With 54 countries in one continent, the adoption and integration of bitcoin in Africa will and continues to happen at different tempos. Although bitcoin has shown massive potential globally, its uptake in most parts of Africa has been and continues to be slow.

For bitcoin to experience massive adoption in Africa, co-founder and CEO of Regenize, a South African startup, Chad Robertson, believes that educating people on how bitcoin works is the key.

Regenize aims to motivate people to recycle things and in exchange they get rewarded with virtual currency that they can use to purchase various goods. The recycling services are monthly and come at a fee. Customers are then rewarded with the virtual currency that they can use on Regenize’s mobile voucher platform.

Since Regenize’s launch in 2016, the startup has had a positive impact on the people of South Africa. Still, Robertson firmly believes that different industries will influence the uptake of digital currencies.

In an interview with Disrupt Africa, he is quoted as saying,

“Using bitcoin as a means of purchasing everyday goods will be determined by the adoption rate of your larger retailers. However, for the financial services sector it has a high uptake due to reduction of costs when transferring bitcoin.”

Factors Hindering the Adoption of Bitcoin in Africa

According to Robertson, several factors make the adoption of bitcoin and other virtual currencies slow in Africa.

Education and Awareness

In his view, education and awareness are mandatory if bitcoin is to scale in Africa.

“Specifically, in South Africa, we have such a huge gap that keeps on growing regarding wealth but also knowledge on the ever-changing tech landscape. If I’m sitting in a coffee shop in the CBD, it’s quite likely someone will know what bitcoin is. However, head down to the Cape Flats or townships, and it’s highly unlikely that there’ll be many people who are aware of this,” he went on to say.

“However, this lack of education and awareness could be drilled down further on to find the root cause. There are too many people living in poverty in South Africa and Africa. They simply cannot think about using bitcoin as it’s not relevant to their needs. The local spaza shop does not accept bitcoin so how will someone get their bread or milk? Schools don’t accept it for school fees. You cannot buy electricity with bitcoin to keep your lights on. So why would they care or want to be educated on it?” he asked.

In Robertson’s view, there is need to develop solutions that work for everyone and not just the minority if bitcoin and other digital currencies are to have significant momentum.

“If you look at the available places one can spend bitcoin in South Africa, it makes sense why it’s the minority who’s focused on it,” he added.

Security and Visibility

Another factor that needs to be addressed before digital currencies can be fully adopted is security which ties back to education.

“There are many people who have been scammed on the internet, especially those who are digitally uneducated. Therefore, there is a fear and a stigma around using the internet as a place to transact,” stated Robertson.

On the other hand, Africans are used to the normal brick and mortar institutions where they can go and make their inquiries. Digital currencies are decentralized and lack visibility hence raising certain questions.

Robertson said, “With bitcoin, there’s no visible place to lay a complaint or an enquiry. I would think change management would play a large role in the transition from using a bank. For generations, people have given their money to the bank and there’s a trust as the bank is a brick and mortar institution. With bitcoin, people might have fears of what happens to my money? Who do I complain to?”

According to him, for more African nations to come on board, the focus shouldn’t be on change but on the people and their needs.

Smartphones and Data Access

The founder of the South African startup, The Sun Exchange, Abraham Cambridge, believes that the most basic hindrance to bitcoin adoption is access to data and smartphone adoption since bitcoin transactions rely on internet access. The Sun Exchange uses bitcoin to crowdfund for solar projects.

“Feature phones don’t really cut it, but it is just a matter of time. With smartphones getting cheaper every day, soon anyone in Africa will be able to use bitcoin services where data is available,” Cambridge said.

“To help reach this point, at The Sun Exchange we are developing hybrid solar/data access projects with cryptomines embedded into the infrastructure. This will ensure that remote villages get energy, communications and their own digital currency money supplies in one fell swoop.”

Despite these setbacks, Cambridge’s optimism on the future of the blockchain technology is significantly high.

“This stuff is just getting started. Think global, free to use, secure computer systems that run autonomous businesses, data storage, and energy transfer. Whole governments will be running on blockchain applications. The UAE city of Dubai has already set a target of being 100 percent running on blockchain by 2020 so we are really not far from this world,” he noted.

“Smart contracts running on self-driving cars that ‘bid’ for their position in traffic is just one of many incredible ideas I have come across that will change every aspect of our civilization.”

Although Africa is slow to the adoption of bitcoin or any other digital currency for that matter, countries like Kenya, Nigeria, and South Africa are already a step ahead. Moreover, the University of Cape Town in Windhoek, Namibia is set to be the first in Africa to offer a postgraduate degree that teaches about bitcoin come January 2018.

News1 year ago

News1 year ago

News1 year ago

News1 year ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

Sponsored Posts2 years ago

Sponsored Posts2 years ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

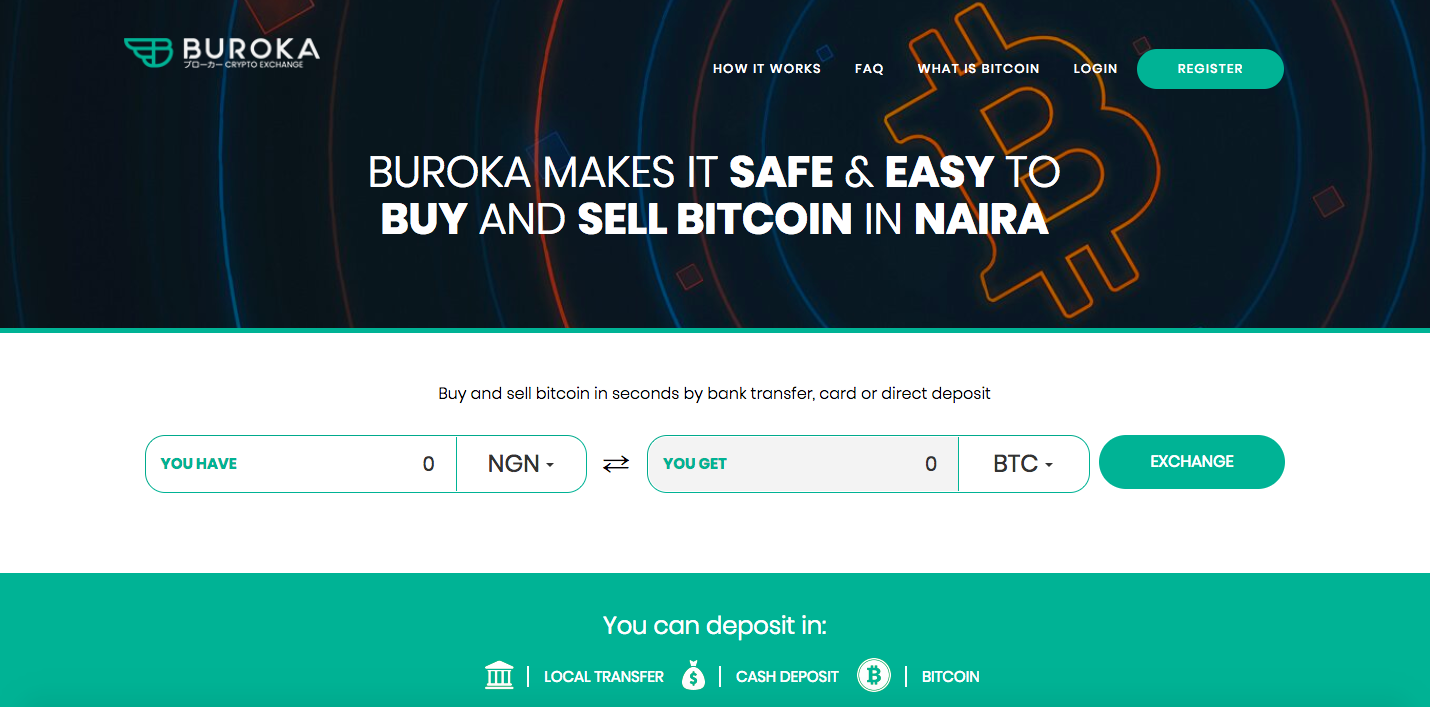

Buroka exchange makes use of Two-Factor Authentication (2FA). 2FA provides an extra layer of protection for users. With the 2FA in place, an extra piece of information is needed before login into the platform or making any withdrawals.

Buroka exchange makes use of Two-Factor Authentication (2FA). 2FA provides an extra layer of protection for users. With the 2FA in place, an extra piece of information is needed before login into the platform or making any withdrawals.