Every week, we search for the best crypto and blockchain news in Africa. This week, we cover the introduction of a new crypto exchange in South Africa, among other stories.

New Bitcoin Exchange Launches in South Africa

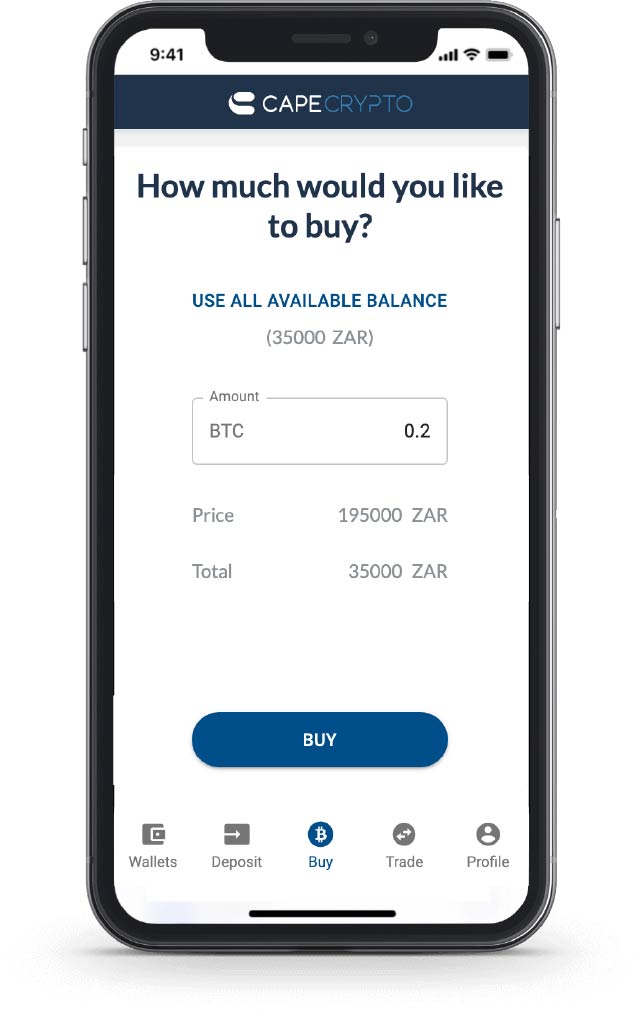

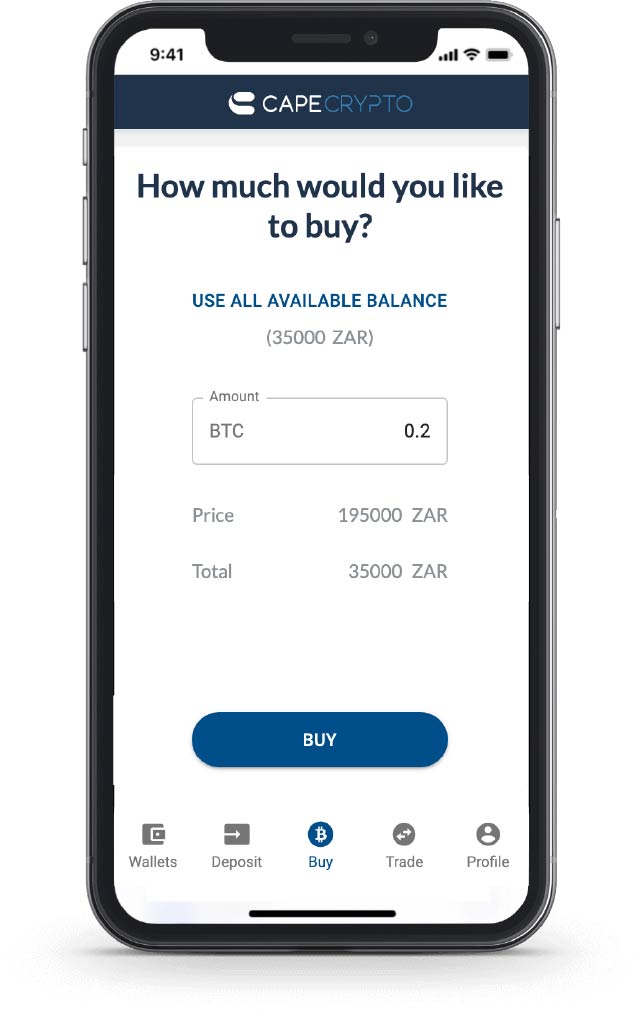

Ex-Luno software developer, Leon Kowalski, has started a crypto exchange in South Africa. Cape Crypto, which launched on November 5, 2020, will allow users to buy bitcoin without the need to verify their identities.

Ex-Luno software developer, Leon Kowalski, has started a crypto exchange in South Africa. Cape Crypto, which launched on November 5, 2020, will allow users to buy bitcoin without the need to verify their identities.

Moreover, Kowalski says the platform will offer the lowest trading fees in the country. Cape Crypto only accepts deposits in South African Rand and bitcoin. The exchange joins other crypto platforms in South Africa like Luno, ICE3X, AltCoinTrader, VALR, and Paxful.

“Being able to register and buy within a minute, Cape Crypto is the fastest way to buy Bitcoin in SA. This is because customers do not need to verify their identities before they can start buying. It is a simple process of confirming their email address, instantly depositing Rand, and buying Bitcoin,” Kowalski told ITWeb Africa.

Although users will not need to verify their identities before purchasing bitcoin, they will have to do so to make withdrawals.

Nigerian Startup Xend Finance Launches DeFi Platform

Xend Finance, a startup based in Nigeria, has launched a DeFi platform for credit unions. Also, the startup has received a strategic funding round of $1.5 million. The company has built its product on Binance Smart Chain.

Speaking to CoinDesk during an interview, Xend Finance Founder and CEO Aronu Ugochukwu said: “A major problem faced by these credit unions or cooperatives is a constant devaluation of the currency because most of the time our economy is unstable.”

Xend aims to promote financial inclusion in developing countries “by converting deposits into crypto and harvesting yield on DeFi platforms” like Aave and Compound. The company has received backing from organisations like Google Launchpad, TRG Capital, and Binance Labs.

Binance Africa Re-Introduces Affiliate Program

Binance Africa has re-introduced its affiliate program to help promote brand identity and awareness across the continent. The program is open to crypto influencers, crypto traders, content creators, and cryptocurrency enthusiasts in Ghana, South Africa, Uganda, Nigeria, and Kenya.

Binance Africa has re-introduced its affiliate program to help promote brand identity and awareness across the continent. The program is open to crypto influencers, crypto traders, content creators, and cryptocurrency enthusiasts in Ghana, South Africa, Uganda, Nigeria, and Kenya.

You can join this program if you love educating others and are knowledgeable about cryptocurrencies and blockchain technology. You can sign up if you have a large online audience, an account on Binance, and are good at brand promotion.

In return for promoting the Binance brand, affiliates will get paid. For instance, for each point you earn, you will receive a cash equivalent reward of up to $3,000. Potential affiliates will get more details about the rewards once Binance approves their applications. To apply, visit the Binance website.

News1 year ago

News1 year ago

News2 years ago

News2 years ago

News3 years ago

News3 years ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

Sponsored Posts3 years ago

Sponsored Posts3 years ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

Ex-Luno software developer, Leon Kowalski, has started a crypto exchange in South Africa.

Ex-Luno software developer, Leon Kowalski, has started a crypto exchange in South Africa.  Binance Africa has re-introduced its affiliate program to help promote brand identity and awareness across the continent. The program is open to crypto influencers, crypto traders, content creators, and cryptocurrency enthusiasts in Ghana, South Africa, Uganda, Nigeria, and Kenya.

Binance Africa has re-introduced its affiliate program to help promote brand identity and awareness across the continent. The program is open to crypto influencers, crypto traders, content creators, and cryptocurrency enthusiasts in Ghana, South Africa, Uganda, Nigeria, and Kenya.

Central African Republic (CAR) has set up a 15-member committee that will be responsible for developing a bill on the use of cryptocurrencies and tokenization in the region.

Central African Republic (CAR) has set up a 15-member committee that will be responsible for developing a bill on the use of cryptocurrencies and tokenization in the region.