Bitcoin

Crypto or Cryptic? Impacts of a Growing Industry

Published

6 years agoon

Is anyone confused? It has been my experience that the topic of cryptocurrency or “crypto” has two distinct effects on water fountain conversation – complete confusion, sometimes masked as boredom, or extreme interest and engagement. So what’s it all about and what are the possible effects on the day-to-day?

A cryptocurrency is a digital medium of exchange that uses encryption to secure the processes involved in generating units and conducting transactions. As digital currencies, cryptocurrencies have no physical representation. They may be used for online or in-person transactions with any vendors who accept them. Face-to-face transactions using cryptocurrencies are typically conducted through mobile payment from a digital wallet.

There are already hundreds of cryptocurrencies around the world. Amongst them, bitcoin whose origins can be traced back as far as 2008, is the most well recognised, so much so that other cryptocurrencies are sometimes referred to as altcoins, as in alternatives to bitcoin.

The underlying technology, blockchain, was originally developed as a technological solution to support bitcoin. Blockchain is an open, distributed ledger that can record transactions between two parties efficiently and in a verifiable and permanent way. The ledger itself can also be programmed to trigger transactions automatically. The Bitcoin protocol enables peer-to-peer (P2P) exchange in a decentralised system that, unlike conventional currencies, is not associated with any financial institution or government.

Impact on global investments

Crypto has become extremely popular over the last 36 months, although the first cryptocurrencies emerged over a decade ago. While most global equity indices rose by 15 to 30 percent in 2017, the top performing cryptocurrencies showed a comparative 9,000 percent rise, with bitcoin, as the most well-established, rising by 1,318 percent. These extreme figures may be alarming, however there is no doubt of the positive effect on capital markets that new entrants into the crypto market had in 2017 with fundraising exceeding €3.2 billion.

Aside from the many benefits of crypto when it comes to straight-through transactions and inflation control, many investors are adding cryptocurrencies as assets to their diversified portfolios. In particular, the non-correlated nature of the market makes cryptocurrencies a potential hedge against risk, similar to precious metals and hard assets.

However, some experts are fearful that a crash in cryptocurrency could have wider systemic risk consequences, similar to the effect that mortgage-backed securities had on triggering the global financial crisis in 2008. It’s worth noting, however, that the total market capitalisation of all cryptocurrencies is less than that of many public blue-chip companies, such as Microsoft, and it is therefore questionable that their instability would currently have a material impact on global markets.

There are hedge funds that are moving into the crypto space, but the assets under management remain insignificant, and thus far, asset management firms have had limited success in launching crypto-related products.

Cryptocurrencies are still a hot topic in many investment forums, but until their volatility and pricing behaviour are better understood and less subject to market sentiment, few asset managers would take the risk of including them in a significant way in their portfolios.

When it comes to the future of money, there is a growing consensus that cryptocurrencies are set to play a major role. However, it is clear that public understanding of the intricacies, advantages and disadvantages of crypto have not yet matured. And while there have been a large number of studies examining the role and future of bitcoin, there have been few that explore the broader cryptocurrency market and how it is evolving.

Yet the fact remains that cryptocurrencies offer an easy-to-use, digital alternative to traditional currencies. While citizens of more developed economies, such as the US and EU are accustomed to stable currencies, others such as Zimbabwe or Venezuela are faced with a continuous struggle with volatile currencies, inflation and falling living conditions. Consumers in these economies are far more likely to view large swings in crypto prices as an acceptable, natural hedge against their domestic options.

Regulation

Cryptocurrency as a concept has had a historical tendency – although this is changing fast – to attract myth and mystery, with many believing that one’s association with crypto could provide unnecessary financial risk exposure or even legal difficulty.

Money Laundering/Terrorist Financing (ML/TF) is a commonly used argument by detractors of cryptocurrencies when describing the downside of the system. Being unable to track the movement of money could be potentially catastrophic to the financial and territorial security of any country.

Of course, there are those that would seek to take advantage of crypto for less honourable outcomes, such as the evasion of tax or illegal purchase of goods abroad, triggering a response from governments in an attempt at control, but these can safely be described as cautious and mixed.

With billions of euros being poured into the market from various sources, it is incumbent upon government and financial institutions to develop rules and regulations to closely monitor the industry. And indeed, while as yet inconsistent as shown below, the regulation of cryptocurrency is now being given serious attention by many developed countries. While cryptocurrencies are not yet recognised as true currency, they are recognised as property and in some cases legal tender, and as such fall within the scope of capital gains taxation.

Since mid-2017, there have been renewed government efforts to regulate the market, although the majority of these efforts have been focused on Know Your Client (KYC) and Anti-Money Laundering (AML) regulations.

KYC and AML rules are at odds with the fundamental philosophies behind blockchain, which seeks to ensure that transactions remain anonymous and untraceable. This is a significant concern as there are fears that criminals could take advantage of such a system.

Government response

To date, government response to crypto concerns has been less than consistent. At a G20 meeting in April 2018, Argentina’s central bank governor outlined a summer deadline for members to have “specific recommendations on what to do” and said task forces are working to submit proposals by July, while Financial Stability Board Chairman and Governor of the Bank of England, Mark Carney, stated in a letter dated 18 March 2018 that “The FSB’s initial assessment is that crypto-assets do not pose risks to global financial stability at this time.”

Some central banks, including those of Sweden and Canada, have discussed creating their own cryptocurrency in response to the declining influence of cash as a means of payment. However, the Bank for International Settlements, in a release dated 12 March 2018, stated that central banks must carefully weigh the implications for financial stability and monetary policy of issuing digital currencies available to the general public, although the underlying technologies might hold more promise for wholesale payments, clearing, and settlements.

Other recent government action can be summarised as follows:

- United States Federal Reserve: Technical issues remain, and governance and risk management will be crucial before cryptocurrencies become part of mainstream society.

Legal tender? Cryptocurrencies are not legal tender in any market, according to Guidance Note FIN-2013-G001 of the Financial Crimes Enforcement Network.

- European Central Bank: EU leaders have voiced concern about money laundering. No EU member state can introduce its own currency, according to European Central Bank President Mario Draghi.

-

-

-

-

- While the ECB believes that cryptocurrencies do not currently pose a real threat to monetary policy, they are concerned about the risk of cyber-attacks. ECB officials are generally wary of cryptocurrencies, calling on commercial banks to provide an alternative by embracing instant payments.

- In April 2018 the European Parliament supported a move to bring closer regulation to cryptocurrencies through an agreement with the European Council proposed in December 2017 for measures aimed, in part, to prevent the use of cryptocurrencies in money laundering and terrorist financing. The agreement, known colloquially as “5AMLD”, is the fifth update to the EU’s anti-money laundering directive.

- The directive proposes to address the anonymity of the financial technology by implementing rules for cryptocurrency exchanges, platforms and wallet providers. Under the proposed new measures, such entities will be forced to register with authorities and will have to apply due diligence procedures, including customer verification.

- The updated directive will come into force three days after publication in the Official Journal of the European Union. After that, member countries of the EU will have 18 months to bring the new rules into national law.

-

-

-

Legal tender? Cryptocurrencies are not considered legal tender.

- Bank of England: Bank of England Governor Mark Carney has said of crypto that “It is not a store of value because it is all over the map. Nobody uses it as a medium of exchange.” In November 2017, the Financial Conduct Authority called crypto assets “high-risk, speculative products,” in a warning to consumers.

Legal tender? Crypto is not considered to be legal tender.

- Germany: Bitcoin is recognised as a form of private money and its use is allowed in commercial and private sales. However, given the concerns raised at the EU level and the recent vote for better governance, it is likely that the German financial regulatory authority BaFin’s hands-off approach may come under pressure from increasing demand for more concrete oversight in the near term.

Legal tender? The BaFin has declared that cryptocurrencies are not legal tender and therefore do not need to be centrally regulated.

- Switzerland: Switzerland has adopted a more open approach towards crypto, with more attention being devoted to regulation of the underlying blockchain technology. Swiss regulatory authorities have been developing a lightweight regulatory system that enables the market to thrive without hindering innovation. It is now possible to pay for municipal services using cryptocurrencies which will likely lead to greater integration into everyday society.

- People’s Bank of China: The central bank wants full control and authorities are cracking down on the cryptocurrency ecosystem in the country. In 2017, the government banned Initial Crypto Offerings (ICOs) and shut down domestic cryptocurrency exchanges.

Legal tender? In China, crypto is not considered legal tender.

- Bank of Japan: Japan is the biggest market for Bitcoin. Almost half of the digital currency’s daily volume is traded in the country’s currency. Exchanges are legal if they are registered with the Japanese Financial Services Agency.

Legal tender? Crypto is considered to be legal tender as of April 2017.

Conclusion

Despite all the attention and hype created by crypto over recent years, the size of the market, as well as its significant imperfections, make it unlikely that cryptocurrencies will become real currency any time soon. However, the underlying technology supporting crypto, blockchain, is likely to have a more significant and long-lasting impact on the investment management and financial services industries.

One of the most redeeming characteristics of blockchain technology is that once records are created they are permanent and unchangeable by a single entity once validated. Not only does this significantly reduce the operational risk associated with high-volume transactions, but it also has a correlated positive impact on transaction costs.

Blockchain is particularly useful in financial areas that require fast, accurate and secure record keeping. For example, in fund transactions, blockchain can help to simplify the subscription and placement process and provide a secure digital record of trade transactions.

Regarding investors, while cryptocurrencies continue to draw significant interest and headlines, their associated volatility, driven largely by investor sentiment and speculation, serves as a strong detractor for conservatively minded investors. There is also a fundamental paradox that the more successful crypto becomes, the greater the necessity for regulation, which reduces the basic reason for their existence. This certainly casts some uncertainty over crypto’s future as an asset class or real currency.

However, the same cannot be said for the practical uses for cryptocurrencies as an online method of payment, or the underlying blockchain technology whose features are likely to have more far-reaching applications.

This article was contributed by Grek Kok, Head of Management Company Services at Maitland.

True financial freedom can now be experienced in Africa thanks to the ability to offramp from fiat-based currencies such as the Kenya Shilling ($KES) to the Bitcoin standard courtesy of the Bitcoin super application, Noones.

As the name suggests, absolutely no one right now can manipulate, intimidate or steal Africans’ value and well as time when they choose to embrace this idea whose time has come by trading peer-to-peer on the Noones App.

The Noones application has a messenger, wallet, and marketplace all in one. These 3 features ensure that Africans can now trade Bitcoin peer to peer either on mobile, tablets, or computers 24/7.

NOONES CHAT

The capability to communicate in real-time is of vital importance when it comes to Bitcoin peer-to-peer trading. This is because the peer who is buying Bitcoin needs to communicate with the selected trader to make sure they are available to trade, the amount they need is available, verify the payment details, confirm they have sent funds and receipt of the Bitcoin.

Access to customer support is also crucial as money is emotive; thus, making the chat feature on the Noones application give users peace of mind that all their queries will be resolved in a timely manner. Their team lead Mr. Ibrahim on his visit to Kenya personally assured me that all customer care issues will be taken very seriously and addressed as soon as possible to ensure high customer satisfaction when anyone uses the Noones app.

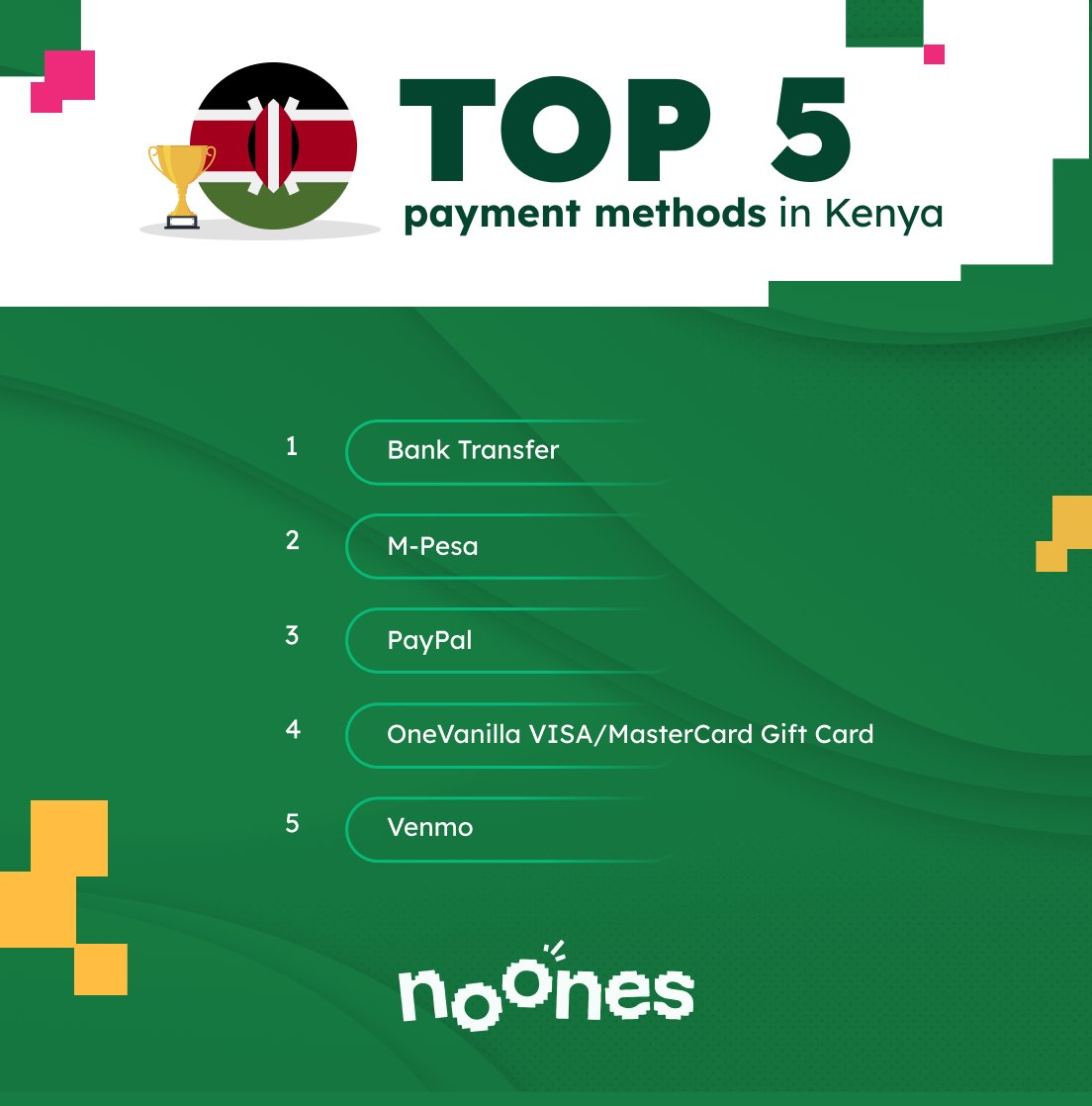

PAYMENT METHODS

The peer-to-peer Bitcoin trading experience on Noones is very convenient due to the multiple payment methods in Kenya. Bank transfers, M-Pesa, PayPal, Visa, and Venmo are some of the most popular ways Kenyans prefer to utilize. Many more payment rails will be added to the platform to make sure convenience is what users experience as they trade.

STRATEGY

BITCOIN EDUCATION

The youth in Kenya make up the biggest demographic of the country’s population, and despite being educated, talented as well very driven, they suffer due to widespread unemployment. The Noones team is very passionate in regards to Bitcoin education to ensure that the youth learn, thus broadening their horizons to be in a position to earn through peer-to-peer Bitcoin trading furthermore, get jobs as per their competencies in Bitcoin companies and or get paid in Bitcoin e.g. for selling art.

As a full-time Bitcoin content creator and educator I love the approach by Noones to address real issues in Kenya by Bitcoin education and training sessions.

GROWTH

Existing peer-to-peer traders in Kenya and Africa have been plagued by stupidity in regards to platforms like Paxful not having their best interest at heart, thus locking accounts. However, Noones is the solution to this as the team is dedicated and on the ground.

EVERYONE EATS

A true champion for Africa as a Bitcoin ambassador building for Africa is a perfect description of Ray who is the C.E.O of Noones. His passion and on the ground experience give a lot of confidence to peer-to-peer traders that they are utilizing a platform that has their best interests at heart.

The Noones partnership program provides a viable and sustainable opportunity for African youth to make an honest living which the Kenyan government can not due to corruption and false promises. Earning via referrals and your own effort is a revolutionary process that takes working from home to a whole new level. Anyone can get started by using the link & referal code ‘MasterGuantai’.

HAPA NI KAZI TU

The Noones marketplace is the best, especially because of the verified peer-to-peer traders. This means you can trade with people who the Noones team has their KYC/AML (Know your customer, Anti-Money laundering) data, meaning they can not steal your funds.

We are always on the grind is the meaning of ‘Hapa Ni Kazi Tu’, which is my mantra. African youth are ready, willing and able to put in the proof of work to make sure they learn and earn in the Bitcoin space. The Noones application provides a perfect opportunity for this to ensure dignity as well as a viable opportunity to not only make ends meet but prosper.

CONCLUSION

The Noones platform provides the change that the youth and young adults want to see in Africa. Having a Bitcoin super application at everyone’s tips provides just that.

The corruption, indoctrination and manipulation of the fiat-based monetary system is evident in everyday life. The way forward is to explore new horizons by unlearning what we were taught to believe is the status quo which is hurting our lives. Fortune Favour a the bold and taking action is the only way forward as stagnation will ensure we are perpetual slaves to a system that is not in our best interest.

The Noones application provides all of as with the opportunity to chart a brighter way forward to preserve our dignity, time and value on the Bitcoin standard.

Statistics, examples, and ways to legally use cryptocurrency

October 1, 2013, was a turbulent day for San Francisco Public Library. A dozen FBI agents pretending to be usual visitors surrounded a man sitting at one of the tables, took his laptop and put a pair of handcuffs on his hands. That man was Ross Ulbricht, founder of Silk Road – the largest darknet marketplace for drug dealers, killers, and other criminals. The seizure of Ulbricht was supposed to tackle the illegal online trade, but, as the news site DeepDotWeb wrote, the bust was “the best advertising the darknet markets could have hoped for”. The reputation of cryptocurrency also suffers from associations with terrorists, who sometimes use it for their needs. How big is the real scale of the problem? And how many legal ways to use crypto exist? ChangeNOW has dived into the topic – and suggests you an overview of the current state of the problem.

Highlights:

- The drugs trade volume using cryptocurrency is relatively large

- Crypto was a significant reason why a part of drug sales migrated to the web, though stays yet not viable and anonymous enough for dealers (same as for terrorists)

- As efficient use of blockchain technology requires good infrastructure, crypto remains not suitable enough for many terrorist groups

- However, some terrorists are trying to adjust to anonymity threats and hold fundraising in crypto

- Legal ways to use cryptocurrency include dozens and vary from IT services to car rentals

Crypto & Drugs & Rock’n’Roll

The total volume of the online drug market using cryptocurrency is around $1 billion. It is located in the darknet, which provides an attractive, profitable, and mostly secure environment for drug dealers. Cryptocurrency, in turn, allows making payments that are hard to be tracked by authorities. This is how blockchain technology has helped to bring a big part of drug sales online from the streets. And it’s not only about drugs themselves – many legal opioid drugs are illegally sold here, too.

However, cryptocurrency is not always as secure and anonymous as it is thought to be. The information about any transaction ever made stays forever in the blockchain, which makes the system way more transparent than cash payments. This is a significant limitation for using crypto in illegal purposes.

According to the University of Technology Sydney, about 46% of criminal activity of each year is connected to Bitcoin. As for the drug sale itself, trade volumes in crypto keep rising, but the percent of Bitcoin drug transactions out of all transactions goes down. This means Bitcoin is more frequently used for legitimate purposes.

What cryptocurrency is used for drug sales most often? Surprisingly, privacy coins such as Monero are used only for 4% of transactions. Due to its pioneer position, Bitcoin is used in 76% of all deals despite all its anonymity risks.

The main problem for drug dealers using crypto is to turn their income into cash. This move remains complicated and insecure. Most cryptocurrency exchanges have instruments to define whether a transaction is coming from a suspicious source like the darknet. The rise of Monero use in the online drug market will hinder such tracking. However, for the reasons listed above, crypto is unlikely to completely replace regular cash in drug sales in the foreseeable future.

Cryptoterrorism

The views on how much cryptocurrency is used and will be used by terrorists vary widely. While some claim that terrorists have no infrastructure to use it and the methods are not secure enough, others argue that they are learning fast and adjust to crypto rapidly. Let’s see what both sides say.

Not actively using, unclear future

Lack of appropriate infrastructure, inability to use crypto. Most terrorist groups settle in the Middle East region, especially on its remote and war-torn territories. The vast majority of roads and technological infrastructure have been destroyed. In such circumstances, cash remains the most common and convenient way to pay and fundraise. Imagine a gun seller in a Syrian village – does it look like he has a tool to accept Monero?

Anonymity threats. Given the relative transparency of blockchain mentioned above, crypto might remain too unsafe for terrorists. Miners can see any potential terrorist money exchange while checking transactions, and it’s not too hard to see who sends them money. It can change with the rising use rate of privacy coins, but the ability to spend such money remains questionable.

Increased attention to crypto by the authorities. As the number of transactions keeps rising, more regulatory bodies’ attention gets focused on cryptocurrency, which apparently makes terrorists nervous and cautious.

Problems of specific currencies. While top cryptocurrencies like Bitcoin receive much regulatory attention, others remain marginal and unreliable because of a lack of support. Conflicts and uncertainty lower the trust to such cryptocurrencies – yes, even terrorists’ trust.

Using actively now, increasingly in the future

Terrorists seem to be rapidly learning to escape from tracking in blockchain. Several years ago it was easy to find any address or transaction made for a terrorists’ fundraiser. Today they use well organized and finely designed websites, where detailed video tutorials show how to donate money anonymously. Unique Bitcoin addresses and other crypto tricks are used to preserve security. Analysts from intelligence services claim there’s only going to be more such cases. And, of course, privacy coins are a “great opportunity” for terrorists too.

Shift to cryptocurrency is a reaction to economic sanctions. ISIS has lost most of its territory and resources, Hamas has been sanctioned by the West. Having been cut off from all main financial institutes, terrorist groups had to find other pathways for their financial activities – and cryptocurrency appeared to be the best substitute.

There might be difficulties and inconveniences, and the number of terrorists using crypto is yet unknown – but as we can see, digital money in terrorism is reality. Same as in drugs. And this is what cryptocurrency is notorious for, lacking trust among millions of people. The reputation of some of the exchange services only adds to this mistrust – ChangeNOW has carried out a special investigation on how such platforms may cheat their clients. But can you buy anything besides heroin and firearms with your crypto? What about pizza or a concert ticket?

Only Antarctica left

Cryptwerk, a platform monitoring actual use cases of different cryptocurrencies, says there are about 3500 ways to spend Bitcoin and more than 800 for Monero today. They range from music services to car rentals, from buying clothes to hotel booking services, and from sports bets to virtual tours.

Organizations accepting cryptocurrency are located on all continents besides Antarctica (what could be a better place for crypto than a continent without governments and countries though?). Mostly, in the USA and Central Europe. Bitcoin as the largest cryptocurrency is relatively widespread in India and Southeast Asia.

As this is a whole another topic, ChangeNOW will issue a post dedicated to use cases of cryptocurrencies. As it will be more detailed, who knows – maybe you’ll find a pizza right by that you could pay for from your crypto wallet!

This article was contributed by Jeremy from ChangeNow.

Bitcoin

Buroka Review: How to Buy Bitcoin on Nigeria’s Newest Bitcoin Exchange

Published

4 years agoon

February 27, 2020

Buroka is a new breed of cryptocurrency exchange for Africa! Currently operating in Nigeria, Buroka was designed to fulfill the needs of modern Africans. Buroka allows customers to buy and sell Bitcoin with Naira via Local Transfers and cash deposits at the bank. In this Buroka review, you will learn more about the exchange and how you can use it to buy bitcoin in Nigeria.

How to Buy Bitcoin on Buroka

Step 1: Account Creation

To create an account, visit Buroka.com and hit the “Register” button. This will lead you to a page where you will be asked to fill in your personal information, including your name, email address, and password. Like any other serious exchange, Boruka will ask you for your ID, Proof of Address, and to take a selfie with your ID to eliminate fraud.

Step 2: Fund Your Account

Funding your account on the platform is straightforward. You can deposit either via bank transfer or at any bank branch. Make sure to use a unique reference code given to you by Buroka deposit system.

Step 3: Buying and Selling BTC

Once your deposit has been credited to your account you can immediately buy your Bitcoin. The buying and selling tab is located on the top right corner of the dashboard. There you can input the amount of bitcoin you want to buy. Once you do that, you then click on the “BUY BTC” button.

Step 4: Storing Your BTC

After buying BTC, Buroka provides users with the option of either storing bitcoin on the platform in a BitGo wallet or any other wallet of their choice.

Currently, Buroka only supports bitcoin (BTC). However, the exchange plans to include other cryptocurrencies going forward.

Security

Buroka exchange makes use of Two-Factor Authentication (2FA). 2FA provides an extra layer of protection for users. With the 2FA in place, an extra piece of information is needed before login into the platform or making any withdrawals.

Buroka exchange makes use of Two-Factor Authentication (2FA). 2FA provides an extra layer of protection for users. With the 2FA in place, an extra piece of information is needed before login into the platform or making any withdrawals.

In addition, Buroka’s platform is also protected using the latest security technology, including web-socket and API protocols that allow for a fast and secure order processing. Buroka also makes use of a well-updated SSL certificate, which makes it easy to detect a phishing attempt.

To further ensure that clients’ funds are secure, Buroka operates segregated accounts. These accounts are held with trusted banks so that clients can enjoy an extra layer of security provided by the banking system.

Conclusion

Buroka is a relatively new Bitcoin exchange with a well-designed, user-friendly interface. The Bitcoin trading platform provides several deposit options, which is attractive for Nigerian Bitcoin traders, as well as competitive market rates for both buyers and sellers.

If you are looking to buy or sell bitcoin in Nigeria, you can give Buroka a try.

Introducing Noones – Africa’s P2P Super App

Why Crypto’s Leading the Way in Africa’s Evolving Finance Landscape

The Rise of Bitcoin in the Online Gaming World

Unlock the Thrills of NHL Crypto Betting and Live Streaming

Understanding the Impact of Cryptocurrency Volatility on NBA Betting Markets

The Future of Crypto College Football Betting: Trends and Predictions

How Mobile Apps are Changing Sports Betting

Weekly Roundup: Africa’s Cassava Network Partners with UniPass to Expand Crypto Adoption in Africa & More

Weekly Roundup: Kenyan Senate in Discussion with CBK to Legalise Bitcoin & More

Weekly Roundup: South Africa Introduces New Cryptocurrency Standards to Advertising Code & More

Popular Posts

-

News1 year ago

News1 year agoWeekly Roundup: Kenyan Senate in Discussion with CBK to Legalise Bitcoin & More

-

News1 year ago

News1 year agoWeekly Roundup: South African Crypto Exchange VALR Launches in Zambia & More

-

News2 years ago

News2 years agoWeekly Roundup: Binance Becomes Official Sponsor of AFCON 2021 & More

-

News2 years ago

News2 years agoWeekly Roundup: Congo-based Web3 Startup Jambo Raises $7.5 Million in Seed Funding & More

-

News2 years ago

News2 years agoAmber Group’s April Corporate News Recap 2022

-

Sponsored Posts2 years ago

Sponsored Posts2 years agoBlockchain Technology: The Driver for Social Change

-

News2 years ago

News2 years agoWeekly Roundup: Kenya Capital Markets Authority Set to Pay More Attention to Cryptoassets

-

News2 years ago

News2 years agoWeekly Roundup: Kenya, Zimbabwe & Zambia Are All Exploring CBDCs