2021 will be remembered as the year in history when cryptocurrency trends grew to new heights. To learn about the biggest cryptocurrency trends in 2021, keep reading.

Institutional Investor Crypto Adoption

More institutional investors adopted cryptocurrencies in 2021, indicating rising acceptance. For instance, asset management company BlackRock commissioned its two funds to invest in bitcoin futures, according to January 2021 SEC filings.

In March 2021, investment bank Goldman Sachs relaunched its crypto trading desk to fulfill the increasing demand from its clients. Another large investment bank, Morgan Stanley, was not left behind either. The bank introduced private bitcoin funds for its clients in 2021. According Coindesk, the bitcoin funds raised $29.4 million in the first 14 days.

Despite the crypto market crash that took place in the second quarter of 2021, institutional investment continues to trend. In May 2021, Glassnode recorded the highest “single-day outflow from OTC addresses in 3.5 months.” This shows that institutional investors, who mainly use OTC desks, are buying the dip.

The Rise of NFTs and Crypto Art

When an NFT artwork sold for $69.3 million, the excitement in the space skyrocketed. The NFT art trend spread to every corner of the world, and artists rushed online to create their own NFTs hoping to rake in the big bucks. In Africa, Picha Images and AFEN embraced the trend, keen to take advantage of the opportunity.

While Beeple’s 69.3 million ‘Everydays: The First 5000 Days’ is the most expensive NFT artwork to date, other artists have also cashed in a pretty penny. WhIsBe sold a rotating golden gummy bear skeleton for $1 million. Another artist that goes by the pseudonym Pak sold NFT artwork for $904.41K.

Several CryptoPunks also sold for a lot of money in 2021. For example, the super rare CryptoPunk alien #3100 sold for $7.58 million.

Although the overall NFT market is experiencing a drop in sales in Q2/2021, NFT art projects like CryptoPunks, Meebits, and SuperRare are performing excellently, according to data on Non-Fungible.

Publicly Traded Companies Buying Bitcoin

Publicly traded companies have been acquiring a slice of the bitcoin pie as confidence in the cryptocurrency continues to rise.

In 2021, companies like Square, Meitu, and MicroStrategy increased their existing crypto holdings as the market boomed. For instance, on February 23, 2021, payments company Square purchased 3,318 BTC, adding to its October 2020 investment of 4,709 BTC. Chinese company Meitu boosted its total crypto holdings to about $90 million after purchasing $28.4 million in ether and $21.6 million in bitcoin in March 2021.

Even as the market crashed in Q2/2021, MicroStrategy, under the leadership of bitcoin evangelist Michael Saylor, did not waver in its commitment to bitcoin. The company bought 229 BTC in May, bringing their total stash to 92,079 BTC. Interestingly, the company is not done. It plans to offer $400 million senior secured notes to fund another bitcoin purchase.

However, things have been different with Tesla. The company, through Elon Musk’s tweets, has publicly displayed its love and hate relationship with crypto. These tweets have, as a result, affected Tesla’s stock price and the crypto market. After revealing a $1.5 billion bitcoin investment on February 8, Tesla started accepting bitcoin payments, then stopped shortly after. Next, the drama continued when Elon Musk tweeted that he had broken up with bitcoin, leaving people wondering if Tesla is set to sell its BTC holdings.

Other publicly traded companies that have bought bitcoin include Nexon, Marathon Digital Holdings, and Riot Blockchain.

Defi Apps and Use Cases

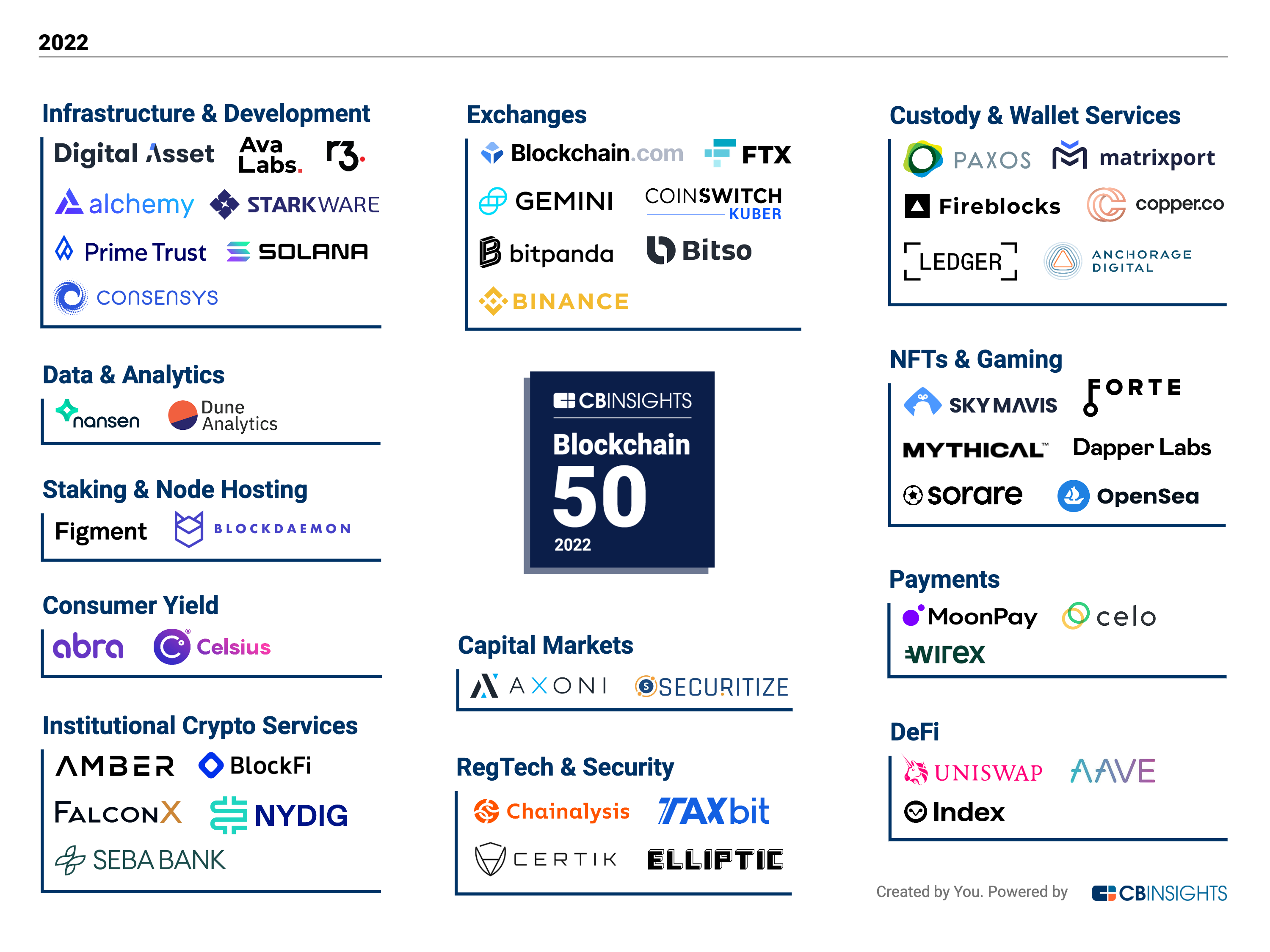

DeFi applications and use cases were another huge cryptocurrency trend in 2021. In the first quarter, the value of the crypto assets that DeFi applications were managing grew by 150 percent to $50 billion. Aave had the highest total locked value (TVL) as of June 9, 2021. The other top DeFi projects based on TVL at the time of writing were Maker, Compound, Curved Finance, Uniswap, and InstaDApp.

Some of the DeFi use cases that are standing out include decentralised exchanges, stablecoins, projects with cross-chain functionality, and derivatives. Uniswap, a decentralised exchange (DEX), has the highest trading volumes. Sushiswap and Synthetix rank second and third, respectively.

Other examples of popular DApps like Bitcoin Keno and Bitcoin Crash.

More Bitcoin Adoption Globally

There are more bitcoin owners globally as companies and individuals rush to grab a share of the limited cryptocurrency. Overall, there are over 200 million crypto users in the world, according to data from Triple A.

The top five countries in bitcoin ownership are the US, Nigeria, Vietnam, the UK, and Turkey. Also, more men (79 percent) than women (21 percent) own cryptocurrencies. 58 percent of the people that own crypto are below 34 years of age.

Paxful CEO Ray Youssef believes that Africa is seeing a lot of cryptocurrency adoption as people look for alternative ways to make a living, store wealth, and send remittances. The P2P platform expects increased growth in 2021 in Kenya and Ghana. Furthermore, Youssef predicted that Cameroon and Ethiopia will “be strong contenders for emerging crypto markets in the” coming years.

Whether people are using crypto to gamble on platforms like BetFury.io, are sending money to family abroad, or use it as a store of value, crypto adoption is growing globally and in Africa.

As 2021 moves to Q3 and Q4, it will be interesting to see how these cryptocurrency trends evolve. Some experts report that NFTs, DeFi, and cryptocurrencies are bubbles that are going to burst. But is this true? Let us wait and find out. Meanwhile, remember to invest wisely.

If you want to use crypto to gamble, check out all of Betfury’s bitcoin games here.

Disclaimer: This is a sponsored post. Readers should do their own due diligence before taking any actions related to any company, product, or service mentioned in this article. BitcoinAfrica.io is not responsible, directly or indirectly, for any loss or damage caused by or in connection with the use of or reliance on any content, product, or service mentioned in this post.

Features3 years ago

Features3 years ago

Bitcoin2 years ago

Bitcoin2 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features7 months ago

Features7 months ago

Rear

Rear