If you want to buy bitcoin in Nigeria using nairas you have come to the right place.

In this guide, you will discover a complete list of exchanges that enable you to buy cryptocurrency in Nigeria using a range of different payment methods.

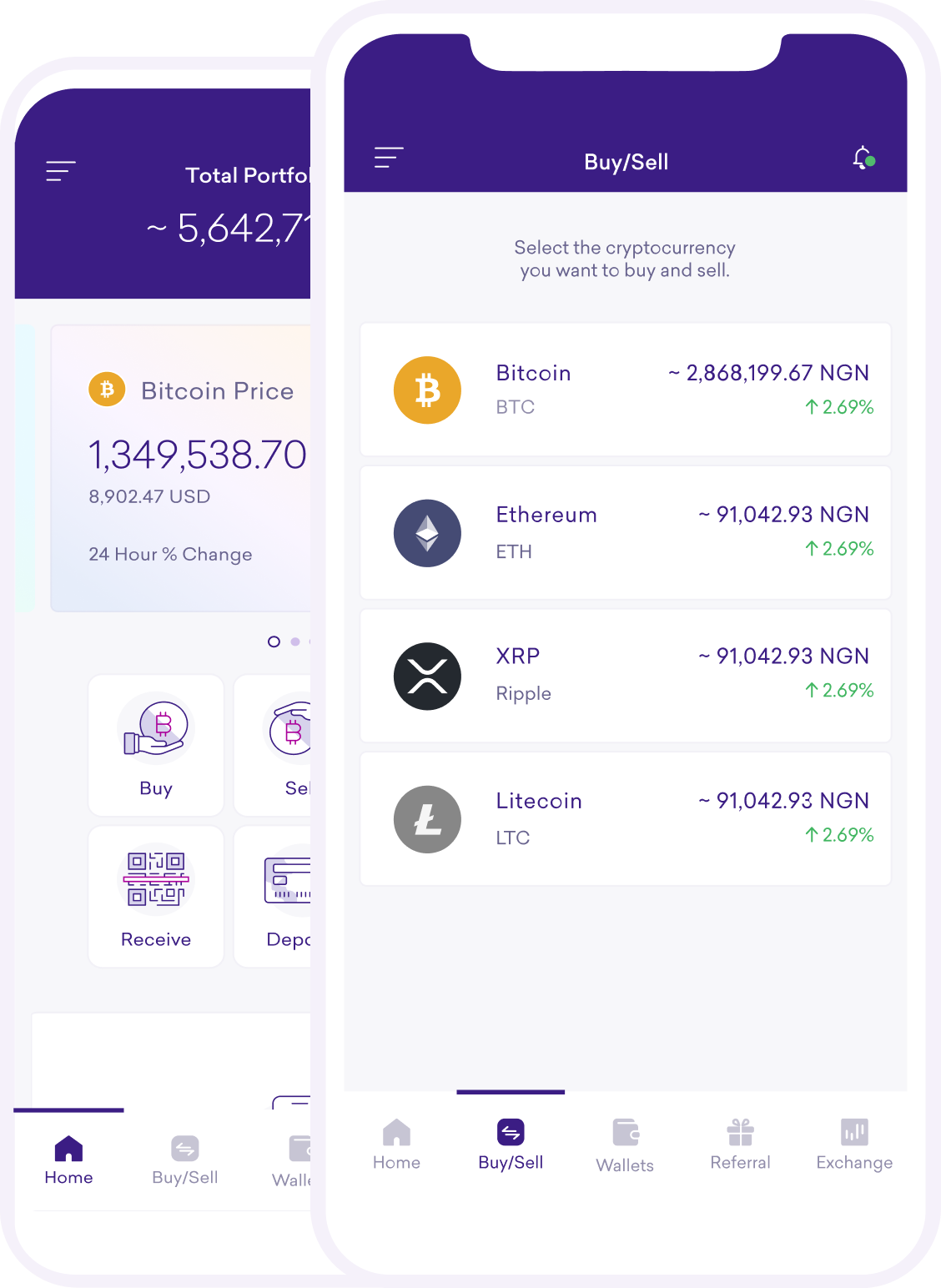

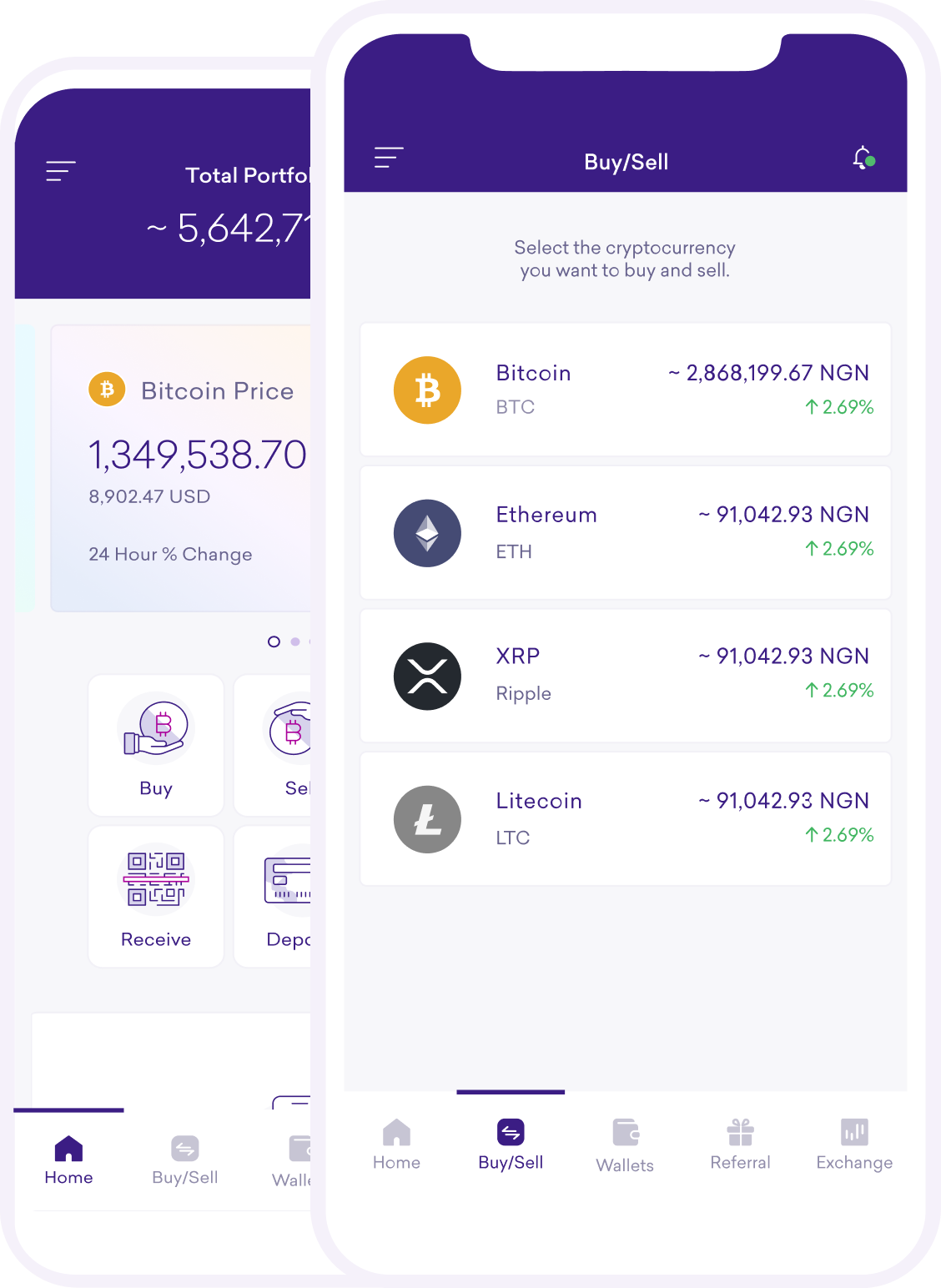

Quidax

Quidax is a leading cryptocurrency exchange that enables Nigerians to buy bitcoin (and several other cryptocurrencies) with the naira. The trading platform launched in 2018 and supports numerous payment methods, including debit card, bank transfer and USSD.

Currently, Quidax enables you to buy, sell, trade, and store bitcoin (BTC), ether (ETH), litecoin (LTC), dash (DASH), USD tether (USDT), and ripple (XRP).

The exchange has both a web-based version and mobile app (iOS and Android) to enable Nigerian to trade at home and on-the-go.

To buy bitcoin using Quidax you need to:

- Sign up for a free account using your name, email, and a password

- Deposit fiat currency using a debit card, bank transfer or USSD

- Buy an instant buy or place an order in the order book

- Receive your BTC in your Quidax wallet

NairaEx

NairaEx is one of the most reliable and longest standing bitcoin exchanges in Nigeria. The exchange was founded in 2015 and is simple and easy to navigate with an inbuilt real-time exchange rate of bitcoin to naira.

NairaEx is one of the most reliable and longest standing bitcoin exchanges in Nigeria. The exchange was founded in 2015 and is simple and easy to navigate with an inbuilt real-time exchange rate of bitcoin to naira.

Buying bitcoin on NairaEx is very simple. All you have to do is sign up to NairaEx, get verified by uploading a valid identity card, deposit money using a bank transfer or PerfectMoney, and proceed to place a buy order. Upon confirmation of your order, the transaction will be initiated and once it has been completed your account will be funded with the bitcoin you just bought.

ICE3X

The South African digital currency exchange ICE3X recently opened its doors in Nigeria giving Nigerians an opportunity to buy bitcoin, litecoin, and ether using nairas through the use of the VoguePay payment processor.

The South African digital currency exchange ICE3X recently opened its doors in Nigeria giving Nigerians an opportunity to buy bitcoin, litecoin, and ether using nairas through the use of the VoguePay payment processor.

To buy bitcoin from ICE3X, you will need to first create an account on ICE3X and fill out the form with your personal details. Once signed up, you will receive an email to verify your account. To fund your ICE3X account with your nairas, you will need to login to your newly created ice3X account, proceed to the DEPOSIT/WITHDRAW tab in the menu bar to make a deposit using your newly created VoguePay wallet (you can get more info here on how to set up a VoguePay wallet).

After successfully funding your account, you can proceed to place a buy order following these simple steps:

- To buy bitcoin, click on the naira balance in the deposit/withdraw section of your ICE3X account.

- Click on the trading tab in the blue menu at the top and click on the bitcoin tab.

- Enter how many bitcoins or fraction of bitcoin you wish to buy.

- Enter your buying price (the current bitcoin rate sale price is on the exchange by default, but you can enter any price you want).

- You will then see your total order slip including your commission.

- Review your transaction and click on the buy tab underneath to execute your order.

Remitano

Remitano is a peer-to-peer exchange that has recently entered the African market. The platform is experiencing rapid growth in Nigeria due to its fast, safe and reliable nature.

Remitano is a peer-to-peer exchange that has recently entered the African market. The platform is experiencing rapid growth in Nigeria due to its fast, safe and reliable nature.

On Remitano, users can easily buy or sell bitcoin using a range of different payment methods. As a way of protecting both the buyer and seller, Remitano offers an escrow service. This is where the seller transfers the amount of bitcoin the buyer wants to a locked Remitano account. The buyer then sends the payment to the seller with no fear of not receiving the paid for bitcoin. Similar to LocalBitcoins.com, Remitano also displays its list of sellers based on their transaction history.

In order for you to buy bitcoin, you have to create an account on Remitano.com and then proceed to the homepage and click on the buy button. After keying in your desired volume and bitcoin address, a list of top sellers will be listed below depending on the rating. You will then click on any seller you wish and proceed to make payment. After successfully making your payment, Remitano will then release the funds to the seller and you receive your bitcoin.

LocalBitcoins

LocalBitcoins.com is a global peer-to-peer bitcoin trading platform. It is a marketplace that helps connect buyers or sellers from different places around the world.

LocalBitcoins.com is a global peer-to-peer bitcoin trading platform. It is a marketplace that helps connect buyers or sellers from different places around the world.

The platform allows users to create buy or sell advertisement with the prices they want to trade at. The exchange platform rates sellers based on their past transactions. As a way of protecting both parties, LocalBitcoins acts as an escrow and has a customer support team ready to help in case of any issues that may arise during a transaction.

To buy bitcoin on LocalBitcoins exchange, you need to create an account on the platform, verify your identity, click on any seller on the homepage that is willing to sell you bitcoin at a price you feel comfortable with and a payment method that works for you.

After clicking on the ‘buy’ button, you will be given details of the transaction including the seller’s terms and conditions. You can choose whether or not to proceed with the particular buyer depending on how comfortable you are with these terms.

To execute a trade, type in the blue box how much bitcoin you want in naira and also add a message to the seller after which you click on the ‘send trade request’ button. Once the payment has been made, click on the ‘I have paid’ button and you will receive your bitcoin on your LocalBitcoins wallet within minutes.

Paxful

Paxful is a peer-to-peer bitcoin marketplace that has gained substantial popularity in Nigeria.

Paxful is a peer-to-peer bitcoin marketplace that has gained substantial popularity in Nigeria.

To buy bitcoin on paxful.com, first, you need to click on the ‘buy bitcoin’ option in the top menu bar. Then you enter the naira amount of bitcoin you intend to purchase and select the payment method you would like to use.

After selecting a way to pay, you click on the ‘search’ button to get a list of sellers who are willing to sell you the amount of bitcoin you requested and are also inclined to your payment method.

Just like on LocalBitcoins, the reputations of sellers are scored and it is highly advisable that you select buyers with high reputation to deal with. You then select a seller and begin your purchase order. The trade details will then pop-up on the left-side of the screen and a chat box on the right side of the screen where you can chat with the seller so you can both track the stages of transaction execution.

Once the trade is completed you will receive your bitcoin on your Paxful wallet.

Luno

Luno, a bitcoin exchange and wallet provider, is one of the most widely used digital asset trading platforms in Nigeria. The exchange offers a free bitcoin wallet that comes with an inbuilt buy and sell feature that enables customers to buy or sell bitcoin directly from within their Luno wallet. It is designed in such a way that newcomers to bitcoin can easily use the wallet.

Luno, a bitcoin exchange and wallet provider, is one of the most widely used digital asset trading platforms in Nigeria. The exchange offers a free bitcoin wallet that comes with an inbuilt buy and sell feature that enables customers to buy or sell bitcoin directly from within their Luno wallet. It is designed in such a way that newcomers to bitcoin can easily use the wallet.

To buy bitcoin from Luno, you need to first and foremost;

- Create an account by signing up at Luno.com

- Verify your identity by uploading a valid identity card

- Proceed to deposit money to your account using any of the various payment options available.

Buying bitcoin from Luno comes in two ways;

- Instant buy or sell (recommended for beginners), which allows users to buy or sell bitcoin either from the Luno wallet or from the website.

- Exchange orders (for advanced or experienced users), which is a little bit more technical as it involves placing an order on the exchange at a specific price and waiting for it to get matched.

NGExchanger

NGExchanger is another e-currency exchange that is well known in Nigeria and specialises in the buying and selling of bitcoin.

To buy bitcoin from the platform, you will need to create an account and get the account verified by uploading a valid ID card. However, you can still buy bitcoin without having a verified account. In such instances, you will need to have a funding limit of $1000 per day with the minimum buying amount being $10. Follow these simple steps to buy bitcoin on NGExchanger:

- After registration, login to your account and click on buy

- Select the e-currency account type you want to buy (in this case click on bitcoin)

- Input the desired volume of bitcoin you want to buy in US Dollars

- Enter your bitcoin wallet address

- After clicking on the proceed button, a payment invoice will be generated with a transaction number. Make payment to the bank details of NGExchanger and include the transaction number in your invoice.

- After successful payment, click on confirm to record and save the transaction. You will receive your bitcoin in your wallet and a confirmation email will land in your inbox.

Bitkoin.Africa

Bitkoin.Africa is a Nigeria-based peer-to-peer exchange that allows Nigerian bitcoin users to buy and sell bitcoin from and to one another in a similar manner as on LocalBitcoins or Paxful.

The new exchange was launched in October 2017 and has since seen substantial user uptake in Nigeria.

Naira4Dollar

Naira4Dollar.com is one of the oldest e-currency platforms in the country with several shop outlets across the country. If you are looking for a place to buy bitcoin offline, then Naira4Dollar is that place. To know any of their offline shops closer to you visit Naira4Dollar.com.

However, you can also make use of their service online where you can purchase bitcoin using various payment methods.

There are also other local e-money exchange platforms that allow you to convert bitcoin to naira and vice versa. Examples include Instant Gold Nigeria, Nigeria Gold Exchange, and CryptoMart.

However, when it comes to buying bitcoin, it is advisable to use well-known established exchanges. Quidax, NairaEx, ICE3X, and Luno are the most secure bitcoin buying options in Nigeria.

To learn more about Bitcoin, download the Bitcoin Beginner’s Handbook for free.

News1 year ago

News1 year ago

News2 years ago

News2 years ago

News3 years ago

News3 years ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

Sponsored Posts3 years ago

Sponsored Posts3 years ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

The South African digital currency exchange ICE3X recently opened its doors in Nigeria

The South African digital currency exchange ICE3X recently opened its doors in Nigeria  Remitano

Remitano LocalBitcoins.com

LocalBitcoins.com Paxful

Paxful