In this week’s news roundup, you will hear about Cardano’s donation to an African graphic novel, Paxful’s adoption of a naira-based stablecoin, and more.

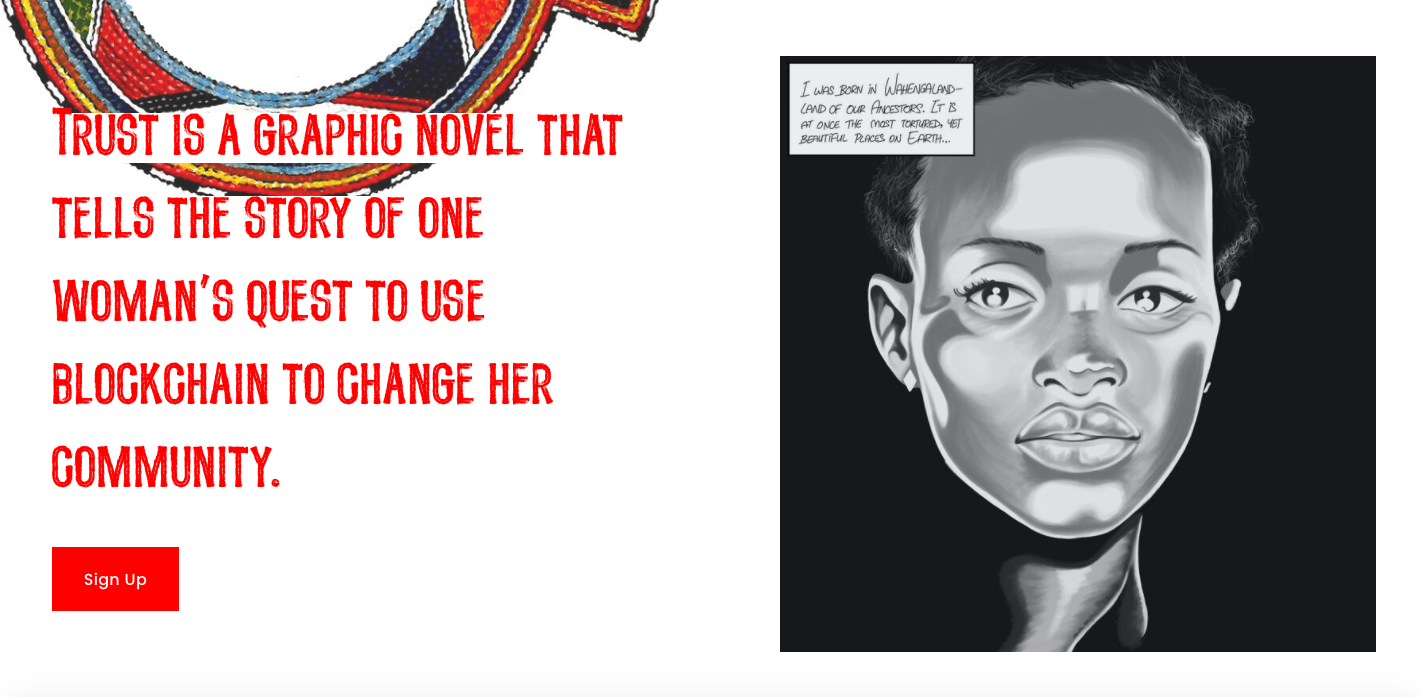

Cardano Foundation Donates to African Trust Graphic Novel

The Cardano Foundation donated in ADA to Trust, a pan-African novel that aims to spread awareness about blockchain technology and its ability to offer financial freedom. The novel will use graphics to tell a story of a woman that uses the blockchain to transform her community.

Chief Nyamweya and Anne Connelly are the writers and illustrators of this novel and will publish it in early 2021. Chief Nyamweya is a novelist and illustrator from Kenya, while Anne is a Canadian blockchain educator and tech entrepreneur.

The woman in the story, Moraa, travels back home to Wahengaland. There, she finds out that her community is at the mercy of her corrupt Uncle Max. To save them, she has to use blockchain technology.

“By using storytelling to educate readers about blockchain technology, we hope to inspire millions of African youth to imagine alternative futures. Trust also empowers African youth to create these futures by providing them with the training and tools to implement blockchain. Trust graphic novel will help African youth become the next generation of crypto users, entrepreneurs, and developers,” Chief Nyamweya said.

Speaking about the donation, Nathan Kaiser, the Chairperson of the foundation, said: “Education is key to the adoption and proliferation of blockchain technology, and engaging visual arts like the Trust graphic novel are powerful tools for reaching a large and diverse audience. The Cardano Foundation’s interest in the African continent extends far beyond commercial applications for the Cardano protocol.”

The book will be available in print and a mobile-first digital format. Moreover, the book will be accessible on online blogs and other learning resources.

Seychelles Transferred the Highest Volume of Bitcoin in H1/2020

According to a report from Crystal Blockchain, Seychelles received and sent $64.46 billion and $80.47 billion in bitcoin, respectively. That was the highest transfer amount recorded in the world in the first half of 2020.

The report, titled International Bitcoin Flows Analytics, also indicates that G20 countries transferred 45 percent of the bitcoin volume moved between exchanges. On the other hand, Seychelles transferred about 31 percent of the total volume of bitcoin exchanges in H1/2020. A large part of this volume comprises of Binance and Huobi transactions.

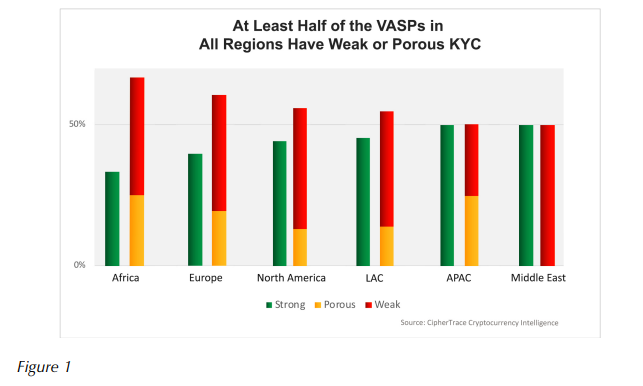

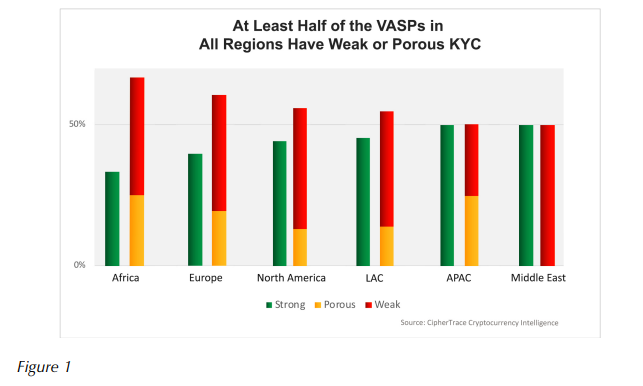

Furthermore, another report from CipherTrace reveals that Seychelles hosts 75 percent of Africa’s KYC-deficient virtual asset service providers (VASPs). Also, Africa hosts the highest number of VASPs with weak KYC processes followed by Europe and North America. Note that 72 percent of VASPs in Africa are located on the island nation.

The report highlights that weak and porous KYC processes could increase the chances of money launderers and cyber criminals exploiting a financial platform.

Paxful Collaborates with BuyCoins to Add Nigerian Stablecoin as a Payment Method

Paxful has collaborated with BuyCoins Africa to add the Naira-backed token (NGNT) as a payment method on the P2P marketplace. As a result, Paxful users can now buy and sell BTC and USDT with NGNT.

Paxful has collaborated with BuyCoins Africa to add the Naira-backed token (NGNT) as a payment method on the P2P marketplace. As a result, Paxful users can now buy and sell BTC and USDT with NGNT.

Paxful CEO Ray Youssef said: “With the Naira Token, users can perform fast, publicly-verifiable, and borderless transactions with a fiat equivalent, which is important to our users. Moreover, Nigeria is one of Paxful’s leading markets. We are excited to partner with BuyCoins to make this payment method available on our platform.”

Paxful had earlier announced its plans to add stablecoins on the platform. So far, the marketplace supports USDT and is now adding NGNT.

BuyCoins Africa is a crypto exchange based in Nigeria that supports the Naira Token. Through its app, users can buy, sell, receive, send, and store ETH, BTC, and LTC. According to the exchange’s CEO, Timi Ajiboye, the partnership is exciting news for the NGNT community.

“It opens up new opportunities and use cases for NGNT. Additionally, it will help increase the trading activity within the crypto ecosystem in Nigeria. Built on the world’s leading smart contract platform, the Ethereum blockchain, whose open-source and transparent stablecoin framework allows fiat to interact with smart contracts, gives cryptocurrency dealers the ability to transact with the Naira across the blockchain,” he said.

News1 year ago

News1 year ago

News2 years ago

News2 years ago

News3 years ago

News3 years ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

Sponsored Posts3 years ago

Sponsored Posts3 years ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

Paxful has collaborated with BuyCoins Africa to add the Naira-backed token (NGNT) as a payment method on the P2P marketplace. As a result, Paxful users can now buy and sell BTC and USDT with NGNT.

Paxful has collaborated with BuyCoins Africa to add the Naira-backed token (NGNT) as a payment method on the P2P marketplace. As a result, Paxful users can now buy and sell BTC and USDT with NGNT.

Central African Republic (CAR) has set up a 15-member committee that will be responsible for developing a bill on the use of cryptocurrencies and tokenization in the region.

Central African Republic (CAR) has set up a 15-member committee that will be responsible for developing a bill on the use of cryptocurrencies and tokenization in the region.