Whaleclub was(!) an online trading platform that enables users to trade the financial markets using cryptocurrencies.

Whaleclub was founded in 2014 by former banker Perry Steegen. Originally, it acted as a forum for bitcoin trade ideas generated primarily from other communities like Teamspeak and TradingView. However, that changed in 2015 when a new management team took over running of the platform and turned it into a trading platform. The exchange is present in 190 countries, enabling traders from around the globe to trade in cryptocurrencies such as bitcoin with ease.

Registration and Deposit Bonuses

While the trading platform’s name may suggest that “whales” (investors with very deep pockets) are the exclusive users of the platform, the reality is that anyone can trade on Whaleclub with any amount of capital they see fit.

Users can take advantage of the fact that there is no minimum deposit required for signing up and more importantly, the process is anonymous. Traders are not required to upload any documents or provide any personal information but instead only require an email address to register. Apart from the email address, users only need to input a username and set a password. A confirmation email will be sent upon registration and once a user has affirmed the details he can sign on to the site and begin trading.

Currently, Whaleclub offers generous bonuses for users who make deposits after signing up. Customers can be eligible for up to 30 percent bonus depending on the amount deposited. Deposits can be made in Bitcoin (BTC), Ether (ETH), Litecoin (LTH) and Dash (DASH). For beginners, the bonus is gradually added to their trading volumes until the bonus amount is fully paid out.

Also, bonus payments can be made on trades that generate losses and thus can be considered as a refund of up to 30 percent on negative trades. Bonus payments are made in real-time to customer balances, who receive a cashback notification on the user interface. Since the platform does not accept fiat money all operations are processed in bitcoin. Withdrawals are processed manually at set times of the day in line with strict protocols that are put in place to protect user funds.

Demo Account and User Interface

In addition, to get a feel for the platform, beginners can access the free practice account by clicking the ‘View Demo’ tab on the site’s landing page. With a demo account, beginners can test all options and understand the functionalities without the chance of losing money. Trading in demo mode means using a fictional balance to make orders and execute transactions on live trading activity. Users can switch between demo mode and real trading from the dashboard.

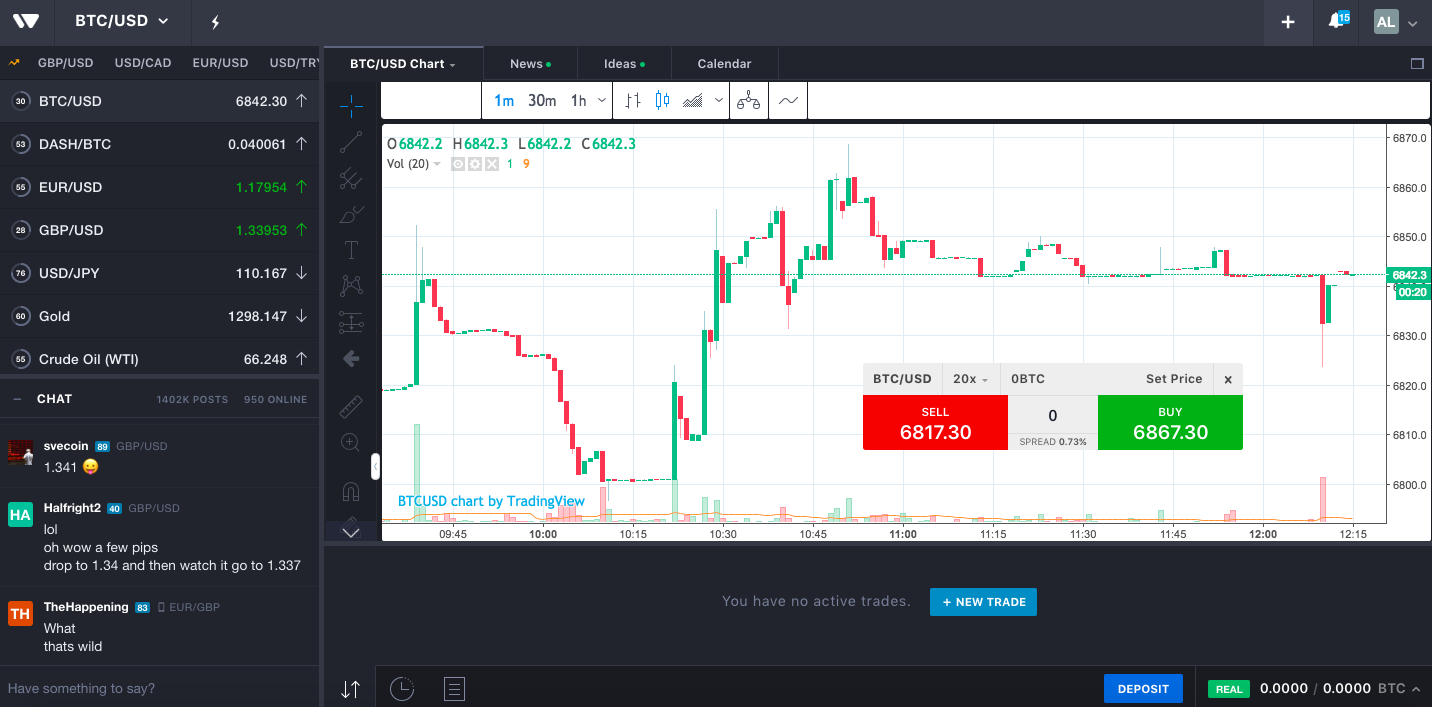

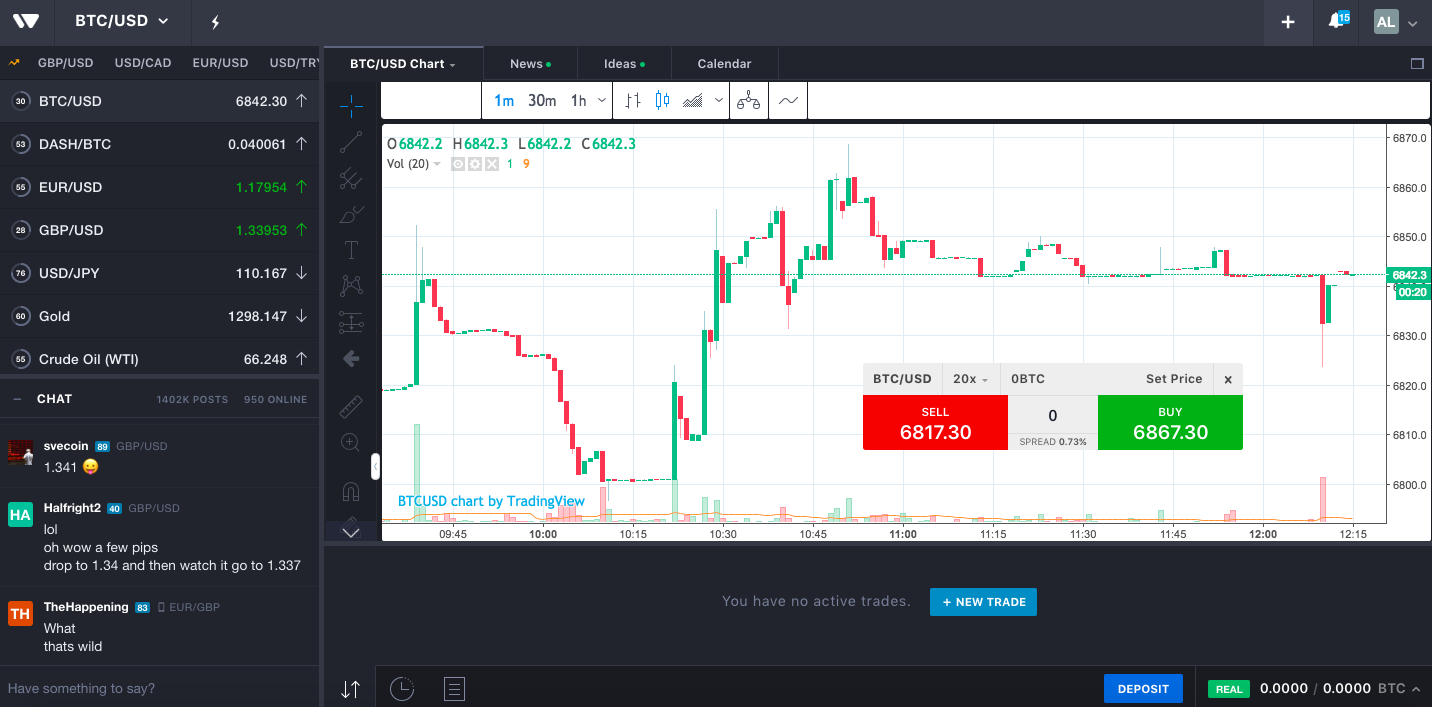

The Whaleclub user interface has been simplified with every step explained in detail to enable traders to execute trades immediately. The user-friendly interface is fast and intuitive. To deposit money into their Whaleclub accounts, users need to sign in and then proceed to the ‘blue deposit button’ at the bottom right of the main page. Once you select the BTC option a pop-up page will appear displaying your personal bitcoin deposit address. The address may change so it is imperative for users to countercheck before making any deposits.

Withdrawing funds from a Whaleclub account is a simple and straightforward process. On the right side of the same page, there is drop down menu with a number of options. Among them is a ‘withdraw’ tab, which when clicked on leads to a pop-up dialogue box that requires you to input your bitcoin wallet address and the amount you want to withdraw. Once that is completed, click on the ‘Withdraw’ tab and the order will be executed.

Trading Pairs and Order Management Options

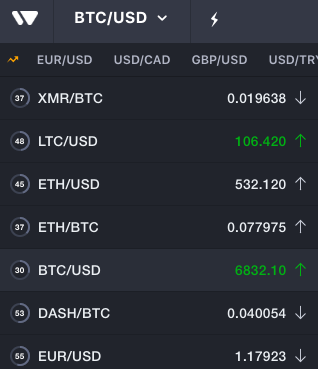

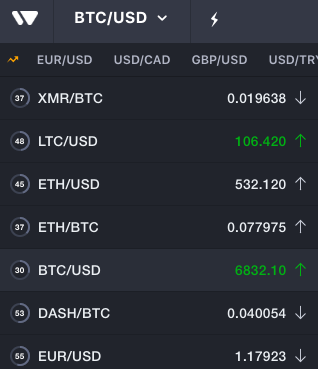

To start a new trade, a user has to select the market on the left top down menu. The cryptocurrency pairs available on the platform are:

To start a new trade, a user has to select the market on the left top down menu. The cryptocurrency pairs available on the platform are:

- BTC/USD

- DASH/BTC

- ETH/BTC

- ETH/USD

- LTC/USD

- XMR/BTC

Once a trading pair has been selected a user can click on the blue ‘new trade’ tab to open the pop-up window. Therein, they can choose to buy and sell, the amount, the price level and whether or not to leverage the trade. Once the order has been placed, a user can click on the corresponding signs within the order management section. The section allows them to add additional settings to an order such as ‘take profit’ levels or ‘trailing stop loss.’

Here are some of the order types available on the platform:

- Market order: Buy and sell at the current market price

- Limit order: This is an order placed to execute a trade at a certain price. The order appears instantly within the exchange’s orderbook.

- Take-profit order: place a sell order once a certain level of profit is achieved.

- Buy/sell stop order: Trade at a certain price, but the order to buy or sell will only be placed in the orderbook when a certain price level has been achieved, which is an additional setting.

- Stop-loss order: The order protects a users position from higher losses. He or she can place an emergency sell order should the price drop below a set limit.

Users can view and amend their positions in the positions section unless they are already being filled.

Fees

There are no fees charged for deposits, trades, balances or inactivity. The only fees charged are margin trading fees and a withdrawal fee of 0.001 BTC. The platform offers up to 200x leverage on FX currencies such as EUR/USD and 50x leverage on other markets like stocks, commodities, and cryptocurrencies. The trading platform allows users to choose the amount of leverage they need before opening a position. Leverage enables users to multiply their buying power since they are able to control large amounts of money with very little money down.

Security

Whaleclub boasts of an excellent security system that is yet to report of any breaches at the trading platform. Apart from manually processing client’s withdrawals, their funds are being kept in cold storage to prevent loss of any coins if the system was hacked. Having said that, it is still advisable for traders to withdraw their bitcoins to external wallets when they are not actively trading on the platform.

Mobile Version, Tools and Customer Support

The trading platform has a mobile version, which is automatically loaded when you access the site on your smartphone. The app operates best on versions of Android 7 Nougat, iOS 10 and Windows 10 Mobile. Also, they are a number of useful tools for technical analysis for bitcoin trading on the site. Traders can use charts that are embedded from tradingview.com. The most commonly used tools are Fibonacci levels and trendlines.

Moreover, the support team on Whaleclub is very responsive and usually thorough with its answers. However, they do not support phone or email messages. Instead, clients have to obtain tickets and wait for the customer care response. In addition, the company provides an extensive knowledge base for general inquiries and guides to help beginners.

Pros

- Anonymous registration

- Free practice account for beginners

- No trade execution fees

- Simple User Interface

- Margin trading enabled

- Secure system and offline cryptocurrency storage

- No minimum deposit

- Good customer support

- Mobile version available

Cons

- Cryptocurrency only deposits, no fiat currency is accepted

- Relatively high margin trading fees

Editors note: Whaleclub has shut its doors and is no longer operational.

News1 year ago

News1 year ago

News1 year ago

News1 year ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

Sponsored Posts2 years ago

Sponsored Posts2 years ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

To start a new trade, a user has to select the market on the left top down menu. The cryptocurrency pairs available on the platform are:

To start a new trade, a user has to select the market on the left top down menu. The cryptocurrency pairs available on the platform are:

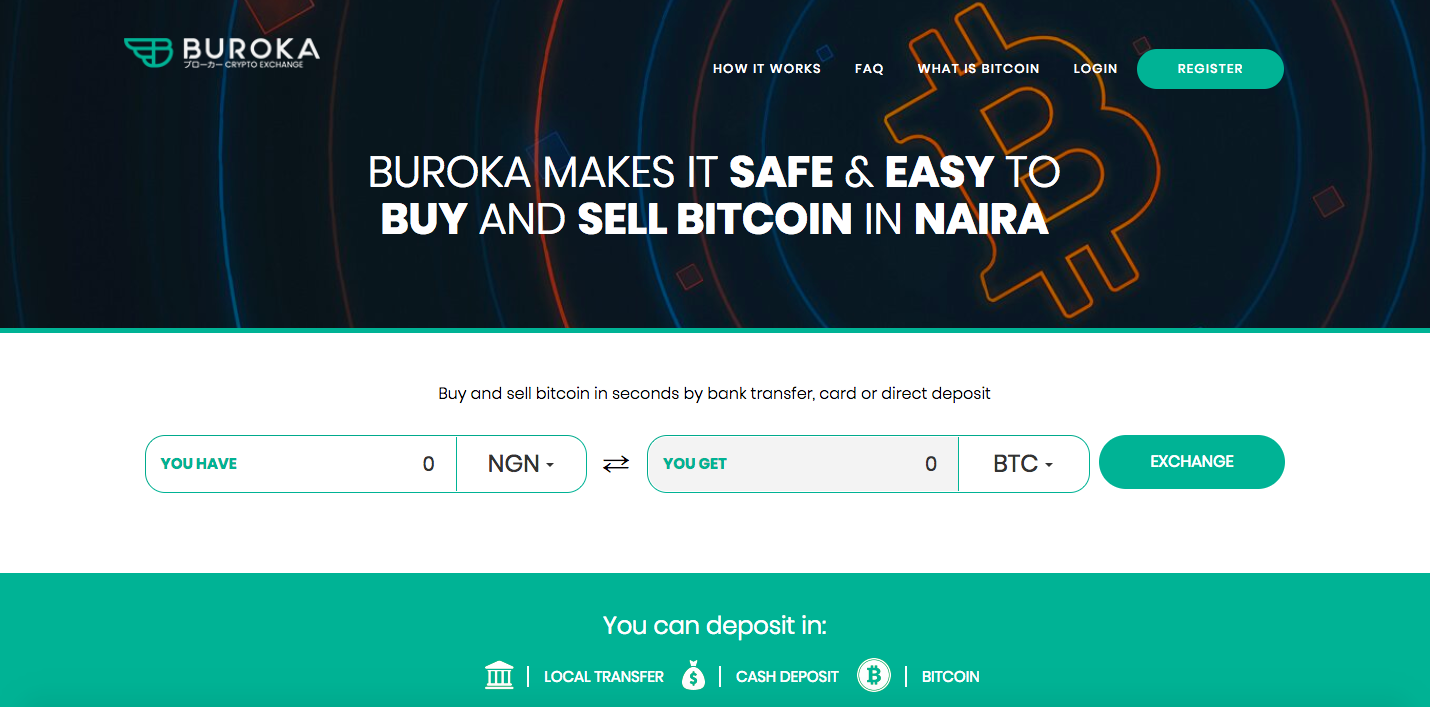

Buroka exchange makes use of Two-Factor Authentication (2FA). 2FA provides an extra layer of protection for users. With the 2FA in place, an extra piece of information is needed before login into the platform or making any withdrawals.

Buroka exchange makes use of Two-Factor Authentication (2FA). 2FA provides an extra layer of protection for users. With the 2FA in place, an extra piece of information is needed before login into the platform or making any withdrawals.