African startups often fail to take off or make it big due to a lack of funding. In this guide, you will discover ten funding options for African tech startups that could help you to kickstart your company and turn it into a raging success in 2019.

Bootstrapping

Bootstrapping is the first funding option every tech startup should consider. This means that as an entrepreneur you will solely rely on your money and company resources to scale and run your business operations.

Bootstrapping is beneficial because it saves your company from debt and makes your business more attractive to potential investors and lenders. Another advantage that comes with bootstrapping is that you will become more business savvy as you get better at creating revenue and boosting your profits without external financial help.

Here are the possible options you can use to fund your tech startup through bootstrapping:

- Let the customer pay for your initial job. This simply entails asking the customer to pay for the money you will use in building a tech solution for them.

- Reduce expenses through sharing your workspace with other businesses to reduce the cost of office rent. You could run your company remotely to alleviate office costs entirely. You might also consider sharing employees and office equipment or hiring consultants instead of hiring people permanently.

- Offer your employees the option to work for equity instead of cash.

Unfortunately, without an efficient marketing technique to bring in customers quickly the business might fail. Moreover, it will take longer to grow your company without investment.

Small Business Loans

Once you have successfully grown your startup through bootstrapping, then you can move to the second funding option which is applying for a small business loan to expand your business.

Once you have successfully grown your startup through bootstrapping, then you can move to the second funding option which is applying for a small business loan to expand your business.

Loans for startups and small businesses are not easily accessible in Africa but with a strong business plan, an existing customer base, and adequate cash flow, banks, micro-finance institutions, savings and credit co-operatives, and mobile app lenders may lend you money to grow your business. However, these loans often come with high interest rates. Hence, it is important to ensure beforehand that you will be able to repay the loan plus interest in full and on time.

You will generally need the following to secure a small business loan:

- A business plan

- A good credit score

- A record of your business financials e.g. tax income returns

- Business licenses and other legal documents

- Collateral

Angel Investors

An angel investor is a wealthy person who is looking to make investments that could potentially result in high returns. If an angel investor believes in what you are doing and they believe that your business will succeed, they may inject capital into your startup in exchange for ownership equity or convertible debt.

Financing your tech startup through an angel investor is beneficial because it is less risky than debt financing. Additionally, angel investors also offer mentorship to founders, thereby, enabling them to run their businesses more effectively.

Angel investors can be wealthy individuals, groups, family members, or friends. Examples of angel investor groups in Africa include Jozi Angels, Angel Investment Network, Team Africa Ventures, and Ghana Angel Investor Network.

To attract an angel investor, your business needs to be:

- Innovative

- Scalable

- On the path to profitability

Additionally, your startup should also have a strong business plan and a strong team of founders because investors generally invest in people and not ideas.

Venture Capital

Venture capital firms invest in businesses that have a high potential for growth. VC generate a return on their investments when the company they invested in gets bought up, goes public or they can sell their stake to another investment firm.

Venture capital firms invest in businesses that have a high potential for growth. VC generate a return on their investments when the company they invested in gets bought up, goes public or they can sell their stake to another investment firm.

Unlike angel investors, venture capital companies generally invest larger amounts of capital into a business. However, VC investment tends to come with conditions that are not always favourable to the startup founders so potential VC investments need to be looked at in detail to see whether they truly benefit the business and its owners or primarily the VC firm.

While some angel investors are motivated to help startups grow through mentorship and capital, venture capitalists are often interested in finding the best business that can make them the most money.

Before approaching a venture capital firm:

- Do your research

- Evaluate the growth potential the current target market offers your business

- Talk to other startups that have raised funds through venture capitalists and learn from their experiences

- Build your idea and gain traction

- Create a short and catchy pitch deck

- Consider bootstrapping, small business loans, and angel investors first

Some of the top venture capital firms in Africa include Matamba Anonaka Technology Holdings (MATHs) and Adlevo Capital.

Startup Incubators/Accelerators

Startup incubators concentrate on innovation while accelerators focus on growth. Tech startups have to apply to be accepted into an accelerator or an incubator program. Once they are picked, startups are given a small amount of seed funding in exchange for a small equity percentage.

Accelerators offer startups a mentorship network which they leverage to grow their businesses. In addition, accelerator programs help startups to build their businesses over a short period of time. Incubators are often characterised by a co-working environment, mentoring, networking, and some connection to the local community. Once a startup joins an incubator program, it gets the opportunity to polish up its idea, create a business plan, and work on a product that fits the target market.

Accelerators and incubators are important because:

- You receive mentorship

- You get access to future investors

- You develop your skills

- You are able to manage the risk associated with your concept

- You are able to establish the next growth level of your business

- You get access to a free or low-cost working space

Accelerators and incubators are ideal for startup founders that want to start their businesses on the right foot. Some examples of accelerators and incubators in Africa include Injini, Google Launchpad Accelerator Africa, FB Start Accelerator, iHub, and MMH Accelerator.

Business Grants

Business grants are non-repayable funds that come with attached conditions. As long as you fulfill these conditions, then you will not have to repay the money.

Business grants are non-repayable funds that come with attached conditions. As long as you fulfill these conditions, then you will not have to repay the money.

Governments, foundations, organisations, large corporations, and trusts are often the givers of business grants. African tech startups simply have to look for a grant that fits their needs before making an application.

The upside of receiving a business grant is that you do not have to repay it or give up any shares. Moreover, you can use the fact that a large corporation or a government has given you a grant as a promotional mechanism.

Examples of organisations that offer grants include Shell LiveWire, Africa Women’s Development Fund, Jack Ma’s Africa Netpreneur Prize Initiative 2019 and Miss.Africa Initiative.

Pitching Competitions

Startup contests and pitching competitions are other ways of funding your tech startup. These opportunities enable a startup to pitch its ideas to potential investors while interacting with a wide network of people that could contribute positively to the growth of its business.

Other perks are competition prizes, support from incubators or accelerators, mentorship, and free access to industry events.

To win a pitching competition, you need to:

- Follow the rules

- Know your material

- Open with a close and catch the attention of the audience

Examples of pitching competitions for African tech startups include MEST Africa Challenge, Seedstars World Competition, and Sanofi in Africa VivaTechnology Challenges.

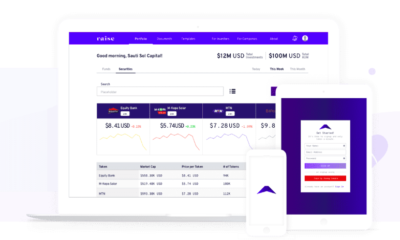

Online Crowdfunding

Online crowdfunding entails raising small amounts of money on the Internet from a large number of people. There are two types of online crowdfunding: equity and rewards-based. Equity-based crowdfunding entails offering shares in exchange for capital while in reward-based crowdfunding, “investors” are given an incentive or a reward.

Online crowdfunding platforms offer an efficient way to raise money and access thousands of potential investors.

Here is how you participate in online crowdfunding:

- Determine the type of online crowdfunding you want

- Research crowdfunding platforms

- Choose the best platform for your business and post your campaign

- Use social media to promote your campaign

African crowdfunding platforms include Uprise.Africa, Thundafund, M-Changa, and Afrikstart.

Initial Coin Offering (ICO)

Raising money through an initial coin offering (ICO) is another funding option that has been gaining popularity over the recent years thanks to the emergence of blockchain technology and cryptocurrencies. During an ICO, tokens are sold to the public as a means to raise funds.

Raising money through an initial coin offering (ICO) is another funding option that has been gaining popularity over the recent years thanks to the emergence of blockchain technology and cryptocurrencies. During an ICO, tokens are sold to the public as a means to raise funds.

ICOs were very popular in 2017 but have since lost their appeal as regulators across the globe have made it clear that companies will no longer be able to raise millions without having to adhere to any regulations. Hence, there is regulatory risk involved in launching an ICO.

To launch an ICO, do the following:

- Research ICOs and the regulations guiding this type of funding in your country

- Decide on what type of token you want to launch and how it will fit into your product or service

- Put together a team of skilled people and advisors

- Create a project roadmap, whitepaper, and website

- Engage with the crypto community

- Market your ICO

- List your token on exchanges

Security Token Offering (STO)

The final funding option on our list is the security token offering (STO). An STO refers to the process of offering tokenised securities for sale, i.e. tokens that are representations of securities such as bonds and stocks.

In an STO, the value of the security tokens is dependent on the value of the company or the underlying asset. In addition, there is more regulation in an STO than in an ICO since securities are regulated.

However, the STO market is still young and has not been tested in the long-term. This means that there is a risk for both startups and investors. Furthermore, STOs require a startup to create its own tokens and a platform to manage them which is costly.

What to do before launching an STO:

- Understand the compliance regulations in your country

- Create an STO business plan

- Seek the consultancy services of an STO development company to create and manage your security tokens

- Market your STO to reach as many investors as possible

With these ten funding options to choose from, you could be on the path to ensuring that your startup will turn into a success story.

Features3 years ago

Features3 years ago

Bitcoin2 years ago

Bitcoin2 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features8 months ago

Features8 months ago

Bitcoin10 months ago

Bitcoin10 months ago

Once you have successfully grown your startup through bootstrapping, then you can move to the second funding option which is applying for a small business loan to expand your business.

Once you have successfully grown your startup through bootstrapping, then you can move to the second funding option which is applying for a small business loan to expand your business. Venture capital firms invest in businesses that have a high potential for growth. VC generate a return on their investments when the company they invested in gets bought up, goes public or they can sell their stake to another investment firm.

Venture capital firms invest in businesses that have a high potential for growth. VC generate a return on their investments when the company they invested in gets bought up, goes public or they can sell their stake to another investment firm. Business grants are non-repayable funds that come with attached conditions. As long as you fulfill these conditions, then you will not have to repay the money.

Business grants are non-repayable funds that come with attached conditions. As long as you fulfill these conditions, then you will not have to repay the money. Raising money through an

Raising money through an