Lagos — August 19, 2020 — Dash, the top digital currency for payments and e-commerce, announced it has partnered with Coinprofile, a Nigerian based cryptocurrency payments company, with a user-friendly platform that allows merchants and normal users to do direct crypto to fiat conversions.

Coinprofile adding Dash to its platform, gives users access to Dash features that allow transactions to take place instantly with zero fees. This will enhance the user experience when purchasing goods and services. Transactions are converted into local national currency giving the merchant the ability to continue to accept Dash payments without the risk of volatility.

Coinprofile adding Dash to its platform, gives users access to Dash features that allow transactions to take place instantly with zero fees. This will enhance the user experience when purchasing goods and services. Transactions are converted into local national currency giving the merchant the ability to continue to accept Dash payments without the risk of volatility.

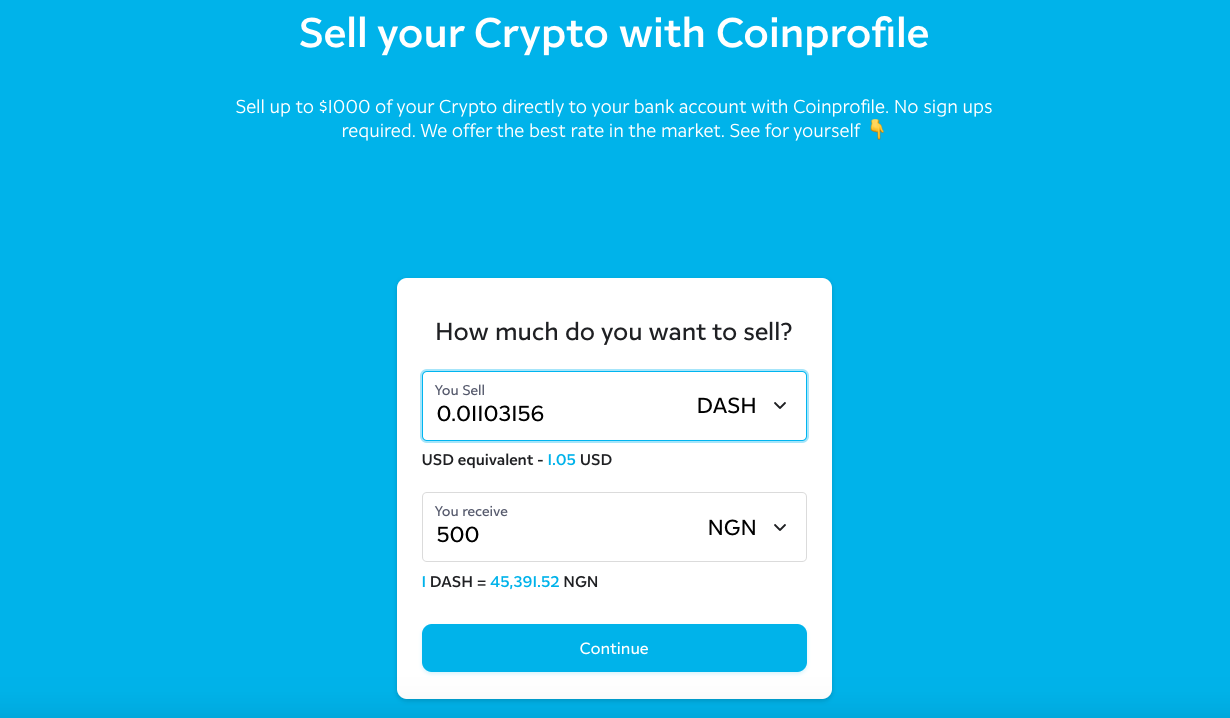

Users can now convert their Dash into Naira without having to pass through exchanges. Users can also purchase goods and services online with Dash on platforms that accept bank deposits. The largest use case is remittances to Nigeria (and other regional markets) from anywhere in the world. Remittances in the continent currently face high-fees and can take several days depending on the method of transfer. Existing fintech platforms charge an average of 15% or more.

Coinprofile integrated Dash’s InstantSend feature which makes it possible for transactions to be received in a second, an obvious edge over bitcoin transactions.

Many have pointed to markets in Sub-Saharan Africa, as having many clear use cases and advantages for cryptocurrency to solve inefficiencies and lower costs around remittances and payments. However, few major cryptocurrency projects have worked on adoption there due to several reasons, including the difficulties in navigating the complexities within the continent. Dash’s DAO model enables local teams to support the network, which enables a global-local approach in market entry and growth.

“This is an amazing one for Dash,” said Nathaniel Luz, Lead of Dash Nigeria. “The partnership with Coinprofile provides Dash users with the ability to live 100% with a ready-to-go scaleable ecosystem to expand our presence in Nigeria and soon after, the rest of Sub-Saharan Africa. Coinprofile is providing its users with the best possible Dash experience, using InstantSend to quickly complete purchases. Their solution makes it easy for merchants to accept Dash while reserving the option to receive fiat.”

“We added Dash because of the speed and 0 transaction fees. These two features of Dash are essential to why we started Coinprofile – To remove high remittance fees and make transactions lighting fast. So adding Dash was a no brainer for us. With Dash, we are scaling our platform to thousands of Dash users around the world, who can now send money back home and receive payments with a fast, and easy to use UX. UX that’s hard to find in the crypto space” said Bashir Aminu, founder of Coinprofile as to their reasons for adding Dash.

About Dash

Dash is digital cash designed to offer financial freedom to everyone. Dash allows millions of individuals across the globe to carry out instantly re-spendable and secure transactions, with near-zero fees. Built to support real-life use cases, Dash is the leading decentralised payment solution: it is accepted at merchants globally, accessible via 1,600+ ATMs and 100+ exchanges worldwide. Dash has pioneered groundbreaking features including a two-tier network with incentivised nodes and decentralised project governance (Masternodes), instantly settled payments (InstantSend), instantly immutable blockchain (ChainLocks) and more. The Dash Network’s development is supported by Dash Core Group, the largest organisation funded by the Dash Treasury, which supports and nurtures the continued worldwide development and integration of Dash. For more information, visit https://www.dash.org/ or follow the organisation on Twitter @DashPay.

About Coinprofile

Coinprofile is a platform primarily built to improve the user experience in cryptocurrency to fiat transactions. Normally, cryptocurrency users have to deposit their cryptocurrency in an exchange wallet, sell for fiat and withdraw to their local bank accounts. With Coinprofile users send their cryptocurrency to an address and the equivalent is sent to their preferred bank accounts. For more information, visit https://www.coinprofile.co or follow on Twitter @Coinprofiledev.

Disclaimer: This is a paid press release. Readers should do their own due diligence before taking any actions related to any company, product or service mentioned in this article. BitcoinAfrica.io is not responsible, directly or indirectly, for any loss or damage caused by or in connection with the use of or reliance on any content, product or service mentioned in this press release.

News1 year ago

News1 year ago

News2 years ago

News2 years ago

News3 years ago

News3 years ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

Sponsored Posts3 years ago

Sponsored Posts3 years ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

1xBit has created Ticket Rush with numerous fanciful prizes that could change your entire gambling experience. With multiple prize draws designed to select many winners, you have a chance at winning big. The prize pool is 3 BTC, with numerous winners per category.

1xBit has created Ticket Rush with numerous fanciful prizes that could change your entire gambling experience. With multiple prize draws designed to select many winners, you have a chance at winning big. The prize pool is 3 BTC, with numerous winners per category.

Tom also brought his creative mind to the forefront when brainstorming the new brand mission alongside the wider team. Crypto Lists had been searching for a new slogan, that is both accurate, descriptive, as well as evergreen – taking into consideration the future developments and growth of the company. Along with the senior leadership, a general consensus was reached: Crypto Done Smarter.

Tom also brought his creative mind to the forefront when brainstorming the new brand mission alongside the wider team. Crypto Lists had been searching for a new slogan, that is both accurate, descriptive, as well as evergreen – taking into consideration the future developments and growth of the company. Along with the senior leadership, a general consensus was reached: Crypto Done Smarter.