We’re excited to formally announce the launch of the first phase of our mainnet rollout!

On April 27, Pontus, Phase I of the Conflux Network mainnet rollout was officially launched. In Pontus, Conflux Network will provide a stable and safe test environment for developers, and users can join and experience the high-performance protocol and ecosystem of Conflux.

Over the past year, the Conflux team has been working hard to improve our network, from version 1.0 to version 5.0, each iteration is a hard-earned achievement by all team members. The launch of Pontus is our way of saying “Thank you” to our partners, community members and friends. Without the support from everyone, Pontus wouldn’t have been possible.

Conflux believes security is top priority for any technology. Hence, with each iteration we ensure that asset and data security of users and partners are upgraded. Pontus is set to provide a stable ground-layer protocol for our partners to develop DApps on top of. It might not be perfect, however, we encourage everyone to participate and improve Conflux as a joint effort and help us take it to the next level!

Pontus — Conflux DEX Ecosystem

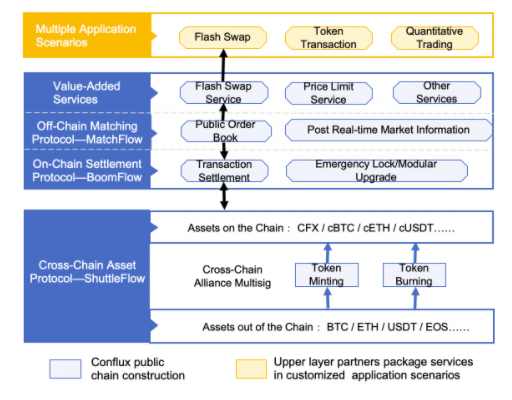

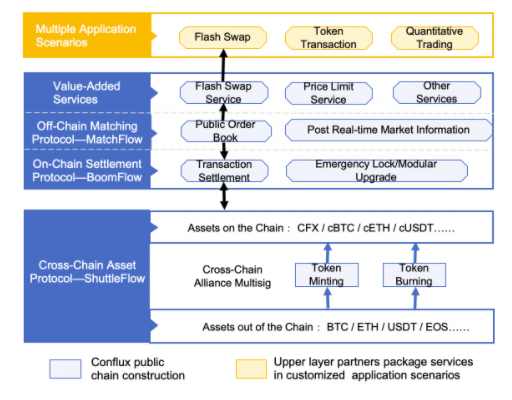

In Pontus, we have launched the Conflux DEX Ecosystem — the first step towards a more secure, stable, and easier-to-use framework for DEXes. The Conflux Foundation supports the development and maintenance of the three basic features of the DEX ecosystem:

1) Cross-Chain Asset Protocol — ShuttleFlow

2) Dual Protocol: On-Chain Settlements — BoomFlow & Off-Chain Matching — MatchFlow

3) Value-Added Services such as Flash Swap and Price Limit services

The overall framework of the Conflux DEX ecosystem is shown in the table below:

In order to realize quick matching and settlement of transaction pairs, Conflux will form a Cross-Chain Custodian Alliance with important participants, such as well-known wallet providers, trusted merchants, and decentralized exchanges. Through the Conflux DEX ecosystem’s ShuttleFlow protocol, we will be mapping assets from other public chains to Conflux with multisig technology. The protocol makes it possible to efficiently match and settle various transactions within the same smart contract protocol. This method is similar to the way people mapped their money to Alipay when transfers between accounts in different banks were inconvenient several years ago. For the specific mechanism of the protocol, please refer to Conflux ShuttleFlow: A Cross-Chain Asset Protocol

To build a scalable, high-performance, and secure DEX, Conflux uses the Dual Protocol: BoomFlow & MatchFlow. With implementing the Dual Protocol, an on-chain ledger and an off-chain ledger are maintained on Conflux concurrently, users need to deposit assets on-chain onto the BoomFlow contract (1), where the off-chain & on-chain ledgers are synchronized in real-time (2). Afterward, the user fills an order (asset change request) to the off-chain matching engine MatchFlow for matching (3). The matching result is recorded on the off-chain ledger first and then synchronized to the on-chain ledger (4), at which point BoomFlow protocol will settle. For the specific mechanism of the protocol, please refer to Conflux Dual Protocol: On-Chain Settlements — BoomFlow & Off-Chain Matching — MatchFlow

The above-mentioned protocols are the two basic features of the Conflux DEX ecosystem supporting the third basic feature for the users to experience: Value-Added Services. The value-added services include flash swaps for tokens without direct trading pairs, token transactions, and quantitative trading.

Pontus — Conflux Transaction Sponsorship Mechanism

Another innovative mechanism on Pontus is the Conflux Transaction Sponsorship Mechanism, which is currently only available on the Conflux Network. The mechanism is developed to tackle the issue of below-average user experiences on current public blockchain products, especially within the DeFi space, hindering the mass-adoption of blockchain technology.

In addition to improving throughput and increasing confirmation times to reduce the cost of users, Conflux has also considered how to facilitate new users’ experience on the blockchain when designing the consensus protocol. Conflux allows new users with zero balance to enjoy on-chain smart contracts. We strive to be user-centric, which is why we decided to remove the hurdle of an initial deposit for operating smart contracts.This is to attract new users, we know how important it is to stimulate users’ interest to give blockchain technology a try, as we drive adoption. As the mechanism title reads, Conflux designed it on the protocol level for “sponsors” to pay a users’ transaction fees when they engage with smart contracts. The Sponsorship Mechanism allows users with no balance to use smart contracts directly, paid by sponsors. For the mechanism details, please refer to Conflux Transaction Sponsorship Mechanism.

Conflux Mainnet Launch Plan

Three phases in the Conflux Mainnet Launch Plan, when Pontus is stable, Phase II — Oceanus will begin. Oceanus will focus on an all-around pilot run of mining algorithms, DApps, DEXes, and other DeFi products with our ecosystem partners. The network features and functions will be gradually released to the community in order to increase the level of decentralization while maintaining high-levels of system security and performance throughout the network. After Oceanus is over, Phase III — Tethys will begin as the final and fully functional mainnet of the Conflux Network!

Apart from the launch of the Conflux DEX ecosystem, Conflux will support the development of DApps, through incubation of selected projects. Partners from all fields are welcomed to join the Conflux Network ecosystem and contribute to the development of advancing decentralized application scenarios on top of this next-generation public blockchain, and thrive towards the mass-adoption of blockchain technology.

Conflux Network officially established its base in Africa, since then a lot has been achieved. The COVID 19 pandemic has stalled major plans of various organizations nevertheless, Conflux network has been able gain reasonable recognition in Africa’s blockchain space through their regional marketing team headed by Ehis Omozusi, who is based in Lagos Nigeria.

Conflux has established partnerships with a couple major blockchain players in Africa, such as Fliqpay, a Nigeria-based cryptocurrency payment gateway to enable merchants to accept cryptocurrency payments from customers anywhere in the world. In the near future we will be publishing Podcasts and Webinar interviews with the community, to share the insights of blockchain technology and cryptocurrencies in Africa!

At Conflux, we aim to “empower decentralized businesses” and this is considered in every new feature we release, Conflux Network will ensure the stability of the underlying network in Pontus, and encourages all members and partners to join us in our mission to jointly promote the development of this ecosystem.

Learn More:

Follow us on Instagram

Follow us on Telegram

Find us on GitHub

Disclaimer: This is a sponsored post. Readers should do their own due diligence before taking any actions related to any company, product or service mentioned in this article. BitcoinAfrica.io is not responsible, directly or indirectly, for any loss or damage caused by or in connection with the use of or reliance on any content, product or service mentioned in this post.

News1 year ago

News1 year ago

News1 year ago

News1 year ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

Sponsored Posts2 years ago

Sponsored Posts2 years ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

Rear

Rear