Bitcoin

BEWARE: All Bitcoin HYIPs and MLM Schemes are Scams!

Published

7 years agoon

Bitcoin is the oldest and most popular cryptocurrency in the world. However, as bitcoin adoption is on the rise so is the number of bitcoin scams. Unfortunately, many of these scams have infiltrated Africa in the past few years and are preying on unknowing users who want to make money online using bitcoin.

In this article, you will find out why all so-called bitcoin high yield investment plans (HYIPs) and MLM schemes that involve bitcoin are outright scams and how to identify these schemes so that you do not fall victim to them.

What Are Bitcoin HYIPs and Why Are They Scams?

HYIPs (high yield investment plans) promise their “investors” very high returns on their invested bitcoin. The claimed returns (which are sometimes “guaranteed”) can range from 1 percent per day up to 100 percent per month, or more.

HYIP operators usually claim that they invest their “investors” bitcoins in a sophisticated way to generate high returns. Of course, that is a complete lie. Instead, they only pay out when new money trickles in through the registration of new “investors”, which is exactly why all HYIPs have well-paying referral programs that are there to lure new members to the scheme and to keep existing members propagating it.

In other words, all bitcoin HYIPs are simple and straightforward Ponzi schemes where existing investors are paid with the money coming in from new investors until the scheme collapses and the operators disappear with the funds. Due to bitcoin’s pseudo-anonymity, disappearing with stolen funds is easier than ever. Hence, the sudden growth in this type of scam.

Legitimate cryptocurrency investment platforms, such as Iconomi, have annual management fees and transparently show their users what they are investing in and how their funds are performing. Also, users can pull out their invested funds at any time.

HYIPs, on the other hand, are always very secretive about their “investment” activities and it is hard to get your money out once you are in the scheme. Why? Because they are simply scams aimed at stealing their investors’ money once the pot has gotten big enough for the operators to exit.

What are Bitcoin MLM Schemes and why are they scams?

Bitcoin MLM (multi-level marketing) schemes take the popular element of network marketing (also known as direct selling) and leverage the popularity of bitcoin to create a scam.

It is very easy to identify a bitcoin MLM scam as they all have one thing in common. They do not sell a product or a service. Big companies that use multi-level marketing such as Herbalife, for example, have products that their direct sales people sell. When it comes to bitcoin MLM schemes there is no product and no service, which is why they can be so easily identified as just another pyramid scheme.

Members of bitcoin MLM schemes only really earn by recruiting new members, which is why you can find so many individuals posting referral links in Facebook groups promoting their “investment plan”, bitcoin doublers, (fake) cloud mining sites or MLM scheme.

Members of bitcoin MLM schemes only really earn by recruiting new members, which is why you can find so many individuals posting referral links in Facebook groups promoting their “investment plan”, bitcoin doublers, (fake) cloud mining sites or MLM scheme.

The funds paid to their users are a small share of the new money from other participants. Those who join have to pay a fee. Then, the organisation pumps the amount into paying referrals. In the end, when the operators have earned enough the scheme collapses and they disappear with the money.

Alleged Bitcoin Scams in Africa

MMM

The recently reincarnated MMM is an alleged Ponzi scheme that has been around for decades. Its founder, Sergei Mavrodi, who ran MMM since the late 80s was found guilty by Russian courts in 2007 of defrauding 10 000 investors out of over $4 million in total and was sentenced to 4.5 years in prison. Unfortunately, after his release, Mavrodi relaunched MMM and targeted new markets, including Africa, for his scheme.

MMM came to South Africa in 2015 and has since spread to Nigeria, Ghana, Kenya, and Zimbabwe. The organisation promises a 30 per cent return on investments but gives no indication of how the business actually intends to generate these returns other than “individuals helping each other”. This should ring alarm bells as it clearly means that MMM is a pyramid scheme. Well, that and the fact that the company’s owner has already been convicted for running a Ponzi scheme with the same name back in Russia. Many governments were quick enough to caution their citizens about the scheme, yet MMM is still up and running in countries like Kenya and Nigeria and preying on unknowing bitcoin newbies who want to invest their coins.

According to reports by MoneyWeb, MMM South Africa collapsed in 2016 and its operators have disappeared with their victims’ funds. MMM announced on its South African Facebook page that the RB “was an experiment, and, unfortunately, it failed”. Victims who were involved in the scam, lost all their invested bitcoin as their accounts online were frozen as is traditionally the case when scammers collapse their schemes.

Onecoin

Onecoin is an alleged pyramid scheme that is claiming to have its own blockchain and cryptocurrency. However, no proof that its blockchain exists has ever been presented, whereas every other blockchain has a blockchain explorer where transactions can be viewed. Furthermore, its “digital currency” is not listed on CoinMarketCap as it is widely believed not to exist at all.

At the moment, Onecoin is under investigation by law enforcement departments in several countries across the globe including the UK, Germany, and India, where arrests were made.. Even the central bank in Uganda has warned its citizens about OneCoin. Nonetheless, you will still find OneCoin “investors” send out promotional material with referral links to unknowing users online in the hope to make money by perpetuating the scheme.

At the moment, Onecoin is under investigation by law enforcement departments in several countries across the globe including the UK, Germany, and India, where arrests were made.. Even the central bank in Uganda has warned its citizens about OneCoin. Nonetheless, you will still find OneCoin “investors” send out promotional material with referral links to unknowing users online in the hope to make money by perpetuating the scheme.

MMM and OneCoin are two of the most prominent alleged bitcoin scams in Africa but there are much more. Many of them promise high returns from bitcoin cloud mining but are in reality just another form of Ponzi scheme.

How To Avoid Becoming Victim to a Bitcoin Scam

1. Ensure that company details and names of the owners are listed and real!

Most bitcoin scams will not list the company address nor have a team section that clearly outlines who runs the business and who the owners are. This is a clear red flag, so it should be the first thing to look out for.

If the company is legally registered and there are owners listed, go do a quick google search and see if these details are actually real. Fraudsters will happily provide false information in the hope that their victims do not conduct thorough research.

2. If the scheme “guarantees” you returns, it’s a scam!

If you come across a website or a system that guarantees you returns, it is almost certain to be a scam. There is always a risk when it comes to investing, so returns can never be guaranteed.

3. If the returns they state that they will generate for you are very high, that’s a red flag!

Despite the sometimes fast-increasing value of digital currencies, if you come across a scheme that tells you that it will double your bitcoin within a month or pay you 10 percent return per day, for example, you will have come across a scam with pretty much 100 percent certainty.

Just use common sense, how would a company be able to pay you 10 percent or even 1 percent returns per day other than by using the money from one investor and giving to the next as Ponzi schemes do? Bitcoin mining will definitely not make you 1 percent per day. That is mathematically impossible as we know how much the blockchain can pay out in rewards each day.

4. Read unbiased reviews online and reach out to users to hear about their experiences!

Another great way to check if an investment platform is legitimate is to find unbiased reviews and to reach out to users who have invested there. However, be wary of those who send you referral links or have them in their reviews as these opinions are not unbiased. Individuals who send you referral links when they give you their opinion are only looking to cash in on referral income, which is how participants in Ponzi schemes make money until the scheme collapses.

5. Check if the company is listed on badbitcoin.org!

The gentlemen who run the website badbitcoin.org provide an invaluable service to bitcoin novices who are tempted by high-returns promising investment schemes that are in reality just straightforward scams. The platform lists most known bitcoin scams and new sites are added on a regular basis.

6. The Golden Rule is: “If something sounds too good to be true, it probably is!”

Probably the easiest way to determine whether something is a scam or not is if it sounds too good to be true. If you are being guaranteed high returns that you can make passively online by “just” investing a few hundred dollars, you will almost certainly have come across a scam.

7. There are no legitimate bitcoin HYIPs or MLM schemes. They are all scams!

Finally, not falling for a bitcoin investment scheme in the form of a high yield investment plan or MLM/pyramid scheme is actually very easy because every single one that you come across online is a scam.

While there are many ways to earn bitcoin online, high yield investment plans and MLM schemes are not part of them and need to be avoided at all cost. If you invest in any of these schemes, you will very likely lose money sooner or later when their operators collapse the scheme and make an exit.

Unfortunately, African bitcoin Facebook groups are often full of individuals (usually with fake Facebook accounts) posting about “amazing” bitcoin investment opportunities that almost always include a referral link to a HYIP, MLM or a fake cloud mining scheme. So, keep your wits about yourself when looking for investment opportunities online and remember: “If it sounds too good to be true, it probably is!”

You may like

-

Get Lucky Tickets for World Cup Bets on 1xBit

-

Weekly Roundup: Bitcoin Hits New All-Time High, Expert Predicts Africa is the Future of DeFi

-

How to Make Profit Selling Bitcoin in South Africa During 2020

-

Is Bitcoin “Digital Gold”?

-

How I Got $1000 In A Month on BTCC Crypto Derivatives Trading Platform

-

BitMinutes Builds on Success in Africa by Enhancing Mobile Application – Making It Easier for Nigerians to Buy Bitcoin and USD

True financial freedom can now be experienced in Africa thanks to the ability to offramp from fiat-based currencies such as the Kenya Shilling ($KES) to the Bitcoin standard courtesy of the Bitcoin super application, Noones.

As the name suggests, absolutely no one right now can manipulate, intimidate or steal Africans’ value and well as time when they choose to embrace this idea whose time has come by trading peer-to-peer on the Noones App.

The Noones application has a messenger, wallet, and marketplace all in one. These 3 features ensure that Africans can now trade Bitcoin peer to peer either on mobile, tablets, or computers 24/7.

NOONES CHAT

The capability to communicate in real-time is of vital importance when it comes to Bitcoin peer-to-peer trading. This is because the peer who is buying Bitcoin needs to communicate with the selected trader to make sure they are available to trade, the amount they need is available, verify the payment details, confirm they have sent funds and receipt of the Bitcoin.

Access to customer support is also crucial as money is emotive; thus, making the chat feature on the Noones application give users peace of mind that all their queries will be resolved in a timely manner. Their team lead Mr. Ibrahim on his visit to Kenya personally assured me that all customer care issues will be taken very seriously and addressed as soon as possible to ensure high customer satisfaction when anyone uses the Noones app.

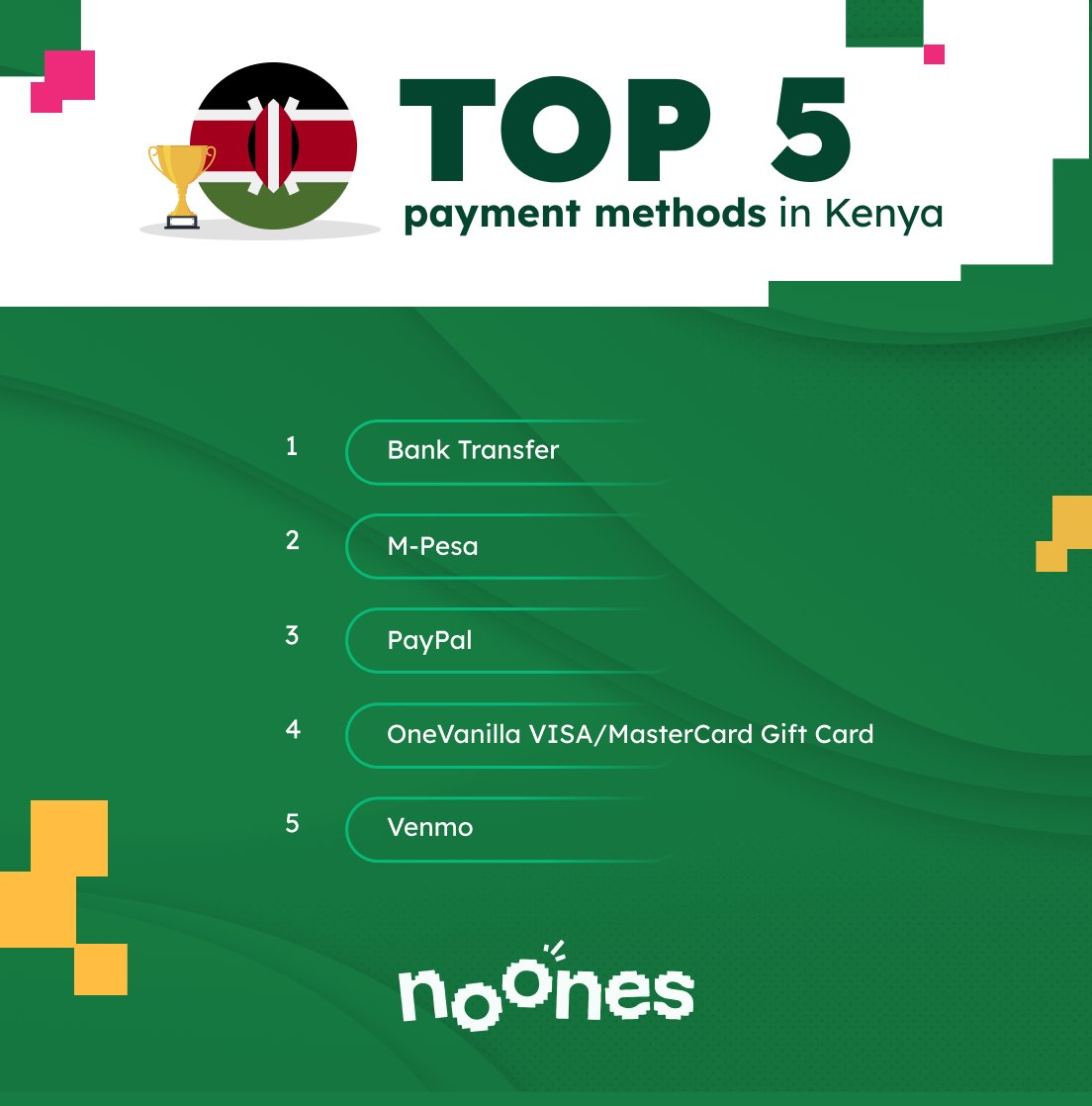

PAYMENT METHODS

The peer-to-peer Bitcoin trading experience on Noones is very convenient due to the multiple payment methods in Kenya. Bank transfers, M-Pesa, PayPal, Visa, and Venmo are some of the most popular ways Kenyans prefer to utilize. Many more payment rails will be added to the platform to make sure convenience is what users experience as they trade.

STRATEGY

BITCOIN EDUCATION

The youth in Kenya make up the biggest demographic of the country’s population, and despite being educated, talented as well very driven, they suffer due to widespread unemployment. The Noones team is very passionate in regards to Bitcoin education to ensure that the youth learn, thus broadening their horizons to be in a position to earn through peer-to-peer Bitcoin trading furthermore, get jobs as per their competencies in Bitcoin companies and or get paid in Bitcoin e.g. for selling art.

As a full-time Bitcoin content creator and educator I love the approach by Noones to address real issues in Kenya by Bitcoin education and training sessions.

GROWTH

Existing peer-to-peer traders in Kenya and Africa have been plagued by stupidity in regards to platforms like Paxful not having their best interest at heart, thus locking accounts. However, Noones is the solution to this as the team is dedicated and on the ground.

EVERYONE EATS

A true champion for Africa as a Bitcoin ambassador building for Africa is a perfect description of Ray who is the C.E.O of Noones. His passion and on the ground experience give a lot of confidence to peer-to-peer traders that they are utilizing a platform that has their best interests at heart.

The Noones partnership program provides a viable and sustainable opportunity for African youth to make an honest living which the Kenyan government can not due to corruption and false promises. Earning via referrals and your own effort is a revolutionary process that takes working from home to a whole new level. Anyone can get started by using the link & referal code ‘MasterGuantai’.

HAPA NI KAZI TU

The Noones marketplace is the best, especially because of the verified peer-to-peer traders. This means you can trade with people who the Noones team has their KYC/AML (Know your customer, Anti-Money laundering) data, meaning they can not steal your funds.

We are always on the grind is the meaning of ‘Hapa Ni Kazi Tu’, which is my mantra. African youth are ready, willing and able to put in the proof of work to make sure they learn and earn in the Bitcoin space. The Noones application provides a perfect opportunity for this to ensure dignity as well as a viable opportunity to not only make ends meet but prosper.

CONCLUSION

The Noones platform provides the change that the youth and young adults want to see in Africa. Having a Bitcoin super application at everyone’s tips provides just that.

The corruption, indoctrination and manipulation of the fiat-based monetary system is evident in everyday life. The way forward is to explore new horizons by unlearning what we were taught to believe is the status quo which is hurting our lives. Fortune Favour a the bold and taking action is the only way forward as stagnation will ensure we are perpetual slaves to a system that is not in our best interest.

The Noones application provides all of as with the opportunity to chart a brighter way forward to preserve our dignity, time and value on the Bitcoin standard.

Statistics, examples, and ways to legally use cryptocurrency

October 1, 2013, was a turbulent day for San Francisco Public Library. A dozen FBI agents pretending to be usual visitors surrounded a man sitting at one of the tables, took his laptop and put a pair of handcuffs on his hands. That man was Ross Ulbricht, founder of Silk Road – the largest darknet marketplace for drug dealers, killers, and other criminals. The seizure of Ulbricht was supposed to tackle the illegal online trade, but, as the news site DeepDotWeb wrote, the bust was “the best advertising the darknet markets could have hoped for”. The reputation of cryptocurrency also suffers from associations with terrorists, who sometimes use it for their needs. How big is the real scale of the problem? And how many legal ways to use crypto exist? ChangeNOW has dived into the topic – and suggests you an overview of the current state of the problem.

Highlights:

- The drugs trade volume using cryptocurrency is relatively large

- Crypto was a significant reason why a part of drug sales migrated to the web, though stays yet not viable and anonymous enough for dealers (same as for terrorists)

- As efficient use of blockchain technology requires good infrastructure, crypto remains not suitable enough for many terrorist groups

- However, some terrorists are trying to adjust to anonymity threats and hold fundraising in crypto

- Legal ways to use cryptocurrency include dozens and vary from IT services to car rentals

Crypto & Drugs & Rock’n’Roll

The total volume of the online drug market using cryptocurrency is around $1 billion. It is located in the darknet, which provides an attractive, profitable, and mostly secure environment for drug dealers. Cryptocurrency, in turn, allows making payments that are hard to be tracked by authorities. This is how blockchain technology has helped to bring a big part of drug sales online from the streets. And it’s not only about drugs themselves – many legal opioid drugs are illegally sold here, too.

However, cryptocurrency is not always as secure and anonymous as it is thought to be. The information about any transaction ever made stays forever in the blockchain, which makes the system way more transparent than cash payments. This is a significant limitation for using crypto in illegal purposes.

According to the University of Technology Sydney, about 46% of criminal activity of each year is connected to Bitcoin. As for the drug sale itself, trade volumes in crypto keep rising, but the percent of Bitcoin drug transactions out of all transactions goes down. This means Bitcoin is more frequently used for legitimate purposes.

What cryptocurrency is used for drug sales most often? Surprisingly, privacy coins such as Monero are used only for 4% of transactions. Due to its pioneer position, Bitcoin is used in 76% of all deals despite all its anonymity risks.

The main problem for drug dealers using crypto is to turn their income into cash. This move remains complicated and insecure. Most cryptocurrency exchanges have instruments to define whether a transaction is coming from a suspicious source like the darknet. The rise of Monero use in the online drug market will hinder such tracking. However, for the reasons listed above, crypto is unlikely to completely replace regular cash in drug sales in the foreseeable future.

Cryptoterrorism

The views on how much cryptocurrency is used and will be used by terrorists vary widely. While some claim that terrorists have no infrastructure to use it and the methods are not secure enough, others argue that they are learning fast and adjust to crypto rapidly. Let’s see what both sides say.

Not actively using, unclear future

Lack of appropriate infrastructure, inability to use crypto. Most terrorist groups settle in the Middle East region, especially on its remote and war-torn territories. The vast majority of roads and technological infrastructure have been destroyed. In such circumstances, cash remains the most common and convenient way to pay and fundraise. Imagine a gun seller in a Syrian village – does it look like he has a tool to accept Monero?

Anonymity threats. Given the relative transparency of blockchain mentioned above, crypto might remain too unsafe for terrorists. Miners can see any potential terrorist money exchange while checking transactions, and it’s not too hard to see who sends them money. It can change with the rising use rate of privacy coins, but the ability to spend such money remains questionable.

Increased attention to crypto by the authorities. As the number of transactions keeps rising, more regulatory bodies’ attention gets focused on cryptocurrency, which apparently makes terrorists nervous and cautious.

Problems of specific currencies. While top cryptocurrencies like Bitcoin receive much regulatory attention, others remain marginal and unreliable because of a lack of support. Conflicts and uncertainty lower the trust to such cryptocurrencies – yes, even terrorists’ trust.

Using actively now, increasingly in the future

Terrorists seem to be rapidly learning to escape from tracking in blockchain. Several years ago it was easy to find any address or transaction made for a terrorists’ fundraiser. Today they use well organized and finely designed websites, where detailed video tutorials show how to donate money anonymously. Unique Bitcoin addresses and other crypto tricks are used to preserve security. Analysts from intelligence services claim there’s only going to be more such cases. And, of course, privacy coins are a “great opportunity” for terrorists too.

Shift to cryptocurrency is a reaction to economic sanctions. ISIS has lost most of its territory and resources, Hamas has been sanctioned by the West. Having been cut off from all main financial institutes, terrorist groups had to find other pathways for their financial activities – and cryptocurrency appeared to be the best substitute.

There might be difficulties and inconveniences, and the number of terrorists using crypto is yet unknown – but as we can see, digital money in terrorism is reality. Same as in drugs. And this is what cryptocurrency is notorious for, lacking trust among millions of people. The reputation of some of the exchange services only adds to this mistrust – ChangeNOW has carried out a special investigation on how such platforms may cheat their clients. But can you buy anything besides heroin and firearms with your crypto? What about pizza or a concert ticket?

Only Antarctica left

Cryptwerk, a platform monitoring actual use cases of different cryptocurrencies, says there are about 3500 ways to spend Bitcoin and more than 800 for Monero today. They range from music services to car rentals, from buying clothes to hotel booking services, and from sports bets to virtual tours.

Organizations accepting cryptocurrency are located on all continents besides Antarctica (what could be a better place for crypto than a continent without governments and countries though?). Mostly, in the USA and Central Europe. Bitcoin as the largest cryptocurrency is relatively widespread in India and Southeast Asia.

As this is a whole another topic, ChangeNOW will issue a post dedicated to use cases of cryptocurrencies. As it will be more detailed, who knows – maybe you’ll find a pizza right by that you could pay for from your crypto wallet!

This article was contributed by Jeremy from ChangeNow.

Bitcoin

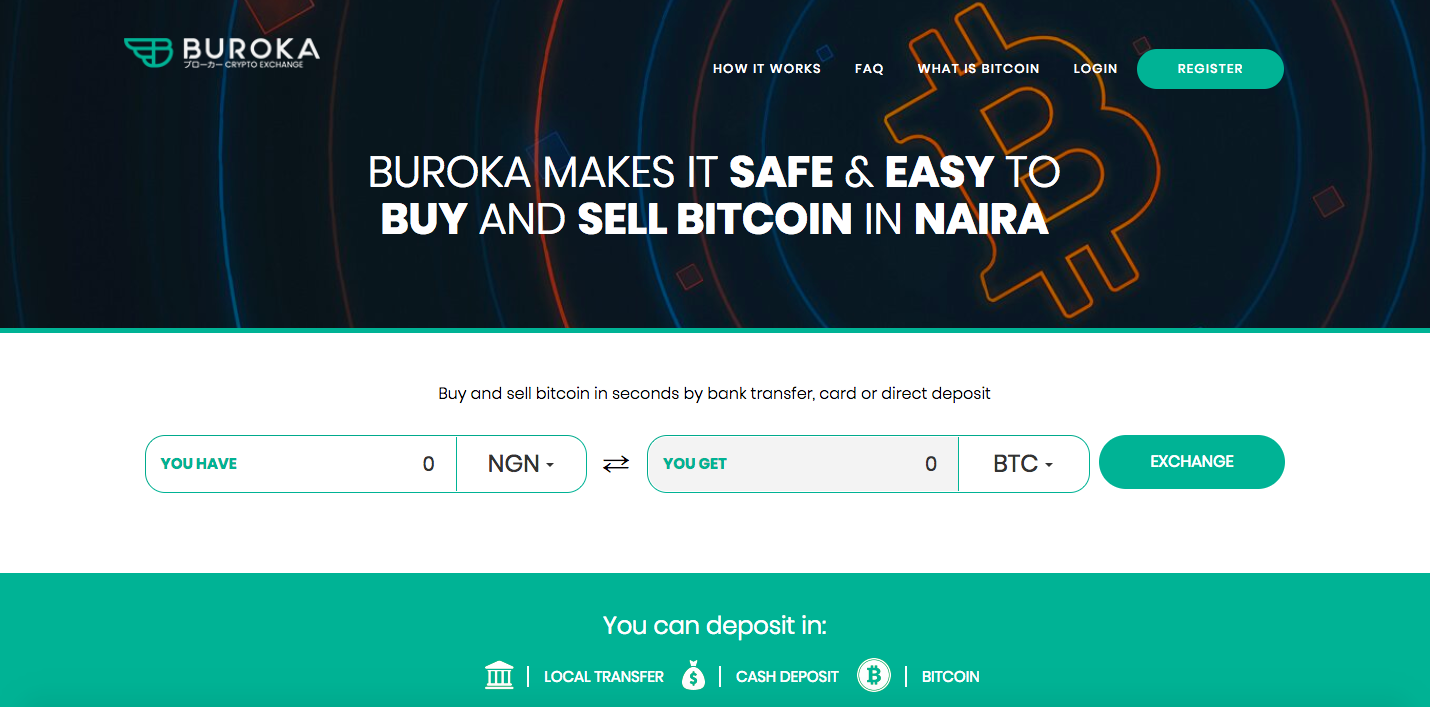

Buroka Review: How to Buy Bitcoin on Nigeria’s Newest Bitcoin Exchange

Published

4 years agoon

February 27, 2020

Buroka is a new breed of cryptocurrency exchange for Africa! Currently operating in Nigeria, Buroka was designed to fulfill the needs of modern Africans. Buroka allows customers to buy and sell Bitcoin with Naira via Local Transfers and cash deposits at the bank. In this Buroka review, you will learn more about the exchange and how you can use it to buy bitcoin in Nigeria.

How to Buy Bitcoin on Buroka

Step 1: Account Creation

To create an account, visit Buroka.com and hit the “Register” button. This will lead you to a page where you will be asked to fill in your personal information, including your name, email address, and password. Like any other serious exchange, Boruka will ask you for your ID, Proof of Address, and to take a selfie with your ID to eliminate fraud.

Step 2: Fund Your Account

Funding your account on the platform is straightforward. You can deposit either via bank transfer or at any bank branch. Make sure to use a unique reference code given to you by Buroka deposit system.

Step 3: Buying and Selling BTC

Once your deposit has been credited to your account you can immediately buy your Bitcoin. The buying and selling tab is located on the top right corner of the dashboard. There you can input the amount of bitcoin you want to buy. Once you do that, you then click on the “BUY BTC” button.

Step 4: Storing Your BTC

After buying BTC, Buroka provides users with the option of either storing bitcoin on the platform in a BitGo wallet or any other wallet of their choice.

Currently, Buroka only supports bitcoin (BTC). However, the exchange plans to include other cryptocurrencies going forward.

Security

Buroka exchange makes use of Two-Factor Authentication (2FA). 2FA provides an extra layer of protection for users. With the 2FA in place, an extra piece of information is needed before login into the platform or making any withdrawals.

Buroka exchange makes use of Two-Factor Authentication (2FA). 2FA provides an extra layer of protection for users. With the 2FA in place, an extra piece of information is needed before login into the platform or making any withdrawals.

In addition, Buroka’s platform is also protected using the latest security technology, including web-socket and API protocols that allow for a fast and secure order processing. Buroka also makes use of a well-updated SSL certificate, which makes it easy to detect a phishing attempt.

To further ensure that clients’ funds are secure, Buroka operates segregated accounts. These accounts are held with trusted banks so that clients can enjoy an extra layer of security provided by the banking system.

Conclusion

Buroka is a relatively new Bitcoin exchange with a well-designed, user-friendly interface. The Bitcoin trading platform provides several deposit options, which is attractive for Nigerian Bitcoin traders, as well as competitive market rates for both buyers and sellers.

If you are looking to buy or sell bitcoin in Nigeria, you can give Buroka a try.

Introducing Noones – Africa’s P2P Super App

Why Crypto’s Leading the Way in Africa’s Evolving Finance Landscape

The Rise of Bitcoin in the Online Gaming World

Unlock the Thrills of NHL Crypto Betting and Live Streaming

Understanding the Impact of Cryptocurrency Volatility on NBA Betting Markets

The Future of Crypto College Football Betting: Trends and Predictions

How Mobile Apps are Changing Sports Betting

Weekly Roundup: Africa’s Cassava Network Partners with UniPass to Expand Crypto Adoption in Africa & More

Weekly Roundup: Kenyan Senate in Discussion with CBK to Legalise Bitcoin & More

Weekly Roundup: South Africa Introduces New Cryptocurrency Standards to Advertising Code & More

Popular Posts

-

News1 year ago

News1 year agoWeekly Roundup: Kenyan Senate in Discussion with CBK to Legalise Bitcoin & More

-

News2 years ago

News2 years agoWeekly Roundup: South African Crypto Exchange VALR Launches in Zambia & More

-

News3 years ago

News3 years agoWeekly Roundup: Binance Becomes Official Sponsor of AFCON 2021 & More

-

News2 years ago

News2 years agoAmber Group’s April Corporate News Recap 2022

-

News2 years ago

News2 years agoWeekly Roundup: Congo-based Web3 Startup Jambo Raises $7.5 Million in Seed Funding & More

-

Sponsored Posts3 years ago

Sponsored Posts3 years agoBlockchain Technology: The Driver for Social Change

-

News2 years ago

News2 years agoWeekly Roundup: Kenya Capital Markets Authority Set to Pay More Attention to Cryptoassets

-

News2 years ago

News2 years agoWeekly Roundup: Kenya, Zimbabwe & Zambia Are All Exploring CBDCs