In this week’s roundup, you will learn about Jack Dorsey and Jay-Z’s Blind Bitcoin Trust dedicated to Bitcoin development in Africa and the biggest crypto investment scam of 2020.

Jack Dorsey and Jay-Z Announce Blind Bitcoin Trust for Africa and India

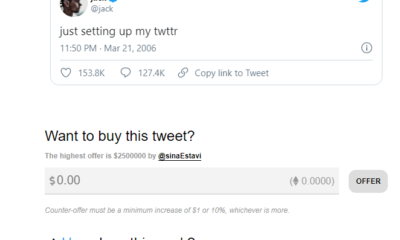

The CEO of Twitter and Square, Jack Dorsey, has announced a Bitcoin Trust with American Rapper Jay-Z. The two announced the initiative through a tweet that garnered over 23,000 likes.

Dorsey and Jay-Z are giving 500BTC to the trust, which will fund bitcoin development in India and Africa. Many companies and organisations commented on the tweet probably with the hopes of becoming beneficiaries of this fund. They include BitPesa, Blockchain Association of Kenya, and SpaceBox.

The announcement came hours after an anonymous source claimed that India would ban all cryptocurrencies. Moreover, the Central Bank of Nigeria recently ordered all banks in the country to stop facilitating payments for crypto exchanges.

According to the tweet, the trust needs three board members to start. Also, Dorsey and Jay-Z will not take part in the leadership of the trust.

Chainalysis Names MTI as 2020’s Biggest Crypto Investment Scam

Chainalysis has named the Mirror Trading International (MTI) scheme as 2020’s biggest crypto investment scam. The company made the declaration in a recent review of cryptocurrency-related crimes.

MTI conducted a crypto investment scheme in South Africa where users deposited a minimum of $100 in bitcoin. The company claimed to use AI trading software to grow the investments of its customers. Additionally, MTI guaranteed customers daily returns of 0.5 percent.

“Mirror Trading International is another example of why the industry must spread the word that algorithmic trading platforms promising unrealistically high returns are nearly always scams. When cryptocurrency exchanges and other services learn of these scams and receive their cryptocurrency addresses, they should discourage users from sending funds to those addresses or at least warn them that financial losses are highly likely,” said Chainalysis.

The Financial Services Conduct Authority (FSCA) in South Africa has been investigating the company since last year. They found that the company was using false trade statements and did not declare losses. Furthermore, the FSCA discovered that the company could not account for more than 16,000 bitcoin of claimed investors’ funds.

Bitcoin Crosses the $50,000 Mark

This week, bitcoin reached yet another milestone by crossing the $50,000 mark.

This week, bitcoin reached yet another milestone by crossing the $50,000 mark.

The bull-run comes at a time when Tesla bought $1.5 billion worth of bitcoin. Additionally, Mastercard announced that it will bring crypto to its network.

Tesla’s move could inspire other companies to consider cryptocurrencies. For instance, the CEO of Uber, Dara Khosrowshahi, told CNBC that the company is considering accepting bitcoin payments.

“I think bitcoin is a much more stable asset class today than it was three years ago. It used to be dominated by leveraged retail traders […] on international markets with a lot of leverage. “Starting in March of 2020, you saw institutions start to arrive, and I think in 2021 you are going to see that trend continue,” Michael Saylor, CEO of MicroStrategy, told CNBC program Street Signs Asia.

Unlike the 2017 bull-run where bitcoin lost over 80 percent of its value the next year, bitcoin appears to be keeping the momentum this time around.

To learn more about Bitcoin, download the Bitcoin Beginner’s Handbook for free.

Features3 years ago

Features3 years ago

Bitcoin2 years ago

Bitcoin2 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features8 months ago

Features8 months ago

Bitcoin10 months ago

Bitcoin10 months ago

This week, bitcoin reached yet another milestone by crossing the $50,000 mark.

This week, bitcoin reached yet another milestone by crossing the $50,000 mark.

Central African Republic (CAR) has set up a 15-member committee that will be responsible for developing a bill on the use of cryptocurrencies and tokenization in the region.

Central African Republic (CAR) has set up a 15-member committee that will be responsible for developing a bill on the use of cryptocurrencies and tokenization in the region.