Africa’s crypto adoption is growing at an unstoppable rate, and several recent studies point to the continent’s transformation into one of the largest cryptocurrency hubs in the past years.

For example, the 2020 Geography of Cryptocurrency Report conducted by Chainalysis revealed that Africa’s cryptocurrency sector is now one of the top 10 in the world, growing from 67% to 78%. Kenya and Nigeria stood out as the countries with the highest crypto usage. This is consistent with the findings of a Yahoo Finance report, which found that Nigeria was the country that used cryptocurrencies the most. According to the report, 32% of Nigerians have used or owned at least one cryptocurrency in 2020 – that’s much more than some countries in Europe and the Americas.

Another report, The State of Crypto in Africa, conducted by Arcane Research, revealed that Africa is one of the most promising continents for crypto, despite recession concerns and lack of banking infrastructure.

So, what factors have favoured Africa’s rise to power, and what threats will it have to overcome to secure its position as the world’s top crypto economy?

Africa’s rise to power as a Fintech hub

Africa’s skyrocketing crypto adoption is inextricably linked to the continent’s booming Fintech sector. Favoured by foreign investments, growing mobile usage, and the completion of the African Continental Free Trade Agreement (AfCFTA), Fintech is maturing in Africa. As more and more countries are embracing digital transformation, VC funding is on the rise.

Despite predictions from the World Economic Forum that the economies of African countries will shrink considerably in 2021, reports show that VC funding for African Fintech startups has grown by 51%. South Africa attracted the most investments, followed by Nigeria, Kenya, and Egypt. More and more people are interacting with digital finance services in all their forms. The popularity of crypto Forex brokers is on the rise, consumers now rely on apps and web services to save money, trade stocks, and manage their portfolio, and online loans are emerging as a simpler alternative to bank loans.

Remittances from diaspora

Remittances from the diaspora are another important factor behind Africa’s rise as a cryptocurrency power. According to the World Bank, remittances to Africa continue to be an essential source of income, despite the drops caused by the pandemic. In 2019, sub-Saharan countries reached $48 billion in 2019, and nearly half of this amount was sent to Nigeria. The average expat sends around 6.8% of their income to their home country.

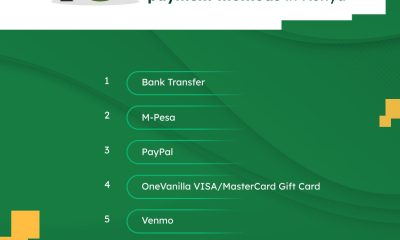

Meanwhile, for African expats, this rate is at 8.9%. What does this have to do with crypto? Well, most people who send money home don’t do this using traditional means because bank transfer rates are prohibitively expensive. Africa is currently the most expensive country to save money to, with transfer fees going as high as 8.3%. Instead, they choose cryptocurrency transfers (bitcoin being the most popular cryptocurrency), which are instant and have no transfer fees.

According to Reuters data, there were over 601,000 cryptocurrency transfers in June 2020, accounting for approximately $316.1 million. However, the actual size of remittances is believed to be much higher than official reports.

Rising inflation rate

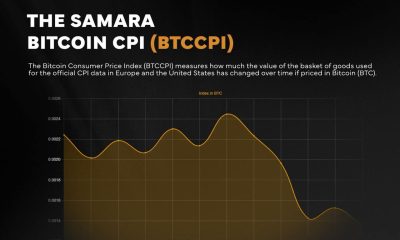

While Africa has a Fintech environment that favours innovation and attracts foreign investment, crypto adoption wouldn’t have been the same without the rising inflation rate. Last year, most African economies were hit hard by the recession. As a result, inflation has skyrocketed, and many national currencies, which were already plummeting before the pandemic), continued to devalue.

For example, South Sudan had a whopping 102% inflation rate between 2016 and 2017. In 2020, the Nigerian Naira suffered a 24% devaluation. As the fate of national currencies remained uncertain, cryptocurrency rapidly became a tempting alternative. Despite the sceptics’ lack of trust in crypto, Bitcoin did not crash because of the pandemic. In fact, it even peaked at $64,000 in April, convincing many that crypto really is here to stay. Other cryptocurrencies, like Ethereum, Stellar, and Binance Coin, have also had a favourable evolution.

Lack of banking infrastructure

Numerous times, Africa has been dubbed “the unbanked continent” due to its lack of banking infrastructure. In 2014, 66% of African consumers did not have a bank account. While this percentage has increased in the past few years, African banks continue to rely on traditional, outdated methods, and their services remain unreachable for people with low income.

There is also a general distrust for banks, which pushed people to choose Mobile Network Operators instead, which are a type of alternative financial services providers. Crypto transfers work in a similar way to MNOs, which convinced many Africans to give them a try.

Potential challenges

Long-term prospects for Africa’s crypto ecosystem are generally positive. However, in order for this technology to reach its full potential, several challenges need to be addressed first.

Lack of high-speed Internet

High-speed Internet is essential for cryptocurrency transfers. However, Africa currently lacks a stable infrastructure. In 2019, Africa had the slowest data speeds, which proved quite problematic when the pandemic hit, and remote work and online learning became essential. Internet access and broadband speed greatly differ from country to country. While speeds are higher in Eastern and Southern Africa, people in West and Central Africa often have to learn and work at speeds of 0.16 Kbps. Due to the lack of competition, Internet prices are higher too.

Low financial literacy

Unfortunately, despite the rising crypto adoption, Africa still has one of the lowest financial literacy rates in the world. According to the Global Financial Literacy Survey conducted by Standard & Poor’s, financial literacy is inconsistent. Botswana ranks the highest, with 52%, but most African countries have low financial literacy (Angola 15%, Nigeria 26%, Sudan 21%, Ethiopia 32%). This will need to be addressed in order for people to use cryptocurrency safely.

Lack of regulation

Although cryptocurrency adoption seems to be unstoppable, most African countries don’t regulate it, which could lead to financial scams. Even experienced investors could be at risk here, so people with low financial literacy who don’t understand exactly how blockchain works could be even more vulnerable.

Features3 years ago

Features3 years ago

Bitcoin2 years ago

Bitcoin2 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features8 months ago

Features8 months ago

Bitcoin10 months ago

Bitcoin10 months ago

Rear

Rear