Crypto-anarchy may be a scary sounding term for some. However, the only people who should be afraid of crypto-anarchists are authorities who actively seek to limit the freedom of individuals.

In this article, you will be introduced to what crypto-anarchy is and why the tools and technologies that crypto-anarchists use are more important today than ever before.

What is Crypto-Anarchy?

Crypto-anarchy is the cyberspatial realization of anarchism. Crypto-anarchists are people who deploy cryptographic software and privacy-enhancing technology to evade persecution from the state while perpetuating their privacy and financial sovereignty, and political freedom.

Crypto-anarchy was born out of the Cypherpunk movement, which started in the late 1980s. The Cypherpunk movement started in San Francisco and included figures such as BitTorrent’s Bram Cohen, Blockstream’s Adam Back, Wikileaks’ Julian Assange, Blockstream’s Adam Back, Zcash’s Zooko Wilcox-O’Hearn, and early-stage Bitcoin developer Hal Finney.

Crypto-anarchy was first publicly propagated through the Crypto-Anarchist Manifesto, which was published by Timothy C. May in 1992.

In the manifesto, May wrote:

“Computer technology is on the verge of providing the ability for individuals and groups to communicate and interact with each other in a totally anonymous manner. Two persons may exchange messages, conduct business, and negotiate electronic contracts without ever knowing the True Name, or legal identity, of the other. Interactions over networks will be untraceable, via extensive re-routing of encrypted packets and tamper-proof boxes which implement cryptographic protocols with nearly perfect assurance against any tampering. Reputations will be of central importance, far more important in dealings than even the credit ratings of today. These developments will alter completely the nature of government regulation, the ability to tax and control economic interactions, the ability to keep information secret, and will even alter the nature of trust and reputation.

“Computer technology is on the verge of providing the ability for individuals and groups to communicate and interact with each other in a totally anonymous manner. Two persons may exchange messages, conduct business, and negotiate electronic contracts without ever knowing the True Name, or legal identity, of the other. Interactions over networks will be untraceable, via extensive re-routing of encrypted packets and tamper-proof boxes which implement cryptographic protocols with nearly perfect assurance against any tampering. Reputations will be of central importance, far more important in dealings than even the credit ratings of today. These developments will alter completely the nature of government regulation, the ability to tax and control economic interactions, the ability to keep information secret, and will even alter the nature of trust and reputation.

The State will of course try to slow or halt the spread of this technology, citing national security concerns, use of the technology by drug dealers and tax evaders, and fears of societal disintegration. Many of these concerns will be valid; crypto anarchy will allow national secrets to be traded freely and will allow illicit and stolen materials to be traded. An anonymous computerized market will even make possible abhorrent markets for assassinations and extortion. Various criminal and foreign elements will be active users of CryptoNet. But this will not halt the spread of crypto anarchy.”

It turns out, May was right with his predictions.

What Crypto-Anarchy Can Teach You About Privacy, Liberty, and Financial Sovereignty

As we know from Edwards Snowden’s NSA revelations, Facebook’s misuse of personal user data, and Amazon Alexa’s recording of its users, we are losing our privacy more and more every day. While some argue (with some merit) that we are simply handing it over by sharing too much (easily harvestable) information on social media, intelligence agencies have been spying on citizens and their entire digital lives for decades.

This is something that has always been going on but has only recently been made public when Edward Snowden blew the whistle on the NSA’s global spying program. But despite the public outcry, these spying programs are still being sanctioned by our elected leaders today.

This bleak reality suggests that if you want privacy in this increasingly digitalising society, you need to take matters into your own hands. That is where crypto-anarchy comes into play.

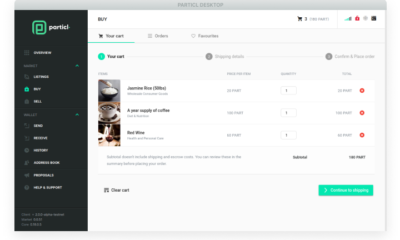

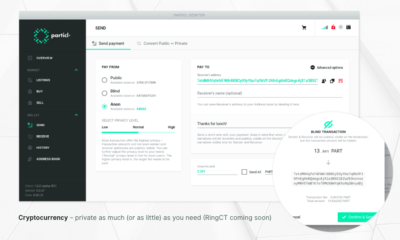

Since crypto-anarchists do not want government agencies or anyone else for that matter, knowing what they are up to they utilise privacy-enhancing technologies to communicate, peer-to-peer networks to engage in commerce and cryptocurrencies to transact.

To surf the web without being tracked, they use the Tor browser. Tor disguises your identity by moving your Internet traffic across different Tor servers so that it cannot be traced back to your IP address location.

To communicate via email, PGP encrypted email services such as Proton Mail are used. Unlike Gmail, Proton does not read your emails. They are end-to-end encrypted, which makes it de facto impossible.

For messaging on the go, encrypted mobile messaging services such as Signal are preferred over Facebook-owned WhatsApp.

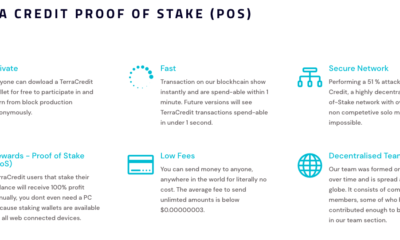

To make payments online – you guessed it – crypto-anarchists use decentralised digital currencies such as bitcoin (BTC) and even more so, anonymous cryptocurrencies such as Monero (XMR) and PIVX (PIVX).

These are just a few of the most common tools that cypherpunks and crypto-anarchists use to protect their privacy and to preserve their financial sovereignty.

Why You Should Take Crypto-Anarchists Serious

Now you may be saying to yourself: “Why should I care about crypto-anarchy? This is total over-kill. I don’t engage in political activism nor am I a target for the state.” While this may be true, do not forget that history has shown us how easily the tide can turn and individual liberties can be limited.

Not only has The Patriot Act in the U.S. shown us how willing governments are to spy on its own citizens even if they are not engaged in any criminal activities but the new social credit ranking system that is being implemented in China shows us clearly how our digital data can be harvested and used against us in a heartbeat.

This article is not meant to convince you to “go dark” like you are being chased by the C.I.A. or switch off all your electronic devices and go live in a cabin in the woods so that “the government” cannot get to you.

Instead, the purpose of this piece is to introduce you to the technologies that are being embraced by the crypto-anarchist community that you can utilise to protect your online privacy, reclaim some of your lost liberties and increase your level of financial sovereignty.

News1 year ago

News1 year ago

News2 years ago

News2 years ago

News3 years ago

News3 years ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

Sponsored Posts3 years ago

Sponsored Posts3 years ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

“Computer technology is on the verge of providing the ability for individuals and groups to communicate and interact with each other in a totally anonymous manner. Two persons may exchange messages, conduct business, and negotiate electronic contracts without ever knowing the True Name, or legal identity, of the other. Interactions over networks will be untraceable, via extensive re-routing of encrypted packets and tamper-proof boxes which implement cryptographic protocols with nearly perfect assurance against any tampering. Reputations will be of central importance, far more important in dealings than even the credit ratings of today. These developments will alter completely the nature of government regulation, the ability to tax and control economic interactions, the ability to keep information secret, and will even alter the nature of trust and reputation.

“Computer technology is on the verge of providing the ability for individuals and groups to communicate and interact with each other in a totally anonymous manner. Two persons may exchange messages, conduct business, and negotiate electronic contracts without ever knowing the True Name, or legal identity, of the other. Interactions over networks will be untraceable, via extensive re-routing of encrypted packets and tamper-proof boxes which implement cryptographic protocols with nearly perfect assurance against any tampering. Reputations will be of central importance, far more important in dealings than even the credit ratings of today. These developments will alter completely the nature of government regulation, the ability to tax and control economic interactions, the ability to keep information secret, and will even alter the nature of trust and reputation.