What Determines the Value of Bitcoin?

As the crypto market experiences yet another bull run in 2021, questions of what determines the value of bitcoin are arising again. At $50,000 plus, bitcoin is beginning to show great promise as an investment asset. It has also defied some predictions like the bubble that was expected in 2018. Sentiments too are changing, and many institutional investors are now betting on bitcoin. Overall, the climate around bitcoin is becoming more positive.

Continue reading to find out what determines the value of bitcoin.

A Brief History of Bitcoin

Believe it or not, bitcoin’s price started from the very bottom. Few people knew about this life-changing new digital currency back then. The digital asset also lacked economic value until October 2009 when the New Liberty Standard (NLS), the first bitcoin exchange, released the first exchange rate. The rate allowed users to buy 1,309.03 BTC for $1!

NLS explained the formula for this rate as follows: “Dividing $1.00 by the average amount of electricity required to run a computer with high CPU for a year, 1331.5 kWh, multiplied by the average residential cost of electricity in the United States for the previous year, $0.1136, divided by 12 months divided, by the number of bitcoins generated over the past 30 days.”

In May 2010, Laszlo Hanyecz purchased two pizzas for about $30, making the first purchase using bitcoin. Unknown to him then, he also bought the most expensive pizza in history. Nonetheless, this transaction pioneered the growth of bitcoin because in five days it grew by 1,000 percent.

In November 2013, the price of bitcoin hit over $1,000 then dropped below this figure. It was four years later that the price reached $2,000 only to rally to $20,000 at the end of 2017. That means that since the first purchase using bitcoin, it took about seven years for the currency to gain the kind of economic value that would catch the attention of the world. In the span of seven years, awareness and user demand were growing steadily but slowly. By the end of 2017, the cryptocurrency had attracted enough demand to record the first all-time high and make major headlines.

You can measure the value of a currency by the exchange rate, demand, and supply. Based on the current bitcoin exchange rate to the dollar, it is clear that the top cryptocurrency has come a long way since NLS published the first rate.

What Determines the Value of Bitcoin?

It is the network effect. Like social media, bitcoin gets its value from the number of people that are using it. As the number of bitcoin miners and users increases, the digital asset becomes more secure, interest rises, and demand grows. As a result, the market cap shoots up.

Industry sentiments have also played a huge role in determining the demand for bitcoin in the past. Recently, the institutional investors that have bought bitcoin have also caused the price to rally.

By design, bitcoin is a scarce asset, with a limit of 21 million. With limited supply and rising demand, the value of bitcoin is likely to increase.

As with any commodity or currency, people create value. That means that bitcoin is worth only what you are willing to accept as a form of payment. That is why crypto exchanges calculate the dollar price of one bitcoin by the average of the transactions taking place.

Drivers of Bitcoin Demand

Bitcoin requires no trust at all because it is decentralized and open-source. It cuts out all intermediaries, allowing people to transact directly with each other. The dependence on intermediaries like banks has traditionally made money transfer slow. For instance, it can take a few working days for a bank transaction to be complete. Bitcoin transactions, on the other hand, are near-instant. Also, anyone can access the Bitcoin code and verify how (and that) it works. On the contrary, decisions surrounding the minting of sovereign currencies are mostly closed out to the public.

Bitcoin is also censorship-resistant. That means that no government can prevent you from using bitcoin or regulate bitcoin itself. What governments can attempt to regulate is the use of bitcoin on platforms like exchanges.

As the first working peer-to-peer money, bitcoin has given people freedom. Beyond that, it has become a store of value. Hence, the growing demand. Many people across the globe are holding bitcoin as an investment, expecting to cash out for a profit sometime in the future.

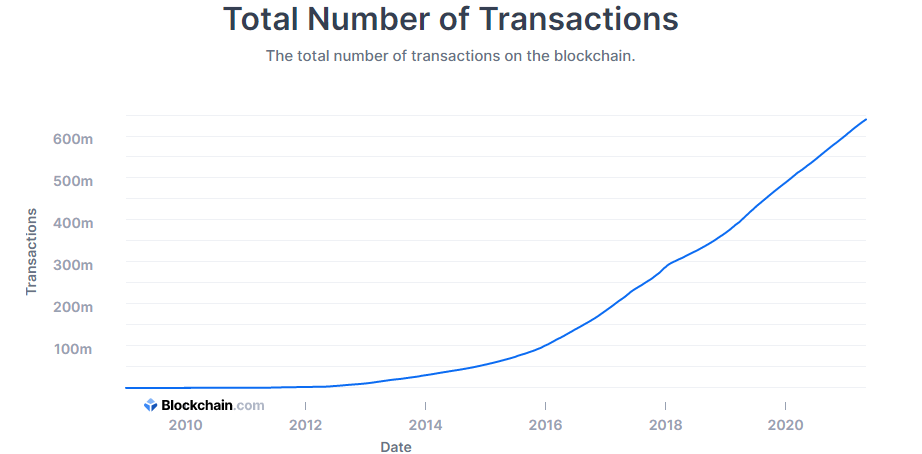

For any form of money to gain value, it needs trust and adoption. So far, bitcoin has earned the trust of both institutions and investors. Adoption is also rising. For instance, the total number of transactions on the bitcoin blockchain in 2021 was over 600 million compared to less than 100 million in 2010. As this trust and adoption continue to grow, so will its value and price.

Like other forms of money (including gold), bitcoin is durable, scarce, recognizable, divisible, and portable. However, it gains these characteristics from mathematics, unlike local currencies, which get these attributes from trust in central authorities.

Conversely, precious metals like gold gain these attributes from physical properties. That makes bitcoin special from traditional currencies and stores of value. This uniqueness creates demand.

Final Thoughts

Bitcoin is still a relatively small market ($1.1 trillion market cap) compared to gold ($11 trillion market cap). This makes sense since the digital asset is slightly over a decade old. With time, however, this market will expand with increasing trust and adoption, and the value of bitcoin will increase as well. Furthermore, price volatility will reduce, allowing all merchants around the world to accept it as a form of payment. Time will also settle the debate of whether bitcoin is a currency, commodity, or both.

The bottom line, however, is that bitcoin users determine the value of bitcoin. As long as more and more people are believing and investing in the long-term benefits of bitcoin, the digital asset will always have value.

To learn more about Bitcoin, download the Bitcoin Beginner’s Handbook for free.

Samara Asset Group Launches Bitcoin CPI (BTCCPI)

Introducing Noones – Africa’s P2P Super App

Why Crypto’s Leading the Way in Africa’s Evolving Finance Landscape

The Rise of Bitcoin in the Online Gaming World

Unlock the Thrills of NHL Crypto Betting and Live Streaming

Understanding the Impact of Cryptocurrency Volatility on NBA Betting Markets

The Future of Crypto College Football Betting: Trends and Predictions

How Mobile Apps are Changing Sports Betting

Weekly Roundup: Africa’s Cassava Network Partners with UniPass to Expand Crypto Adoption in Africa & More