MINNEAPOLIS, Aug. 29, 2018 /PRNewswire/ — BanQu has developed the first-ever, blockchain economic-identity technology solution that enables a secure, immutable platform and creates economic opportunities for small-scale farmers in Africa. Leading brands looking to improve supply chain management, and enhance ROI through asset provenance, have leaped at the company’s for-profit/for-purpose blockchain-as-a-service software.

In June 2018, BanQu piloted a new partnership with the world’s leading brewer, Anheuser-Busch InBev, working to connect 2,000 Zambian farmers to the mobile platform as they harvest and sell a projected 2,000 tonnes of cassava, producing a high-quality starch used in beer—by the end of Zambia‘s growing season in August.

According to the World Health Organization about a quarter of all alcoholic beverage consumption globally is unrecorded. With supply chain traceability and transparency, BanQu provides Anheuser-Busch InBev’s local business, Zambian Breweries, with the ability to track its product every step of the way through built-in geo-location tags on all transactions along with farmer identity profiles. As products like the cassava crop move from one step to the next in the supply chain, from the farmer at the source to local businesses, aggregated buyers and retailers at the top, BanQu facilitates a record of sale etched on the immutable, decentralized ledger that is the blockchain.

According to the World Health Organization about a quarter of all alcoholic beverage consumption globally is unrecorded. With supply chain traceability and transparency, BanQu provides Anheuser-Busch InBev’s local business, Zambian Breweries, with the ability to track its product every step of the way through built-in geo-location tags on all transactions along with farmer identity profiles. As products like the cassava crop move from one step to the next in the supply chain, from the farmer at the source to local businesses, aggregated buyers and retailers at the top, BanQu facilitates a record of sale etched on the immutable, decentralized ledger that is the blockchain.

Zambian Breweries Agricultural Manager Chris Nicolle commented: “This is one of the most exciting programs to be involved with. The scope and empowerment that the platform provides to the Small Holder is exceptional and I look forward to seeing the implementation of the project, from pilot to our full-time buying platform.”

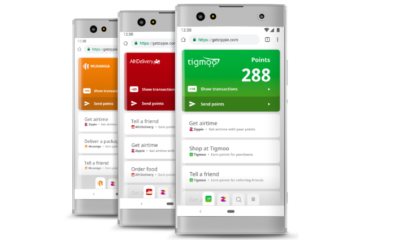

The same BanQu technology also creates economic opportunities for the world’s poorest, including refugees and the displaced. The platform gives these “unbanked” or “underbanked” people a free, secure, online profile that provides a recognizable economic identity. In just a number of minutes, unbanked mobile users set up a personal digital identification profile that connects to their banked network, including family, friends, small businesses, and associated NGOs. As they start accumulating transaction histories on the BanQu blockchain, the world’s unbanked also develop a traceable, vetted financial and personal history.

“Since 60% of the 2.7 billion unbanked and underbanked people already own mobile phones, these devices make the best platform for these people to connect to the global economy,” said BanQu Founder and CEO Ashish Gadnis. “BanQu is enabling the democratization of data, money, and eventually power, while delivering a distinct business advantage to global brands like Anheuser-Busch InBev and their localized company, Zambian Breweries, who believe in an inclusive agricultural model. Our goal is to strengthen this partnership across multiple crops and countries setting up a long-term, sustainable and responsible supply chain that directly benefits the small-scale farmers in the world.”

The BanQu Platform core includes features such as a universal design that works on any device—from the oldest to newest cell phones. The platform is 100-percent translatable by supporting any language in the world, and it is fully configurable to global brands, micro, small and medium-sized enterprises (SMEs), government and philanthropic organizations, as well as financial services (KYC/AML). The platform provides 24/7 free access to all consumers for every imaginable use case, from remote purchasing to cash disbursements. Lastly, as the platform is not tied to a cryptocurrency, the speed and security of transactions won’t be impacted by the volatility of Bitcoin or any other cryptocurrency.

The BanQu Platform core includes features such as a universal design that works on any device—from the oldest to newest cell phones. The platform is 100-percent translatable by supporting any language in the world, and it is fully configurable to global brands, micro, small and medium-sized enterprises (SMEs), government and philanthropic organizations, as well as financial services (KYC/AML). The platform provides 24/7 free access to all consumers for every imaginable use case, from remote purchasing to cash disbursements. Lastly, as the platform is not tied to a cryptocurrency, the speed and security of transactions won’t be impacted by the volatility of Bitcoin or any other cryptocurrency.

BanQu was founded in 2016 and has connected over 15,000 last-mile farmers, displaced and refugees to the platform across eight countries. The company aims to help lift 100-million people out of extreme poverty through the use of blockchain technology by the year 2028.

About AB InBev in Zambia

Zambian Breweries Plc is part of Anheuser-Busch InBev (AB InBev), the leading brewer, with more than 500 beer brands and approximately 180,000 employees based in nearly 50 countries worldwide.

Zambian Breweries was established in Zambia in 1968 and its product range has grown to include clear beers such as Mosi Lager, Castle, Carling Black Label and Eagle lager.

SOURCE BanQu, Inc

Related Links

http://www.banquapp.com

*Readers should do their own due diligence before taking any actions related to the company, product or service. BitcoinAfrica.io is not responsible, directly or indirectly, for any loss or damage caused by or in connection with the use of or reliance on any content, product or service mentioned in this press release.*

News1 year ago

News1 year ago

News2 years ago

News2 years ago

News3 years ago

News3 years ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

Sponsored Posts3 years ago

Sponsored Posts3 years ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

According to the World Health Organization about a quarter of all alcoholic beverage consumption globally is unrecorded. With supply chain traceability and transparency, BanQu provides Anheuser-Busch InBev’s local business, Zambian Breweries, with the ability to track its product every step of the way through built-in geo-location tags on all transactions along with farmer identity profiles. As products like the cassava crop move from one step to the next in the supply chain, from the farmer at the source to local businesses, aggregated buyers and retailers at the top, BanQu facilitates a record of sale etched on the immutable, decentralized ledger that is the blockchain.

According to the World Health Organization about a quarter of all alcoholic beverage consumption globally is unrecorded. With supply chain traceability and transparency, BanQu provides Anheuser-Busch InBev’s local business, Zambian Breweries, with the ability to track its product every step of the way through built-in geo-location tags on all transactions along with farmer identity profiles. As products like the cassava crop move from one step to the next in the supply chain, from the farmer at the source to local businesses, aggregated buyers and retailers at the top, BanQu facilitates a record of sale etched on the immutable, decentralized ledger that is the blockchain. The

The

1xBit has created Ticket Rush with numerous fanciful prizes that could change your entire gambling experience. With multiple prize draws designed to select many winners, you have a chance at winning big. The prize pool is 3 BTC, with numerous winners per category.

1xBit has created Ticket Rush with numerous fanciful prizes that could change your entire gambling experience. With multiple prize draws designed to select many winners, you have a chance at winning big. The prize pool is 3 BTC, with numerous winners per category.

Tom also brought his creative mind to the forefront when brainstorming the new brand mission alongside the wider team. Crypto Lists had been searching for a new slogan, that is both accurate, descriptive, as well as evergreen – taking into consideration the future developments and growth of the company. Along with the senior leadership, a general consensus was reached: Crypto Done Smarter.

Tom also brought his creative mind to the forefront when brainstorming the new brand mission alongside the wider team. Crypto Lists had been searching for a new slogan, that is both accurate, descriptive, as well as evergreen – taking into consideration the future developments and growth of the company. Along with the senior leadership, a general consensus was reached: Crypto Done Smarter.