In Bitcoin Africa’s Weekly News Roundup, we look at the most trending blockchain and cryptocurrency stories from Africa this week.

Here are our best picks!

Luno to Add Litecoin in May

Cryptocurrency exchanges operating in Africa are racing to add more features to retain and increase users. Luno continues to remain popular in South Africa and Nigeria, despite an increase in competition in those markets.

This week, Luno announced they would be adding Litecoin (LTC) to their platform. Litecoin will be offered on the exchange and Instant Buy/Sell platforms.

The cryptocurrency was created in 2011 by Charlie Lee as a “faster” and “lighter” alternative to bitcoin. Before building Litecoin, Lee has worked with Google and Coinbase. Litecoin joins bitcoin, bitcoin cash, ripple, and ethereum as cryptocurrency platforms supported on Luno.

According to the Luno Africa team, Litecoin trading will go live on May 12.

“We can confirm that LTC will go live to all customers on the 11th of May. Customers will be able to create their LTC wallets, send/receive, and use instant buy/sell. The exchange will be in post-only mode on Monday 11th, and will be in full post mode on Tuesday 12th May.”

Luno also hinted at adding more cryptocurrencies in the coming weeks.

Crypto.com Enters Kenya

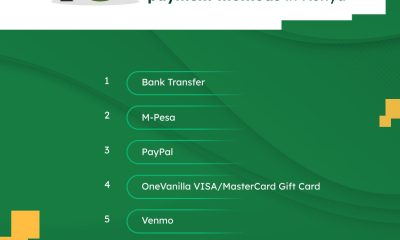

Crypto.com is a cryptocurrency payments platform that allows users to buy, sell, and pay all in one application. The exchange has been operating in Europe, Asia, North America, and now Africa.

The platform announced that it was entering the Kenyan market on Twitter, signifying its presence on the continent. As part of the expansion, Crypto.com has launched a giveaway for new community members. Interested persons will have to join the Crypto.com Kenya Telegram group.

You could be one of 25 people to win $20 in CRO – the Crypto.com native utility token.

Are Africans Gearing Up for the Halving

Unless you are living under a rock, you must be aware of the bitcoin halving event that is scheduled to take place between May 11 and 12.

The hype behind the halving is suspected of having contributed to the bitcoin price increase over the week. Bitcoin broke from the $7,500 physiological level to over $9,000 in value. As at the time of writing, Bitcoin is currently trading at a little over $8,500.

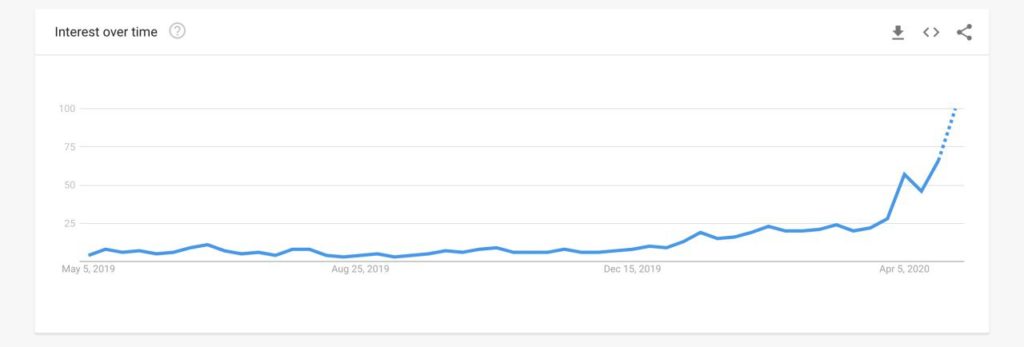

The bitcoin halving hype is spreading globally, and Africa has not been left out. Based on Google trends data, three African countries: South Africa, Nigeria, and Kenya are among the top 50 countries with high search interest in the halving.

It will be interesting to see how the halving may impact the adoption and popularity of bitcoin on the continent.

Bitcoin Africa will be covering all news concerning the halving on Twitter. Follow us to get the latest updates.

News1 year ago

News1 year ago

News2 years ago

News2 years ago

News3 years ago

News3 years ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

Sponsored Posts3 years ago

Sponsored Posts3 years ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

Central African Republic (CAR) has set up a 15-member committee that will be responsible for developing a bill on the use of cryptocurrencies and tokenization in the region.

Central African Republic (CAR) has set up a 15-member committee that will be responsible for developing a bill on the use of cryptocurrencies and tokenization in the region.