In this week’s news roundup, you’ll read about the IMF’s readiness to work with the Central Bank of Nigeria to help improve the eNaira, Nigerian cryptocurrency exchange Busha raising a US$4.2 million seed round, and other top crypto stories.

The International Monetary Fund (IMF) Ready to Collaborate with Nigeria to Improve the eNaira

Hillato / CC BY-SA (https://creativecommons.org/licenses/by-sa/4.0)

The International Monetary Fund (IMF) has said it is ready to work with the Central Bank of Nigeria to improve its CBDC, the eNaira. The news comes after Nigeria launched its CBDC on October 25, 2021.

Since going live, the eNaira wallet has been downloaded by more than 100,000 people on the Google Play Store. However, its first week was marred by various issues leading to an embarrassing first week. Despite all that, the IMF has now said it’s ready to collaborate with Nigeria to provide the technical assistance and policy advice needed.

The IMF’s Monetary and Capital Markets Department has been involved in the rollout process of the eNaira and also provided reviews of the product design. The IMF also emphasised that it’s ready to work with the relevant authorities on cross-country studies, data analysis, discussing further evolution of the eNaira including its design, regulatory framework, and other aspects as well as sharing the eNaira experience with other countries.

While the IMF acknowledged some of the measures that Nigeria had put in place to mitigate the risks that come with launching a CBDC, it still pointed out the risks that the West African country needs to carefully navigate in regards to the eNaira. The risks included cyber security, financial integrity and stability, monetary policy implementation, and operational resilience.

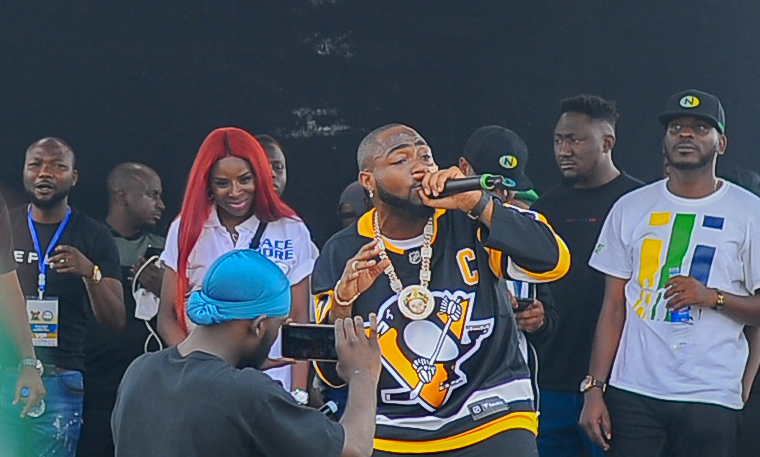

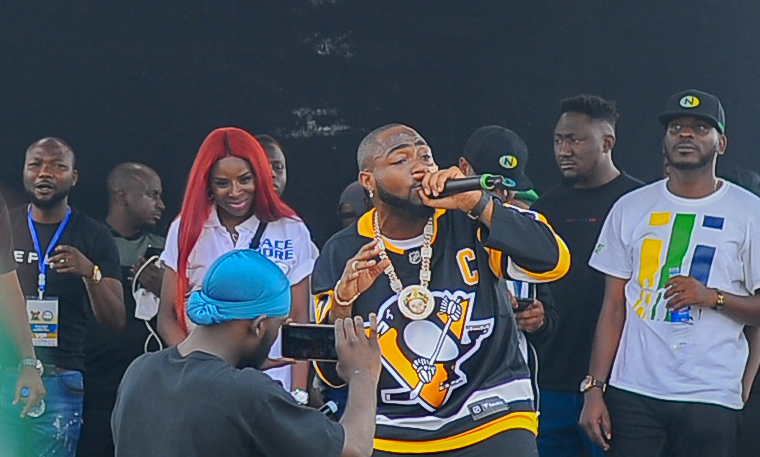

Nigerian Musician, Davido, Launches the ‘Echoke Social Token’ in Partnership with Bitsika Africa

Kaizenify, CC BY-SA 4.0 via Wikimedia Commons

Davido, a Nigerian musician, has launched the ‘Echoke Social Token’ in partnership with Bitsika Africa’s new crypto company Omegoat.

Bitsika Africa is a Pan-African remittance company that is at the moment only serving the Nigerian market.

Davido described the Echoke token as a community token that has been developed to provide value to fans.

In an Instagram post, he wrote, “Every day, millions of fans create value that is captured by a few execs in a boardroom. Not anymore. We’re giving the power back to the fans.”

The tokens will, however, not be sold to the public. Instead, the tokens will be released to fans through periodic giveaways over the next 12 months. Additionally, the token holders will get free access to giveaways, non-fungible tokens (NFTs), jobs, backstage passes, exclusive merchandise, festivals, media, and hospitality benefits.

Nigerian Cryptocurrency Exchange Platform, Busha, Secures a Seed Funding Round Worth $4.2Million to Expand Across Africa

Busha, a Nigerian cryptocurrency exchange, has raised US$4.2 million in its seed funding round. The company intends to use the funds to scale its operations across Africa.

As reported in Disrupt Africa, the funding round was led by Jump Capital, a venture capital firm specialising in scalable software opportunities in the fintech, crypto, IT, and data infrastructure space. Other investors that participated in the round include Blockwall Capital, Cadenza Ventures, CMT Digital, Greenhouse Capital, Raba Capital, among others.

“Our immediate mission is to onboard the next one million Africans into the crypto economy. We have seen the significant difference in financial freedom that crypto can make in the lives of our over 200,000 users, and we are very motivated to extend this to more people on the continent,” said Michael Adeyeri, co-founder and chief executive officer (CEO) at Busha.

The company was founded in 2019 and makes it easy for users to buy, sell, as well as manage their crypto portfolios from its mobile app.

Speaking on the investment, Peter Johnson, a partner at Jump Capital said, “We believe Nigeria and the African continent are one of the most promising places for crypto to make a significant impact in offering financial freedom to millions of individuals. We are excited to work with the Busha team to continue to enhance their market-leading product offering.”

Report Shows that $10.5 Billion Has Been Lost to DeFi Scams and Hacks in 2021 Alone

According to a report done by Elliptic, a London-based blockchain analysis provider, investors have lost over $10 billion due to theft and fraud cases on decentralized finance (DeFi) products in 2021 alone.

The report stated that losses caused by exploits to DeFi platforms have totalled $12 billion. Out of the $12 billion, fraud and theft alone accounted for $10.5 billion which is a 10 times increase from the previous year where fraud and theft alone accounted for $1.5 billion. The increased fraud cases come at a time when the DeFi sector has increased a major spike in terms of money being deposited at DeFi services from $500 million to $247 billion. Additionally, it also comes at a time when the price of cryptocurrencies such as Bitcoin and Ethereum have rallied this year.

To learn more about Bitcoin, download the Bitcoin Beginner’s Handbook for free.

News1 year ago

News1 year ago

News2 years ago

News2 years ago

News3 years ago

News3 years ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

Sponsored Posts3 years ago

Sponsored Posts3 years ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

Central African Republic (CAR) has set up a 15-member committee that will be responsible for developing a bill on the use of cryptocurrencies and tokenization in the region.

Central African Republic (CAR) has set up a 15-member committee that will be responsible for developing a bill on the use of cryptocurrencies and tokenization in the region.