Ethereum is one of the most popular cryptocurrencies in the world. As part of the emerging blockchain technology, it has been at the forefront of developing decentralized finance and apps.

For many traders, the network’s native currency, Ether, has been the go-to digital money to invest. Its appeal doesn’t only lie in its many uses (particularly now after an increasing number of vendors have decided to accept payments in digital money) but also in the fact that the blockchain is so new and exciting to be a part of.

As of mid-September 2022, Ethereum has undergone a change known among traders as the “Merge.” This upgrade represents a switch from the proof-of-work system that has been used so far to a proof-of-stake model. This model is expected to bring a reduction of no less than 99.95% of the energy consumption currently used when mining ETH. Not only will this be very good for the environment (the decrease is analogous to the carbon footprint of a country like Portugal completely vanishing), but it’ll also help further scale the Ethereum ecosystem and make it more manageable.

But what does the Merge actually mean, and how is it set to impact your trading ventures? Let’s have a closer look at the possible implications.

What is the Ethereum Merge?

Since its creation, the Ethereum blockchain has been secured with a proof-of-work mechanism. Proof of work requires hardware processing power, as it needs to solve complicated math problems in order to mine the next block. The recent update has removed the need for this process and, by extension, for the mining nodes and the competition for block-solving rewards.

- There are many advantages to the move towards the Merge, among them including the following:

- Faster transaction confirmation: Ethereum transactions were already faster than those in other cryptocurrencies, but they are now set to become even faster.

- Energy reduction: Crypto has constantly been accused of unsustainable energy consumption by its detractors. In today’s world, massive amounts of power needed to generate digital money isn’t a very good look. The Merge is set to change this aspect and reduce energy consumption by over 99%.

- Sharding: This component of the upgrade is part of the strategy to make the Ethereum ecosystem a more scaled-down environment. Sharding allows for the split of extensive processes into smaller pieces, making them more cost-effective and easier to monitor and manage.

- Further decentralization: While the blockchain is already a decentralized ledger, lowering the hardware requirements, as well as the use of node operators, will take it one step further.

ETH Supply and Demand

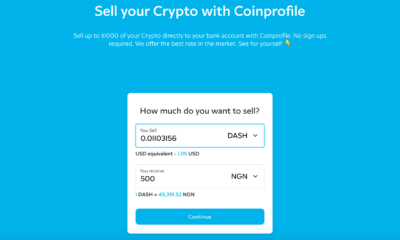

When you’re thinking about ETH, you’re probably thinking about the different strategies of how to buy Ethereum. It’s not a difficult thing at all. All you need to do is create an account on a platform that accepts Ethereum. Make sure to provide proof of your identity and wait for your account to be properly validated. Depending on the website you’re using, this may take a few hours to a few days. Even after your account has been activated, you might still not be able to perform transactions for a few days as part of the exchange’s policy. This may seem annoying and perhaps even overkill, but it’s crucial in order to safeguard the safety of your money and identity.

The success of the Merge can signal a boost in the value of all crypto assets. If you’ve diversified your portfolio by adding several other digital currencies, then you’re in luck. Overall, the amount of ETH issued per block is expected to drop by around 80%. This means safer and cheaper transactions, which are going to create a higher demand for Ethereum in the investment ecosystem. It’s very likely that even naysayers may finally be convinced to become less critical of cyber money and give it a try.

Reduced Emissions

One of the most critical aspects of the Merge lies in its promise to reduce the carbon emissions associated with mining. This is a step in the right direction and may also be exactly the thing Ethereum needs to attract new traders. Since the commitment to solving ecological problems is paramount for many customers and consumers these days, and many don’t want to interact with a vendor that doesn’t promise to deliver an ethical, environmentally-friendly experience.

The same stands true in the case of Ethereum. While the coin is widely popular considering its relatively recent appearance in the financial world, the upgrade is set to improve its reputation. Convincing a large number of prospective traders to take the plunge and enter the world of Ethereum is no easy feat, but this last upgrade may have been able to achieve just that in one fell swoop.

If you’ve been on the fence as well, willing to join in on the crypto hype yet reticent to harm the planet, the Merge might just provide a permanent solution to this dilemma.

How Does Staking Work?

The staking process involves validators locking up 32 ETH as collateral into a small contact device. The coins remain locked until further upgrades enable a withdrawal. The rewards are also collected at that point in the form of a balance over the 32 Ether previously staked. These funds don’t contribute to the overall stake weight.

If you don’t have 32 coins at your disposal or don’t want to use them for this purpose, you can enter a staking pool. This mechanism combines several individuals’ deposits to raise funds to collect the 32 ETH necessary for the use of the validator block. The rewards are shared proportionately to the amount deposited by everyone. Generally, the gains will be pre-determined and of a fixed amount.

The blockchain isn’t a perfect mechanism. It still has quite a way to go before achieving this status. Many are still concerned about the possibility of scams, DoS attack vulnerabilities, and staked ETH centralization. But overall, the system is very safe and seems only to be getting better. Soon enough, we might expect to see it replacing traditional operating systems.

News1 year ago

News1 year ago

News2 years ago

News2 years ago

News3 years ago

News3 years ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

Sponsored Posts3 years ago

Sponsored Posts3 years ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago