NFTs (non-fungible tokens) can represent any type of physical or digital object as a blockchain-powered digital token.

NFTs in the decentralized finance (Defi) sector function as a representative property title to some object or element, which facilitates the sale and purchase and transfer of ownership, among others.

Although, it can be used in almost all areas of human life, very similar as blockchain is applicable, its particular characteristics: unrepeatable, authentic, and non-divisible have made it gain popularity in various (ideal) use cases, which we will mention below.

Collectibles

Whether physical or digital, now the ownership of said objects are or may be represented by an NFT Token, which facilitates the security processes, public auction and the transfer of purchase and sale, advantage of all the benefits of the blockchain technology, that is, NFTs are auditable like open-source cryptocurrencies like bitcoin and ETH, but at the same time it is immutable.

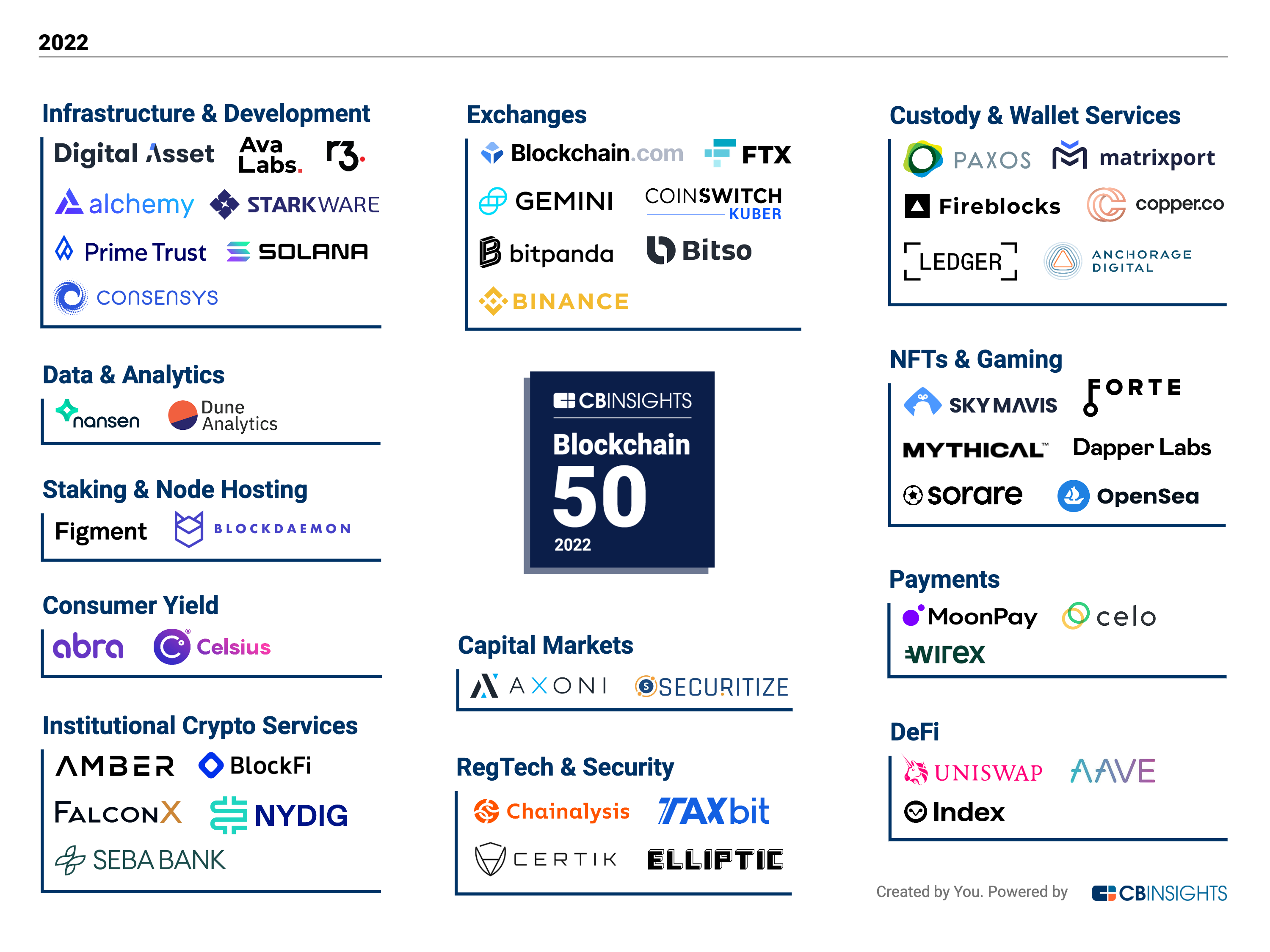

As diverse as the human mind is, there are all kinds of collecting cases, the most popular are, for example, sports accessories (digital and physical), which can be auctioned on platforms such as Opensea, BakerySwap, and Treasureland.

However, there is also a type of collecting classified as rare, as is the case of people who collect a tweet through NFTs, this process can be carried out through a platform called Valuables, a platform that tokenizes tweets.

This platform creates a digital auction, the tweet author decides who is the highest bidder, that is, the person to whom he will sell his tweet. The tweet will then be minted on the blockchain, creating a 1-to-1 NFT that includes the author’s autograph.

Art

This use case is the best example of how blockchain technology through NFTs can empower a professional union. In this case, artists of different genres.

As in the previous cases, platforms such as Nifty Gateway, SuperRare, OpenSea, MakersPlace, FLOW, Enjin, and Decentraland offer the possibility for artists to advertise their works of art (digital designs, animations, painting, sculpture, music) with incorruptible copyright ownership, in turn, anchored to an NFT, which is representative of the title of ownership of said work.

This technology implies a great solution for artists motivated to eliminate intermediaries who charge large commissions in the various art industries, among which are record labels, galleries, producers, and managers. This situation translates into higher profits for the creative and author artist.

As in the previous case, the artist decides who is his highest bidder and once the offer is finalized, he transfers the ownership of his work of art through the NFT that includes an author’s signature, a fact that adds more value to the work of art.

Games

What makes digital games an ideal use case for NFTs is immersed in the very dynamics of games, where, for example, action figures, real or fiction, need to interact with other entities, and therefore do micro-transactions in exchange for digital objects and items that are rare, exclusive and with special qualities.

For example, Axie Infinity and Battle Pets are Pokémon-style games with pets and interchangeable items.

According to Binance Academy:

“ Each Axie pet has a skill set to fight. These abilities also affect the value of the pet when they are traded. A CryptoKitty can be extremely valuable just for its desirable replay attributes. Determining the value of each pet depends on a combination of unusual appearance, characteristics, and utility”.

But beyond this example, the world of games is the most fertile ground for NFTs, this motivated by combine digital artworks, collectibles, game tools, aesthetics, and utility. All it is elements that become NFTs, to then be exchanged for cryptocurrencies such as bitcoin in Exchanges external to the game.

Find out the easiest and safest way to buy bitcoin in India.

Documentation and Real-World Assets

Perhaps the present use case is the least developed and applied of those mentioned in this article, but we have annexed it as it has great potential, and it would not be surprising if it would soon become the main one.

This is motivated by the fact that currently, the world’s societies have a great need for the digitization of real assets, and more importantly, optimizing the processes of ownership and purchase-sales, then, there is no doubt that NFTs can embody (become) in the great solution as a universal notary public that humanity needs.

For example, imagine for a moment that you can buy a property such as a house, a building, a farm, a vehicle, etc., through a simple NFT from and anywhere in the world, with all the benefits that it brings the blockchain technology, security, auditing and immutability.

How to Buy the NFTs in India?

It is much easier to buy bitcoin in India than to obtain NFTs because the structure and infrastructure of the NFT are intrinsically correlated with the crypto market. And without a doubt, the strongest cryptocurrency in the crypto-cosmo is bitcoin.

Therefore, if you are wondering at the moment how to buy bitcoin in India, converting from INR to bitcoin and from bitcoin to INR? It is important that you know that despite the creation of the “Bill on Cryptocurrencies and regulation of the official digital currency, 2021”, this is very simple to do.

What you need to do first is to buy bitcoins in India on a P2P exchange, and if you want to do it instantly, the best option is to go for Remitano’s integrated fiat INR wallet, the only exchange that currently provides such a service in India, which also allows you converting from BTC to INR to you: https://remitano.com/btc/in.

Once you have bitcoins, it will be much easier for you to buy NFT by depositing bitcoins in the wallets of the Exchange specialized in NFT that we have named in this article.

If you still have questions about how to buy bitcoin in India, you can consult the following guide that explains the step-by-step: https://support.remitano.com/en/articles/3988518-how-to-sell-bitcoin-ethereum.

Disclaimer: This is a sponsored post. Readers should do their own due diligence before taking any actions related to any company, product, or service mentioned in this article. BitcoinAfrica.io is not responsible, directly or indirectly, for any loss or damage caused by or in connection with the use of or reliance on any content, product, or service mentioned in this post.

News1 year ago

News1 year ago

News2 years ago

News2 years ago

News3 years ago

News3 years ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

Sponsored Posts3 years ago

Sponsored Posts3 years ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

Rear

Rear