Another interesting week in crypto saw Coinbase go public by listing on Nasdaq while dogecoin rallied with a 400 percent price increase. In this week’s news roundup, we cover Sygnia’s plans to list a crypto ETF on the Johannesburg Stock Exchange, among other top stories.

Sygnia Plans to List Crypto ETF on Johannesburg Stock Exchange

Sygnia, an asset management company in South Africa, is planning to list a crypto exchange-traded fund (ETF) on the Johannesburg Stock Exchange (JSE). This is the second time the company will be making an application to list a crypto ETF.

The company made the first application in 2017, which JSE rejected because it was “not ready to approve crypto listings.” Since the crypto environment has changed, Sygnia hopes that the bourse will approve this time around.

“A lot of work went into designing the actual structure of the ETF in 2017, which we can reuse. With cryptocurrencies becoming more mainstream, we are hopeful that the JSE will be more receptive to our application this time around,” said Sygnia’s CEO David Hufton.

According to JSE Director Andre Visser, the exchange would have to engage with other relevant regulators to consider a crypto listing of any kind. Also, companies would have to meet certain conditions first. Another South African company, DCX Capital, is also considering listing a crypto ETF on the same exchange.

Kenyan Artist Launches African Art NFT Collection

Photo credits: Kureng Dapel/Rich Allela

Picha Images – a digital media company powered by Artificial Intelligence and Big Data – is launching African crypto art non-fungible tokens (NFTs).

The upcoming auction will feature African art from the Kenyan-based award-winning photographer and filmmaker Rich Allela and will be held from April 26 to May 3, 2021, on OpenSea.

Speaking to BitcoinAfrica.io, Rich Allela said;

“By launching the Afro-renaissance collection as NFTs, Picha Images aims to empower artists to maintain the copyright of their work and earn from secondary sales. Through this auction, the public will place their bids where the highest bidder will walk away with a piece of digital art and send a message to the world on the value of art as an investment worth making.”

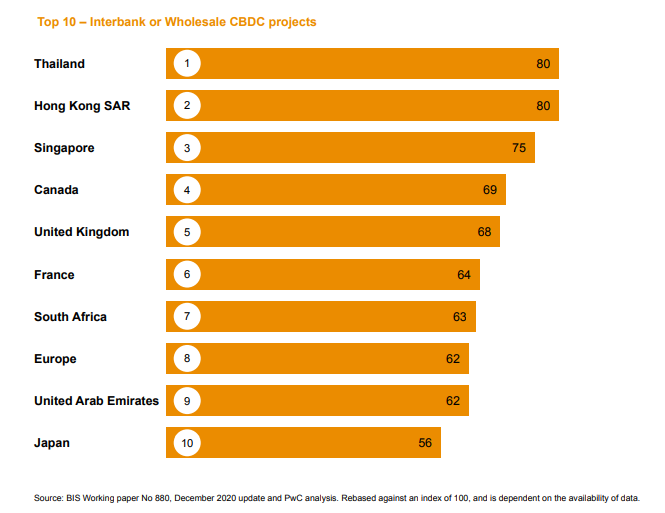

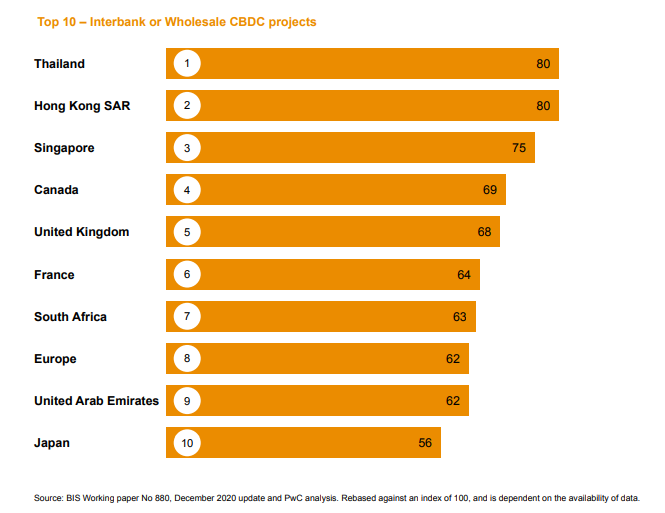

South Africa Among Top Countries with Mature CBDC Projects

According to a recent PwC report, South Africa is among the top countries with mature CBDC projects. The report ranks South Africa seventh in interbank CBDC development ahead of Europe, UAE, and Japan. An interbank or wholesale CBDC is confined for use by financial institutions. Conversely, citizens and corporates can hold a retail CBDC.

South Africa’s Central Bank Digital Currency (CBDC) project is called Project Khokha. The South African Reserve Bank successfully ran a trial of this project in 2018.

The second phase, Project Khokha 2, was announced this year. The purpose of the second phase is to explore the policy and regulatory implications of tokenisation in financial markets.

“More than 60 central banks have already entered the central bank digital currency race. CBDCs will be a game-changer, providing access to alternative payment solutions for citizens and corporates as well as reinventing financial market settlement and interbank monetary transactions,” stated Benoit Sureau, Partner Financial Services Risk and Blockchain at PwC France & Maghreb.

To learn more about Bitcoin, download the Bitcoin Beginner’s Handbook for free.

Features3 years ago

Features3 years ago

Bitcoin2 years ago

Bitcoin2 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features7 months ago

Features7 months ago

Central African Republic (CAR) has set up a 15-member committee that will be responsible for developing a bill on the use of cryptocurrencies and tokenization in the region.

Central African Republic (CAR) has set up a 15-member committee that will be responsible for developing a bill on the use of cryptocurrencies and tokenization in the region.