There is no doubt that bitcoin, and cryptocurrency as a whole, can have a huge impact on the world economy. Also, Africa could benefit from it more than any other region.

Jack Dorsey, CEO of Twitter and Square, recognised this fact and recently claimed that Africa will define the future of bitcoin. He might be right as Africa is predicted to have some of the most populous metropolises by 2100 and the banking situation here is abysmal.

As it stands, bitcoin literally has the power to boost the economy of the entire continent of Africa. The question is whether it will happen as regulation by local authorities plays a key part in the adoption of cryptocurrency.

Why Africa Is the Best Place for Bitcoin to Shine?

Jack Dorsey is a well-known advocate of Bitcoin, which means he understands its potential better than most. And he is right to note that Africa is an exceptionally fertile ground for cryptocurrency. The entire continent is struggling because banking services are outright unavailable to many.

Remote is the best way to decide the vast majority of towns and other settlements in Africa. Many of them are days away from any urban areas, let alone places urbanised enough to actually have banks, Yet millions of people in these remote places rely on remittances from their migrant-worker relatives to survive. With a great number of these people being unbanked getting that money to them is a huge problem. A problem that literally costs lives.

Wherever banking is available, it still leaves a lot to be desired. Many governments in Africa are not trustworthy and hardly seem to work for the people’s best interests. As all banking services are regulated at the state level, people distrust them the same way they do the governments.

The fact that the number of banks is limited doesn’t help. With very little competition they set outrageous terms, especially for those poor families relying on remittances.

The situation is changing a little with the help of online money transfer companies. A transfer from UK to South Africa now costs a MINIMUM of 0.5% in fees. This is a great improvement, but it doesn’t change the fact that such transfers still cost 7% to 10% for the majority of Africa.

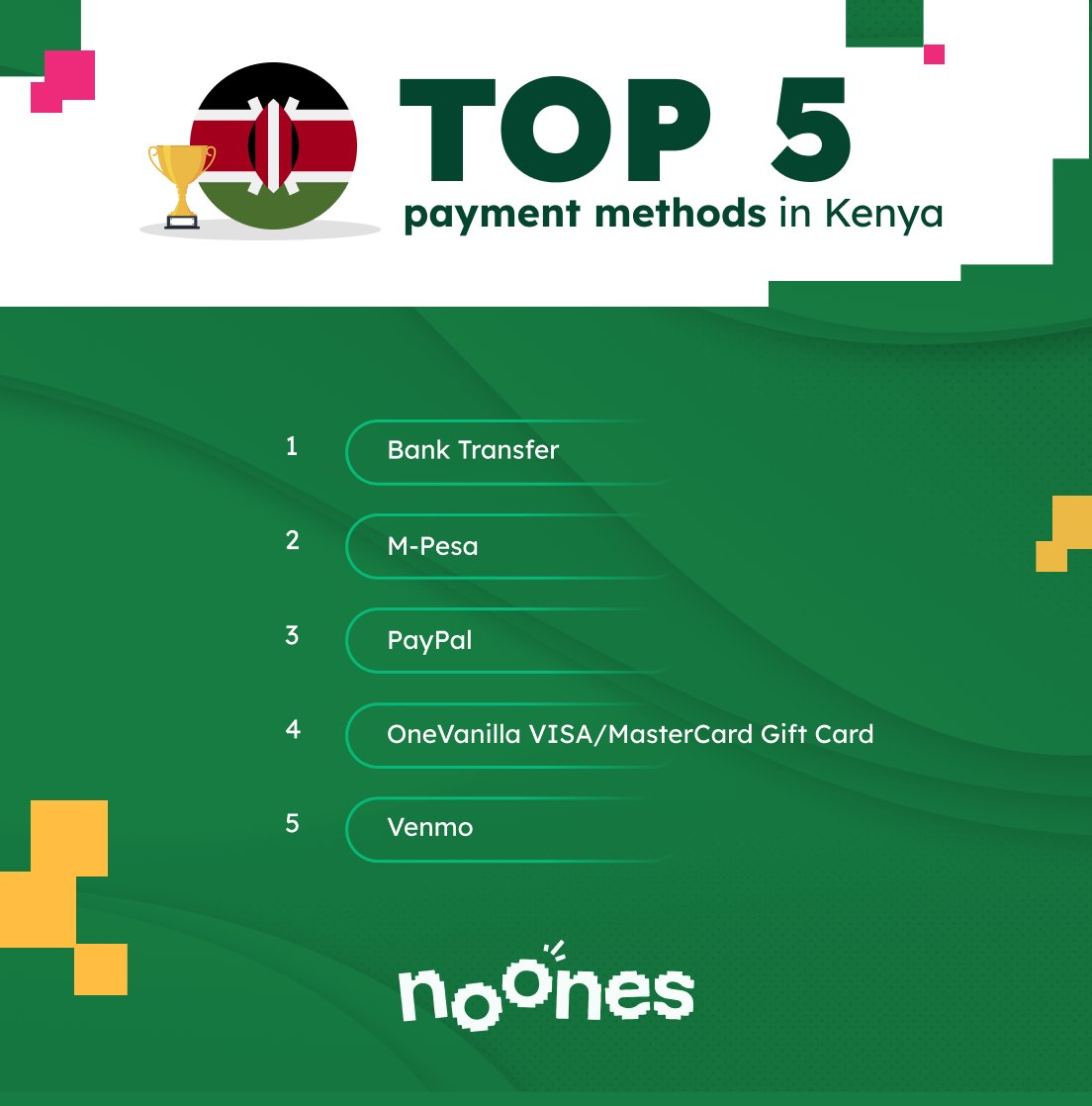

In such conditions, easy and virtually free bitcoin transfers can make a huge difference in the quality of life. And people need this kind of service desperately. Therefore, it’s no surprise that if bitcoin is allowed full freedom as an accepted universal currency, Africa will adopt it wholesale.

How is Bitcoin Doing in Africa Today?

For all its potential, bitcoin is not a big thing in Africa today. Admittedly, cryptocurrency as a whole is not yet a big enough power to be a major factor in the global economy. It has the potential but it has not yet been realised.

Bitcoin is legal in most African countries, but this hardly matters because this only means that it’s not illegal to buy and trade it. You cannot actually use this cryptocurrency to make any payments, like pay utilities or your grocery bill. The best you can hope for is to pay at some international online shopping platforms that accept bitcoin.

In the states where using bitcoin isn’t banned, the government’s stance on it is very similar. Local finance authorities are investigating the potential impact of cryptocurrency. However, no state as of yet has reached a point where it decided to actually give it a legitimate status. Therefore, cryptocurrencies remain largely unregulated.

Being unregulated is one of the main benefits of cryptocurrency in the eyes of users. It’s an even more attractive advantage for countries where the level of trust in the government isn’t high. In fact, in many developing countries with unstable political and economic environments, residents now see crypto as an effective hedge that can protect their assets in times of turmoil. But truly benefitting from crypto is still hard due to its lack of legal status as a recognised currency.

The Wealth Lost in African Remittances Every Year

To understand how much of a difference adopting bitcoin can make for Africa one should consider some simple numbers. According to the World Bank, global remittances have already exceeded $530 billion annually. And this number keeps growing fast. About $40 billion of that money is sent by immigrant workers to Africa, over half of that money coming to Nigeria, where remittances are one of the main contributors to the GDP.

However, Nigeria is among the parts of Africa where the banking situation isn’t good at all. Therefore, remittances here cost about 10% of the transaction amount. With the overall amount of transactions about $29 billion, nearly $3 billion is lost in fees. Those are $3 billion that could go to the families and be invested in the country’s economy.

To understand how much of a difference that amount would make for regular people you should remember that GDP per capita in Nigeria is a little over $2,000 a year. Compare this to the US, where GDP per capita is over $60,000. Every cent counts for the families of migrant workers, especially when you consider that the size of an average remittance is under $500.

Bitcoin in Africa: Hopes for the Future of the Big Continent

The situation with banking and remittances to Africa is rather grim. But it doesn’t have to be this way. Bitcoin offers an opportunity to change this. The question is whether local governments will accept this and take the risk of adopting a decentralised cryptocurrency. So far, there have been no official announcements from that direction.

If this does happen, the economy of the entire continent could receive a boost. And the best thing is that this would be an immediate boost because that money already belongs to Africa, it’s just lost on the way there.

Bitcoin will make a difference. Jack Dorsey is absolutely right about that. Should this change happen, the difference for bitcoin itself, and cryptocurrencies in general, will also be huge. Recognition in Africa could tip the rest of the world in favor of crypto.

Features3 years ago

Features3 years ago

Bitcoin2 years ago

Bitcoin2 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features3 years ago

Features8 months ago

Features8 months ago

Bitcoin10 months ago

Bitcoin10 months ago