The global crypto scene has been vibrant this week as two BlackRock funds invest in bitcoin futures and Chengdu City prepares to launch a central bank digital currency (CBDC) test. Additionally, the FSCA in South Africa wants more power to deal with crypto Ponzi schemes. We will cover this and other top crypto news in our weekly roundup.

South Africa’s FSCA Wants More Power to Deal with Crypto Ponzi Schemes

Amidst the collapse of yet another (alleged) crypto Ponzi scheme in South Africa, the Financial Sector Conduct Authority (FSCA) has said it wants more power to deal with such fraudulent matters.

Mirror Trading International Ltd has supposedly been operating without a license. Additionally, many investors could fail to recover their money after the regulator put the club in provisional liquidation last month.

“At the point something becomes a Ponzi scheme, we have lost our jurisdiction. We need the police and the prosecuting authority to work fast and put people in jail,” said the head of the FSCA Brandon Topham.

In November, Mirror Trading said it had 26,000 members and 23,000 bitcoin. The temporarily appointed overseers will now start to trace the investors as the asset recovery process begins. Moreover, they will have to find the early investors that received large payouts in millions of rands.

In July 2020, the regulators of Texas State declared that Mirror Trading was running a fraudulent business and issued it with a cease and desist order.

Bitcoin Ponzi schemes are rife across the world, and this will probably not be the last.

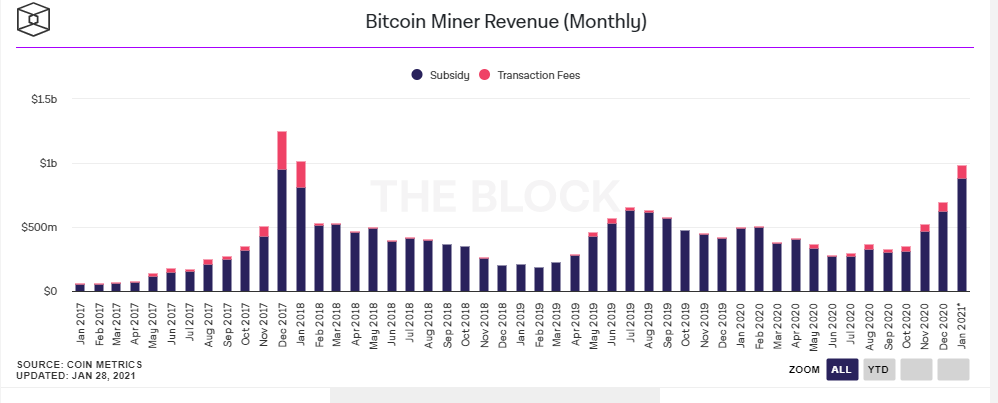

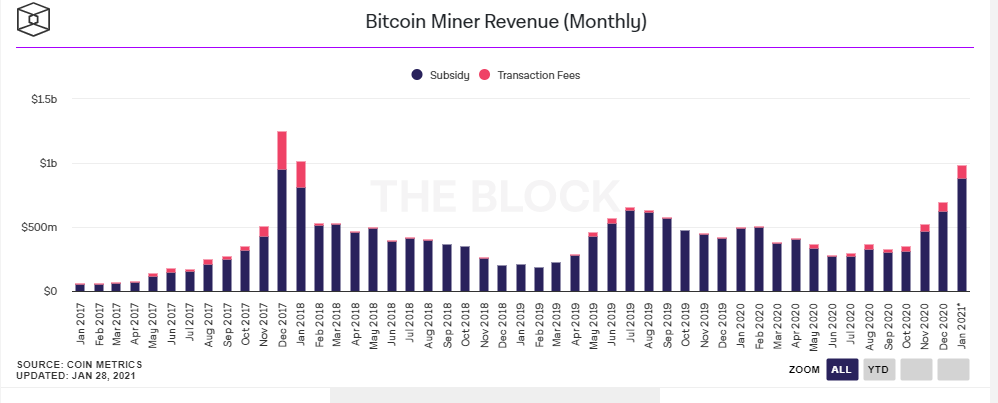

Bitcoin Miners Make $985.08 Million in January 2021

As of January 28, 2021, bitcoin miners made $985.08 million, according to data on The Block. This is compared to $692.32 million in December 2020. The high revenue could be attributed to bitcoin hitting a new all-time high of $41,000 this month.

Furthermore, the revenue growth comes at a time when the supply of mining hardware is low and the demand is high. According to The Block, this unfulfilled demand is forcing people to turn to older mining hardware.

The mining revenue surpassed $1 billion in December 2017 and January 2018. During these months, the recorded figures were $1.25 billion and $1.02 billion, respectively.

OKEx P2P Trading Service Now Supports NGN

Crypto exchange OKEx has announced that it has added eleven currencies to its P2P trading service. These currencies include the Nigerian Naira, the Philippine Peso, the Turkish Lira, the Singapore Dollar, the Pakistani Rupee, the Indonesian Rupiah, the Russian Ruble, the Argentine Peso, the Brazilian Real, the Ukrainian Hryvnia, and the Thai Baht. Moreover, the exchange has added new payment methods to support the new currencies.

The P2P platform allows users to make zero-fee transactions and already supports local currencies like the Indian Rupee and the Vietnamese Dong.

“We are always looking for ways to make user onboarding easier and purchasing cryptocurrencies as frictionless and convenient as possible. By giving our customers the ability to buy and sell crypto with their local currencies and preferred payment methods, we can make entering the crypto space easier for people around the world,” stated OKEx CEO Jay Hao.

Besides Paxful, Localbitcoins, and Binance, Nigerians can now use OKEx for P2P trading.

To learn more about Bitcoin, download the Bitcoin Beginner’s Handbook for free.

Features3 years ago

Features3 years ago

Bitcoin2 years ago

Bitcoin2 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features8 months ago

Features8 months ago

Bitcoin10 months ago

Bitcoin10 months ago

Central African Republic (CAR) has set up a 15-member committee that will be responsible for developing a bill on the use of cryptocurrencies and tokenization in the region.

Central African Republic (CAR) has set up a 15-member committee that will be responsible for developing a bill on the use of cryptocurrencies and tokenization in the region.