A while ago you decided to buy bitcoins, not only because cryptocurrency seemed as an exciting idea, but also because you were looking for investment opportunities. Now that you have found a secure way to store your bitcoins and can comfortably navigate through bitcoin exchanges, you may be asking yourself, what next? The good news is, there are various ways you can invest your bitcoins such as cloud mining, margin lending on exchanges, and investing in initial coin offerings (ICOs).

In this article, you will be introduced to one of the best ways to invest your bitcoins, which is bitcoin peer-to-peer lending using Bitbond.

What is Peer-to-Peer Lending?

Peer-to-peer lending refers to individuals lending to other individuals or small businesses via an online peer-to-peer lending platform. This allows individuals and small businesses who struggle to secure a bank loan to receive funding and allows private investors to lend money for a high-interest return. Peer-to-peer lending returns are higher than those of government bonds, for example, as individuals and small businesses have a higher credit risk and are, therefore, more likely to default.

Peer-to-peer lending refers to individuals lending to other individuals or small businesses via an online peer-to-peer lending platform. This allows individuals and small businesses who struggle to secure a bank loan to receive funding and allows private investors to lend money for a high-interest return. Peer-to-peer lending returns are higher than those of government bonds, for example, as individuals and small businesses have a higher credit risk and are, therefore, more likely to default.

Bitbond is the first and leading peer-to-peer lending platform using the digital currency bitcoin. That means that small investors from around the world can engage in peer-to-peer lending without needing a bank account.

If you believe that the price of bitcoin will continue to appreciate and you want to earn interest income on your bitcoins, then bitcoin peer-to-peer lending is an excellent investment opportunity.

How to Invest in Peer-to-peer Loans using Bitcoin

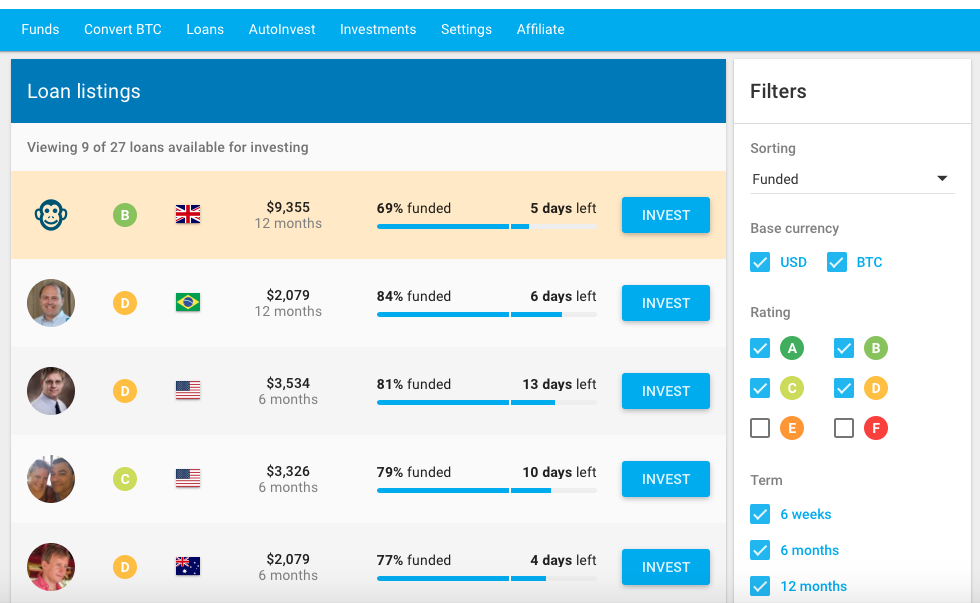

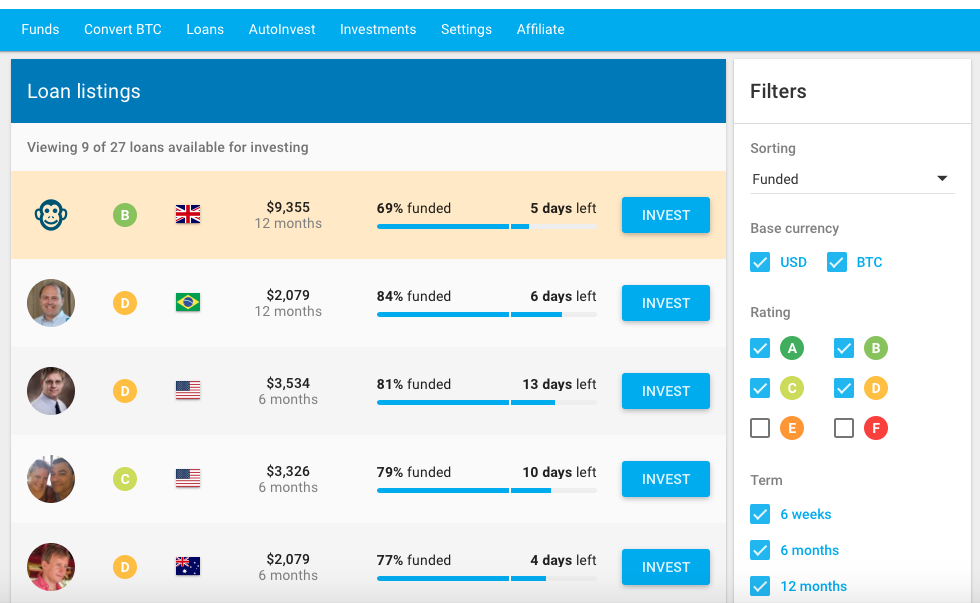

To invest in peer-to-peer loans you simply sign up to the Bitbond platform, deposit bitcoins into your Bitbond wallet and then browse through the available investment opportunities. Once you have identified the borrowers you want to lend to you invest your bitcoins into these loans. As soon as the loan has been fully funded your investment in that loan is finalised and you will start receiving monthly repayments with interest until your loan matures.

Different borrowers have different risk classifications, time horizons, and interest rates. That allows you to adjust your levels of risk to the levels of returns you are seeking.

Your loan repayments will go straight into your Bitbond bitcoin wallet and you can then reinvest those funds or send them to a bitcoin exchange to exchange them back into fiat currency.

Diversifying your Lending

Investing in bitcoin peer-to-peer lending using Bitbond has a number of advantages. Key among them is the decentralized nature of bitcoin, which is not beholden to any country like other global currencies are. Therefore, this means whether you invest in someone from the United Kingdom, or Kenya you don’t have to worry about currency conversion rates.

Diversification is key when it comes to peer-to-peer lending. To reduce the overall default risk of your peer-to-peer loan portfolio, it is important that you spread you investable income across several loans. That way, if one borrower defaults, your overall loss is limited due to your diversification. Bitbond allows users to make investments as low as 0.01 BTC. This makes it possible for every user to diversify their lending portfolio across continents, people, and credit ratings. This, in turn, lessens the risk of borrower defaults.

Low Fees

A key feature about bitcoin peer-to-peer lending is the low fees involved for both lenders and borrowers. In the case of Bitbond, there are no charges incurred by the lender for investing or registration. A lender on Bitbond can expect to get returns on his investment without having to fork out money to cover the associated loan expenses.

In addition, Bitbond has one of the lowest origination fees you can find anywhere. The fees range from 1%-3%, the former being the smallest term loans and the latter, the longest term loan. Also, the minimum amount a borrower can loan is BTC 0.01. The maximum limit depends on the borrower’s ability to repay the loan.

Lenders can evaluate borrower’s business information

Unlike conventional P2P sites, lenders on Bitbond can learn more about borrowers through social media or by engaging them directly via the platform. Most borrowers on Bitbond are online entrepreneurs who sell products on large e-commerce platforms such as Amazon or eBay. You will find their social media and e-commerce accounts linked so that you can get a very good idea of who you will be lending to.

This means a lender can check out the borrower’s eBay page and read the customer feedback, which can help him decide whether or not to fund a project. Such stories are more reliable compared to the number of Facebook and Twitter followers a borrower possesses. Most traditional peer-to-peer lending platforms do not have this feature.

Higher Returns Than Other P2P Lenders

In 2015, US-based peer-to-peer Prosper recorded $14 billion in returns and an average interest rate of 6.87%, while its largest competitor, Lending Club, has an average interest rate of between 6%-8%. However, these returns pale in comparison to the to 13% average APR that you can generate on bitcoin peer-to-peer loans on the Bitbond platform.

Bitcoin P2P lending offers you one of the best ways to grow your money, as bitcoin usage continues to increase and new developments in the blockchain are creating more opportunities. Platforms such as Bitbond, do not have any hidden fees and offer competitive returns on your loans, thereby making P2P lending an excellent way for you to earn passive income regardless of where you are in the world.

If you want to start earning passive investment income through bitcoin peer-to-peer lending, sign up to Bitbond today and get started!

News2 years ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

News3 years ago

News3 years ago

News3 years ago

News3 years ago

News3 years ago

News3 years ago

News2 years ago

News2 years ago

Features2 years ago

Features2 years ago

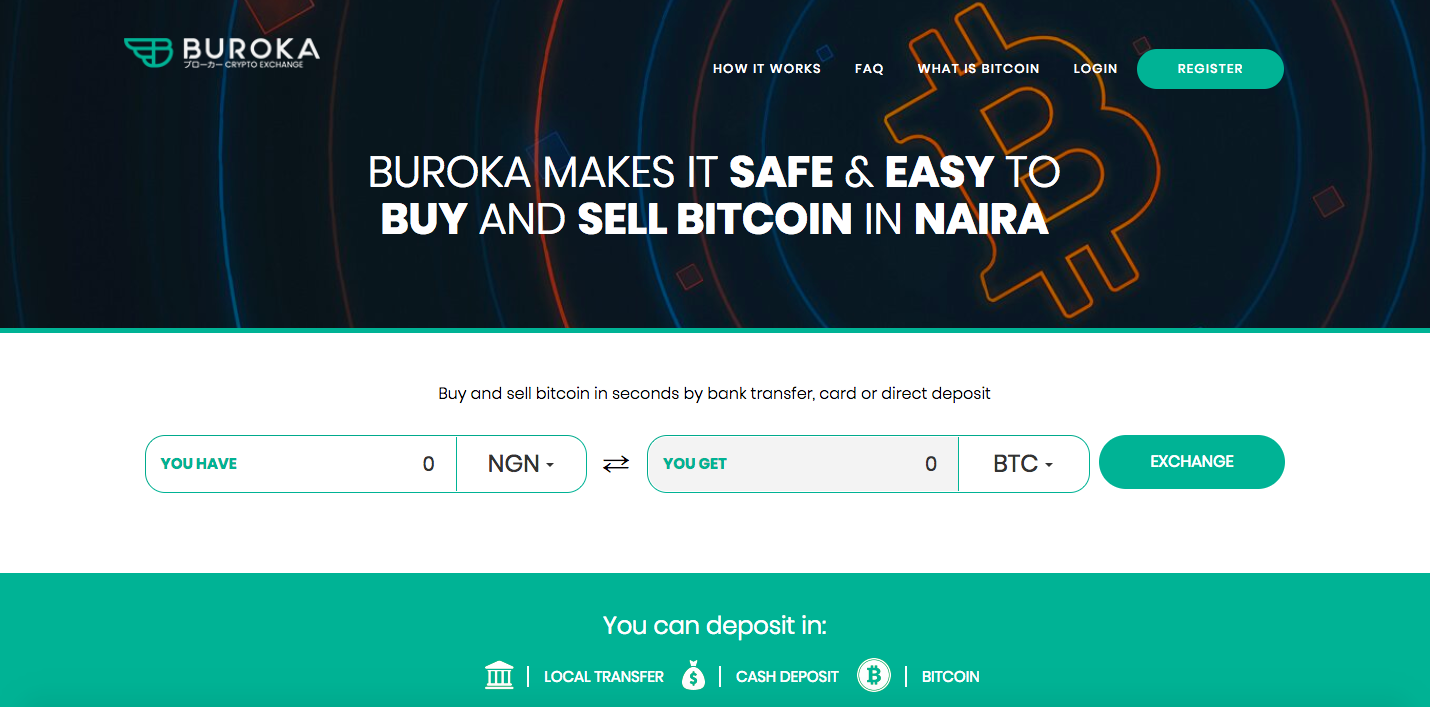

Buroka exchange makes use of Two-Factor Authentication (2FA). 2FA provides an extra layer of protection for users. With the 2FA in place, an extra piece of information is needed before login into the platform or making any withdrawals.

Buroka exchange makes use of Two-Factor Authentication (2FA). 2FA provides an extra layer of protection for users. With the 2FA in place, an extra piece of information is needed before login into the platform or making any withdrawals.