In this week’s news roundup, you’ll read about Nigeria’s eNaira CBDC’s disconcerted first week, Chipper Cash’s new funding from FTX, and other top crypto stories.

Nigeria’s eNaira Digital Currency Faces an Unsuccessful First Week

Barely a week after its launch, Nigeria’s eNaira digital currency had an embarrassing first week that was marred by various issues.

Hillato / CC BY-SA

As the first central bank digital currency launched by an African country, the eNaira is supposed to exist within a mobile wallet and have the same value as a physical naira as well as be interchangeable for everyday transactions. This move saw the Central Bank of Nigeria launch two types of eNaira wallets – one for individuals and the other for merchants – both available on Android and Apple users.

However, users experienced a lot of challenges and according to a report published on Quartz, some users reported that some parts of the wallet didn’t work properly for the individuals’ wallet.

Following the poor reviews left for the Android version of the individual app, it was taken down despite having been downloaded 100,000 times before that while its Apple version was still available.

Despite the unsuccessful first week, the eNaira platform is said to have integrated 33 banks and onboarded more than 2,000 users, with the website receiving over 2.5 million visitors per day.

South African Treasury Prohibits Pension Funds From Investing in Cryptocurrencies

The South African government through the Treasury has published a regulatory draft prohibiting pension funds from investing in cryptocurrencies.

According to The Treasury, the need to introduce the regulation – known as Regulation 28 – has been fuelled by the high-risk characteristic of cryptocurrencies. The draft states that pension funds cannot invest in crypto assets whether directly or indirectly.

“Crypto-asset means a digital representation of value that is not issued by a central bank, but is capable of being traded, transferred or stored electronically by natural and legal persons for the purpose of payment, investment and other forms of utility; applies cryptographic techniques and uses distributed ledger technology,” the Treasury states.

The Treasury’s definition of crypto assets seems to encompass anything issued on the blockchain such as tokenised conventional assets like bonds, real estate, and stocks.

The draft by the South African Treasury went further to state, “This restriction is in line with the Intergovernmental Fintech Working Group (IFWG) policy proposal of not allowing collective investment schemes and pension funds to have exposure to crypto-assets be maintained until further notice.”

Chipper Cash Secures a Series C Extension Round Led by FTX Worth $150 Million

Chipper Cash has secured a Series C extension funding round worth $150 million. Chipper Cash is an African cross-border payments company.

As reported in TechCrunch, the investment round was led by FTX, a cryptocurrency exchange platform. FTX is one of the largest cryptocurrency derivatives exchanges in the world and the investment in Chipper Cash is its first in Africa.

As reported in TechCrunch, the investment round was led by FTX, a cryptocurrency exchange platform. FTX is one of the largest cryptocurrency derivatives exchanges in the world and the investment in Chipper Cash is its first in Africa.

SVB Capital also reinvested during the extension round amidst other existing investors like Bezos Expeditions, Deciens Capital, One Way Ventures, Ribbit Capital, and Tribe Capital.

The new investment comes barely six months after the startup closed its first Series C round after raising $100 million. Additionally, Chipper Cash has since been able to expand to the United Kingdom and the US, making it possible for people living in those countries to send money to the African markets.

Chipper Cash’s total Series C raise currently stands at $250 million and it plans to use the funds to continue scaling and “maintain our lead in the space.”

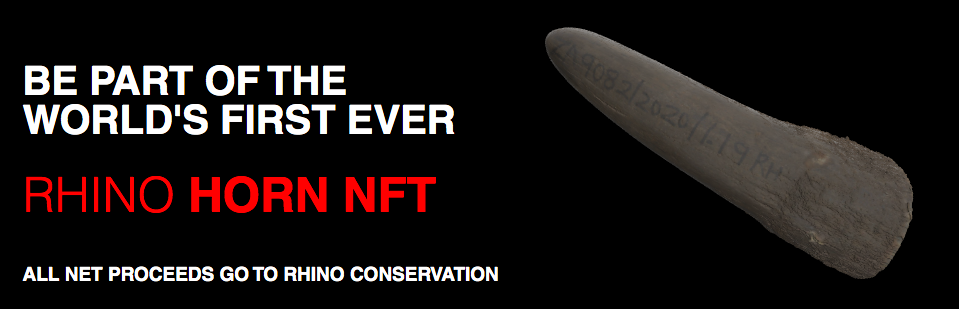

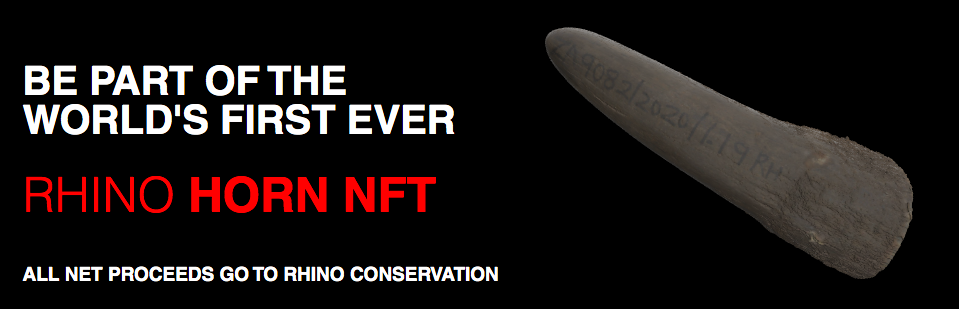

Black Rock Rhino Set to Raise Funds for Rhinos via the Auction of Horn NFTs

Black Rock Rhino, a leading rhino conservancy in South Africa, plans to raise funds for the endangered species through an auction of rhino horn non-fungible tokens (NFTs). The move will see Black Rock Rhino partner with Virtual Nation Builders – a blockchain technology firm – to auction the NFTs at Momint, one of South Africa’s biggest NFT marketplaces.

The auction is expected to take place on November 11, 2021, and according to a statement shared by Black Rock Rhino, the proceeds will be used to cater for some of the sanctuary’s day-to-day expenses.

“The net proceeds will go towards securing the area, feeding, vaccines as well as the other day to day operating expenditure of the conservancies,” explained the statement.

Moreover, part of the proceeds will also aid conservationists in their ongoing efforts to minimize the number of rhino deaths. The auction of horn NFT will enable rhino lovers across the world to acquire a rhino horn without necessarily killing a rhino.

To learn more about Bitcoin, download the Bitcoin Beginner’s Handbook for free.

News1 year ago

News1 year ago

News2 years ago

News2 years ago

News3 years ago

News3 years ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

Sponsored Posts3 years ago

Sponsored Posts3 years ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

As reported in TechCrunch, the investment round was led by FTX, a cryptocurrency exchange platform. FTX is one of the largest cryptocurrency derivatives exchanges in the world and the investment in Chipper Cash is its first in Africa.

As reported in TechCrunch, the investment round was led by FTX, a cryptocurrency exchange platform. FTX is one of the largest cryptocurrency derivatives exchanges in the world and the investment in Chipper Cash is its first in Africa.

Central African Republic (CAR) has set up a 15-member committee that will be responsible for developing a bill on the use of cryptocurrencies and tokenization in the region.

Central African Republic (CAR) has set up a 15-member committee that will be responsible for developing a bill on the use of cryptocurrencies and tokenization in the region.