Bitcoin

The State of Bitcoin Regulation in Africa

Published

7 years agoon

The legal status of bitcoin varies from one country to another and is mostly undefined or under review in most parts of the world. While some African central banks have explicitly banned or restricted its use, others have allowed it or have simply not issued any statement or regulations covering digital currencies.

In this guide, you will find a list of financial regulators in Africa that have made statements or issued regulations for the use of bitcoin and other decentralised cryptocurrencies within its borders.

Kenya

Kenyan Central Bank is not a Fan of Bitcoin

In 2015, the Central Bank of Kenya (CBK) issued a public notice warning against the use of bitcoin citing the lack of regulations to govern its use. The CBK proceeded to send out a circular to local banks instructing them not to provide services to bitcoin startups.

In 2015, the Central Bank of Kenya (CBK) issued a public notice warning against the use of bitcoin citing the lack of regulations to govern its use. The CBK proceeded to send out a circular to local banks instructing them not to provide services to bitcoin startups.

However, the CBK’s stance seemed to have little impact on Kenyans appetite for bitcoin with the country being ranked third in Africa when it came to trading volumes at local exchanges such as Localbitcoins. Also, things seem to be looking up with a number of public and private entities now experimenting with blockchain technology.

In addition, some financial regulators seem to differ with CBK’s stance, such as the country’s financial market regulator, the Capital Markets Authority (CMA). The CMA announced plans in April 2017 to organise forums for fintech and cryptocurrency players to discuss the state of regulations and challenges it poses to their activities. It is also worth noting the Kenyan government and World Bank announced their intention to partner in using blockchain technology to sell government bonds earlier this year.

South Africa

South African Reserve Bank is Open to Digital Currencies

The South African market regulator was the first to warn against the use of bitcoin in Africa saying it wasn’t a legal tender. The South African Reserve bank (SARB) argued in a December 2014 public notice that while cryptocurrencies and their underlying technologies had the potential to facilitate faster transactions, efficiency and reduce payment costs, they could also, “simultaneously provide a platform for, inter alia, money laundering and the financing of terrorism, and introduce a new set of risks to consumers as DCVCs (cryptocurrencies) are susceptible to misuse and at the very worst, have the ability to disrupt the financial system.”

The South African market regulator was the first to warn against the use of bitcoin in Africa saying it wasn’t a legal tender. The South African Reserve bank (SARB) argued in a December 2014 public notice that while cryptocurrencies and their underlying technologies had the potential to facilitate faster transactions, efficiency and reduce payment costs, they could also, “simultaneously provide a platform for, inter alia, money laundering and the financing of terrorism, and introduce a new set of risks to consumers as DCVCs (cryptocurrencies) are susceptible to misuse and at the very worst, have the ability to disrupt the financial system.”

Having said that, in August 2016, the SARB softened its stance on digital currencies with the Reserve Bank Governor, Lesetja Kganyago hinting the bank was open to cryptocurrencies. In July 2017, the SARB indicated plans to test regulations related to bitcoin and other digital currencies and selected Bankymoon, a blockchain solutions provider for its first sandbox trial run.

The Reserve Bank had already announced its intention to undertake its own research about blockchain technology’s feasibility in South Africa. However, according to an ITWeb report, the deputy governor of the SARB, Francis Groepe indicated at an August 2017 conference in Johannesburg,

“For the central bank to issue virtual currencies or cryptocurrencies in an open system will be too risky for us. This is something we really need to think about.”

Nigeria

The Central Bank of Nigeria is Open to Digital Currencies

The Central Bank of Nigeria (CBN) is notorious for currency controls and so it came as no surprise when it informed the public to be wary of speculating in bitcoin and other cryptocurrencies. The January 2017 directive caused uncertainty in the local bitcoin community, which is among the largest in Africa, with trading volumes on the P2P marketplace Localbitcoins showing an average of $3.2 million worth of trades being conducted every week.

The Central Bank of Nigeria (CBN) is notorious for currency controls and so it came as no surprise when it informed the public to be wary of speculating in bitcoin and other cryptocurrencies. The January 2017 directive caused uncertainty in the local bitcoin community, which is among the largest in Africa, with trading volumes on the P2P marketplace Localbitcoins showing an average of $3.2 million worth of trades being conducted every week.

Having said that, the CBN has shifted its position and is now researching blockchain technology and its possible applications in various industries. The regulator has also allocated personnel and resources to work on a whitepaper on digital currencies and its underlying technologies.

Many people in Nigeria view bitcoin as the alternative to hedge their wealth against currency losses, brought about by the constant depreciation of the local currency, the naira.

Speaking at a recent cryptocurrency conference in Lagos, CBN deputy director, Musa Jimoh said,

“[The CBN] cannot stop the tide of waves generated by the blockchain technology and its derivatives. Currently, we have taken measures to create four departments in the institution that are looking forward to harmonising the white paper on cryptocurrency.”

Uganda

The Bank of Uganda warns against Cryptocurrencies

The Bank of Uganda sent out a strong statement cautioning investors against MLM schemes such as OneCoin, which was promising people high returns if they invested in the scheme.

The Bank of Uganda sent out a strong statement cautioning investors against MLM schemes such as OneCoin, which was promising people high returns if they invested in the scheme.

The bank also warned against the use of digital currencies indicating there was lack of consumer protections or a regulatory framework to govern their use. As of the time of writing this article, the central bank’s position remains unchanged despite a growing bitcoin presence in the country.

Namibia

The Bank of Namibia bans Bitcoin for Commercial Purposes

In August 2015, the Central Bank of Namibia issued a statement saying that it did not support the use of digital currencies and users did so at their own risk. Similar to Kenya and other jurisdictions, the bank cited the lack of regulatory oversight as being its biggest concern with a promise to clarify its position in the future.

In August 2015, the Central Bank of Namibia issued a statement saying that it did not support the use of digital currencies and users did so at their own risk. Similar to Kenya and other jurisdictions, the bank cited the lack of regulatory oversight as being its biggest concern with a promise to clarify its position in the future.

In September 2017, the bank proceeded to officially ban the use of bitcoin or other cryptocurrencies in the country. The directive was contained in a nine-page position paper which cited risks such as money laundering, legal, credit and operational risks as threats to Namibian users. However, recognising the potential of blockchain technology and its possible application in various sectors, the Namibian Central bank acknowledged the need for further research stating, “the current position of the Bank may be amended and/or supplemented, should a need arise.”

Cameroon

Cameroon Still Undecided on Bitcoin

Presently, bitcoin traders and startups operating in Cameroon do not fall under regulatory oversight as the Central African Central Bank is yet to release specific guidance on the use of digital currencies. This means Cameroonians can purchase, hold or use bitcoin until specific guidance by the market regulator is issued.

Presently, bitcoin traders and startups operating in Cameroon do not fall under regulatory oversight as the Central African Central Bank is yet to release specific guidance on the use of digital currencies. This means Cameroonians can purchase, hold or use bitcoin until specific guidance by the market regulator is issued.

The government has previously tested a cryptocurrency called Trest in 2015, which shows the country could be open to cryptocurrency solutions given its largely underbanked population.

Egypt

The Central Bank of Egypt Rejects Bitcoin Use

Bitcoin and other cryptocurrencies are not officially recognised by the Egyptian Central Bank and trading them for fiat currencies is thus not authorised. In July 2017, the deputy governor of the Egyptian Central Bank, Mr Gamel Negm, responding to rumours that the bank was looking to officially adopt cryptocurrencies, insisted the bank only recognises official currencies and would not accept any digital currencies.

Bitcoin and other cryptocurrencies are not officially recognised by the Egyptian Central Bank and trading them for fiat currencies is thus not authorised. In July 2017, the deputy governor of the Egyptian Central Bank, Mr Gamel Negm, responding to rumours that the bank was looking to officially adopt cryptocurrencies, insisted the bank only recognises official currencies and would not accept any digital currencies.

Mauritius

State Bank of Mauritius is Receptive to Cryptocurrencies

The island nation is aiming to become a leading hub for blockchain companies and serve as a gateway to African and Asian markets. Setting up this ‘Silicon Corridor’, which will be known as the Ethereum Island, is a collaborative effort between local authorities and blockchain-based companies.

The island nation is aiming to become a leading hub for blockchain companies and serve as a gateway to African and Asian markets. Setting up this ‘Silicon Corridor’, which will be known as the Ethereum Island, is a collaborative effort between local authorities and blockchain-based companies.

Already, the country’s second-largest bank, State Bank of Mauritius (SBM) has partnered with Secured Automated Lending Technology (SALT) to allow its clients to use bitcoin or ether as a guarantee for loans. However, this was not always the case with recognition of cryptocurrencies in the country. Previously, in December 2013 the Bank of Mauritius warned the public about risks associated with the use of bitcoin. It appears the Bank reversed its position in light of the island nations ambitions to cement its position as a breeding ground for blockchain solutions.

Swaziland

Swaziland Central Bank is Studying Cryptocurrencies

Swaziland is among the few African countries that is actively researching cryptocurrencies and their potential applications. Swaziland Central Bank Governor, Majozi Sithole, disclosed the bank was looking at potential case studies, at the Swaziland Economic Conference (SEC 2017). Speaking to the Swazi Observer, the Chief Banker said,

Swaziland is among the few African countries that is actively researching cryptocurrencies and their potential applications. Swaziland Central Bank Governor, Majozi Sithole, disclosed the bank was looking at potential case studies, at the Swaziland Economic Conference (SEC 2017). Speaking to the Swazi Observer, the Chief Banker said,

“It may not be wise to dismiss virtual currencies, and as the CBS we are learning, and we want to accept and support innovation. If this is innovation, we do not want to stifle it. We want to learn more about it.”

Currently, cryptocurrencies like bitcoin remain unregulated in the country and Sithole cautioned traders on local exchanges to be careful as the Central Bank seeks opinions of experts on the issue.

Algeria

Algeria Plans to Ban Bitcoin and Other Cryptocurrencies

Bitcoin use, for the most part, has been undefined under the law in Algeria. However, a new 2018 Finance Bill being considered at the National’s People Congress (NPC) will make it unlawful to possess bitcoins or use it for transactions. The government aims to establish stricter control over cryptocurrencies, and its perceived dangers such as money laundering or tax evasion due to the pseudo-anonymity it guarantees its users.

Bitcoin use, for the most part, has been undefined under the law in Algeria. However, a new 2018 Finance Bill being considered at the National’s People Congress (NPC) will make it unlawful to possess bitcoins or use it for transactions. The government aims to establish stricter control over cryptocurrencies, and its perceived dangers such as money laundering or tax evasion due to the pseudo-anonymity it guarantees its users.

Article 113 of the Finance Bill states,

“The purchase, sale, use and holding of the so-called virtual currency is prohibited. The virtual currency is the one used by Internet users through the web. It is characterized by the absence of physical support such as coins, banknotes, payments by check or bank cards. […] Any violation of this provision is punished in accordance with the laws and regulations in force.”

The document also recognises that cryptocurrencies such as bitcoin have no central authority, and presently escape any regulations or control by the state. This means bitcoin users in Algeria can still go about their activities until tighter restrictions are put in place.

Zimbabwe

Reserve Bank of Zimbabwe Remains skeptical about Bitcoin

Bitcoin adoption in the Southern African country is among the highest in Africa buoyed by hyperinflation, weak local currency and limited access to financial services. This has resulted in Zimbabweans moving to local exchanges to trade for bitcoins, which are immune from inflation, and thus allow them to protect their savings.

Bitcoin adoption in the Southern African country is among the highest in Africa buoyed by hyperinflation, weak local currency and limited access to financial services. This has resulted in Zimbabweans moving to local exchanges to trade for bitcoins, which are immune from inflation, and thus allow them to protect their savings.

The Reserve Bank of Zimbabwe (RBZ) has not officially permitted the use of bitcoin. In July 2016, the RBZ’s Director of National Payments, Josephat Mutepfa, warned Zimbabweans about the risks associated with bitcoin while speaking at a conference. He asserted that while they were a number of bitcoin initiatives in the country offering specific services, the central bank was yet to devise regulations for use of cryptocurrencies.

Recently, Reserve Bank of Zimbabwe director and registrar of banking institutions, Norman Mataruka, stated that the use of bitcoin is illegal in Zimbabwe. However, no actual regulations have been issued by the RBZ and no laws have been passed covering digital currencies in Zimbabwe.

Morocco

Regulators in Morocco Declare Bitcoin to be Illegal

The central bank of Morocco, Bank Al-Maghrib and the country’s Foreign exchange office, issued a joint statement on November 20, 2017, informing the public that transacting in cryptocurrencies such as bitcoin is now considered illegal. According to the statement, transactions in digital currencies such as bitcoin, ether and others will constitute a violation of the country’s exchange regulations.

The central bank of Morocco, Bank Al-Maghrib and the country’s Foreign exchange office, issued a joint statement on November 20, 2017, informing the public that transacting in cryptocurrencies such as bitcoin is now considered illegal. According to the statement, transactions in digital currencies such as bitcoin, ether and others will constitute a violation of the country’s exchange regulations.

The two regulators point to the risks involved in using digital currencies for transactions as their reason for the directive. They further state,

“As a hidden payment system that is not backed by a financial institution, the use of virtual currencies entails significant risks for their users.”

This comes at a time when the demand for bitcoin in Morocco has been growing steadily for the past one and half years evident from trading volumes on the bitcoin exchange, Localbitcoins. But while the ban is a blow to bitcoin adoption in the country, it will be hard to control the cryptocurrency given its pseudo-anonymous and censorship-resistant nature.

Rest of Africa

Bitcoin regulation in the rest of Africa is essentially uncharted territory as regulators are still coming to terms with how best they can assimilate decentralised digital currencies into their economic structures without potentially destabilising their economies.

Ultimately, the challenge will be to come up with a regulatory framework that protects consumers against harmful activities and promotes cryptocurrency-based innovation. For now, bitcoin is largely unregulated and, therefore, de facto legal to use in the majority of African countries.

You may like

-

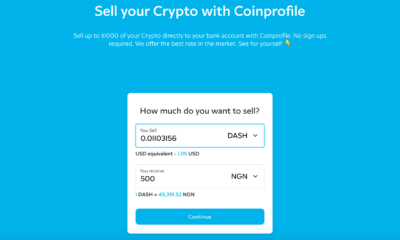

Coinprofile Listing Enhances Living on Dash in Nigeria

-

Chinese Blockchain Startup Conflux to Establish Base in Africa

-

10 Reasons Why Africa Will Set the Pace for Bitcoin Adoption

-

Africa Blockchain Alliance Announces Call for Applications for Second Cohort of Africa Blockchain Developer Program

-

How Blockchain Turns the Game in African Financial Life

-

3 Reasons Why Africa Is Set For A Cryptocurrency Explosion

True financial freedom can now be experienced in Africa thanks to the ability to offramp from fiat-based currencies such as the Kenya Shilling ($KES) to the Bitcoin standard courtesy of the Bitcoin super application, Noones.

As the name suggests, absolutely no one right now can manipulate, intimidate or steal Africans’ value and well as time when they choose to embrace this idea whose time has come by trading peer-to-peer on the Noones App.

The Noones application has a messenger, wallet, and marketplace all in one. These 3 features ensure that Africans can now trade Bitcoin peer to peer either on mobile, tablets, or computers 24/7.

NOONES CHAT

The capability to communicate in real-time is of vital importance when it comes to Bitcoin peer-to-peer trading. This is because the peer who is buying Bitcoin needs to communicate with the selected trader to make sure they are available to trade, the amount they need is available, verify the payment details, confirm they have sent funds and receipt of the Bitcoin.

Access to customer support is also crucial as money is emotive; thus, making the chat feature on the Noones application give users peace of mind that all their queries will be resolved in a timely manner. Their team lead Mr. Ibrahim on his visit to Kenya personally assured me that all customer care issues will be taken very seriously and addressed as soon as possible to ensure high customer satisfaction when anyone uses the Noones app.

PAYMENT METHODS

The peer-to-peer Bitcoin trading experience on Noones is very convenient due to the multiple payment methods in Kenya. Bank transfers, M-Pesa, PayPal, Visa, and Venmo are some of the most popular ways Kenyans prefer to utilize. Many more payment rails will be added to the platform to make sure convenience is what users experience as they trade.

STRATEGY

BITCOIN EDUCATION

The youth in Kenya make up the biggest demographic of the country’s population, and despite being educated, talented as well very driven, they suffer due to widespread unemployment. The Noones team is very passionate in regards to Bitcoin education to ensure that the youth learn, thus broadening their horizons to be in a position to earn through peer-to-peer Bitcoin trading furthermore, get jobs as per their competencies in Bitcoin companies and or get paid in Bitcoin e.g. for selling art.

As a full-time Bitcoin content creator and educator I love the approach by Noones to address real issues in Kenya by Bitcoin education and training sessions.

GROWTH

Existing peer-to-peer traders in Kenya and Africa have been plagued by stupidity in regards to platforms like Paxful not having their best interest at heart, thus locking accounts. However, Noones is the solution to this as the team is dedicated and on the ground.

EVERYONE EATS

A true champion for Africa as a Bitcoin ambassador building for Africa is a perfect description of Ray who is the C.E.O of Noones. His passion and on the ground experience give a lot of confidence to peer-to-peer traders that they are utilizing a platform that has their best interests at heart.

The Noones partnership program provides a viable and sustainable opportunity for African youth to make an honest living which the Kenyan government can not due to corruption and false promises. Earning via referrals and your own effort is a revolutionary process that takes working from home to a whole new level. Anyone can get started by using the link & referal code ‘MasterGuantai’.

HAPA NI KAZI TU

The Noones marketplace is the best, especially because of the verified peer-to-peer traders. This means you can trade with people who the Noones team has their KYC/AML (Know your customer, Anti-Money laundering) data, meaning they can not steal your funds.

We are always on the grind is the meaning of ‘Hapa Ni Kazi Tu’, which is my mantra. African youth are ready, willing and able to put in the proof of work to make sure they learn and earn in the Bitcoin space. The Noones application provides a perfect opportunity for this to ensure dignity as well as a viable opportunity to not only make ends meet but prosper.

CONCLUSION

The Noones platform provides the change that the youth and young adults want to see in Africa. Having a Bitcoin super application at everyone’s tips provides just that.

The corruption, indoctrination and manipulation of the fiat-based monetary system is evident in everyday life. The way forward is to explore new horizons by unlearning what we were taught to believe is the status quo which is hurting our lives. Fortune Favour a the bold and taking action is the only way forward as stagnation will ensure we are perpetual slaves to a system that is not in our best interest.

The Noones application provides all of as with the opportunity to chart a brighter way forward to preserve our dignity, time and value on the Bitcoin standard.

Statistics, examples, and ways to legally use cryptocurrency

October 1, 2013, was a turbulent day for San Francisco Public Library. A dozen FBI agents pretending to be usual visitors surrounded a man sitting at one of the tables, took his laptop and put a pair of handcuffs on his hands. That man was Ross Ulbricht, founder of Silk Road – the largest darknet marketplace for drug dealers, killers, and other criminals. The seizure of Ulbricht was supposed to tackle the illegal online trade, but, as the news site DeepDotWeb wrote, the bust was “the best advertising the darknet markets could have hoped for”. The reputation of cryptocurrency also suffers from associations with terrorists, who sometimes use it for their needs. How big is the real scale of the problem? And how many legal ways to use crypto exist? ChangeNOW has dived into the topic – and suggests you an overview of the current state of the problem.

Highlights:

- The drugs trade volume using cryptocurrency is relatively large

- Crypto was a significant reason why a part of drug sales migrated to the web, though stays yet not viable and anonymous enough for dealers (same as for terrorists)

- As efficient use of blockchain technology requires good infrastructure, crypto remains not suitable enough for many terrorist groups

- However, some terrorists are trying to adjust to anonymity threats and hold fundraising in crypto

- Legal ways to use cryptocurrency include dozens and vary from IT services to car rentals

Crypto & Drugs & Rock’n’Roll

The total volume of the online drug market using cryptocurrency is around $1 billion. It is located in the darknet, which provides an attractive, profitable, and mostly secure environment for drug dealers. Cryptocurrency, in turn, allows making payments that are hard to be tracked by authorities. This is how blockchain technology has helped to bring a big part of drug sales online from the streets. And it’s not only about drugs themselves – many legal opioid drugs are illegally sold here, too.

However, cryptocurrency is not always as secure and anonymous as it is thought to be. The information about any transaction ever made stays forever in the blockchain, which makes the system way more transparent than cash payments. This is a significant limitation for using crypto in illegal purposes.

According to the University of Technology Sydney, about 46% of criminal activity of each year is connected to Bitcoin. As for the drug sale itself, trade volumes in crypto keep rising, but the percent of Bitcoin drug transactions out of all transactions goes down. This means Bitcoin is more frequently used for legitimate purposes.

What cryptocurrency is used for drug sales most often? Surprisingly, privacy coins such as Monero are used only for 4% of transactions. Due to its pioneer position, Bitcoin is used in 76% of all deals despite all its anonymity risks.

The main problem for drug dealers using crypto is to turn their income into cash. This move remains complicated and insecure. Most cryptocurrency exchanges have instruments to define whether a transaction is coming from a suspicious source like the darknet. The rise of Monero use in the online drug market will hinder such tracking. However, for the reasons listed above, crypto is unlikely to completely replace regular cash in drug sales in the foreseeable future.

Cryptoterrorism

The views on how much cryptocurrency is used and will be used by terrorists vary widely. While some claim that terrorists have no infrastructure to use it and the methods are not secure enough, others argue that they are learning fast and adjust to crypto rapidly. Let’s see what both sides say.

Not actively using, unclear future

Lack of appropriate infrastructure, inability to use crypto. Most terrorist groups settle in the Middle East region, especially on its remote and war-torn territories. The vast majority of roads and technological infrastructure have been destroyed. In such circumstances, cash remains the most common and convenient way to pay and fundraise. Imagine a gun seller in a Syrian village – does it look like he has a tool to accept Monero?

Anonymity threats. Given the relative transparency of blockchain mentioned above, crypto might remain too unsafe for terrorists. Miners can see any potential terrorist money exchange while checking transactions, and it’s not too hard to see who sends them money. It can change with the rising use rate of privacy coins, but the ability to spend such money remains questionable.

Increased attention to crypto by the authorities. As the number of transactions keeps rising, more regulatory bodies’ attention gets focused on cryptocurrency, which apparently makes terrorists nervous and cautious.

Problems of specific currencies. While top cryptocurrencies like Bitcoin receive much regulatory attention, others remain marginal and unreliable because of a lack of support. Conflicts and uncertainty lower the trust to such cryptocurrencies – yes, even terrorists’ trust.

Using actively now, increasingly in the future

Terrorists seem to be rapidly learning to escape from tracking in blockchain. Several years ago it was easy to find any address or transaction made for a terrorists’ fundraiser. Today they use well organized and finely designed websites, where detailed video tutorials show how to donate money anonymously. Unique Bitcoin addresses and other crypto tricks are used to preserve security. Analysts from intelligence services claim there’s only going to be more such cases. And, of course, privacy coins are a “great opportunity” for terrorists too.

Shift to cryptocurrency is a reaction to economic sanctions. ISIS has lost most of its territory and resources, Hamas has been sanctioned by the West. Having been cut off from all main financial institutes, terrorist groups had to find other pathways for their financial activities – and cryptocurrency appeared to be the best substitute.

There might be difficulties and inconveniences, and the number of terrorists using crypto is yet unknown – but as we can see, digital money in terrorism is reality. Same as in drugs. And this is what cryptocurrency is notorious for, lacking trust among millions of people. The reputation of some of the exchange services only adds to this mistrust – ChangeNOW has carried out a special investigation on how such platforms may cheat their clients. But can you buy anything besides heroin and firearms with your crypto? What about pizza or a concert ticket?

Only Antarctica left

Cryptwerk, a platform monitoring actual use cases of different cryptocurrencies, says there are about 3500 ways to spend Bitcoin and more than 800 for Monero today. They range from music services to car rentals, from buying clothes to hotel booking services, and from sports bets to virtual tours.

Organizations accepting cryptocurrency are located on all continents besides Antarctica (what could be a better place for crypto than a continent without governments and countries though?). Mostly, in the USA and Central Europe. Bitcoin as the largest cryptocurrency is relatively widespread in India and Southeast Asia.

As this is a whole another topic, ChangeNOW will issue a post dedicated to use cases of cryptocurrencies. As it will be more detailed, who knows – maybe you’ll find a pizza right by that you could pay for from your crypto wallet!

This article was contributed by Jeremy from ChangeNow.

Bitcoin

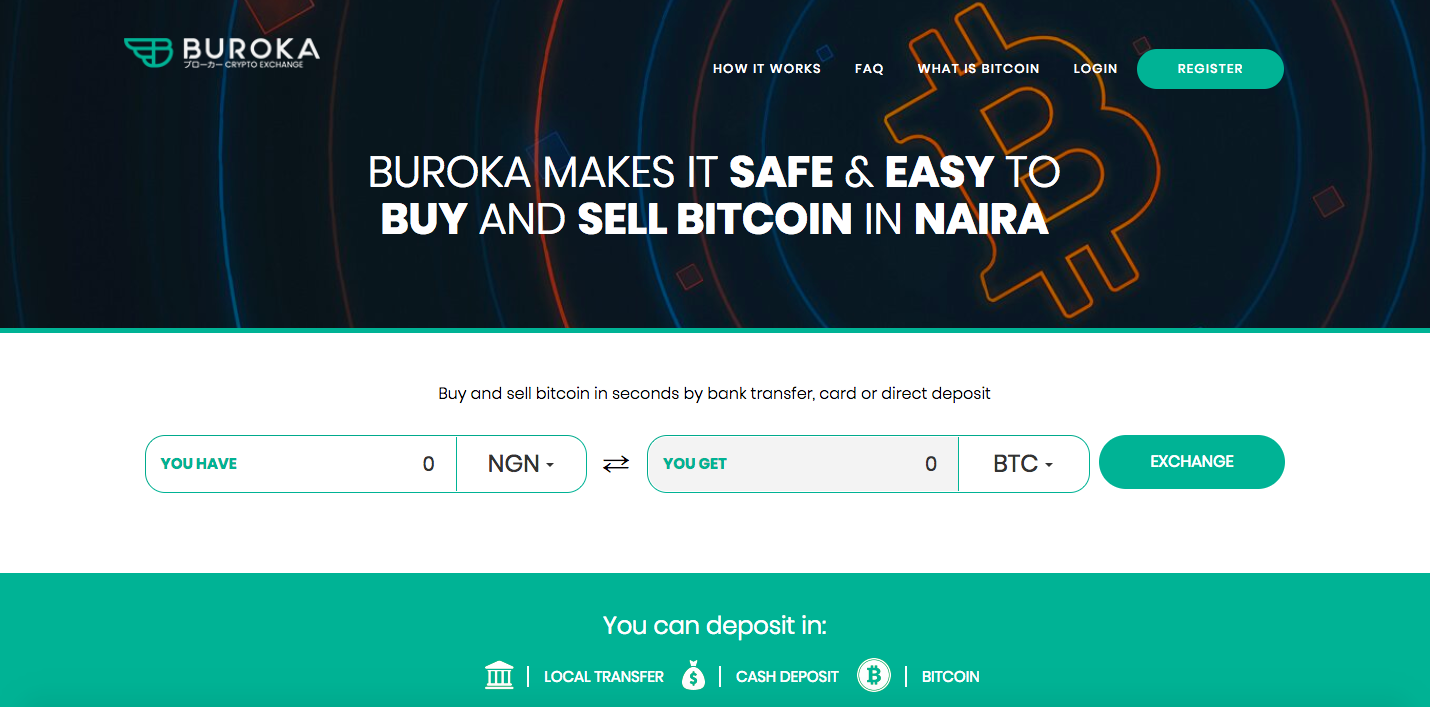

Buroka Review: How to Buy Bitcoin on Nigeria’s Newest Bitcoin Exchange

Published

4 years agoon

February 27, 2020

Buroka is a new breed of cryptocurrency exchange for Africa! Currently operating in Nigeria, Buroka was designed to fulfill the needs of modern Africans. Buroka allows customers to buy and sell Bitcoin with Naira via Local Transfers and cash deposits at the bank. In this Buroka review, you will learn more about the exchange and how you can use it to buy bitcoin in Nigeria.

How to Buy Bitcoin on Buroka

Step 1: Account Creation

To create an account, visit Buroka.com and hit the “Register” button. This will lead you to a page where you will be asked to fill in your personal information, including your name, email address, and password. Like any other serious exchange, Boruka will ask you for your ID, Proof of Address, and to take a selfie with your ID to eliminate fraud.

Step 2: Fund Your Account

Funding your account on the platform is straightforward. You can deposit either via bank transfer or at any bank branch. Make sure to use a unique reference code given to you by Buroka deposit system.

Step 3: Buying and Selling BTC

Once your deposit has been credited to your account you can immediately buy your Bitcoin. The buying and selling tab is located on the top right corner of the dashboard. There you can input the amount of bitcoin you want to buy. Once you do that, you then click on the “BUY BTC” button.

Step 4: Storing Your BTC

After buying BTC, Buroka provides users with the option of either storing bitcoin on the platform in a BitGo wallet or any other wallet of their choice.

Currently, Buroka only supports bitcoin (BTC). However, the exchange plans to include other cryptocurrencies going forward.

Security

Buroka exchange makes use of Two-Factor Authentication (2FA). 2FA provides an extra layer of protection for users. With the 2FA in place, an extra piece of information is needed before login into the platform or making any withdrawals.

Buroka exchange makes use of Two-Factor Authentication (2FA). 2FA provides an extra layer of protection for users. With the 2FA in place, an extra piece of information is needed before login into the platform or making any withdrawals.

In addition, Buroka’s platform is also protected using the latest security technology, including web-socket and API protocols that allow for a fast and secure order processing. Buroka also makes use of a well-updated SSL certificate, which makes it easy to detect a phishing attempt.

To further ensure that clients’ funds are secure, Buroka operates segregated accounts. These accounts are held with trusted banks so that clients can enjoy an extra layer of security provided by the banking system.

Conclusion

Buroka is a relatively new Bitcoin exchange with a well-designed, user-friendly interface. The Bitcoin trading platform provides several deposit options, which is attractive for Nigerian Bitcoin traders, as well as competitive market rates for both buyers and sellers.

If you are looking to buy or sell bitcoin in Nigeria, you can give Buroka a try.

Introducing Noones – Africa’s P2P Super App

Why Crypto’s Leading the Way in Africa’s Evolving Finance Landscape

The Rise of Bitcoin in the Online Gaming World

Unlock the Thrills of NHL Crypto Betting and Live Streaming

Understanding the Impact of Cryptocurrency Volatility on NBA Betting Markets

The Future of Crypto College Football Betting: Trends and Predictions

How Mobile Apps are Changing Sports Betting

Weekly Roundup: Africa’s Cassava Network Partners with UniPass to Expand Crypto Adoption in Africa & More

Weekly Roundup: Kenyan Senate in Discussion with CBK to Legalise Bitcoin & More

Weekly Roundup: South Africa Introduces New Cryptocurrency Standards to Advertising Code & More

Popular Posts

-

News1 year ago

News1 year agoWeekly Roundup: Kenyan Senate in Discussion with CBK to Legalise Bitcoin & More

-

News2 years ago

News2 years agoWeekly Roundup: South African Crypto Exchange VALR Launches in Zambia & More

-

News3 years ago

News3 years agoWeekly Roundup: Binance Becomes Official Sponsor of AFCON 2021 & More

-

News2 years ago

News2 years agoAmber Group’s April Corporate News Recap 2022

-

News2 years ago

News2 years agoWeekly Roundup: Congo-based Web3 Startup Jambo Raises $7.5 Million in Seed Funding & More

-

Sponsored Posts3 years ago

Sponsored Posts3 years agoBlockchain Technology: The Driver for Social Change

-

News2 years ago

News2 years agoWeekly Roundup: Kenya Capital Markets Authority Set to Pay More Attention to Cryptoassets

-

News2 years ago

News2 years agoWeekly Roundup: Kenya, Zimbabwe & Zambia Are All Exploring CBDCs