What is Yield Farming: A Beginner’s Guide

In this guide, you will learn what yield farming is, how it works, and what risks you need to keep in mind if you decide to try it out yourself.

What is DeFi?

To understand yield farming, you must first grasp decentralised finance (DeFi). DeFi is one of the hottest trends in crypto in 2020.

DeFi refers to financial applications that leverage smart contracts and blockchain technology to replicate traditional financial products and services without the need for a financial intermediary.

You can interact with these applications as long as you have an internet connection and a crypto wallet. Most projects have built DeFi applications on the Ethereum platform. However, DeFi applications could also run on other blockchains.

Examples of DeFi applications include:

- Decentralised exchanges: these exchanges do not have access to user’s funds

- Wrapped bitcoin (WBTC): this is an ERC-20 token that represents bitcoin. It enables users to earn interest from lending bitcoin on Ethereum-based decentralised lending platforms.

- Lending platforms: these are intermediary-free platforms that allow users to borrow and lend crypto.

The latest and hottest trend in DeFi today, however, is yield farming.

What is Yield Farming?

Yield farming, also known as liquidity mining, is the process of earning investment income on your crypto holdings by depositing them in yielding DeFi protocols. To put it another way, yield farmers or liquidity providers supply liquidity to DeFi protocols and earn rewards in return.

Your crypto holdings are your seeds, the DeFi protocols your possibly fertile ground, and the rewards are the harvest.

Therefore, instead of allowing your crypto holdings to lie idle, you can put them to work in DeFi. In a sense, yield farming is a method of earning passive income with crypto.

How Did Yield Farming Gain Popularity?

The yield farming boom started with the launch of the COMP token in June 2020. This is an ERC-20 governance token that gives governance rights to holders. To make the Compound network as decentralised as possible, the project owners distributed the governance tokens algorithmically with incentives. As a result, the project attracted liquidity providers to “farm” the “token by providing liquidity to the protocol.”

The token distribution model made COMP highly successful. Consequently, other DeFi projects followed suit, hoping to be just as successful.

In the process, DeFi projects created new ways to attract liquidity providers to their ecosystems as the popularity of yield farming increased.

How it Works

Yield farming typically occurs in automated market maker (AMM) protocols. An AMM is a decentralised exchange that uses an algorithm to price assets instead of using an order book like traditional exchanges.

Here is how it works:

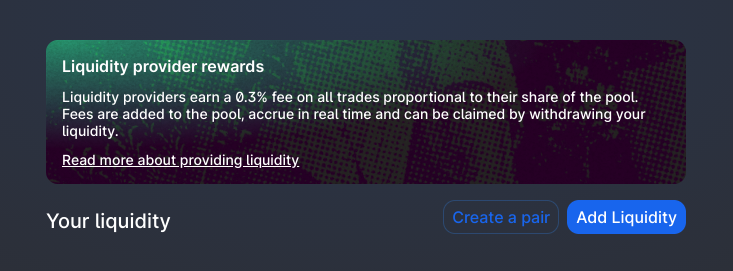

- Liquidity providers deposit money into a liquidity pool.

- The funds in the pool power an underlying DeFi platform that provides the ability to exchange tokens.

- Users have to pay fees for these services, which liquidity providers receive as income.

- Liquidity providers also receive the platform’s governance token as an additional incentive, boosting the liquidity providers earnings on the platform.

Returns

DeFi projects calculate the returns of yield farming using annual percentage yield (APY). APY takes into consideration the effects of compounding. Compounding means directly reinvesting earnings to make more profits.

Since the competition in yield farming is high and the market is fast-paced, your returns will fluctuate quickly.

To make as much money as possible, liquidity providers move between different protocols often. They could also move from strategy to strategy to maximise returns.

Where Can You Farm DeFi Yields?

You can farm DeFi yields from three avenues. These include:

- Money markets: investors make money on their crypto holdings by lending tokens on platforms like Compound and Aave. The interest rate will vary from platform to platform. For instance, Aave offers a variable and fixed interest rate. On the contrary, Compound supplies its token as an incentive when users borrow or lend a certain amount. Note that DeFi lending platforms require borrowers to overcollateralise their loans. That means that the collateral that borrowers present should have a higher value than the loan they wish to borrow. This process protects the market from liquidation risk.

- Liquidity pools: DeFi protocols need liquidity to provide their users with quality services. Investors can supply this liquidity and earn money from the fees that users pay plus the platform’s native token. Uniswap is an example of a project that uses this model.

- Incentive schemes: projects use incentives to encourage people to use the protocol. For instance, Synthetix gives users its token SNX as an incentive for providing liquidity.

The Risks of Yield Farming

Like any investment, yield farming has risks. Moreover, this form of investment is limited to advanced crypto users because yield farming strategies are only suitable for those that understand how DeFi platforms work.

One of the risks of liquidity mining is depositing tokens in unaudited protocols. If there is a bug in the smart contract, you could lose your funds. Audited protocols can have bugs as well. Therefore, keep this in mind when locking funds in a smart contract.

The founders of an unaudited protocol could also attempt to scam their community. For instance, the anonymous founder of Sushiswap moved about $14 million worth of SUSHI tokens resulting in a price drop of over 80 percent in a day. Fortunately, this exit scam did not compromise the project entirely since he (surprisingly) returned the funds and apologised to the community.

There is also the risk of Impermanent Loss if you are yield farming on an AMM. Impermanent Loss refers to the loss you make when one of the assets you placed in a trading pool rallies and would have earned you more if you kept it in your wallet than in an AMM pool. As pools typically adjust the deposited tokens for the ratio to remain 50:50, you can easily lose out on capital gains while yield farming.

The Takeaway

Yield farming is a high-risk investment where you can easily lose all your funds. The returns can be substantial but the risk of a complete loss of funds is high. If you do decide to yield farm, you should probably only put a small amount of capital at risk.

How Mobile Apps are Changing Sports Betting

Weekly Roundup: Africa’s Cassava Network Partners with UniPass to Expand Crypto Adoption in Africa & More

Weekly Roundup: Kenyan Senate in Discussion with CBK to Legalise Bitcoin & More

Weekly Roundup: South Africa Introduces New Cryptocurrency Standards to Advertising Code & More

ND Labs Launches Crypto Exchange Software Development

Weekly Roundup: African Web3 Mobile Games Publisher Carry 1st Secures $27M in Funding & More

Weekly Roundup: Morocco’s Central Bank Announces Completion of Draft Cryptocurrency Regulatory Framework & More

Weekly Roundup: Nigeria Looking to Legalise Cryptocurrency Usage, CAR’s Sango Coin Postponed & More

Weekly Roundup: South African Crypto Exchange VALR Launches in Zambia & More