What Is a Masternode And Should You Invest in One?

If you are looking for new ways to make money in the cryptocurrency market besides day-trading and “HODLing,” then you might want to consider running a masternode.

Masternodes are becoming increasingly popular in the cryptocurrency community, with Google search volumes for the term masternodes being significantly higher in 2018 than in previous years. Currently, there are over 500 cryptocurrency projects that have masternodes, which can make choosing which one(s) to invest in a difficult task.

In this guide, we will examine what masternodes are, the pros and cons of running one, and highlight the best available masternodes in the market to help you discover which masternodes may be right for you.

What is a Masternode?

If you are fairly competent with computers then you will most likely have heard of the term node. A node is a device that participates and maintains a network. In the cryptocurrency space, there are three common types of nodes namely: full nodes, light clients and masternodes. Full nodes can access and store a network while light nodes can only access and download a part of the network.

Masternodes are full nodes that perform specialised functions on a blockchain and possess a greater level of responsibility and authority in a network. They are sometimes referred to as bonded validator systems. For most cryptocurrency projects, masternodes are set up by the community members. In some cases, a masternode owner may desire to support the smooth functioning of his chosen project through his server. However, most people set up masternodes to enjoy the financial rewards gained from running one.

The masternode incentive system is necessary considering the number of resources that go into setting up one. A masternode requires the operator to have a large amount of technical know-how as the process of setting up one is complex. Additionally, the nodes must meet a certain threshold before they can function as masternodes on a blockchain. The threshold is usually a degree of financial investment that a masternode operator must make before being able to run one.

How to Run a Masternode

Masternodes were first witnessed in the cryptocurrency space through Dash (DASH). The altcoin introduced these type of nodes to enable instant transactions and support its PrivateSend feature, which allows for anonymous transactions on its network. As a bonus incentive, those running masternodes were allowed to play a role in the governance of the community through a voting system. This is the opposite for normal nodes, which have no voting rights.

![]() The main feature of the masternode setup is the requirement to lock up a significant portion of the native digital currency of the network in which the node operates.

The main feature of the masternode setup is the requirement to lock up a significant portion of the native digital currency of the network in which the node operates.

While it is essential to lock away cryptocurrency in order to create a stake, the prerequisite is independent of the consensus method utilised in a specific network. Therefore, anyone running a masternode needs to put up some tokens regardless of whether the network may rely on a proof-of-work or any other consensus method.

Other requirements for setting up a masternode which are common across all digital currency networks include, a dedicated IP address and server to service the node, as well as the availability of storage capacity for the whole network. Additional qualifying requirements vary from one network to another and are usually dependent on the basis of the cryptocurrency project.

As a result of the success of the masternode feature in the Dash ecosystem, blockchain projects began to implement the system in their networks. Masternodes can be tailored to support any number of features on a network. For instance, PIVX is using masternodes to facilitate anonymous transactions whereas Syscoin is using masternodes to support a decentralised marketplace.

Pros and Cons of Operating a Masternode

To run a masternode you must evaluate and grasp the merits and demerits of running one. An important part of running a masternode is the staking of coins. The purpose of this is to provide security in the network. Giving up a stake ensures those setting up masternodes remain honest since any hostile action of any of the participants may result in the loss of value of their coins and consequently erode their capital investment. Actually, some networks are structured in a way that if a masternode owner is acting maliciously, his stake is seized or significantly reduced. That being so, staking tokens is advantageous as it keeps networks secure and discourages bad actors.

Furthermore, masternodes are essential in assisting networks to avoid centralisation that may emerge as an effect of mining pools. If any mining pool was to gain control of 51 percent of an entire network, the mining pool might initiate a so-called “51 percent attack” on the network and execute double spends. This could negatively impact the value of the token and put the project in jeopardy.

Pros

The inclusion of masternodes in a blockchain network is effective in preventing any collusion by miners that may affect network security. In most cases, masternode owners are able to accept or reject any transactions guaranteed by miners. This oversight authority is essential in keeping the miners in check and ensuring the crypto-ecosystem remains healthy.

Obviously, the financial incentive is the key reason why people set up masternodes. The rewards are proportionate based on the seniority level of masternode operators, with those who have staked tokens longer getting more financial rewards. Majority of networks designate masternode owners a part of the block rewards. The rewards will be in the form of tokens from the project. Therefore, running a masternode is an easy way to earn digital currency as well as recoup your initial investment.

In addition, some actors view running masternodes as a clever way of “HODLing”, since the staked tokens are practically held in reserve and are earning “interest” from the network. Besides, running a masternode is seen by many as a step towards financial sovereignty.

In addition, some actors view running masternodes as a clever way of “HODLing”, since the staked tokens are practically held in reserve and are earning “interest” from the network. Besides, running a masternode is seen by many as a step towards financial sovereignty.

The Dash masternode community states it clearly:

“Think of a masternode as a savings account with a minimum deposit of 1,000 DASH. A traditional savings account pays interest, and a masternode pays rewards which are very much like interest. In the case of a masternode, the reward (or interest) comes from performing services for the network. Not from lending. The big difference between a traditional savings account and a masternode is that your initial deposit never leaves your possession.”

Away from the profit motive, masternode operators also get to actively participate in the projects they support as masternodes often come with voting rights.

Finally, it is also important to note, masternodes run on a layer on top of the original network. Developers are able to introduce new features on the blockchain on this second layer. Subsequently, masternodes are essential to the growth of a project.

Cons

However, there is fear that the barriers to entry for running a masternode may create a platform for centralisation. While cryptocurrency networks have long maintained decentralisation as the cornerstone of their community, the reality is running a masternode requires resources and technical knowledge, which are out of reach for many. This means only a few parties can participate and opens up the network to the possibility of collusion by bad actors.

Similar to mining pools, a 51 percent attack by a group of masternode owners is theoretically possible. Nevertheless, some point out that taking such an action would have a very little upside for masternode owners as compared to miners. To begin with, they would end up losing the block rewards and lose a part of their total stake. In addition, a 51 percent attack would destabilise the crypto ecosystem and affect the value of their remaining tokens.

Finally, to run a masternode requires you to lock away a significant amount of tokens as a stake. The downside is the staked tokens cannot be used as capital in any other way. Interestingly, if the locked up coins are moved from the wallet connected to the masternode, it reverts to being a normal node.

Best Masternodes to Invest in

To find a suitable masternode it would be advisable for you to conduct research into the prerequisite criteria for each network. One of the things to consider is the ROI percentage of a project, and more importantly, whether the digital currency has real value when pegged to the dollar or bitcoin (BTC) or else it will make little financial sense.

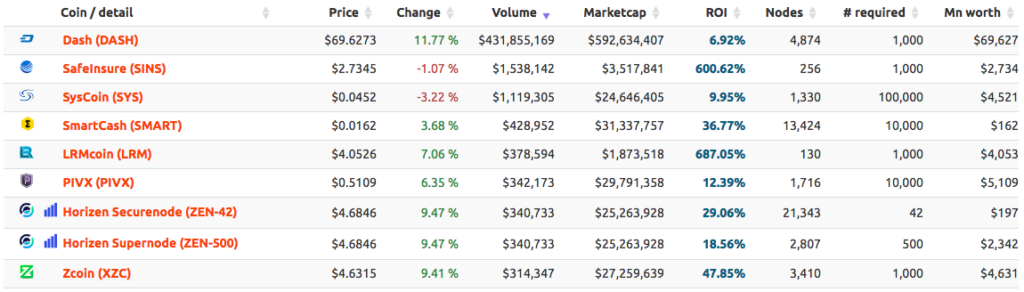

Masternode Ranking by Masternodes.online

A project you can consider is Dash. The Dash masternode is not only crucial for relaying transactions across the DASH network but also enables private transactions and double spend-proof transactions. To run these nodes a 1,000 DASH (currently worth $66,877) is required for staking. Masternodes are entitled to 45 percent of the block reward on every block and is distributed to owners one at a time. Usually, around two DASH are paid to masternodes every week.

PIVX is another example of an excellent masternode. The PIVX masternode requires you to stake only 10,000 PIVX (currently worth $4,975) coins, which is a much cheaper alternative to setting up a Dash Masternode. The ROI of PIVX fluctuates with several variables depending on the node activity on the blockchain, though it is currently set at around 12 percent annually.

Moreover, Zcoin (XZC) another promising privacy-focused altcoin, requires an initial stake of 1,000 coins (currently worth $4,580) and has an ROI of 56 percent. Other notable high-ROI masternodes include SysCoin, SmartCash, and Horizen.

An excellent starting point for researching masternodes is masternodes.online, a comparison site that can assist you in finding the masternode that best fits your investment needs. You will still need to do your own research on the project, its goals, and long-term viability, though, as a coin’s price will directly affect the profitability of your masternode.

Introducing Noones – Africa’s P2P Super App

Why Crypto’s Leading the Way in Africa’s Evolving Finance Landscape

The Rise of Bitcoin in the Online Gaming World

Unlock the Thrills of NHL Crypto Betting and Live Streaming

Understanding the Impact of Cryptocurrency Volatility on NBA Betting Markets

The Future of Crypto College Football Betting: Trends and Predictions

How Mobile Apps are Changing Sports Betting

Weekly Roundup: Africa’s Cassava Network Partners with UniPass to Expand Crypto Adoption in Africa & More

Weekly Roundup: Kenyan Senate in Discussion with CBK to Legalise Bitcoin & More