In this week’s news roundup, read about an SA company that is set to accept crypto for rental deposits, Binance educating 350,000+ Africans about crypto & more.

SA Company First to Accept Crypto for Rental Deposits

Quorum Holdings, a South African company that provides affordable residential and student housing, will be the first to accept crypto for rental deposits in the country. This will enable tenants’ deposits to grow over the lease period instead of lying idle. The company will begin the trial with one of its developments in Johannesburg.

“We are excited to be trialling rental deposits in crypto for our latest development in Johannesburg, Forest Views. Depending on how it works, we will expand to other properties in both Joburg and Cape Town. Our typical tenants are young professionals, who are familiar with crypto and may want to use theirs as a deposit instead of the standard deposit practice,” said Saul Mayers, Group Legal of Quorum Holdings.

Tenants will send their crypto rental deposits to Quorum’s Luno business account where the crypto exchange will hold them safely.

“The risks associated with the price volatility of crypto are still there, but all gains are for the tenant when they leave the development. [The landlord will] shoulder any possible losses,” Mayers explained.

Binance Educates More Than 350,000 Africans in 2021

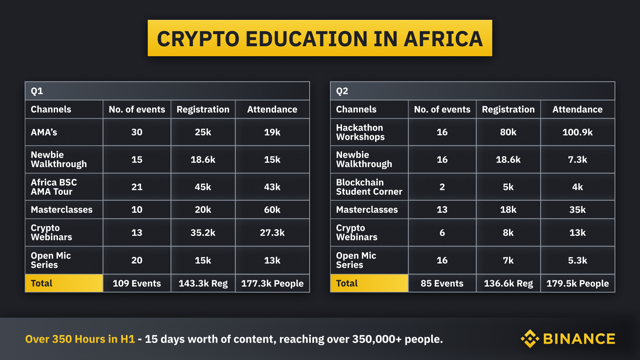

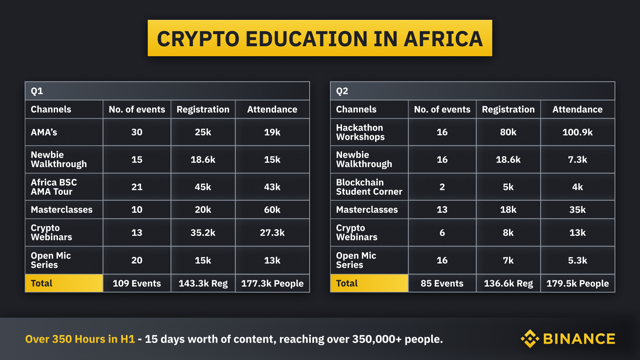

Binance has educated more than 350,000 Africans so far in 2021. Through the Binance Masterclass, which kicked off in January 2020, the crypto company has taught thousands of crypto beginners on various topics like how to avoid bitcoin scams and how to create careers in the crypto industry. Binance offered educational resources to more than 177,000 Africans in Q1 2021 and over 179, 500 in Q2 2021. The company also trained more than 1,000 African blockchain developers in Q1 2021.

“Blockchain education is at the heart of our focus in the global market. As a blockchain infrastructure provider, we are committed to ensuring that more and more people have access to the right information about the workings of the ecosystem. Africa is a very important market for Binance because we see the profound opportunity blockchain brings to the entire continent,” said Emmanuel Babalola, Director at Binance Africa.

Binance facilitates crypto education through webinars, My Binance Class, hackathons, and an AMA webinar series.

Six African Countries Appear on the Top 20 Global Crypto Adoption Index

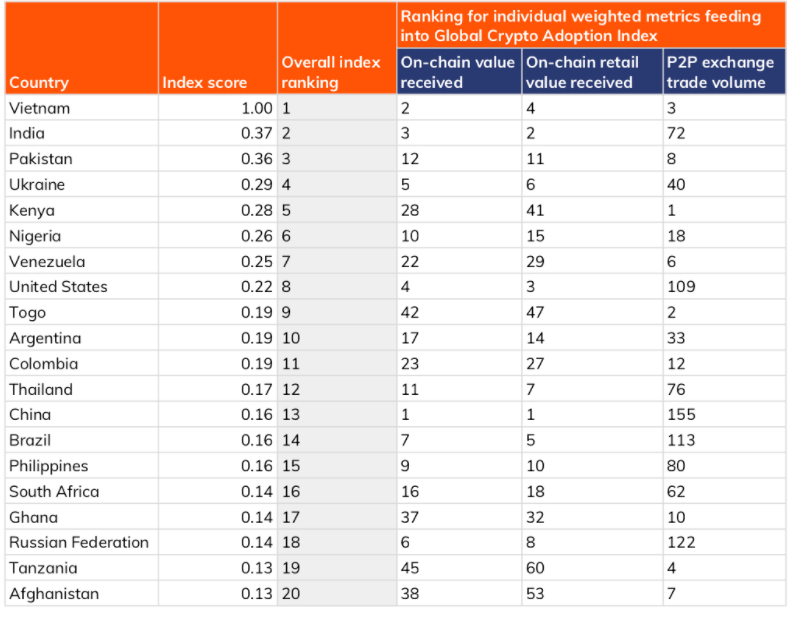

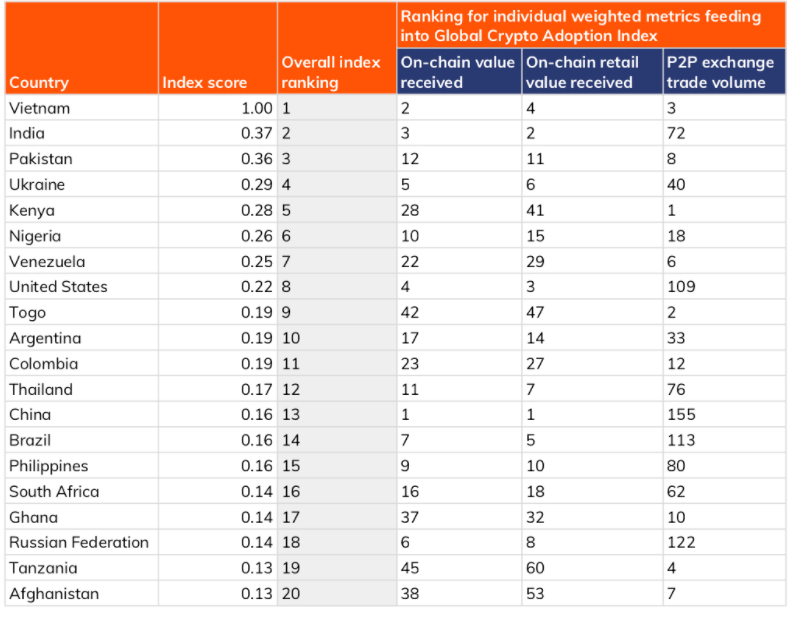

Six African countries – Kenya, Nigeria, Togo, South Africa, Ghana, and Tanzania (in that order) – have appeared on the 2021 top 20 global crypto adoption index. Chainalysis compiled the list after evaluating 154 countries “based on on-chain cryptocurrency value received, on-chain retail value transferred, and peer-to-peer exchange trade volume.”

Based on the results of this analysis, six African countries received high indexes, ranking them among the top 20 globally. Kenya ranked fifth, followed by Nigeria at the sixth position. Chainalysis ranked Togo ninth, South African sixteenth, Ghana seventeenth, and Tanzania nineteenth.

This indicates that crypto adoption is on the rise in Africa. Moreover, platforms like Paxful are at the forefront of driving this adoption in Africa, according to the report.

“P2P platforms have a greater share of total transaction volume made up of smaller, retail-sized payments under $10,000 worth of cryptocurrency,” Chainalysis said.

To learn more about Bitcoin, download the Bitcoin Beginner’s Handbook for free.

News2 years ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

News3 years ago

News3 years ago

News3 years ago

News3 years ago

News3 years ago

News3 years ago

News2 years ago

News2 years ago

Features2 years ago

Features2 years ago

Central African Republic (CAR) has set up a 15-member committee that will be responsible for developing a bill on the use of cryptocurrencies and tokenization in the region.

Central African Republic (CAR) has set up a 15-member committee that will be responsible for developing a bill on the use of cryptocurrencies and tokenization in the region.