A Forecast for the Next Decade of Crypto

Cryptocurrency is young. Thursday — October 31, 2018 — will mark its first anniversary, 10 years since Satoshi Nakamoto’s fateful email. It wasn’t until January 2009 that the first Bitcoin block had been mined, and March 2010 that Bitcoin was first assigned a monetary value. Simple math shows that the anniversaries of those dates are still in the future.

Yet it’s time to think about what this future will be like. Bitcoin has dominated the whole industry since its birth, dictating the trends on the market. However, now Ripple, Bitcoin Cash, and Ethereum are challenging the king. It’s too early to say, but we might be heading towards a more competitive cryptocurrency market.

In this article we will:

- Explain why Bitcoin was a dominant force on the market;

- Review the significant alternative cryptocurrencies and their impact;

- Predict the next 10 years of crypto, based on the current data.

Why Bitcoin Holds The Market Hostage

Satoshi Nakamoto was not the first to propose the idea of a privacy-focused value transaction system. He was standing on the shoulders of David Chaum, Douglas Jackson and Barry Dowey, Adam Back, as well as many other cypherpunk idealists.

And yet, the general public remembers only Nakamoto and Bitcoin. The absolute majority of the newcomers to crypto purchases Bitcoin and ignores the other currencies. This only increases the importance and influence of Bitcoin and leads more investors towards it.

According to CoinMarketCap, right now Bitcoin is claiming mind-boggling 52% of the total market capitalisation. Ethereum, which led to an ICO craze of late 2017, has less than 10%. Ripple has less than 9%. And it’s not a good thing. Compare these three charts:

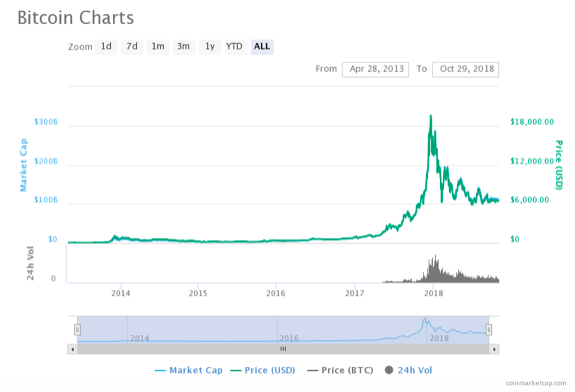

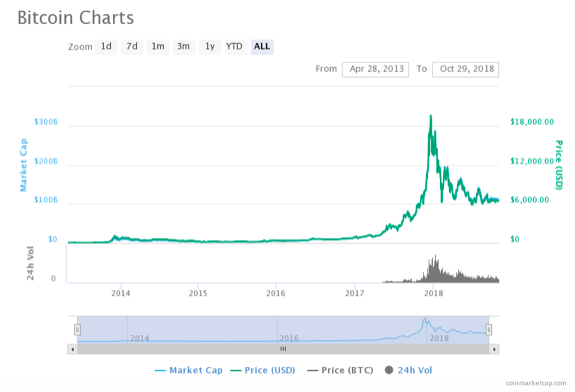

A Bitcoin capitalisation-over-time chart. Note the shape of the graph starting from 2017.

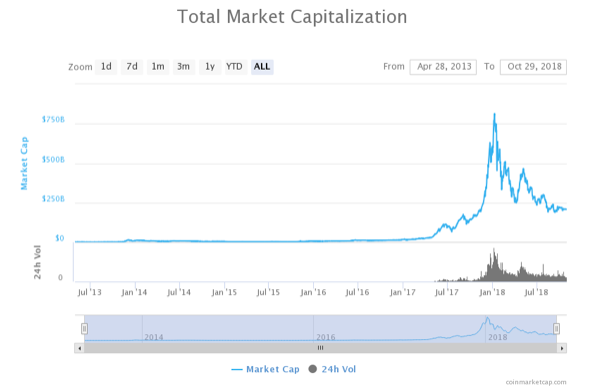

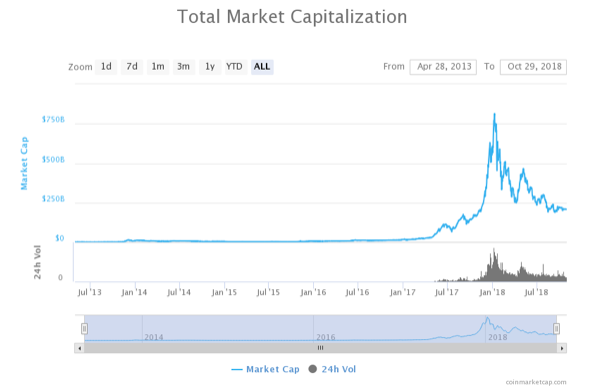

A cryptocurrency market capitalisation-over-time chart. Note the similar shape of the graph.

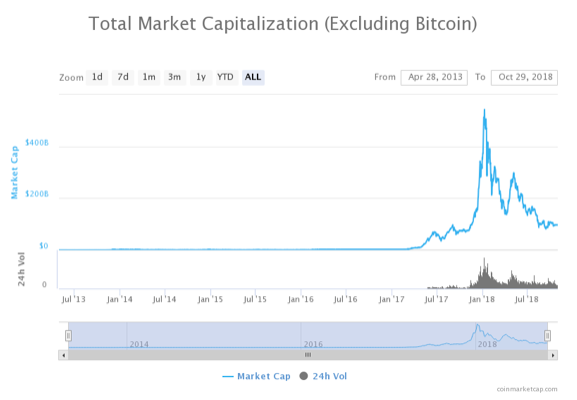

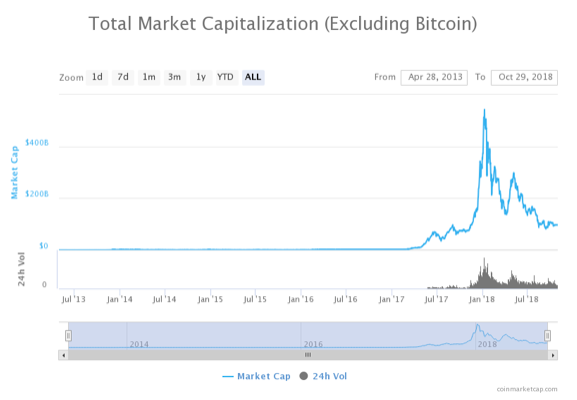

A capitalisation-over-time chart with Bitcoin removed. The shape of the graph is exactly the same.

The first two charts should be similar — after all, Bitcoin dominates the market. However, the last chart proves that Bitcoin has a significant influence on the value of the other currencies too. This situation is not healthy for the economy and makes the altcoins hostages to the Bitcoin.

Imagine if Apple had that much clout on the stock market. Imagine that everyone’s stock would rise and fall in value according to Apple’s decisions, news, and press releases. This situation would crush the businesses worldwide — but it will never happen. Apple’s leadership is constantly challenged by other companies like Amazon, Microsoft, and Alphabet. In fact, Amazon might take over the next quarter, if the reports are accurate.

And yet, nothing even remotely similar ever happened on the cryptocurrency market. Which begs a question — will the next 10 years of cryptocurrency be equally dominated by Bitcoin?

What Can Challenge Bitcoin?

Bitcoin has 2070 competitors. However, even combined, they do not represent a proper competition. Take a look at the combined capitalisation-over-time chart:

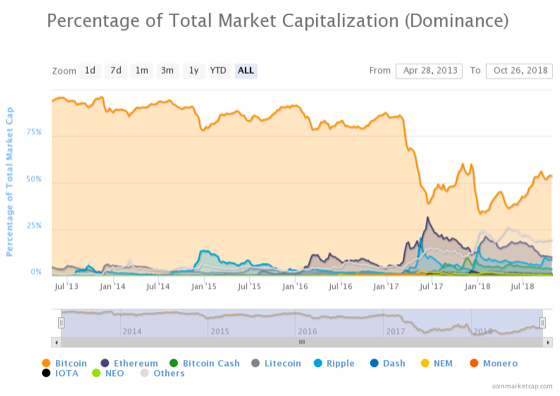

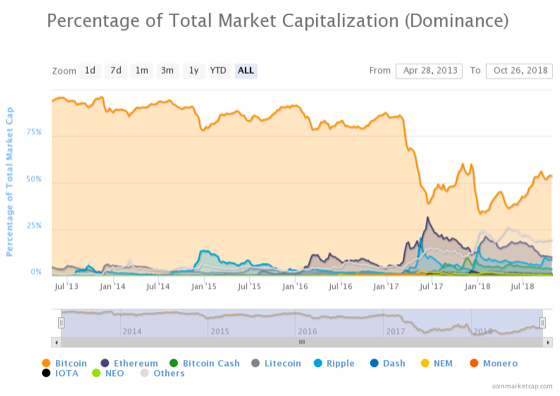

However, the situation is slowly getting better. While back in 2013 Bitcoin controlled almost 90% of the market, it is “only” 52% right now. Moreover, some of the currencies begin to ignore the trends set by Bitcoin, becoming more and more independent. Let’s review three of those currencies in more detail.

Ethereum (ETH)

Ethereum, released in 2015, was the first altcoin to register in the public mind. Just like Bitcoin, it wasn’t the first overall — LiteCoin has been around since 2011. However, Ethereum offered something unique — smart contracts for everyone with minimal effort.

What followed was an ICO craze that propelled Ethereum far beyond the initial expectations. You can see the exact moment this happened on the chart above. It’s marked as Jul ‘17 and represents the only moment when Bitcoin’s dominance was threatened.

Unfortunately for the ETH holders, the ICO bubble burst in late 2017. Right now Ethereum is barely trucking on, continually losing the market volume and capitalisation. However, Vitalik Buterin, the founder of the Ether project, thinks that a comeback is more than possible.

Ripple (XRP)

Ripple is not a cryptocurrency in the narrow sense of the word. It is centralized and not really that transparent. However, it is still a private and a secure digital payment network that is based on a blockchain, so most cryptocurrency enthusiasts let it slide. Mainly since it now controls almost 9% of the market capitalization.

The best feature of Ripple is its ease of use. Due to a highly efficient system, Ripple allows for fast transactions with a standard fee of 0.00001 XRP. As a reference, Bitcoin’s standard fee on October 29 was 1356 Satoshi or 0.19050295 XRP.

Such accessibility led to the creation of multiple gateways — official or semi-official exchange points between Ripple and other currencies, both fiat and crypto. Right now, Ripple is not only a transaction network, but also a favourite medium for transactions made in different currencies.

XRP took a couple of hits along the way due to controversial management decisions and the lack of trust from the cryptocurrency community. However, right now it is feeling better than ever and is, for the first time, ready to challenge Ethereum.

Bitcoin Cash (BCH)

Bitcoin Cash came to be due to a schism between Bitcoin Core developers. One group wanted to increase the size of a block in the chain. Others insisted that the issues with the transaction cost should be solved with less intrusive methods. In 2017, the “rogue” developers split and created a new currency — identical to Bitcoin, but with larger block size.

Despite controlling almost 5% of the cryptocurrency market capitalisation, Bitcoin Cash does not have great prospects. In 2018 the mainline Bitcoin introduced a Lightning Network, which is a different, yet a more conventional solution to the transaction cost issues. Since then, BCH is a just another altcoin, although a particularly popular one.

What Will The Next Decade of Crypto Look Like

The world of cryptocurrency changes daily, so making any kind of a forecast is impossible. However, some recent trends promise a better, more healthy tomorrow.

We reached out to Igor Afa, a financial analyst at Forex broker JustForex, and asked to share his vision of the next cryptocurrency decade. Here are his points:

- Bitcoin will remain a dominant currency, yet it will lose some market value to its competitors.

- Ripple and Ethereum will grow and start challenging Bitcoin’s dominance. Neither will come as close as Ethereum in June 2017.

- Bitcoin Cash will not advance from its positions, but likely won’t fade away either. A large number of users acquired during the split will keep it afloat.

- Should Tether, Petro and other stablecoins succeed, they will take over a niche market segment.

Of course, this doesn’t take into account things that are impossible to predict. For example, cryptocurrencies might be banned. Or Vitalik Buterin will take that job at Google and run Ethereum into the ground. Or maybe an entirely new cryptocurrency will appear, with a completely unique offering, and take over the market.

Overall, the market will become a little healthier. It still won’t be anywhere near normal, but at the very least we won’t have a whole market living and dying on a single entity. Which, all things considered, is already a huge win.

Disclaimer: Readers should do their own due diligence before taking any actions related to any company, product or service mentioned in this article. BitcoinAfrica.io is not responsible, directly or indirectly, for any loss or damage caused by or in connection with the use of or reliance on any content, product or service mentioned in this sponsored post.

Features3 years ago

Features3 years ago

Bitcoin2 years ago

Bitcoin2 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features8 months ago

Features8 months ago

Bitcoin10 months ago

Bitcoin10 months ago

Rear

Rear