Features

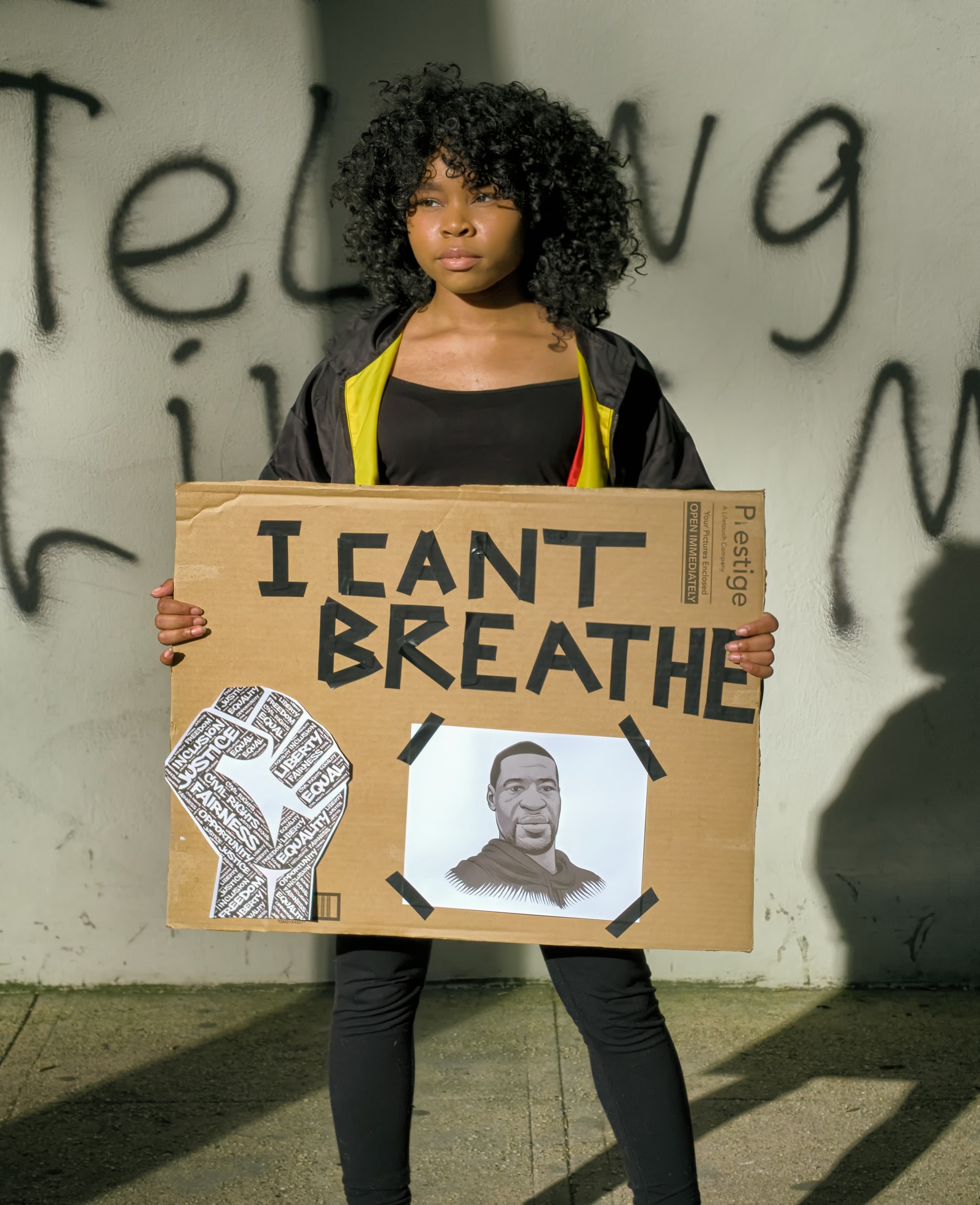

RESIST! How Activists Can Use Bitcoin

Published

4 years agoon

As social justice movements leverage social media platforms like Twitter to make their voices heard, many have discovered a new tool: Bitcoin. The internet is the epicentre of social change, and it only makes sense that activists are now adding bitcoin to their arsenal. During the recent #EndSARS Nigerian campaign, young feminists raised $55,000 in cash and bitcoin donations, which is an example of how activists can use bitcoin to raise funds.

So, can cryptocurrencies provide the same level of impact on activism as social media platforms? This article explores how activists can use bitcoin.

The Financial Challenges of Activism

Any activist willing to protest against injustice should know how to raise money. Protesters need banners, water, food, and medical care in case they get hurt. These requirements come at a cost, necessitating movements to search for funds.

Activists can raise money out of pocket or they can reach out to well-wishers for donations. The former option is unreliable, which means that social justice movements have to fully rely on donations. Unfortunately, government censorship can make it hard for such movements to receive donations through banks and other conventional financial institutions. Moreover, they could punish the donors that support social justice campaigns.

The #EndSARS campaign, for instance, has faced challenges with receiving donations because the Flutterwave links were down for some time. According to Tweets on the Feminist Coalition account, the Central Bank of Nigeria could have been behind the Flutterwave payment issues. However, it is unclear. Flutterwave is a payment solution in Nigeria, while the Feminist Coalition is one of the organisations that has been active in raising donations for the campaign.

Furthermore, donors outside the country where a campaign is taking place will find it challenging to send donations due to the high cost of sending money. Also, online payment platforms like PayPal are not available in every country. That prevents people in these countries from making donations to campaigns happening in other parts of the world.

Speed is also important when collecting donations. Activists will often need funds immediately to keep a campaign going long enough to make an impact. Therefore, if they are not receiving cash directly, they might have to visit a bank to withdraw large amounts of money. That could waste a lot of precious time.

Can Activists Use Bitcoin to Solve Financial Problems?

Yes, they can.

Bitcoin is censorship-resistant, which means that governments cannot prevent activists from receiving donations in bitcoin. That provides the convenience that activists need to fund their campaigns when they are still “hot” enough to make a difference.

To solve the challenge of receiving donations through Flutterwave, the Feminist Coalition is now accepting bitcoin donations only.

Bitcoin is pseudonymous, which means that governments cannot easily trace bitcoin transactions to the real-world identities of the senders and recipients. That offers a sense of security to both donors and activists, especially in countries where protesting can mean beatings, jail time, or death.

It is even better when social justice movements are decentralised because there are no public leaders that law enforcement can pursue. For instance, much of the #EndSARS and #BlackLivesMatter campaigns grew organically online.

Therefore, activists can use bitcoin to receive pseudonymous and censorship-resistant donations.

Moreover, they can receive donations from anywhere at any time. That is because bitcoin is accessible 24/7 to anyone with a smartphone or computer and an internet connection. As a result, more people can financially support causes they believe in, even though they live on another continent.

Also, bitcoin transactions do not involve third parties, thereby cutting down the cost and increasing transaction speeds. Once a donor sends BTC, the activist will receive it in minutes and fund their campaign immediately.

Furthermore, buying supplies for a protest becomes easier when local businesses start accepting crypto payments. For instance, several local businesses started accepting cryptocurrencies in 2019 in support of the Hong Kong protests against Chinese influence.

Bridging the Wealth Gap

Fighting deep-rooted social injustices require bridging the wealth gap between the oppressors and the oppressed.

Fighting deep-rooted social injustices require bridging the wealth gap between the oppressors and the oppressed.

In a world where the wealthy influence political decisions in their favour, amassing wealth could be a possible solution that marginalised communities can adopt to fight discrimination.

Here is where bitcoin can come in.

Since marginalised communities suffer discrimination from traditional financial institutions, bitcoin becomes an attractive alternative. The censorship-resistant and easy accessibility of bitcoin means that marginalised communities can use it to create wealth and acquire financial freedom and the power to fight prejudices.

By way of illustration, activists can direct part of the bitcoin donations they receive to fund small businesses in the community. As a result, financially stronger businesses can create jobs and increase the purchasing power of other community members.

Other methods that communities can use to create wealth include buying and holding bitcoin and accessing business loans in crypto.

Money can help fight police brutality better than protesting on the streets. That is what Bitcoin and Black America author, Isaiah Jackson, believes.

“Without economic strength, you have cops coming from outside of the community […], and they do not value it [or the people]. They do not see you as a person, and that is an issue,” he told Cointelegraph.

Moreover, marginalised communities can create their tokens or community currencies to improve their financial positions.

Social media has made the world aware of the social injustices that take place in various parts of the world. Now, bitcoin and other cryptocurrencies are giving the world a chance to support social justice movements financially. Together, both tools are creating a world where no one has to fight injustices alone.

You may like

-

Weekly Roundup: Africa’s Cassava Network Partners with UniPass to Expand Crypto Adoption in Africa & More

-

Weekly Roundup: Morocco’s Central Bank Announces Completion of Draft Cryptocurrency Regulatory Framework & More

-

Weekly Roundup: Nigeria Looking to Legalise Cryptocurrency Usage, CAR’s Sango Coin Postponed & More

-

Weekly Roundup: First Cohort of African Women Graduate from Binance Blockchain Bootcamp & More

-

Weekly Roundup: Graphic Novel about Blockchain ‘TRUST’ to Launch in Nairobi & More

-

Weekly Roundup: South African Reserve Bank Plans to Introduce New Crypto Trading Regulations & More

Features

Why Crypto’s Leading the Way in Africa’s Evolving Finance Landscape

Published

1 year agoon

July 24, 2023

Cryptocurrency adoption is on the rise throughout Africa. According to Chainalysis, the African crypto market is one of the fastest growing in the world, with an estimated $20 billion worth of transactions taking place per month. Meanwhile Kenya, Nigeria and South Africa are positioned in bitcoin.com top 10 global countries by Cryptocurrency Adoption.

In this article, we’ll take a closer look at the appeal of decentralised currencies in Africa and discuss how they’re leading the way in the continent’s ever-evolving finance landscape.

The Global Crypto Era

For several years now, cryptocurrencies and blockchain technology have been having a transformative effect on various industries and markets across the globe. From the disruption of the gaming industry via the emergence of play-to-earn gaming and online casino with crypto deposit platforms to smart contracts that are being used everywhere, from healthcare to real estate, the impact is evident.

With the rise of the DeFi and GameFi sectors, it’s clear that the global crypto era is now in full swing, and it’s an industry that’s gaining noticeable traction across Africa. Approximately 1.2 million Africans now actively trade cryptocurrencies, with Kenya, Nigeria and South Africa leading the way. Decentralised crypto trading platforms like Paxful and LocalBitcoins bypass financial institutions and present new opportunities for residents to buy and sell crypto tokens.

In terms of which crypto tokens are leading the way in Africa, Bitcoin (BTC) holds the position of the most dominant digital currency, with a substantial user base and trading volume. BTC is accepted and used for various purposes, including remittances and as a store of value.

Altcoins, too, are becoming more widespread in the continent, particularly Ether (ETH) and Binance Coin (BNB). Ethereum’s smart contract capabilities have fuelled its growth in the region, providing a solution to developers for building DApps (decentralised applications) that address Africa-specific challenges.

Additionally, several homegrown cryptocurrencies have emerged in recent years that are tailored to the local needs of the region. The Akoin token (AKN), for example, was founded by musical artist and humanitarian Akon as a means of powering a digital financial ecosystem in those regions with limited access to traditional banking services.

The Appeal of Cryptocurrencies

Cryptocurrencies offer several unique advantages, which, coupled with the economic stagnation still present in the continent, makes them particularly appealing to Africans.

One of the key drivers behind the burgeoning popularity of crypto in Africa is the lack of access to traditional financial services that many Africans still face. Many residents stay either unbanked or underbanked, excluding them from taking part in the global economy.

Decentralised currencies are gaining increased acceptance among the financially marginalised, particularly the low-income population, who have often been excluded from the banking system or had to face disproportionally high transaction costs. By their very nature, cryptocurrencies remove the need for traditional intermediaries, instead offering a borderless alternative that enables individuals to send and receive secure financial transactions instantly.

Currencies in countries such as Kenya and Nigeria have been damaged by decades of inflation, contributing to a surge in both economic and political instability. Cryptos hold the power to remedy financial exclusion and present an alternative to weak domestic currencies.

Unlike the more established traditional banking options in Africa, decentralised finance enables anyone with an internet connection and compatible device — smartphones included — to engage in a variety of financial transactions, from sending remittances to making investments. Crypto investing allows Africans to purchase and hold assets that will not be impacted by financial turbulence, such as rapid depreciation and ever-increasing inflation.

As mentioned above, cryptocurrencies are typically cheaper, easier to use and faster than conventional methods. The blockchain technology that eases peer-to-peer (P2P) transactions exists outside established fiat currency institutions, supplying a far more accessible and user-friendly solution.

Traditional remittance services are often slow, expensive and largely inaccessible to a significant portion of the African population. Digital currencies allow for frictionless cross-border transactions, meaning that individuals can send and receive money globally in a matter of minutes. Not only does this benefit individual consumers, but it also empowers African businesses and entrepreneurs, easing economic growth in the process.

A Lasting Impact

Given that Africa’s crypto ecosystem is still in an evolutionary stage, the popularity of decentralised currencies and blockchain applications will vary between countries and regions. Regulatory environments, infrastructure development and specific social-economic conditions can all influence the popularity and success of a crypto project. However, there’s no denying that the emergence of this industry has sparked a wave of innovation throughout many African countries.

Several blockchain-based startups have found innovative ways to leverage the potential of the technology to address the most prevalent socio-economic challenges. BitPesa is transforming the cross-border payments sector, while other startups have used blockchain tech to make supply chain management more transparent and even improve voting processes. By leapfrogging traditional infrastructures, decentralised currencies and technologies are proving to be the key to sustainable, long-term economic growth in Africa.

Cryptocurrencies have disrupted traditional financial systems in recent years, and Bitcoin profiled itself as the most famous crypto. It has already found its way to e-commerce and investment, but this crypto is also present in the world of online gaming. In this article, we will explore the growing influence of Bitcoin in the online gaming world.

Bitcoin and Online Casinos

Thanks to Bitcoin’s integration into online casinos, players and operators now have a vast range of possibilities. With the use of Bitcoin, online casinos create another level of advantage over traditional payment options. Most of all, if you perform transactions in Bitcoin, they will be quicker and more efficient.

You can deposit or withdraw the funds within seconds without the need for complex verification processes or intermediaries. This makes the gaming experience smoother and more seamless for any player. Additionally, Bitcoin offers a higher level of privacy and security. We have already experienced how much financial and personal information traditional payment methods require.

Nevertheless, unlike them, Bitcoin transactions are pseudonymous, which means they provide players with greater anonymity. This privacy feature particularly appeals to those who value their online security and wish to enjoy online gaming without revealing their identities. Integrating Bitcoin into online casinos has also resulted in innovative bonus structures and rewards.

Some Bitcoin casinos offer exclusive promotions and bonuses for players who use Bitcoin as their preferred payment method. The best Bitcoin casinos in the Philippines are safe to deposit at, according to this guide, and you can choose the one that appeals to you the most. That’s why more and more players turn to Bitcoin as their payment method, fostering its further adoption in the gaming industry.

Since Bitcoin is decentralized, transactions bypass the regular censorship and control that we can see involved with traditional payment methods. Thanks to this, players from regions with strict gambling regulations can participate in online gaming with fewer restrictions. Bitcoin-powered online casinos do not impose geographical limitations, opening their services to players worldwide.

Bitcoin and Esports Betting

Beyond online casinos, Bitcoin has made significant breakthroughs in esports betting. We could witness a skyrocketing rise of esports in recent years, which resulted in millions of enthusiasts and viewers worldwide. Thanks to Bitcoin’s integration into esports, players have a wider range of options to engage with their favorite games and gamers.

Esports, or competitive video gaming, has witnessed a meteoric rise in popularity, attracting millions of viewers and enthusiasts worldwide. Bitcoin’s integration into esports betting platforms has revolutionized how fans engage with their favorite games and players.

Bitcoin’s advantages, such as fast and secure transactions, align perfectly with the dynamic nature of esports betting. Users can easily deposit and withdraw funds, allowing for quick reactions to changing odds or game outcomes. Bitcoin’s decentralized nature also ensures that bettors from any location can participate, overcoming the obstacles of regional restrictions and currency exchange complications.

Moreover, Bitcoin’s integration into esports betting platforms has provided players with increased transparency and fairness. The technology behind Bitcoin, blockchain, allows for unalterable and auditable records of transactions, ensuring that betting outcomes are tamper-proof.

This transparency has fostered greater trust among players, operators, and regulators, further fueling the growth of Bitcoin-powered esports betting.

Bitcoin and In-Game Purchases

As the gaming industry evolves, it has also opened innovative ways for gamers to enhance their gaming experience. With the involvement of Bitcoin, players can use it for in-game purchases. Nowadays, many popular online games support cryptocurrencies for item purchases, upgrades, or other enhancements.

Since crypto transactions are more seamless, Bitcoin has become a better alternative compared to traditional in-game payment methods. Game developers have also benefited from introducing Bitcoin as a payment option. Now they can offer a more convenient way of purchasing in-game items, transaction fees are lower, and processing times have become faster.

Moreover, you, as a player, don’t need to disclose any sensitive information anymore. That way, Bitcoin usage in gaming reduces the risk of potential data breaches. The adoption of Bitcoin in in-game purchases has also opened up new possibilities for cross-platform transactions.

As Bitcoin operates globally, players can easily trade or transfer in-game assets across different games or platforms, fostering a vibrant secondary market for virtual goods. This flexibility enhances player engagement and allows for a more interconnected gaming experience.

The integration of Bitcoin into in-game purchases has also paved the way for blockchain-based gaming ecosystems. Some game developers have embraced blockchain technology to create decentralized gaming platforms where players truly own their in-game assets through blockchain-based tokens. This ownership empowers players and introduces concepts of shortage and value to virtual items.

Benefits of Using Bitcoin in Online Gaming

Players can enjoy multiple benefits from using Bitcoin in online gaming. The most obvious one is that traditional payment methods cannot match the level of Bitcoin’s security and anonymity. Due to cryptos’ decentralized nature, you don’t need to disclose your sensitive data. If you want to get started in the gaming world easily and quickly, there’s no more attractive option than Bitcoin.

Transactions are completed within seconds, and they are cheaper in terms of fees compared to other popular methods. Since Bitcoin has become more popular in the online gaming industry, gaming platforms recognized its benefits.

Therefore, they introduced it as a payment method, and nowadays, the world’s most popular online gaming platforms accept Bitcoin, including Steam, Xbox Live, and PlayStation Network.

Security Considerations When Using Bitcoin in Gaming

While Bitcoin offers many benefits for online gaming, such as fast and secure transactions, there are also some security considerations to keep in mind. Performing online financial transactions always brings a high risk of potential hacking and theft of Bitcoin wallets. That’s why you should use a secure and reputable digital wallet and keep your private keys safe and inaccessible to unauthorized persons.

Also, online gaming platforms that you use should have strong security features established to keep your financial and personal information away from the eyes of unauthorized third parties.

Conclusion

Bitcoin’s rise in online gaming has brought many benefits for all entities in this growing industry. From online casinos to esports betting and in-game purchases, Bitcoin’s unique characteristics have reshaped the gaming landscape, offering increased speed, privacy, security, and global accessibility. It shouldn’t take too long before cryptocurrencies gain mainstream acceptance since they are continuously evolving.

That’s why we believe the Bitcoin integration in the online gaming industry will continue. Ultimately, it should unlock new ways of innovation and interaction for gaming fans worldwide, leading to limitless possibilities for the future of online gaming.

Features

Unlock the Thrills of NHL Crypto Betting and Live Streaming

Published

1 year agoon

July 15, 2023

Are you a passionate NHL fan who craves excitement both on and off the ice? Look no further! NHL Crypto Betting and Live Streaming bring a revolutionary experience to your fingertips. Witness the fusion of cutting-edge technology, crypto-powered wagers, and seamless live streaming that will take your NHL engagement to new heights.

In this comprehensive guide, we delve into the world of NHL Crypto Betting, explore the latest trends in NHL betting, and uncover the exhilaration of live streaming. Brace yourself for an unparalleled journey that combines heart-pounding action, lucrative opportunities, and the thrill of cheering for your favorite teams in real-time.

The Evolution of NHL Crypto Betting

With the rise of blockchain technology, NHL Crypto Betting has emerged as a game-changer in the sports betting landscape. Powered by cryptocurrencies such as Bitcoin, Ethereum, and others, NHL Crypto Betting offers a secure, transparent, and decentralized platform for enthusiasts to engage with their favorite teams.

By leveraging blockchain’s immutability and smart contract capabilities, NHL Crypto Betting ensures fair and tamper-proof transactions, providing users with a sense of trust and integrity.

Moreover, NHL Crypto Betting introduces a new dimension to the traditional sports betting experience. Cryptocurrencies enable users to make instant deposits and withdrawals, eliminating the hassles associated with fiat currencies. This streamlined process enhances convenience and accessibility for bettors, empowering them to place wagers quickly and effortlessly.

Unleashing the Power of NHL Trends Betting

Keeping up with NHL trends is essential for successful betting. NHL Trends Betting allows users to analyze historical data, team performance, player statistics, and other crucial factors to make informed betting decisions. By identifying patterns, tendencies, and emerging trends, bettors can gain a competitive edge and increase their chances of winning.

Whether you’re an experienced bettor or new to the world of NHL betting, understanding and leveraging NHL trends is paramount. Stay ahead of the game by monitoring team form, home and away records, head-to-head matchups, injury reports, and other key indicators. NHL trends betting offers a strategic approach to maximize your chances of success and unlock profitable opportunities.

Immersive Live Streaming: Amplifying the NHL Experience

Live streaming has transformed the way sports fans engage with their favorite leagues, and the NHL is no exception. Experience the thrill of NHL games in real-time, no matter where you are, with seamless live streaming. Witness jaw-dropping goals, clutch saves, and heart-stopping moments as they happen, all from the comfort of your own device.

Thanks to advancements in technology, NHL live streaming offers impeccable video quality, multi-camera angles, and expert commentary, providing an immersive viewing experience.

Whether you’re a die-hard fan or a casual observer, live streaming brings you closer to the action, making you a part of every exhilarating moment. Cheer for your team, revel in the intensity, and celebrate their victories as if you were right there in the arena.

Maximizing User Engagement: The NHL Crypto Betting and Live Streaming Advantage

Combining NHL Crypto Betting and Live Streaming amplifies user engagement to unprecedented levels. When you become a part of this dynamic ecosystem, you open doors to exhilarating possibilities. Here’s how NHL Crypto Betting and Live Streaming enhance your overall experience:

- Real-Time Betting: Engage in fast-paced, live betting opportunities that align with the pulse of the game. React to game-changing moments and adapt your strategy instantly to seize the best odds and maximize your winnings.

- Community Interaction: Connect with fellow NHL enthusiasts, discuss predictions, and share your excitement within the vibrant community. Joining forces with like-minded individuals adds another layer of enjoyment to your NHL journey.

- Rewards and Bonuses: Benefit from exclusive rewards, loyalty programs, and enticing bonuses offered by NHL Crypto Betting platforms. From sign-up bonuses to seasonal promotions, these incentives boost your bankroll and heighten the thrill of your NHL experience.

- Accessible Anywhere, Anytime: Never miss a moment of NHL action, whether you’re at home, on the go, or traveling. NHL Crypto Betting and Live Streaming platforms are designed to cater to your mobile lifestyle, ensuring you’re always connected to the games you love.

Ignite Your NHL Experience with Crypto Betting and Live Streaming

As an NHL fan, you deserve an extraordinary experience that transcends the boundaries of traditional engagement. NHL Crypto Betting and Live Streaming offer a gateway to a realm where exhilaration knows no bounds.

Dive into the electrifying world of NHL Crypto Betting, stay ahead of the game with NHL trends betting, and immerse yourself in the adrenaline of seamless live streaming. The perfect fusion of technology, sports, and entertainment awaits you. Join now and ignite your NHL experience like never before!

Introducing Noones – Africa’s P2P Super App

Why Crypto’s Leading the Way in Africa’s Evolving Finance Landscape

The Rise of Bitcoin in the Online Gaming World

Unlock the Thrills of NHL Crypto Betting and Live Streaming

Understanding the Impact of Cryptocurrency Volatility on NBA Betting Markets

The Future of Crypto College Football Betting: Trends and Predictions

How Mobile Apps are Changing Sports Betting

Weekly Roundup: Africa’s Cassava Network Partners with UniPass to Expand Crypto Adoption in Africa & More

Weekly Roundup: Kenyan Senate in Discussion with CBK to Legalise Bitcoin & More

Weekly Roundup: South Africa Introduces New Cryptocurrency Standards to Advertising Code & More

Popular Posts

-

News1 year ago

News1 year agoWeekly Roundup: Kenyan Senate in Discussion with CBK to Legalise Bitcoin & More

-

News2 years ago

News2 years agoWeekly Roundup: South African Crypto Exchange VALR Launches in Zambia & More

-

News3 years ago

News3 years agoWeekly Roundup: Binance Becomes Official Sponsor of AFCON 2021 & More

-

News2 years ago

News2 years agoAmber Group’s April Corporate News Recap 2022

-

News2 years ago

News2 years agoWeekly Roundup: Congo-based Web3 Startup Jambo Raises $7.5 Million in Seed Funding & More

-

Sponsored Posts3 years ago

Sponsored Posts3 years agoBlockchain Technology: The Driver for Social Change

-

News2 years ago

News2 years agoWeekly Roundup: Kenya Capital Markets Authority Set to Pay More Attention to Cryptoassets

-

News2 years ago

News2 years agoWeekly Roundup: Kenya, Zimbabwe & Zambia Are All Exploring CBDCs