Features

Is KeniCoin Kenya’s First Homegrown Cryptocurrency Scam?

Published

5 years agoon

KeniCoin is a Kenyan cryptocurrency that has been in the spotlight recently over allegations of potentially being a scam. BitcoinAfrica.io investigated KeniCoin to determine whether it is a legitimate cryptocurrency or a fraudulent operation. In this article, you will discover our findings.

What is KeniCoin?

KeniCoin claims to be a multi-utility cryptocurrency platform that is fueled by KeniCoin (KNC) tokens. According to the KeniCoin website, the cryptocurrency is backed by real businesses, which is supposed to make it a reliable and predictable payment option for vendors.

The platform claims to offer free and fast peer-to-peer online transactions. Moreover, KeniCoin investors will allegedly receive a high return on investment (ROI) on KNC tokens due to their limited supply and presence of a strong merchant network. Consumers, on the other hand, will be able to enjoy a 40 percent discount whenever they transact using KeniCoin.

Furthermore, KeniCoin claims to provide an alternative saving option to banks, which allows for micro-savings and provides interest. The website describes KeniCoin as the “Next Generation Banking Platform for the people in Kenya and Africa.”

How Does KeniCoin Work?

KeniCoin is marketed as an ERC-20 token based on the Ethereum blockchain. To purchase the cryptocurrency you have to register on the KeniCoin site and provide your name, a username, email address, and password. Once your account has been verified you can proceed to log in.

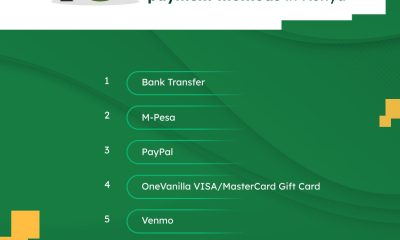

To get started, you have to fund your account using bitcoin (BTC) or fiat currency via mobile money.

Once you deposit money in your KeniCoin account, you will receive the equivalent amount of KNC in your in-platform wallet. However, during our analysis, we noticed the BTC wallet option appeared to be no longer working. It is unclear whether this is a technical problem or a shift to a fiat-only operation.

If you are looking to convert your KeniCoins to another cryptoasset, there are instructions on the site directing you to the KeniCoin Exchange. Information on the platform states users can trade KeniCoins (KNC) for bitcoin (BTC) or ether (ETH).

The exchange asserts that you can trade your KNC for fiat and withdraw your earnings via a direct bank transfer. Moreover, should you decide to lock away 50 or more KeniCoins in the platform, you are entitled to ten percent interest every month.

The KeniCoin ICO

KeniCoin launched an ICO in July 2018. The token sale was marketed aggressively on local radio and through KeniCoin agents. According to the site, ten million KNC tokens were provided for the ICO and retailed at KES 100 (worth around $1.00).

The site alleges $250,000 was raised from the token sale with 500,000 tokens being sold. Moreover, according to the KeniCoin whitepaper, the newly issued tokens will gain in value. Specifically, the company stated in the whitepaper:

“We are very sure that, within the first 12 month after ICO, the value of KeniCoin will have increased at least 30 folds, which is around 3000%.”

The project road map outlines that 20 percent of the funds raised will go to the founders with the bulk of the remainder being used to develop various platforms accepting KNC payments. The KeniCoin tokens were to be traded on the KeniCoin Exchange, which was launched soon thereafter.

Regulator Warns Against KeniCoin

In January 2019, the Capital Markets Authority (CMA), Kenya’s market regulator issued a press release warning the public against participating in the KeniCoin token sale or trading KNC. The CMA CEO, Paul Muthaura stated,

“It is important for the general public to note that the nature and features of the Capital Raising and Coins Trading promoted by Wiseman Talent Ventures is taking the form of Regulated activities which have not yet been approved by the Authority.”

[ALERT] CAUTIONARY STATEMENT ON INITIAL COIN OFFERING AND COIN TRADING #trading #ico #cryptocurrency #cryptoexchange #blockchain #capitalmarkets pic.twitter.com/DCPeChHl1J

— Capital Markets Authority Kenya (@CMAKenya) January 3, 2019

The regulator expressed its concerns about KeniCoin promising investors a ten percent monthly return on their initial investment on KNC tokens. In addition, the CMA pointed out that KeniCoin was being marketed as rising exponentially in value since its ICO which posed “substantive information asymmetry, liquidity and fraud risks.”

“The Authority is currently investigating the operations of Wiseman Talent Ventures. We have noted discrepancies in the information provided on the firm’s website www.kenicoin.com and the information given to the Authority during interviews of Wiseman Talent Ventures leadership in relation to the total number of Kenicoin sold and the total funds raised,” Muthaura added.

Obscure Founders

Our efforts to establish the team behind KeniCoin also proved unsuccessful. According to the KeniCoin whitepaper, the founder of the cryptocurrency is Haron Muthomi Kiriba who is sometimes referred to as Haron Wiseman. We did a little digging to find out more about Wiseman.

Our efforts to establish the team behind KeniCoin also proved unsuccessful. According to the KeniCoin whitepaper, the founder of the cryptocurrency is Haron Muthomi Kiriba who is sometimes referred to as Haron Wiseman. We did a little digging to find out more about Wiseman.

What we managed to uncover was a Twitter account under the name Haron Wiseman, which described him as a transformational speaker and founder of Wiseman Talent Ventures. Wiseman Talent Ventures is mentioned in the CMA cautionary statement as the company behind KeniCoin. An online search for Wiseman Talent Ventures was only able to produce an office address.

Also, Haron Kiriba’s Twitter account appears to have been inactive for a while. His LinkedIn profile portrays him as the CEO of a property company. Nothing we uncovered pointed to any prior involvement in the cryptocurrency space or any other venture for that matter.

The KeniCoin whitepaper states that the cryptocurrency is supposedly developed by a number of international blockchain and AI experts. However, their names are not mentioned and their identities – if they ever actually existed – remain unknown which is standard practice in fraudulent cryptocurrency-based ventures.

Providing little to no public information about the company’s ownership structure does not help the company in its attempts to be perceived as a legitimate venture.

More Red Flags

A critical examination of the information provided on the KeniCoin site and whitepaper reveals a number of inconsistencies and falsehoods. For instance, the KeniCoin whitepaper claims the project is backed by a number of companies yet we can only prove one, Wiseman Talent Ventures, and even its existence is in doubt.

Also, the amount of funds raised during the concluded KeniCoin ICO seems unclear. The site claims $250,000 worth of KNC tokens were sold during its token sale. However, when it comes to distribution of ICO funds, the amount displayed is $5.3 million.

In addition, the company claims KNC is the first local digital currency to be released in the market with a network of up to 10,000 merchants. This is an outright falsehood with research failing to turn up a single business associated with KeniCoin. You will notice most of the statements concerning stability and increasing value of KNC tokens, are tied to the assurance of many businesses in the ecosystem.

Perhaps, the obvious flaw with KNC is the de facto promise of returns for early adopters. The whitepaper states KNC holders can expect the value of the token to increase by 3,000 percent in twelve months after the ICO. At the time of writing this article, the price of KeniCoin published on the company’s website was $3.45.

Currently, there is an update on KeniCoin Exchange teasing users about the launch of a new utility, that will result in the price of KNC rising to Ksh. 10,000 (worth around $100). Strangely, KeniCoin appears immune to market volatility and according to numbers presented on the platform, has so far managed to retain an upward trajectory.

Yet, this does not resonate with what we know of the crypto markets which are highly volatile. In fact, since early 2018, the value of most digital currencies have slumped as the markets have been experiencing a “crypto winter.”

It stands to reason any investment exhibiting a continued uptrend in price over a long period could indicate price manipulation or fraud.

A summary of KeniCoin’s potential red flags include:

- The mystery surrounding the persona of Haron Wiseman, the alleged founder of KeniCoin

- The company gives no insight into the ownership structure

- The alleged rise in KeniCoin price without any real use case outside of trading

- Lack of a merchant network driving adoption as is claimed in the whitepaper

- A claim of profits for investors, which no real investment can ever guarantee

- The Kenyan Capital Markets Authority has issued a warning against KeniCoin

- Very little technical details on how the cryptocurrency actually works

- KeniCoin can only be bought and sold on the company’s own exchange

Unavailability for Comment

BitcoinAfrica.io tried to contact KeniCoin to hear the company views on the issues raised by the Kenyan financial regulator. However, this proved difficult as our attempts to engage the KeniCoin team proved unsuccessful.

Initially, we tried to contact them using the phone numbers provided on its website. We managed to get through but were twice rebuffed with the response being “ongoing consultations with management.” At the time of writing this article, no feedback has been forthcoming from KeniCoin.

Interestingly, the KeniCoin staff member who we were able to reach on the phone expressed distrust for news agencies saying, “you social media guys are tarnishing our name.” The company does not seem to want to talk to the media.

BitcoinAfrica.io also attempted to reach out to the Nairobi-based company via social media but our attempts to get in contact with the company over Twitter, LinkedIn and Email were futile. The company’s email address does not work and the company’s Twitter account has been suspended.

BitcoinAfrica.io also attempted to reach out to the Nairobi-based company via social media but our attempts to get in contact with the company over Twitter, LinkedIn and Email were futile. The company’s email address does not work and the company’s Twitter account has been suspended.

Kenyan Crypto Twitter Responds to KeniCoin

Leading figures of the Kenyan cryptocurrency community responded on social media to KeniCoin advertisement on Kameme FM.

Micheal Kimani, Chairman of the Kenya Blockchain Association, tweeted:.

There is this KeniCoin marketed on Kameme fm as the next big thing, started at 50 now they are telling listeners it has gained up to 2k

this is a scam @kamemefm

Your management should take a second look

— Kioneki (@pesa_africa) December 30, 2018

Ken Kimathi, Kenya’s Remitano representative, also shared his opinion about the alleged digital currency scam. He tweeted:

There is a coin being advertised in Kameme Fm called KeniCoin. Let the people its a scam and people should be aware. The coin has no fundamentals and Utility @RobertAlai @pesa_africa @kenyanwalstreet

— AfricanWhale (@ken_Qimathi) December 30, 2018

And they were not the only Kenyans to voice their concerns on social media. An ample amount of Twitter users highlighted the project’s unrealistic earnings potential, which makes the company look like a fraudulent operation.

Why is Kenicoin being allowed to do such massive marketing?? Unless I missed something on their whitepaper this is a massive scam. Goodness. Who will be our brother's keeper?

— Gakinya MD (@drgakinya) December 19, 2018

That Kenicoin on @kameme101 is a ponzi/pyramid scheme,lol ati what is "mining". Cyptocurrency is not about buying ,you are giving the owner actual money while he promises some profits in unknown future…

— kim (@kajonee) November 29, 2018

Any gullible person who falls for that con gospel from Kenicoin is setting up themselves for endless rounds of shafting with no lube.

— Nelson Kimaiga (@Nelsonkimaiga) December 5, 2018

Is KeniCoin a Scam?

While there may be people who believe that KeniCoin is a real investment opportunity, it would be hard to ignore the evidence that suggests the opposite.

While there may be people who believe that KeniCoin is a real investment opportunity, it would be hard to ignore the evidence that suggests the opposite.

KeniCoin has several of the same characteristics as crypto scams that have previously penetrated the African market.

KeniCoin may not be different from a typical MLM operation used by pyramid schemes like OneCoin and MMM, which succeeded in defrauding hundreds of thousands of Africans.

Conversely, one may argue that KeniCoin closely resembles a pump and dump scheme where the owners are making money by pumping up the value of KNC and then selling it for a profit on the open market. Once they have made enough profits, they exit, and users are left holding worthless coins.

Moreover, since price discovery for KNC tokens only occurs on the company’s own platform, it is impossible to say how much one KeniCoin is really worth.

Given that KeniCoin makes claims such as: “KeniCoin platform allows you to grow your wealth up to x12 every year,” it is difficult to see how this could possibly be a legitimate cryptocurrency investment.

Conclusion

Investors are always advised to conduct thorough research, consult experts, and use common sense before investing in any digital asset venture.

“Investments” like KeniCoin provide a good example of the type of cryptocurrency investment “opportunity” to avoid. While no one can claim that KeniCoin is a scam until it has been declared a fraudulent operation by a court of law, the mountain of evidence against the company would suggest that it probably is.

You may like

-

Introducing Noones – Africa’s P2P Super App

-

Weekly Roundup: Kenyan Senate in Discussion with CBK to Legalise Bitcoin & More

-

Weekly Roundup: Morocco’s Central Bank Announces Completion of Draft Cryptocurrency Regulatory Framework & More

-

Weekly Roundup: South African Crypto Exchange VALR Launches in Zambia & More

-

Weekly Roundup: Kenya’s Capital Markets Bill 2022 Seeks to Tax Crypto Transactions & More

-

Weekly Roundup: First Cohort of African Women Graduate from Binance Blockchain Bootcamp & More

Features

Why Crypto’s Leading the Way in Africa’s Evolving Finance Landscape

Published

1 year agoon

July 24, 2023

Cryptocurrency adoption is on the rise throughout Africa. According to Chainalysis, the African crypto market is one of the fastest growing in the world, with an estimated $20 billion worth of transactions taking place per month. Meanwhile Kenya, Nigeria and South Africa are positioned in bitcoin.com top 10 global countries by Cryptocurrency Adoption.

In this article, we’ll take a closer look at the appeal of decentralised currencies in Africa and discuss how they’re leading the way in the continent’s ever-evolving finance landscape.

The Global Crypto Era

For several years now, cryptocurrencies and blockchain technology have been having a transformative effect on various industries and markets across the globe. From the disruption of the gaming industry via the emergence of play-to-earn gaming and online casino with crypto deposit platforms to smart contracts that are being used everywhere, from healthcare to real estate, the impact is evident.

With the rise of the DeFi and GameFi sectors, it’s clear that the global crypto era is now in full swing, and it’s an industry that’s gaining noticeable traction across Africa. Approximately 1.2 million Africans now actively trade cryptocurrencies, with Kenya, Nigeria and South Africa leading the way. Decentralised crypto trading platforms like Paxful and LocalBitcoins bypass financial institutions and present new opportunities for residents to buy and sell crypto tokens.

In terms of which crypto tokens are leading the way in Africa, Bitcoin (BTC) holds the position of the most dominant digital currency, with a substantial user base and trading volume. BTC is accepted and used for various purposes, including remittances and as a store of value.

Altcoins, too, are becoming more widespread in the continent, particularly Ether (ETH) and Binance Coin (BNB). Ethereum’s smart contract capabilities have fuelled its growth in the region, providing a solution to developers for building DApps (decentralised applications) that address Africa-specific challenges.

Additionally, several homegrown cryptocurrencies have emerged in recent years that are tailored to the local needs of the region. The Akoin token (AKN), for example, was founded by musical artist and humanitarian Akon as a means of powering a digital financial ecosystem in those regions with limited access to traditional banking services.

The Appeal of Cryptocurrencies

Cryptocurrencies offer several unique advantages, which, coupled with the economic stagnation still present in the continent, makes them particularly appealing to Africans.

One of the key drivers behind the burgeoning popularity of crypto in Africa is the lack of access to traditional financial services that many Africans still face. Many residents stay either unbanked or underbanked, excluding them from taking part in the global economy.

Decentralised currencies are gaining increased acceptance among the financially marginalised, particularly the low-income population, who have often been excluded from the banking system or had to face disproportionally high transaction costs. By their very nature, cryptocurrencies remove the need for traditional intermediaries, instead offering a borderless alternative that enables individuals to send and receive secure financial transactions instantly.

Currencies in countries such as Kenya and Nigeria have been damaged by decades of inflation, contributing to a surge in both economic and political instability. Cryptos hold the power to remedy financial exclusion and present an alternative to weak domestic currencies.

Unlike the more established traditional banking options in Africa, decentralised finance enables anyone with an internet connection and compatible device — smartphones included — to engage in a variety of financial transactions, from sending remittances to making investments. Crypto investing allows Africans to purchase and hold assets that will not be impacted by financial turbulence, such as rapid depreciation and ever-increasing inflation.

As mentioned above, cryptocurrencies are typically cheaper, easier to use and faster than conventional methods. The blockchain technology that eases peer-to-peer (P2P) transactions exists outside established fiat currency institutions, supplying a far more accessible and user-friendly solution.

Traditional remittance services are often slow, expensive and largely inaccessible to a significant portion of the African population. Digital currencies allow for frictionless cross-border transactions, meaning that individuals can send and receive money globally in a matter of minutes. Not only does this benefit individual consumers, but it also empowers African businesses and entrepreneurs, easing economic growth in the process.

A Lasting Impact

Given that Africa’s crypto ecosystem is still in an evolutionary stage, the popularity of decentralised currencies and blockchain applications will vary between countries and regions. Regulatory environments, infrastructure development and specific social-economic conditions can all influence the popularity and success of a crypto project. However, there’s no denying that the emergence of this industry has sparked a wave of innovation throughout many African countries.

Several blockchain-based startups have found innovative ways to leverage the potential of the technology to address the most prevalent socio-economic challenges. BitPesa is transforming the cross-border payments sector, while other startups have used blockchain tech to make supply chain management more transparent and even improve voting processes. By leapfrogging traditional infrastructures, decentralised currencies and technologies are proving to be the key to sustainable, long-term economic growth in Africa.

Cryptocurrencies have disrupted traditional financial systems in recent years, and Bitcoin profiled itself as the most famous crypto. It has already found its way to e-commerce and investment, but this crypto is also present in the world of online gaming. In this article, we will explore the growing influence of Bitcoin in the online gaming world.

Bitcoin and Online Casinos

Thanks to Bitcoin’s integration into online casinos, players and operators now have a vast range of possibilities. With the use of Bitcoin, online casinos create another level of advantage over traditional payment options. Most of all, if you perform transactions in Bitcoin, they will be quicker and more efficient.

You can deposit or withdraw the funds within seconds without the need for complex verification processes or intermediaries. This makes the gaming experience smoother and more seamless for any player. Additionally, Bitcoin offers a higher level of privacy and security. We have already experienced how much financial and personal information traditional payment methods require.

Nevertheless, unlike them, Bitcoin transactions are pseudonymous, which means they provide players with greater anonymity. This privacy feature particularly appeals to those who value their online security and wish to enjoy online gaming without revealing their identities. Integrating Bitcoin into online casinos has also resulted in innovative bonus structures and rewards.

Some Bitcoin casinos offer exclusive promotions and bonuses for players who use Bitcoin as their preferred payment method. The best Bitcoin casinos in the Philippines are safe to deposit at, according to this guide, and you can choose the one that appeals to you the most. That’s why more and more players turn to Bitcoin as their payment method, fostering its further adoption in the gaming industry.

Since Bitcoin is decentralized, transactions bypass the regular censorship and control that we can see involved with traditional payment methods. Thanks to this, players from regions with strict gambling regulations can participate in online gaming with fewer restrictions. Bitcoin-powered online casinos do not impose geographical limitations, opening their services to players worldwide.

Bitcoin and Esports Betting

Beyond online casinos, Bitcoin has made significant breakthroughs in esports betting. We could witness a skyrocketing rise of esports in recent years, which resulted in millions of enthusiasts and viewers worldwide. Thanks to Bitcoin’s integration into esports, players have a wider range of options to engage with their favorite games and gamers.

Esports, or competitive video gaming, has witnessed a meteoric rise in popularity, attracting millions of viewers and enthusiasts worldwide. Bitcoin’s integration into esports betting platforms has revolutionized how fans engage with their favorite games and players.

Bitcoin’s advantages, such as fast and secure transactions, align perfectly with the dynamic nature of esports betting. Users can easily deposit and withdraw funds, allowing for quick reactions to changing odds or game outcomes. Bitcoin’s decentralized nature also ensures that bettors from any location can participate, overcoming the obstacles of regional restrictions and currency exchange complications.

Moreover, Bitcoin’s integration into esports betting platforms has provided players with increased transparency and fairness. The technology behind Bitcoin, blockchain, allows for unalterable and auditable records of transactions, ensuring that betting outcomes are tamper-proof.

This transparency has fostered greater trust among players, operators, and regulators, further fueling the growth of Bitcoin-powered esports betting.

Bitcoin and In-Game Purchases

As the gaming industry evolves, it has also opened innovative ways for gamers to enhance their gaming experience. With the involvement of Bitcoin, players can use it for in-game purchases. Nowadays, many popular online games support cryptocurrencies for item purchases, upgrades, or other enhancements.

Since crypto transactions are more seamless, Bitcoin has become a better alternative compared to traditional in-game payment methods. Game developers have also benefited from introducing Bitcoin as a payment option. Now they can offer a more convenient way of purchasing in-game items, transaction fees are lower, and processing times have become faster.

Moreover, you, as a player, don’t need to disclose any sensitive information anymore. That way, Bitcoin usage in gaming reduces the risk of potential data breaches. The adoption of Bitcoin in in-game purchases has also opened up new possibilities for cross-platform transactions.

As Bitcoin operates globally, players can easily trade or transfer in-game assets across different games or platforms, fostering a vibrant secondary market for virtual goods. This flexibility enhances player engagement and allows for a more interconnected gaming experience.

The integration of Bitcoin into in-game purchases has also paved the way for blockchain-based gaming ecosystems. Some game developers have embraced blockchain technology to create decentralized gaming platforms where players truly own their in-game assets through blockchain-based tokens. This ownership empowers players and introduces concepts of shortage and value to virtual items.

Benefits of Using Bitcoin in Online Gaming

Players can enjoy multiple benefits from using Bitcoin in online gaming. The most obvious one is that traditional payment methods cannot match the level of Bitcoin’s security and anonymity. Due to cryptos’ decentralized nature, you don’t need to disclose your sensitive data. If you want to get started in the gaming world easily and quickly, there’s no more attractive option than Bitcoin.

Transactions are completed within seconds, and they are cheaper in terms of fees compared to other popular methods. Since Bitcoin has become more popular in the online gaming industry, gaming platforms recognized its benefits.

Therefore, they introduced it as a payment method, and nowadays, the world’s most popular online gaming platforms accept Bitcoin, including Steam, Xbox Live, and PlayStation Network.

Security Considerations When Using Bitcoin in Gaming

While Bitcoin offers many benefits for online gaming, such as fast and secure transactions, there are also some security considerations to keep in mind. Performing online financial transactions always brings a high risk of potential hacking and theft of Bitcoin wallets. That’s why you should use a secure and reputable digital wallet and keep your private keys safe and inaccessible to unauthorized persons.

Also, online gaming platforms that you use should have strong security features established to keep your financial and personal information away from the eyes of unauthorized third parties.

Conclusion

Bitcoin’s rise in online gaming has brought many benefits for all entities in this growing industry. From online casinos to esports betting and in-game purchases, Bitcoin’s unique characteristics have reshaped the gaming landscape, offering increased speed, privacy, security, and global accessibility. It shouldn’t take too long before cryptocurrencies gain mainstream acceptance since they are continuously evolving.

That’s why we believe the Bitcoin integration in the online gaming industry will continue. Ultimately, it should unlock new ways of innovation and interaction for gaming fans worldwide, leading to limitless possibilities for the future of online gaming.

Features

Unlock the Thrills of NHL Crypto Betting and Live Streaming

Published

1 year agoon

July 15, 2023

Are you a passionate NHL fan who craves excitement both on and off the ice? Look no further! NHL Crypto Betting and Live Streaming bring a revolutionary experience to your fingertips. Witness the fusion of cutting-edge technology, crypto-powered wagers, and seamless live streaming that will take your NHL engagement to new heights.

In this comprehensive guide, we delve into the world of NHL Crypto Betting, explore the latest trends in NHL betting, and uncover the exhilaration of live streaming. Brace yourself for an unparalleled journey that combines heart-pounding action, lucrative opportunities, and the thrill of cheering for your favorite teams in real-time.

The Evolution of NHL Crypto Betting

With the rise of blockchain technology, NHL Crypto Betting has emerged as a game-changer in the sports betting landscape. Powered by cryptocurrencies such as Bitcoin, Ethereum, and others, NHL Crypto Betting offers a secure, transparent, and decentralized platform for enthusiasts to engage with their favorite teams.

By leveraging blockchain’s immutability and smart contract capabilities, NHL Crypto Betting ensures fair and tamper-proof transactions, providing users with a sense of trust and integrity.

Moreover, NHL Crypto Betting introduces a new dimension to the traditional sports betting experience. Cryptocurrencies enable users to make instant deposits and withdrawals, eliminating the hassles associated with fiat currencies. This streamlined process enhances convenience and accessibility for bettors, empowering them to place wagers quickly and effortlessly.

Unleashing the Power of NHL Trends Betting

Keeping up with NHL trends is essential for successful betting. NHL Trends Betting allows users to analyze historical data, team performance, player statistics, and other crucial factors to make informed betting decisions. By identifying patterns, tendencies, and emerging trends, bettors can gain a competitive edge and increase their chances of winning.

Whether you’re an experienced bettor or new to the world of NHL betting, understanding and leveraging NHL trends is paramount. Stay ahead of the game by monitoring team form, home and away records, head-to-head matchups, injury reports, and other key indicators. NHL trends betting offers a strategic approach to maximize your chances of success and unlock profitable opportunities.

Immersive Live Streaming: Amplifying the NHL Experience

Live streaming has transformed the way sports fans engage with their favorite leagues, and the NHL is no exception. Experience the thrill of NHL games in real-time, no matter where you are, with seamless live streaming. Witness jaw-dropping goals, clutch saves, and heart-stopping moments as they happen, all from the comfort of your own device.

Thanks to advancements in technology, NHL live streaming offers impeccable video quality, multi-camera angles, and expert commentary, providing an immersive viewing experience.

Whether you’re a die-hard fan or a casual observer, live streaming brings you closer to the action, making you a part of every exhilarating moment. Cheer for your team, revel in the intensity, and celebrate their victories as if you were right there in the arena.

Maximizing User Engagement: The NHL Crypto Betting and Live Streaming Advantage

Combining NHL Crypto Betting and Live Streaming amplifies user engagement to unprecedented levels. When you become a part of this dynamic ecosystem, you open doors to exhilarating possibilities. Here’s how NHL Crypto Betting and Live Streaming enhance your overall experience:

- Real-Time Betting: Engage in fast-paced, live betting opportunities that align with the pulse of the game. React to game-changing moments and adapt your strategy instantly to seize the best odds and maximize your winnings.

- Community Interaction: Connect with fellow NHL enthusiasts, discuss predictions, and share your excitement within the vibrant community. Joining forces with like-minded individuals adds another layer of enjoyment to your NHL journey.

- Rewards and Bonuses: Benefit from exclusive rewards, loyalty programs, and enticing bonuses offered by NHL Crypto Betting platforms. From sign-up bonuses to seasonal promotions, these incentives boost your bankroll and heighten the thrill of your NHL experience.

- Accessible Anywhere, Anytime: Never miss a moment of NHL action, whether you’re at home, on the go, or traveling. NHL Crypto Betting and Live Streaming platforms are designed to cater to your mobile lifestyle, ensuring you’re always connected to the games you love.

Ignite Your NHL Experience with Crypto Betting and Live Streaming

As an NHL fan, you deserve an extraordinary experience that transcends the boundaries of traditional engagement. NHL Crypto Betting and Live Streaming offer a gateway to a realm where exhilaration knows no bounds.

Dive into the electrifying world of NHL Crypto Betting, stay ahead of the game with NHL trends betting, and immerse yourself in the adrenaline of seamless live streaming. The perfect fusion of technology, sports, and entertainment awaits you. Join now and ignite your NHL experience like never before!

Introducing Noones – Africa’s P2P Super App

Why Crypto’s Leading the Way in Africa’s Evolving Finance Landscape

The Rise of Bitcoin in the Online Gaming World

Unlock the Thrills of NHL Crypto Betting and Live Streaming

Understanding the Impact of Cryptocurrency Volatility on NBA Betting Markets

The Future of Crypto College Football Betting: Trends and Predictions

How Mobile Apps are Changing Sports Betting

Weekly Roundup: Africa’s Cassava Network Partners with UniPass to Expand Crypto Adoption in Africa & More

Weekly Roundup: Kenyan Senate in Discussion with CBK to Legalise Bitcoin & More

Weekly Roundup: South Africa Introduces New Cryptocurrency Standards to Advertising Code & More

Popular Posts

-

News1 year ago

News1 year agoWeekly Roundup: Kenyan Senate in Discussion with CBK to Legalise Bitcoin & More

-

News2 years ago

News2 years agoWeekly Roundup: South African Crypto Exchange VALR Launches in Zambia & More

-

News3 years ago

News3 years agoWeekly Roundup: Binance Becomes Official Sponsor of AFCON 2021 & More

-

News2 years ago

News2 years agoAmber Group’s April Corporate News Recap 2022

-

News2 years ago

News2 years agoWeekly Roundup: Congo-based Web3 Startup Jambo Raises $7.5 Million in Seed Funding & More

-

Sponsored Posts3 years ago

Sponsored Posts3 years agoBlockchain Technology: The Driver for Social Change

-

News2 years ago

News2 years agoWeekly Roundup: Kenya Capital Markets Authority Set to Pay More Attention to Cryptoassets

-

News2 years ago

News2 years agoWeekly Roundup: Kenya, Zimbabwe & Zambia Are All Exploring CBDCs