANCISCO, Sept. 4, 2018 /PRNewswire/ — Abra, the first and only all-in-one cryptocurrency wallet and exchange, today announced its support for Single Euro Payment Area (SEPA) bank accounts. With today’s announcement, European users can now initiate direct transfers from European banks, offering one more point of entry into the growing sector of cryptocurrency investing.

“With users from over 70 countries globally, and a greater demand for the ability to invest in cryptocurrencies from any bank account, it is really important to give investors the opportunity to fund their Abra wallet directly from any bank account,” said Bill Barhydt, founder and CEO of Abra. “This new feature is helping to change the way people invest, adding to a brighter future for the cryptocurrency market around the world.”

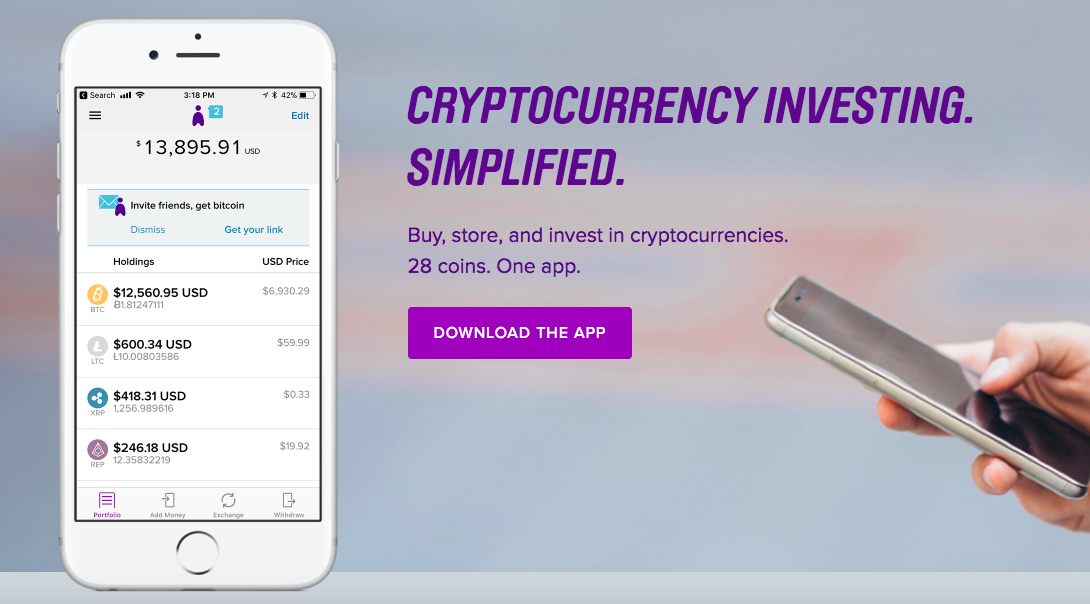

The new functionality enables every user in Europe the ability to fund their Abra wallet using their European bank account and then use the funds to invest in any of the 28 cryptocurrencies supported on Abra.

“As we continue to expand our capabilities, we are by constantly looking for efficient and secure on-ramps that will enable our users to easily invest in cryptocurrencies,” says Barhydt. “Ease, efficiency and effectiveness are paramount for us in helping our clients invest.”

Previously, Abra wallets were funded using bank and wire transfers in the United States as well as via American Express, Visa and MasterCard debit and credit cards around the world. Officially, Abra’s European bank transfers will occur using the SEPA guidelines. Under SEPA, several European member countries will also be eligible to deposit national fiat currency in addition to Euros.The SEPA area includes the 28 members of the European Union, as well as four members of the European Free Trade Association (Austria, Germany, Netherlands, Belgium, Greece, Poland, Bulgaria, Hungary, Portugal, Cyprus, Ireland, Romania, Czech Republic, Italy, Slovak Republic, Denmark, Latvia, Slovenia, Estonia, Lithuania, Spain, Finland, Luxembourg, Sweden, France, Malta, United Kingdom and Croatia, Iceland , Monaco , Switzerland, Liechtenstein, Norway, San Marino).

The Abra wallet is unique because it is non-custodial where cryptocurrencies and the wallet’s private key are held directly by the user. The Abra model is 100% peer-to-peer, with no middleman ever holding, managing or touching the users funds at any point in any transaction.

Once European users have transferred money to Abra they will receive the bitcoin into their Abra wallet where it can be securely stored, exchanged for 28 other “altcoins,” or converted back to their currency and re-deposited back into the Abra user’s Europe-based bank.

Along with the news of its support for SEPA, Abra has announced the addition of three new coins. Cardano (ADA), Basic Attention Token (BAT) and Tron (TRX) will be available in the Abra app in addition to Bitcoin [BTC], Bitcoin Cash [BCH], Dash [DASH], Dogecoin [DOGE], Ethereum [ETH], Ethereum Classic [ETC], Golem [GNT], Litecoin [LTC], OmiseGO [OMG], Qtum [QTUM], Ripple [XRP], Vertcoin [VTC] Zcash [ZEC], Bitcoin Gold [BTG], Stellar Lumens [XLM], DigiByte [DGB], Augur [REP], Status [SNT], Stratis [STRAT], 0x [ZRX], Monero [XMR], NEM [XEM], NEO [NEO], Lisk [LSK] and Verge [XVG].

In addition to the new coins released, beginning over the next several days users will also have the ability to fund their Abra wallet using Bitcoin Cash (BCH). This would come in addition to the newly launched SEPA bank transfers and cryptocurrency deposit options already available in the app today.

How Abra works

Consumers can add money to their wallets using a bank account, Visa, Mastercard, American Express card or cryptocurrency including bitcoin, litecoin and bitcoin cash purchased outside Abra from anywhere in the world. They can then invest in any of the 28 cryptocurrencies and 50 fiat currencies offered on the Abra app, quickly, easily and safely. To develop the new wallet and integrated exchange, Abra built a first-of-its-kind platform using stablecoins that facilitates holding both fiat coins as well as cryptocurrencies through a combination of bitcoin and litecoin based smart contracts. This unique multi-sig smart contract based investment platform uses P2SH scripts on the bitcoin and litecoin blockchains that simulate investment contracts the way a gold ETF is a contract based on USD. Abra acts as the counterparty to the P2SH scripts, and the company runs a market-making operation that hedges away its counterparty risk on these contracts.

Consumers can add money to their wallets using a bank account, Visa, Mastercard, American Express card or cryptocurrency including bitcoin, litecoin and bitcoin cash purchased outside Abra from anywhere in the world. They can then invest in any of the 28 cryptocurrencies and 50 fiat currencies offered on the Abra app, quickly, easily and safely. To develop the new wallet and integrated exchange, Abra built a first-of-its-kind platform using stablecoins that facilitates holding both fiat coins as well as cryptocurrencies through a combination of bitcoin and litecoin based smart contracts. This unique multi-sig smart contract based investment platform uses P2SH scripts on the bitcoin and litecoin blockchains that simulate investment contracts the way a gold ETF is a contract based on USD. Abra acts as the counterparty to the P2SH scripts, and the company runs a market-making operation that hedges away its counterparty risk on these contracts.

Because of its stablecoin platform, Abra can quickly add additional cryptocurrencies to the app once they pass the platform’s rigid analysis around liquidity, contract market making, and other factors. Additionally, consumers in any country will eventually be able to invest in other asset classes regardless of where the asset originated. This model can be extended to stocks, bonds, commodities and more with minimal changes to the existing Abra app.

The Abra wallet is unique because it is non-custodial where cryptocurrencies and the wallet’s private key are held directly by the user. The Abra model is 100% peer-to-peer, with no middleman ever holding, managing or touching the funds at any point in any transaction.

About Abra

Abra is the first and only all-in-one global app offering a true crypto exchange and digital wallet in one place – making cryptocurrency investing simple. Abra empowers consumers to buy, store, invest and hold 28 cryptocurrencies and 50 fiat currencies on a single app. Exchanges between multiple cryptocurrencies or fiat are quick, easy, and safe. Plus, with the Abra app, consumers can manage all crypto investments in one screen. Abra was founded in 2014 by Bill Barhydt, a veteran in the cryptocurrency space and an early Netscape employee. Investors include American Express Ventures, First Round Capital, Foxconn Technology Group, Arbor Ventures, Lerer Hippeau, RRE Ventures, Silver8 Capital and others.

Media Contact: Nicole Cueto

Nicole@Agentofchange.com

Readers should do their own due diligence before taking any actions related to the company, product or service. BitcoinAfrica.io is not responsible, directly or indirectly, for any loss or damage caused by or in connection with the use of or reliance on any content, product or service mentioned in this press release.*

Features3 years ago

Features3 years ago

Bitcoin2 years ago

Bitcoin2 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features8 months ago

Features8 months ago

Bitcoin10 months ago

Bitcoin10 months ago

Consumers can add money to their wallets using a bank account, Visa, Mastercard, American Express card or cryptocurrency including bitcoin, litecoin and bitcoin cash purchased outside Abra from anywhere in the world. They can then invest in any of the 28 cryptocurrencies and 50 fiat currencies offered on the Abra app, quickly, easily and safely. To develop the new wallet and integrated exchange, Abra built a first-of-its-kind platform using stablecoins that facilitates holding both fiat coins as well as cryptocurrencies through a combination of bitcoin and litecoin based smart contracts. This unique multi-sig smart contract based investment platform uses P2SH scripts on the bitcoin and litecoin blockchains that simulate investment contracts the way a gold ETF is a contract based on USD. Abra acts as the counterparty to the P2SH scripts, and the company runs a market-making operation that hedges away its counterparty risk on these contracts.

Consumers can add money to their wallets using a bank account, Visa, Mastercard, American Express card or cryptocurrency including bitcoin, litecoin and bitcoin cash purchased outside Abra from anywhere in the world. They can then invest in any of the 28 cryptocurrencies and 50 fiat currencies offered on the Abra app, quickly, easily and safely. To develop the new wallet and integrated exchange, Abra built a first-of-its-kind platform using stablecoins that facilitates holding both fiat coins as well as cryptocurrencies through a combination of bitcoin and litecoin based smart contracts. This unique multi-sig smart contract based investment platform uses P2SH scripts on the bitcoin and litecoin blockchains that simulate investment contracts the way a gold ETF is a contract based on USD. Abra acts as the counterparty to the P2SH scripts, and the company runs a market-making operation that hedges away its counterparty risk on these contracts.

1xBit has created Ticket Rush with numerous fanciful prizes that could change your entire gambling experience. With multiple prize draws designed to select many winners, you have a chance at winning big. The prize pool is 3 BTC, with numerous winners per category.

1xBit has created Ticket Rush with numerous fanciful prizes that could change your entire gambling experience. With multiple prize draws designed to select many winners, you have a chance at winning big. The prize pool is 3 BTC, with numerous winners per category.

Tom also brought his creative mind to the forefront when brainstorming the new brand mission alongside the wider team. Crypto Lists had been searching for a new slogan, that is both accurate, descriptive, as well as evergreen – taking into consideration the future developments and growth of the company. Along with the senior leadership, a general consensus was reached: Crypto Done Smarter.

Tom also brought his creative mind to the forefront when brainstorming the new brand mission alongside the wider team. Crypto Lists had been searching for a new slogan, that is both accurate, descriptive, as well as evergreen – taking into consideration the future developments and growth of the company. Along with the senior leadership, a general consensus was reached: Crypto Done Smarter.