Since its invention, bitcoin has been one of the best performing cryptocurrencies to date. And just like most crypto enthusiasts, I took a liking for it and I have been a bitcoin trader for quite a while. But most, unfortunately, the better part of my trading experience at the beginning did not have a breakthrough.

Bitcoin Price Boom in 2017 and the Unpredicted Fall!

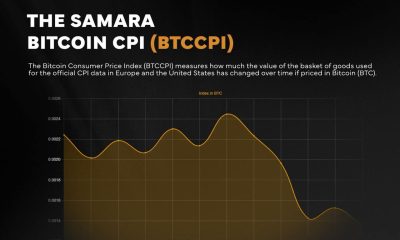

Bitcoin market can be quite volatile especially for bitcoin spot trading, which is how I initially used to trade bitcoin. For instance, everyone remembers the end of the year 2017 when bitcoin prices soar past $19,000 per single bitcoin. And most investors – I included – thought that we had found a new investment opportunity thinking that our new found gold was going to rise further in the year 2018 and we bought some significant amount of Bitcoins waiting to sell them once the prices climb a bit higher.

But I don’t need to explain what happened in the following months! From $19,000 to almost $5,000 in less than six months was quite a frustration for bitcoin investors. I mean how did I not see that coming? How did I ignore the fact that the bubble was just about to burst?

In a way, I did not blame myself too much since almost every other cryptocurrency registered a similar drop. But that was a turning point in how I was to trade Bitcoin into the future!

Crypto Futures Contracts

It did not take me long before I learned about bitcoin futures contracts. However, I had to be careful this time around. Once bitten, twice shy!

I took my time for the better of 2019 to learn about crypto futures, how they work, and where I can trade them.

The first thing that struck my attention is the fact that Bitcoin futures trading did not require me to own the actual bitcoin. That was a great relief because if you hold bitcoin in a wallet, you don’t want their market value to drop below what you bought them at, which makes you be constantly in a trading mood even though you may not be doing it on an exchange platform. In a way, I felt that was a way of eliminating the stress involved.

Secondly, I realized that crypto futures involved market price speculations just like most of the financial trading markets like Forex and Binary Options. And that to be sounded quite interesting and easy to do.

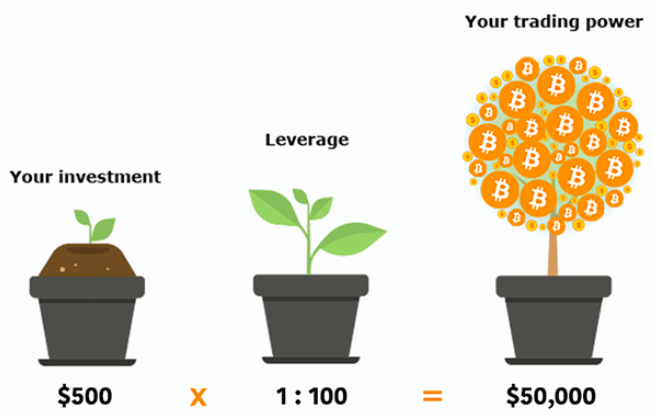

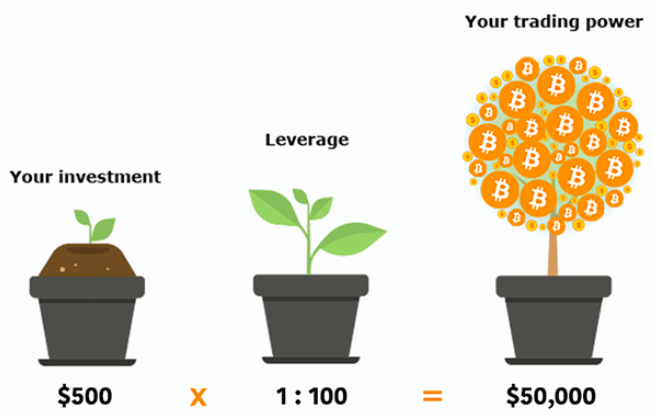

But there is one thing that complicated things a bit and that was the issue of leverage trading. Most crypto futures exchanges offer leverage trading which means you can open contracts/trades that are larger than collateral (what you invest in the trade). This way you can open and hold very large contracts though it depends on the maximum amount of leverage that your futures exchange provides and that translates to larger profits.

And although I learned that leverage trading was a double-edged sword since if your market speculations are wrong you end up making larger losses, I was convinced and determined to do an adequate market analysis to ensure I get most if not all the speculations right to close most of my futures contracts in profits.

Now the hard part was locating a Bitcoin futures exchange that offers the largest leverage possible. Most of the ones that I found had the leverage of up to 100x, which I felt was still too low. I needed a platform that would allow me more.

BTCC Exchange

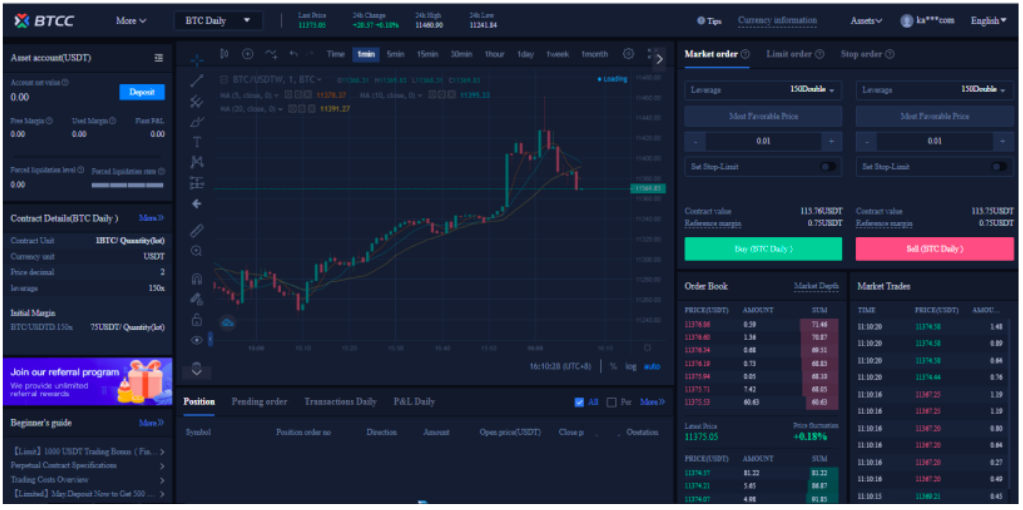

A few months ago I found BTCC exchange, which is the world’s longest-running crypto exchange offering leveraged weekly/perpetual futures on nine major cryptocurrencies including Bitcoin, Ethereum, Litecoin, EOS, Bitcoin Cash, XRP, ADA, XLM, and DASH. And from the first impression, it seemed to tick all my requirements of a crypto futures exchange.

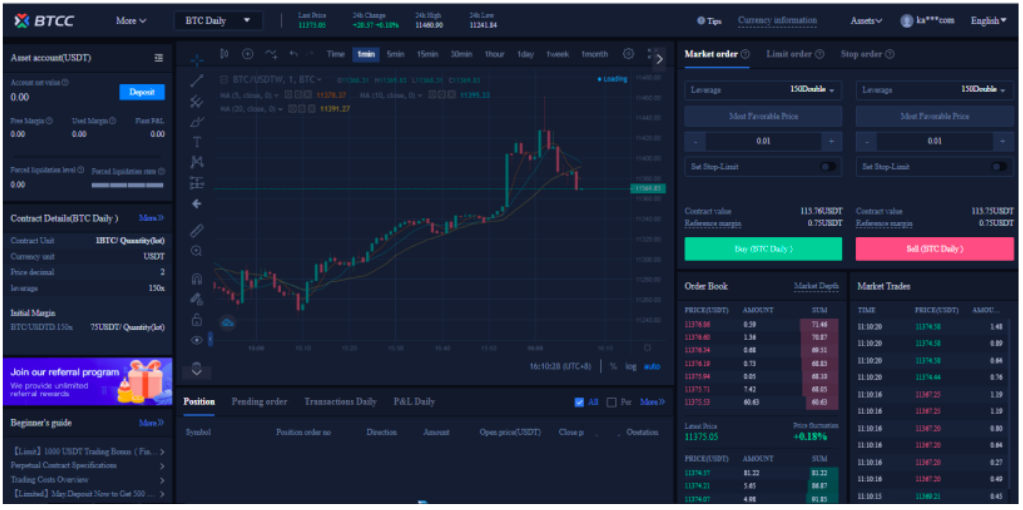

To start with, it met my requirement for an exchange that offered more than 100x leverage. To my amusement, it offers 150x, which was what I would ask for.

I decided to open an account with them. To start with, the account opening process and registration process was very easy and I could access their trading platform. So I took a month or two learning how its platform works, which was not a tough thing since they have a very simple to use platform.

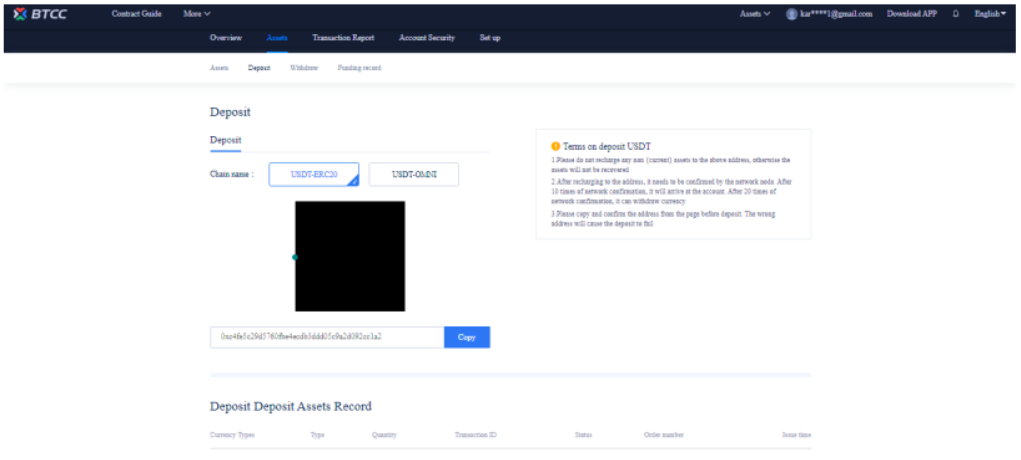

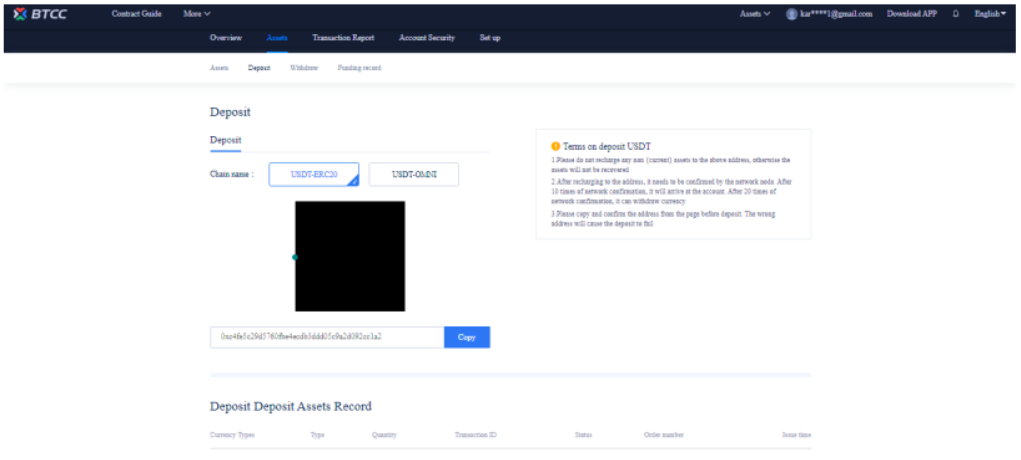

Eventually, last month I decided to deposit $200 worth of USDT with them to officially start my live trading experience. I had very great hopes in them and they did not disappoint!

To my advantage, I also found out that BTCC also has a mobile trading app for Android and IOS users and I find it very helpful especially when I want to follow my contracts while I am outdoors.

Making $1000 in a Month Trading Bitcoin Futures

This was a dream come true.

My first Bitcoin futures contract was on BTC Daily futures contract where I placed a BUY Market Order with a lot size of 1 and leverage of 150x, which cost me 75USDT as collateral for the contract. The contract value was 11,257.66USDT at the time I was placing the order and at the expiry, the value had climbed to 11,636.74 USDT. I ended up making 379.08USDT, which is an equivalent of $379.08. Honestly, I had not made such an amount from a single Bitcoin trade before.

I decided to rest for the rest of that week hoping to make another trade once I had good market speculations. Mid the following week, I opened another BUY Market Order with a lot size of 1 and leverage of 150x, which cost me 75USDT as collateral. The contract value was 11,716.08USDT at the time I was placing the order and at the expiry, the value had climbed to 11,839.51USDT. I ended up making 123.43USDT, which is an equivalent of $123.43.

I was doing fine so far. But in the next trade, I made a loss of 70.45USDT. I had anticipated that Bitcoin prices were on the rise and the following week I placed another BUY Market Order with a lot size of 1 and leverage of 150x, which cost me 75USDT as collateral. The contract value was 11,619.03USDT at the time I was placing the order and at the expiry, the value had dropped to 11,548.58USDT.

I became more proactive in doing my market analysis and last week it paid off. I placed a SELL Market Order with a lot size of 1.50 and leverage of 150x, which cost me 112.5USDT as collateral. The contract value was 17,653.425USDT at the time I was placing the order and at the expiry, the value had dropped to 16899.71USDT. I ended up making 753.71USDT which is equivalent to $753.71.

Doing the math, last month I made a cool $1185.77 trading on BTCC.com! I can recommend anyone to use this futures trading exchange. I believe it is the best.

Go for a free account on BTCC in seconds and make your first crypto leverage trading. The deposit amount is as low as 0.5 USDT. And if your first deposit is 500 USDT or above BTCC will give you a bonus of up to 2000 USDT.

Note: The futures contracts on BTCC are USDT-margined, and that means you need to have USDT to do the trading.

Tip: If you like to trade on the go, you can download BTCC Mobile APP which will give you a better trading experience than the web.

Disclaimer: This is a sponsored post. Readers should do their own due diligence before taking any actions related to any company, product, or service mentioned in this article. BitcoinAfrica.io is not responsible, directly or indirectly, for any loss or damage caused by or in connection with the use of or reliance on any content, product, or service mentioned in this post.

Features3 years ago

Features3 years ago

Bitcoin2 years ago

Bitcoin2 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features9 months ago

Features9 months ago

Bitcoin10 months ago

Bitcoin10 months ago

Rear

Rear