Bitcoin is having quite a rough year. After reaching an all-time high of $19,000 last December, the cryptocurrency shed off more than 80 percent value in the first eight months of 2018. A market correction, declining investor confidence, and bad press have been blamed for the price crash. But will bitcoin ever rise again?

Bitcoin first crossed below the $10,000 mark on February 1. Since then, the digital currency has only crossed the mark twice. Bitcoin came close to reaching the mark in the first week of May, but it never did.

History

Throughout bitcoin’s history, the cryptocurrency has had ups and downs. Some of the downs have been soul-crushing to investors. But on the bright side, the cryptocurrency has recovered from every single price dip. Is anything different in 2018?

Many financial experts believe bitcoin is undergoing a price correction as most digital assets do. And like with every market correction, a price surge follows. Bitcoin’s problems this year will most likely end with a rise in value. You can also check this infographic by Playcasinoonline.net.

After its bullish run in 2017, the cryptocurrency was expected to correct. Market corrections are commonplace in the stocks and bonds industries. It has happened before with bitcoin, and every crash was followed by a market rise. Although it has taken longer to rise past $10,000, that date will come.

Of course, the digital currency won’t gain value out of the blues. After regulatory threats by governments decrease, investor confidence on the cryptocurrency will increase. Increased adoption by banks and large financial institutions will also help bitcoin’s case. We may not know exactly when it will happen, but bitcoin’s correction will be followed by a rise in prices.

The Law of Supply and Demand

Bitcoin’s prices are determined purely by the law of supply of demand. Governments don’t put a price on the cryptocurrency. When the digital currency’s demand increases, its price increases because more people invest. When its demand decreases, its price reduces.

Bitcoin’s prices are determined purely by the law of supply of demand. Governments don’t put a price on the cryptocurrency. When the digital currency’s demand increases, its price increases because more people invest. When its demand decreases, its price reduces.

For the better part of this year, bitcoin’s demand has been low. That is evident in the huge number of people dumping the cryptocurrency. Despite the low demand, something else is happening that could save bitcoin’s value. Its supply is reducing at a fast pace.

Bitcoin’s pseudo-anonymous founder Satoshi Nakamoto set a limit to how many bitcoins will ever be mined. That number is 21 million. As of April, 17 million bitcoins were mined. The remaining 20 percent will be mined in the cause of the next two decades.

This year, bitcoin’s price has been dropping for a number of reasons. Some of the factors like low investor confidence will fade with time. Once that is done, investors will be met with high prices as bitcoin’s supply decrease. The longer the bear market continues, the higher the likelihood of bitcoin’s value rising later on.

Post Regulatory Threats

Bitcoin’s biggest nightmare is the threat of regulation all around the world. From Beijing to Seoul, Washington to London, governments are considering enforcing regulations on crypto. China already banned two crucial industries in the crypto world last year: ICOs and trading exchanges.

Earlier in the year, the Reuters reported that the Chinese government was threatening to ban any form of centralised trading and related businesses in the country. South Korea has also been introducing regulations that target bitcoin traders. The Japanese government and the US have also been contemplating similar moves.

China, South Korea, Japan, and the US ranked among the top 5 countries with high bitcoin trading volumes. Regulations in the countries have been influencing the industry hugely. As an example, some crypto’s prices in South Korea went down 20 percent after the government claimed it would ban crypto trading. After the statement was corrected, EOS prices went up 40 percent within hours.

Since the US Securities and Exchange Commission hasn’t made any clear regulations about bitcoin yet, the cryptocurrency is likely to continue struggling. Once regulations are put in place, bitcoin’s price will change. Most governments don’t intend to ban bitcoin entirely. In fact, most countries have been finding ways to incorporate bitcoin into their countries.

Once the uncertainty surrounding bitcoin’s regulation declines, bitcoin’s price will resume a steady path. While we can’t be certain which direction the coin goes, it’s highly likely it will rise. Many institutional investors are simply holding back to see what regulations SEC introduces. If the US and other countries back the cryptocurrency with favorable rules, it will rise again.

Low Volatility

Bitcoin’s has always had a volatility problem since it was launched. With no regulations in place, the digital currency’s prices are solely determined by what buyers want to pay. The prices have always gone sharply and then fallen in equal measures.

Bitcoin’s has always had a volatility problem since it was launched. With no regulations in place, the digital currency’s prices are solely determined by what buyers want to pay. The prices have always gone sharply and then fallen in equal measures.

In recent months, bitcoin’s value seems to have stabilised. Maybe the cryptocurrency has finally corrected. But in the past six months, bitcoin has not lost more than 20 percent value in one month. Investors who have always feared the coin’s volatility problem are giving it a try.

Of course, many investors are still nervous about investing now that the cryptocurrency is on a bear run. But once the cryptocurrency resumes a bullish run again, investors will feel more confident to invest.

Disappointing ICOs and Altcoins

As bitcoin grew in 2016, the initial coin offering industry was also booming. ICOs represent a financial model where crypto startups sell in-house coins in exchange for more established cryptocurrencies. While the industry had been growing sharply, things seem to have changed.

Investors no longer view ICOs and small altcoins as shortcuts to make big bucks in the crypto industry. A series of scam ICOs and underperforming altcoins has been shaking investor confidence in cryptocurrencies. Instead, the focus is getting back to bitcoin and other established cryptocurrencies. If more ICOs continue to disappoint, more people will get back to bitcoin and its value will rise.

To Conclude

Bitcoin has lost more than 80 percent its value since it peaked nearly $20,000 last year. There have been many theories about why it lost so much value. One theory pertains governments threatening to regulate bitcoin operations. Some argue the crypto is simply having a market correction and will get back to its old shine.

When and if that happens is anyone’s guess. But given that there is a lot of support for bitcoin-related technologies, its price will likely increase in the coming months.

News1 year ago

News1 year ago

News1 year ago

News1 year ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

Sponsored Posts2 years ago

Sponsored Posts2 years ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

Bitcoin’s prices are determined purely by the law of supply of demand. Governments don’t put a price on the cryptocurrency. When the digital currency’s demand increases, its price increases because more people invest. When its demand decreases, its price reduces.

Bitcoin’s prices are determined purely by the law of supply of demand. Governments don’t put a price on the cryptocurrency. When the digital currency’s demand increases, its price increases because more people invest. When its demand decreases, its price reduces. Bitcoin’s has always had a volatility problem since it was launched. With no regulations in place, the digital currency’s prices are solely determined by what buyers want to pay. The prices have always gone sharply and then fallen in equal measures.

Bitcoin’s has always had a volatility problem since it was launched. With no regulations in place, the digital currency’s prices are solely determined by what buyers want to pay. The prices have always gone sharply and then fallen in equal measures.

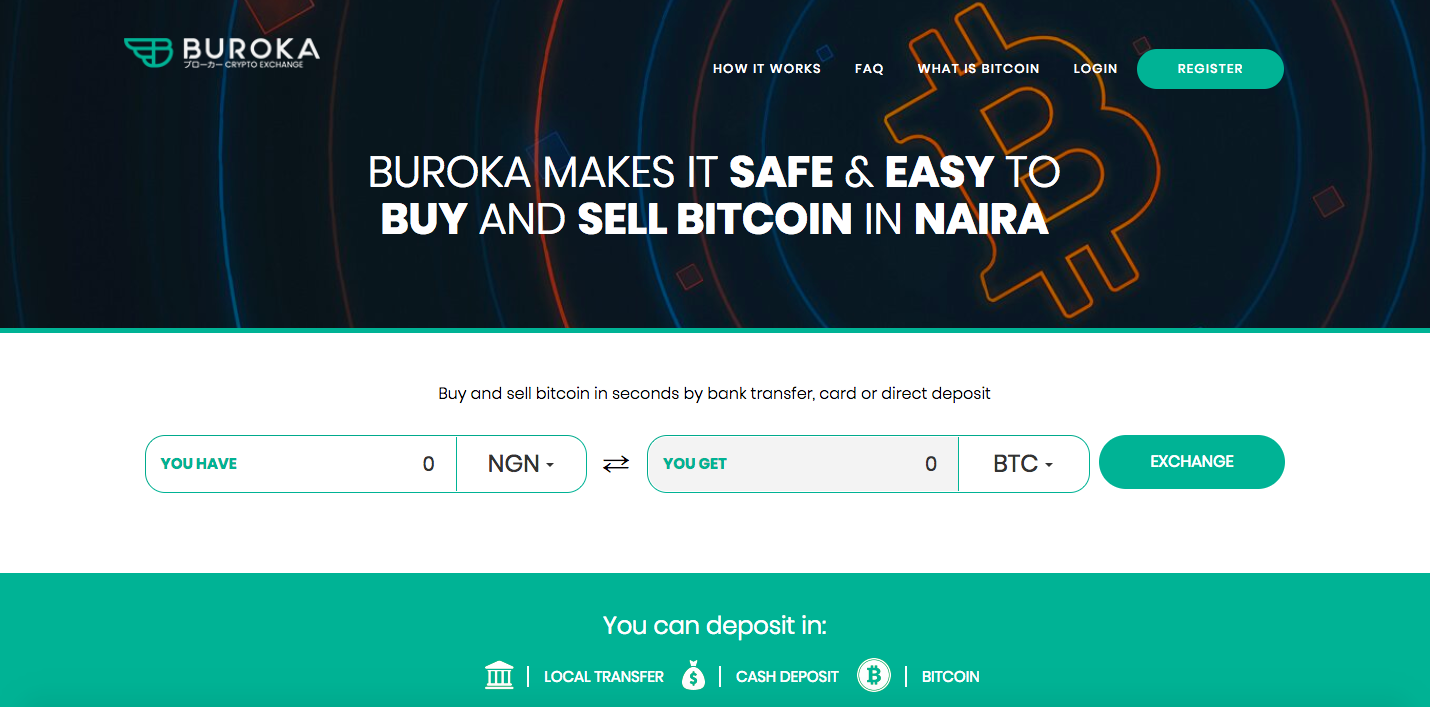

Buroka exchange makes use of Two-Factor Authentication (2FA). 2FA provides an extra layer of protection for users. With the 2FA in place, an extra piece of information is needed before login into the platform or making any withdrawals.

Buroka exchange makes use of Two-Factor Authentication (2FA). 2FA provides an extra layer of protection for users. With the 2FA in place, an extra piece of information is needed before login into the platform or making any withdrawals.