If blockchain technology was the hype last year, then this year it has moved beyond having the potential to transform industries to actually cementing its place as a formidable disruptive entity in its own right. Despite cryptocurrency markets experiencing a bear market since the start of the year, African blockchain startups are focusing on implementing distributed ledger technologies as they look to solve everyday challenges with this innovative new technology.

In this guide, you will discover seven high-profile blockchain startups that are spearheading innovation in Africa.

BitPesa

BitPesa is a blockchain startup that focuses on cross-border business-to-business payments and bitcoin exchange services. The company was founded in 2013 by Elizabeth Rossiello, with the aim of providing an alternative payment system to consumers that would surpass legacy systems and reduce the cost of money transfers. BitPesa incorporates blockchain technology to hasten payments by utilising its peer-to-peer nature for transactions and relies on bitcoin (BTC) as a transactional currency.

BitPesa is a blockchain startup that focuses on cross-border business-to-business payments and bitcoin exchange services. The company was founded in 2013 by Elizabeth Rossiello, with the aim of providing an alternative payment system to consumers that would surpass legacy systems and reduce the cost of money transfers. BitPesa incorporates blockchain technology to hasten payments by utilising its peer-to-peer nature for transactions and relies on bitcoin (BTC) as a transactional currency.

BitPesa has managed to attract funding from a number of reputable venture capital firms over its history, which is a testament to the confidence investors have in its innovative business model. The company is also actively seeking out strategic partners as it seeks to roll out B2B products like trade finance and lending.

Early this year, BitPesa purchased Spanish money transfer platform TransferZero. The acquisition will enable the startup to grow its presence in European remittance and payment markets. The Nairobi-headquartered startup is now operational in seven African markets including Kenya, Uganda, Tanzania, DRC, Ghana, Senegal, and Nigeria. There are also plans in the works to launch in South Africa soon.

Golix

Golix is a Harare-based cryptocurrency exchange that was founded in 2014. Formerly known as BitFinance, the local exchange aimed to offer digital currencies as an alternative to alleviate the economic woes brought about by Zimbabwe’s failing monetary system. In 2018, Golix set its sights on the broader African market and announced a token sale.

Golix is a Harare-based cryptocurrency exchange that was founded in 2014. Formerly known as BitFinance, the local exchange aimed to offer digital currencies as an alternative to alleviate the economic woes brought about by Zimbabwe’s failing monetary system. In 2018, Golix set its sights on the broader African market and announced a token sale.

The Golix ICO was intended to raise money for future expansion into other African markets as well as expand their portfolio of services. However, the company would have to contend with the Reserve Bank of Zimbabwe which issued a cryptocurrency ban. After taking the matter to court, the order was rescinded and the company proceeded to relaunch its ICO. Subsequently, investors were able to purchase the Golix utility token (GLX).

Throughout 2018, the exchange expanded its operations to Kenya, Uganda, South Africa, Cameroon, Tanzania, Nigeria, and Rwanda. Currently, investors can purchase a range of cryptocurrencies on the Golix platform including bitcoin (BTC), ether (ETH), monero (XMR), bitcoin cash (BCH), bitcoin gold (BTG), Dash (DASH), SureRemit (RMT), and Dala (DALA).

Wala

Wala is a blockchain startup that offers remittance services and payments using an Android app. Launched in 2017, the company aims to offer financial services to the un(der)banked through strategic partnerships with banks and financial institutions and at low cost. The goal is that Wala users will be able to open bank accounts, apply for credit, access remittance services, purchase value-added services and transact with retailers and merchants.

Wala is a blockchain startup that offers remittance services and payments using an Android app. Launched in 2017, the company aims to offer financial services to the un(der)banked through strategic partnerships with banks and financial institutions and at low cost. The goal is that Wala users will be able to open bank accounts, apply for credit, access remittance services, purchase value-added services and transact with retailers and merchants.

The blockchain-powered platform is underpinned by the Dala token (DALA), which is a general purpose ERC20 token that enables quick and borderless micro-payments at zero fees. The Wala app is available for download on Google Play Store for Android users in Uganda, South Africa, and Zimbabwe.

CentBee

CentBee is a cryptocurrency wallet provider and offers payment processing services for merchants. The South Africa-based blockchain startup was founded by Lorien Gamaroff and Angus Brown, and its vision is to allow users to make payments for products using bitcoin cash (BCH) and settle payments in digital currency at accepted retailers.

CentBee is a cryptocurrency wallet provider and offers payment processing services for merchants. The South Africa-based blockchain startup was founded by Lorien Gamaroff and Angus Brown, and its vision is to allow users to make payments for products using bitcoin cash (BCH) and settle payments in digital currency at accepted retailers.

The company received a substantial equity investment from nChain in February 2018 for the development of its new mobile bitcoin cash wallet and released the Alpha version of its bitcoin cash wallet just a few months later. While the service is currently limited to South Africa, the company plans to expand to other countries in Sub-Saharan Africa and beyond.

The Sun Exchange

The Sun Exchange is a peer-to-peer marketplace that allows anyone, anywhere to invest in solar panel projects using bitcoin (BTC). Founded in 2015, the South African startup enables bitcoin users to purchase solar panels and lease them to schools, factories, and communities to earn rental income. The company’s business model has been successful and attracted $1.6 million in seed funding from several investors ahead of its token sale.

The Sun Exchange is a peer-to-peer marketplace that allows anyone, anywhere to invest in solar panel projects using bitcoin (BTC). Founded in 2015, the South African startup enables bitcoin users to purchase solar panels and lease them to schools, factories, and communities to earn rental income. The company’s business model has been successful and attracted $1.6 million in seed funding from several investors ahead of its token sale.

The Sun Exchange launched its very own token in April 2018, known as the SUNEX token, which is being utilised for the design of a Solar Project Insurance Fund for users on the platform.

Moreover, the company announced a partnership with Powerhive to create solar-powered rural electrification mini-grid projects in rural Kenya. The platform has so far facilitated funding for six operational solar projects via its micro-leasing service and is gearing up for a seventh project. The Sun Exchange also received an additional equity investment from Alphabit bolstering its potential to create a global solar-powered economy.

Pesamill

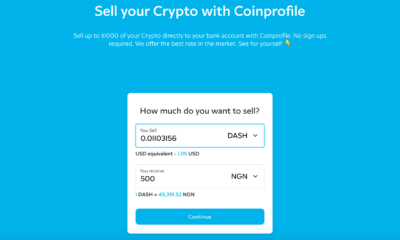

Pesamill is a cryptocurrency exchange that allows users to purchase digital currencies using payment methods like mobile money. The Nairobi-based startup was launched in September 2018 and aims to offer an alternative solution to users who find it difficult to access international cryptocurrency exchanges on account of their lengthy KYC processes.

Pesamill is a cryptocurrency exchange that allows users to purchase digital currencies using payment methods like mobile money. The Nairobi-based startup was launched in September 2018 and aims to offer an alternative solution to users who find it difficult to access international cryptocurrency exchanges on account of their lengthy KYC processes.

As such, the site offers simplified registration and KYC procedures for new users to sign up and trade digital currencies. Currently, users can trade in bitcoin (BTC), litecoin (LTC), ether (ETH), ripple (XRP) and bitcoin cash (BCH). Users can make deposits on the platform using their local fiat currency making it more accessible for the mass market.

Tari Labs

Tari Labs is the blockchain startup that runs Tari, an open source, digital assets focused blockchain protocol that is being designed as a merge minded sidechain with Monero.

Tari Labs is the blockchain startup that runs Tari, an open source, digital assets focused blockchain protocol that is being designed as a merge minded sidechain with Monero.

Tari was launched in 2018 by South African blockchain developer and Monero founder, Riccardo Spagni. The protocol will enable consumers to utilise applications developed on top of the Tari blockchain to easily transfer their digital assets while respecting the parameters set by the issuers. The company is backed by reputable venture capital and equity firms and the development team plans to integrate payment channels and transaction cut through to make Tari scalable. In addition, the startup launched a free blockchain university, to assist in the development of blockchain developers locally and internationally.

News1 year ago

News1 year ago

News2 years ago

News2 years ago

News3 years ago

News3 years ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

Sponsored Posts3 years ago

Sponsored Posts3 years ago

News2 years ago

News2 years ago

News2 years ago

News2 years ago

BitPesa

BitPesa Golix

Golix Wala

Wala CentBee

CentBee The Sun Exchange

The Sun Exchange Pesamill

Pesamill Tari Labs

Tari Labs

Since it was registered in 2017 as a non-profit, the

Since it was registered in 2017 as a non-profit, the

Some of the target implementation areas for blockchain and AI include the Ministry of Lands, Huduma Centres where important documents are issued, and the Ministry of Transport.

Some of the target implementation areas for blockchain and AI include the Ministry of Lands, Huduma Centres where important documents are issued, and the Ministry of Transport.